Leadership

It Rhymes With Trouble And Flashes Orange Before It Goes Red

For Frank Anton, the strongest signals in housing are ones that impact a stark 'fundamentals' gap between households' payment power and the combo of asking prices and monthly costs. Data, evidence, action.

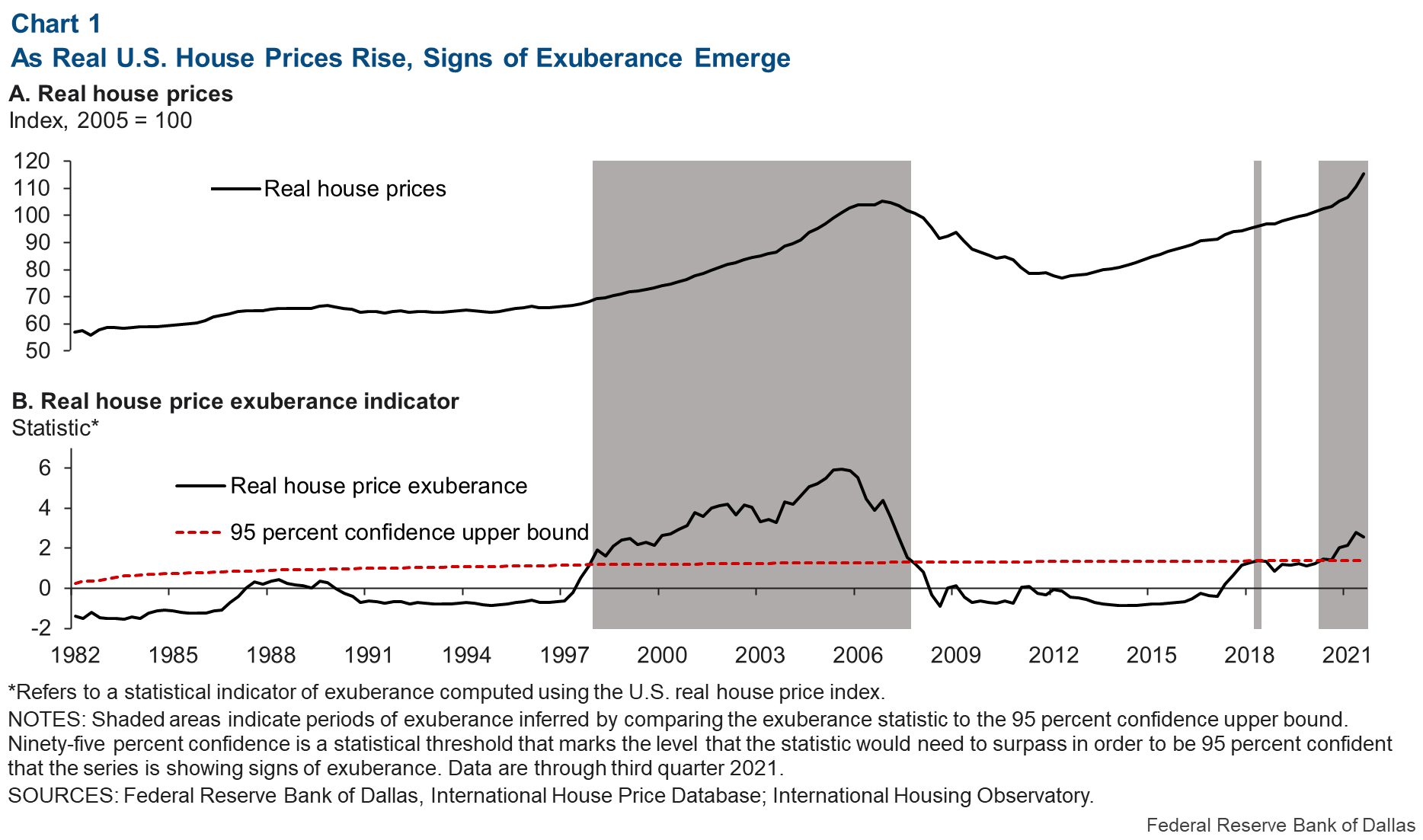

That is an index number developed by the Federal Reserve Bank of Dallas. The index is meant to gauge if the rate of housing price increases is in line with economic fundamentals. At 115% the index, according to the bank, shows “abnormal explosive behavior” and “the start of a brewing U.S. housing bubble.”

Which somehow reminds me of what was a common back and forth between my mother and father when my father was driving and ran a red light.

Carmen,” my mother would say, “you ran the light.” “No,” he’d say “it was yellow.” “No, it was red.” she would reply. To which he would say “No, it was orange.”

Well, I’d say, there are a lot of other orange lights flashing besides that 115%, and maybe that means that builders need to take notice and step hard on the brakes.

Here is one of those other orange lights -- $52,667 – that really shocked me. That is how much American homeowners made on average in home appreciation last year, which happens to be more than the average American’s median income of $50,000. Something about that doesn’t seem right at all, does it?

In the last year housing prices have increased by 19.2%. In the last two years, the median sales price of homes rose by 33% and it now sits at $390,000. During the same time the percentage of homes nationwide worth more than $1 million almost doubled from 4.8% to 8.2%. And, get this: in San Francisco 90% of the listings of homes for sale are priced at more than $1 million. Nationwide, the median listing price is $405,000, the highest ever, which represents a 27% increase in the last two years. In February alone the average listing price increased by 1.84% or 4 times the 25 year average. I count at least eight orange lights in this paragraph.

Maybe you’re thinking that what I said were warning lights were in fact indicators of just how robust the housing market has been and still is. In fact they were green lights. To that I repeat the old adage: what goes up too fast, must go down. And, in fact, there are some pretty bright orange lights flashing that I take as warning signs that maybe it is time to pull back, buy less land, start fewer units, hold off on price increases and hunker down for a while.

For example, NAHB’s housing market index, which in essence measures builder confidence in the market, has declined from a record high of 90 a year ago to 79 today. An index of 79 doesn’t portend disaster, but down is down, and so are year over year sales of new homes. They have declined by 6% this year. Also down by 8% are mortgage applications.

What are not down are, as you certainly know, are mortgage interest rates, which now sit at almost 5%. That almost 1.5% year-to-date increase in mortgage rates has a profound effect on housing affordability and housing price elasticity. To be more specific, at the beginning of the year, a home buyer who could afford a monthly principal and interest payment of $1,700 would qualify to buy a $500,000 house. It is now less than four months later and that same buyer can only qualify for a $425,000 house, which translates to a 21% decline in purchasing power. Another way to look at how higher rates affect the housing market is to note that every .25% increase in mortgage rates reduces the new home buyer pool by 1.4 million households.

Maybe all those orange lights still don’t even give you pause. And, maybe you are right. There are experts galore pointing out that there is a 4 to 5 million unit shortfall in housing supply. Another group of experts says that the pandemic has made homeownership more important and more desirable than ever. So what we really are facing is a supply and demand problem that can only be solved by increasing supply.

But I’m not buying much of that. I think those orange lights are about to turn red, and running red lights often gets you in trouble.

Join the conversation

MORE IN Leadership

Westwood-Hippo Deal Raises Stakes On Home Insurance Trust

A landmark deal expands embedded insurance capabilities, aiming to ease closings, manage climate risk, and restore buyer trust.

From Afterthought to Dealbreaker: Why Home Insurance is Now Key to Sales

By working with the right insurance expert, builders gain short- and long-term advantages in keeping current deals on track and making sure their business thrives into the future.

How Outlier Homebuilders Build An Edge, Even In a Slow Market

Focus On Excellence 2025 reveals what top homebuilding leaders are doing now to separate—and stay ahead—for 2026-through-2030 and beyond.