Marketing & Sales

What To Watch: How To Model For An Either-Way Year Ahead

How might we pick up telltales that better help us predict what's ahead? Looking back at "trends that have been stopped in their tracks" may offer clues.

On the matter of clairvoyance and 2022 housing trends, it's humbling to scan a late-innings work life and reflect on one of its central facts, a fact at least some like me tend to obscure from ourselves.

For example, in my chosen livelihood, the number of people who worked for me but who were much smarter better journalists than I am. That's the fact.

One such person is Cheryl Russell, who once upon a time in the late-1990s, crossed paths with me in my career, and found herself, in a dotted-line-kind-of-way, reporting to me, ever so briefly.

Cheryl today is an accomplished author, a host of the ever-enlightening "Demo Memo" blog, and a demographer at Cornell University, and back then, our livelihoods fleetingly merged, criss-crossed it turned out. That one swift moment -- had I been self-aware enough to recognize it – I'd been assigned to manage someone's work whose rigor, power of expression, and canny sense of connection to what meaningfully impacts markets including housing simply eclipsed me at every turn.

And in all truth, Cheryl was one of more than a handful of younger, older, same-aged people whose talents overshadowed my own, but who found themselves in an org chart somewhere below my own name. I can only say for sure that my work and bullheaded style and the limitations of my intellect seldom, if ever, stalled talent at any level from finding its natural height of accomplishment. Many who once reported to me went on to bigger, better opportunities and achievements.

Here's why this came up today, and why I'm on about it on the brink of 2022 as the first year of the rest of the decade we'll one day call the '20s.

Cheryl, and this fixation today on how we often ignore opportunities to learn something important as we strive to accomplish our own personally-shaped goals, come to mind as we focus on questions about demand for market-rate housing.

The trends – structural ones like demographics, household formations, job formations, income growth, and family formations, as well as a host of policy supports – all signal a constructive 2020s decade ahead.

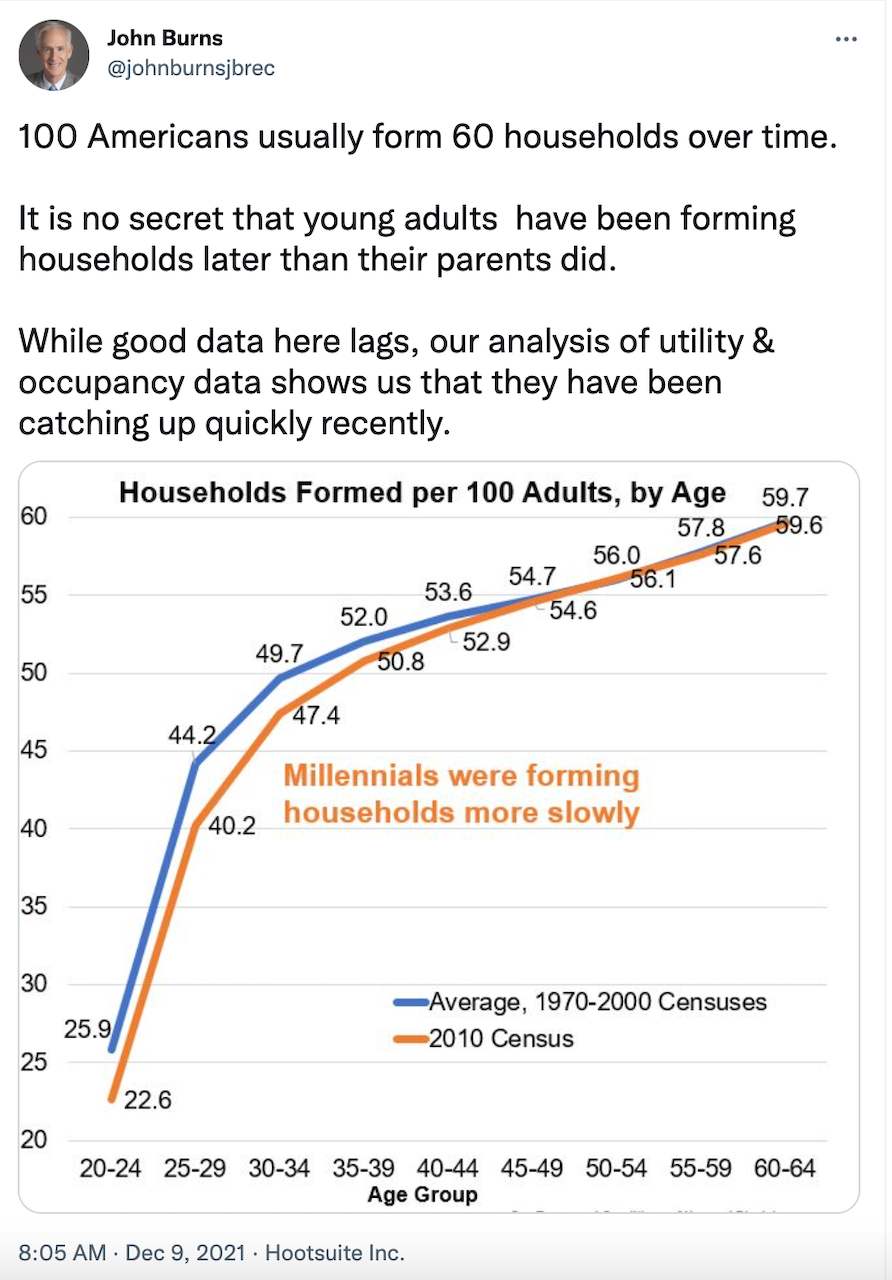

A recent Tweet from John Burns adds to support for a highly sanguine view of both standing and growing demand for market-rate single- and multi-family real estate investment, development, and construction. John tweets:

100 Americans usually form 60 households over time.

It is no secret that young adults have been forming households later than their parents did.

While good data here lags, our analysis of utility & occupancy data shows us that they have been catching up quickly recently.

Trends make or break housing cycles; or maybe it's the reverse. It's common now to look at disparities between available for-sale and for-rent inventory, and add that together with new construction rates of development, compared with natural, structural demand indicators – the number of people, for instance – and make conclusions about the steady state of demand, its arc, and its duration.

Practically no one we regard as a serious analyst covering market-rate homebuilding and multifamily comes to our attention as having a view for anything other than a continued strong and strengthening demand stream flowing into 2022 and beyond. Few if any predict a 2022 recession, nor any significant impact gradual and relatively-benign interest rate increases might have to squelch demand. We're not prepared to contradict that view either; we do note that almost all prognosticators name risks to their assumptions.

And still, as a market watcher of sorts, rumblings that something's not as it should be for current trends to sustain themselves on Wall Street make me queasy about how dots can and do connect to those very basic benchmarks we describe as fundamental housing demand.

For instance, headlines that begin "What goes up ...":

In a note to clients, Bank of America equity strategists led by Savita Subramanian said that the S&P 500 now has a real earnings yield, the inflation-adjusted ratio of earnings per share to the stock price, approaching negative 3 percent, the lowest since 1947.

It's not a stretch to believe that irrationally exuberant behavior and belief bridge across from the financial markets to real estate.

I can't help but wonder which of the zillion bellwether data points Cheryl Russell might regard as leading – rather than trailing – indicators of new home demand.

The idea would be to spot which future-predictive data sensor might signal a changing ratio – from plus, to flat, to minus – as a domino-effect role-player, ultimately flowing through to new-home demand for for-sale or for-rent houses and communities. That would flag a trend-break, a threshold before and after which the arc has ascended and begins to descend.

What about heightening our awareness of a behavior motivator that comes through in some of our already-existing research on why people do things "for financial reasons?" If, for instance, there are more folks in more households exhibiting behavior "for financial reasons," then that may be the data sensor that could pre-indicate a shift in means or wherewithal, which in turn could alter big-ticket consumer behavior like household formation, purchases, etc.

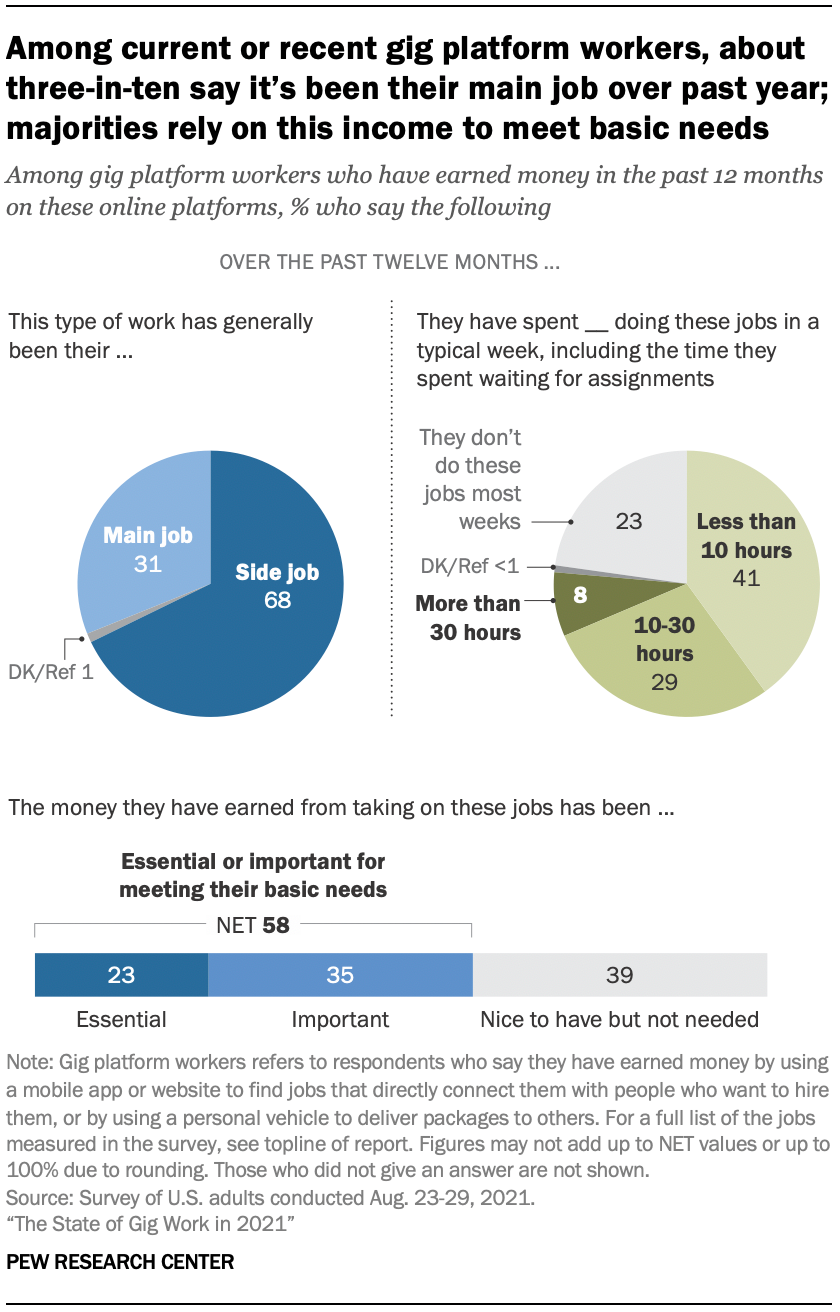

Here's a glimpse at the type of pre-indicator we're thinking may be more sensitive than other factors in flagging new sequences that lead to demand, or not. The story, from Bloomberg correspondent Yoshiaki Nohara notes that one in six Americans reports that they earn gig-work income, according to a just-released Pew Research report.

More than half of the online gig workers said they wanted to save extra money or cover gaps in their incomes. Roughly six in 10 gig workers said the money they earned has been essential or important for meeting their basic needs.

Market-rate housing demand – as we know all too well – separates us by level of means or wherewithal into those who want from those who need, and those who want either currently have the means, or are on a demonstrable glide-path to getting there.

Behavior "for financial reasons" can tell us who's on that glide-path, and who's prone to slipping off it; we imaging more people in the next year or so sliding off the glide-path than getting onto it. For that reason, today, anyway, we're thinking about those who were smarter in realizing various types of "writing on the wall" than we were.

Here, from the solid-gold archive of Cheryl Russell's Demo Memo work, we'd ask you to look at both the headline and the details. They illustrate that trend-break point, where growth first stalls, then flattens, then falls. Sometimes, it's a slow gentle curve to the negative. Others, it's a free-fall.

Here's how this begins, with 5 more in the link:

Ten Trends that Have Been Stopped

in Their Tracks…and What It Means

The economic downturn has not only emptied bank accounts and turned neighborhoods into ghost towns, it has derailed many of the demographic trends that businesses had been counting on for customers. Which trends will get back on track and which will be permanently detoured? Here’s what you can expect.

Births: Bye-Bye Boomlet. After rising robustly during the past few years, the annual number of births fell by 1.6 percent to 4,247,000 in 2008. A decline of this magnitude has occurred only once (in 1993) since the birth years of the baby-bust generation (Generation X) in the 1970s. What it means: The decline could be a blip as it was in 1993 or the start of another baby-bust generation.

Mobility: Pent-Up Demand. With the housing market in paralysis, the geographic mobility rate is at a historic low. Only 11.9 percent of Americans moved from one house to another between 2007 and 2008. The 4.7 million people who moved from state to state was the fewest since 1949-50, despite a more than doubling of the U.S. population. What it means: Expect to see a leap in the number of movers and the mobility rate when the housing market thaws.

Homeownership: Below the Peak. After reaching a record high of 69 percent in 2004, the homeownership rate fell to 67 percent in 2009 as foreclosures turned owners into renters. Because homeownership rises with age and peaks (at 83 percent) in the 65-to-74 age group, the rate should be rising–not falling–as boomers age. What it means: The aging of the population will prevent the homeownership rate from dropping much more.

Living Arrangements: Crowded Nest. The number of people who live alone fell by 510,000 between 2008 and 2009, the first decline since 1993. Behind the decline is the return of many young adults–unable to find jobs–to their parents’ home. According to the Pew Research Center, 19 percent of 45-to-54-year-olds with grown children have had an adult child move back home in the past year. What it means: More stress on the middle-aged backbone of the economy.

College: Enrollment Declines. You might have heard that college enrollment is at an all-time high despite the Great Recession–but not at traditional four-year schools. Those numbers peaked in 2005. Among full-time students at private four-year schools, enrollment in 2008 was 10 percent below the 2005 peak. In contrast, enrollment at two-year schools climbed 24 percent during those years. What it means: Trouble for private colleges.

Different times, yes. And enormously different household balance sheets than now. So we'll see. I still think business measures and models are far more accurate on the way up than they are at detecting that all-important trend break.

Join the conversation

MORE IN Marketing & Sales

Wray Of Light: Here's How To Keep Pace As Headwinds Stiffen

More than four out of five consumers think it’s a bad time to buy a home; here are seven strategies builders and developers can deploy as a more effective marketing plan to win sales.

These 5 Time-Tested Tips Will Jump Start 55+ Resident Referrals

When managing 55+ community homeowners associations, builders and developers need to meet and overdeliver on the high expectations of a particularly discretionary consumer group.

How A Homebuilder Stands Out In Florida's Fierce Competitive Arena

"Investing in your brand doesn't give you a direct return on investment immediately. It takes a long time, but over time, branding successfully does increase financial value." -- Alex Akel, President, Akel Homes