Leadership

New Home Search Trends Dip As Market Digests Prices And Crises

While Census February New Home Sales lag recent intensification of headwinds, online search patterns may prefigure impacts of newer inflation and sentiment shocks following Russia's invasion of Ukraine.

Today's new homes sales release – taking stock of U.S. Census' sample-based report of sales contracts – shows a 6.2% decline year-on-year from February 2021's rip-roaring seasonally-adjusted annual rate of 823,000 sales.

The buried lead is new home prices – $400,600 median (up 11% year-on-year) and $511,000 average (up 25% year-on-year) – and what February 24th may mean as an inflection point on buyer demand.

Comping with early last year – before builders fully baked in shocks and stresses to their supply chains, and subsequently, began to stall releases and meter sales to the volume levels they could produce – was going to be tough as it was.

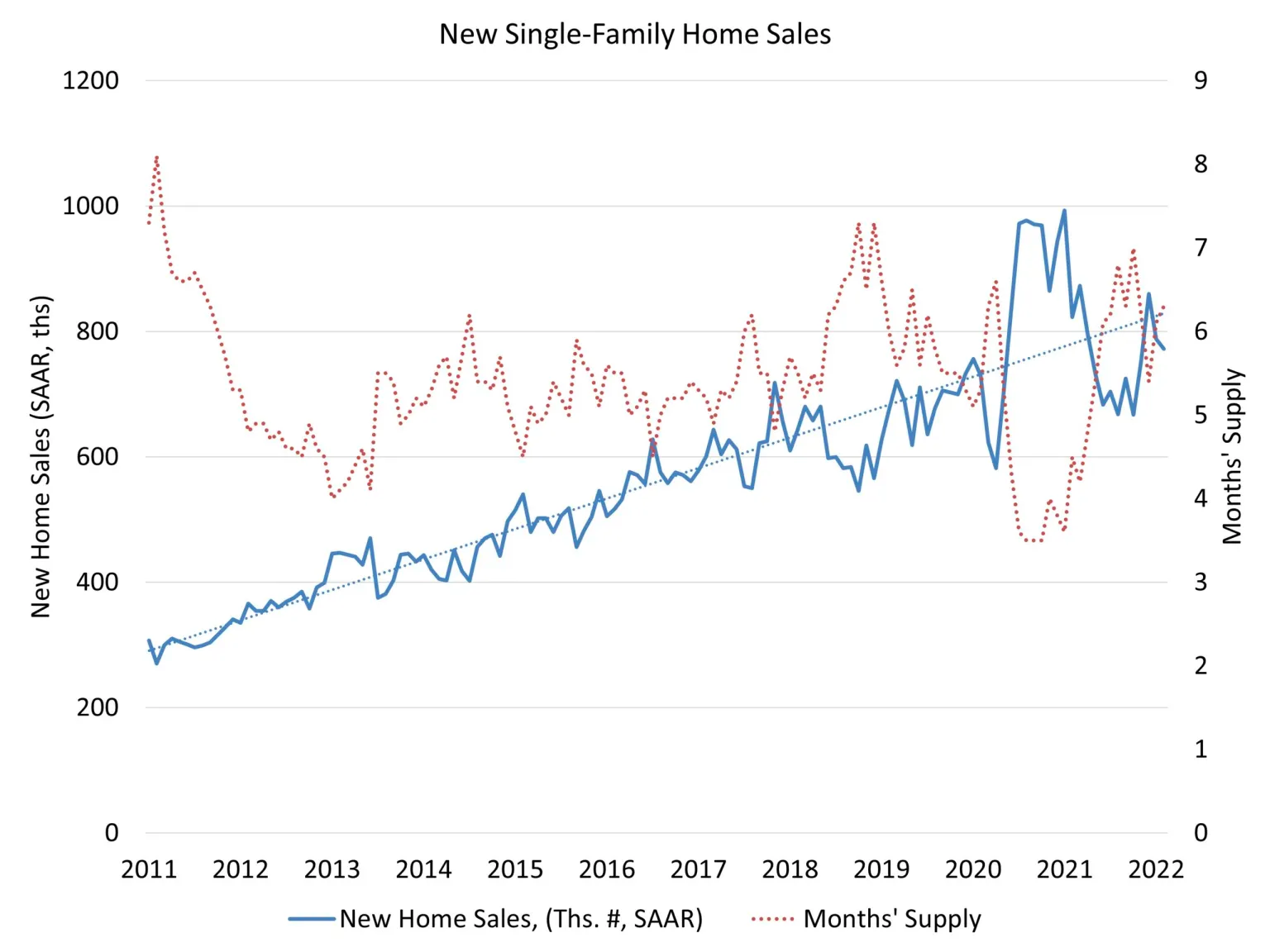

Here's the National Association of Home Builders' chart of new home sales trends, tied to months' supply, extending through the latest Census Bureau release:

The February print reflects a second consecutive jog downward in comparison with year-earlier numbers. By the end of January this year, stresses and strains that had begun to snowball starting in the back half of 2021, actually started to chip into year-on-year momentum, hitting both capacity and uptake:

- aggressive price increases began to test wherewithal elasticity and tolerance levels for at least some prospects

- interest rate creep began to winnow out – on a qualifications and monthly payment power level – at least some would-be buyers

- consumer inflation – at the gas pump, grocery store, and every other ripple-and-trickle down effect oil price increases impact – had begun to eat into households' monthly budgets, outpacing real wage increases

What builders, their capital partners, and the broad ecosystem of partners vested and invested in new home building sales trends need to know – and the jury's not in yet – is the depth and duration of Russia's military assault on Ukraine and its known, not-yet-known, and hard-to-know collateral impacts.

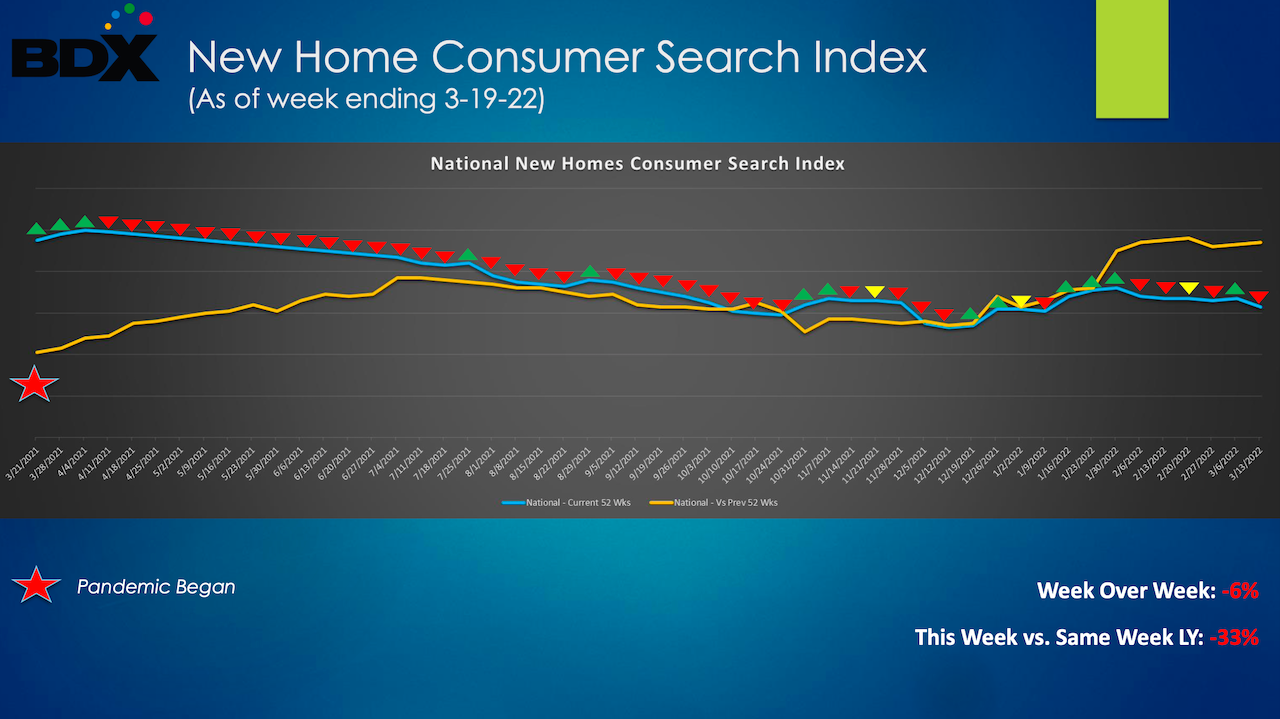

For a real-time pulse on whether or not an inflection point in the housing demand boom may be here, thanks to data provided to The Builder's Daily by BDX, which tracks new-home online search trends.

The BDX New Home Consumer Search Index tends to foreshadow physical traffic and order trends as a leading indicator.

Here's commentary from Jay McKenzie, senior director at BDX, accompanying the following graph, illustrating the BDX New Home Consumer Search Index for the week ended March 19 (this past Friday).

The topline reading here is this:

- Down 6% week-over-week

- Down 33% vs. same week last year (3rd week March 2021)

Here's Jay McKenzie's comments on the data:

It’s important to note that consumer search for new homes online in the first quarter of 2021 was the highest in the many years we have calculated the Index.

The Year-over-Year comparison is based on that high-water mark, which makes the trend vs. last year more pronounced. As noted in a prior Index, the normal seasonality we see each year – absent in 2021 – has also returned.

Given the events of the last 25 days, it’s not surprising that the volume of consumer search for newly built homes online is down. There are clearly many factors at play – including the Russian invasion of Ukraine, the widening repercussions of global sanctions on Russia as the world’s 11th largest economy, further supply chain disruption, uncertainty over supplies of oil and grain, continuing gains in home prices driven in great part by labor, land and material costs and the Fed’s clear resolve to tame inflation.

Given the factors above – each significant in isolation, but magnified in total impact – it would be more remarkable if search volume was not down.

As much as search volume trends may serve as a proxy for near-term purchase plans, the benchmark is has sensitivities to events that may be head-fakes in one direction or another.

Areas to watch on the new home sales front include, primarily the months' supply benchmark – currently higher than "normal" at 6.3 months – and how that impacts tactical price adjustments like discounts, upgrade incentives, and other inducements builders might start activating to keep the absorption pace in each new community at tolerable levels.

NAHB chief economist Robert Dietz, per U.S. Census break-outs, charts new home inventory in three separate sub-buckets:

- Completed "spec" for-sale homes

- Started, but still "under-construction" homes

- Permitted, and listed for-sale, but not started homes

In the February NHS release, of 407,000 homes of the total inventory of new for-sale homes – combining the three stages bulleted above – 35,000 (8.6%) are ready-to-occupy spec homes, and 106,000 (26%) are for-sale but not started. The balance – 266,000 (56.4%) – are new homes still under construction.

As Bill McBride notes in Calculated Risk:

The inventory of homes under construction at 266 thousand is the highest since 2007. The inventory of homes not started is at a record 106 thousand.

Will demand slow?

BDX trends show slackening new home search volume, but the time framing of the slippage may recover after a temporary hiccup following the events of February 24, or may flatten and stabilize for the near feature, or may trend downward.

As for the strength of the pulse of demand, builders will be watching closely their absorptions per community per week and month benchmarks, their cancelation rates, their competitors price incentive tactics, and the broad dynamic backdrop of economic conditions as they navigate through multiple crises, but with a really strong demographic underpinning.

Join the conversation

MORE IN Leadership

How Signature Homes Wins While Other Builders Pull Back

Sales are sliding for most private builders. Dwight Sandlin’s team is defying the trend with strategy, speed, and customer obsession.

HW Media Acquires The Builder’s Daily, Expanding into the Homebuilding Vertical

Strategic acquisition adds leading homebuilding publication and strengthens HW Media’s commitment to serving the full housing economy

C-Suite Leaders Will Gather To Chart Homebuilding’s '26 Reset

The Builder’s Daily announces the speaker lineup for this October’s high-impact leadership summit in Denver, where the best minds in homebuilding operations, marketing, and technology will explore how to lead through the now and build for what’s next.