Land

Landsea Adds Colorado To Its Map With Richfield Homes Deal

Another week, another deal as homebuilding's M&A juggernaut grinds forward, reshaping the new residential real estate and construction balances of power.

Landsea Homes' aggressive move up the charts among the nation's biggest homebuilding and residential real estate enterprises gets another burst of momentum in typical fashion, by securing a dynamic and potent springboard in a top-15 U.S. new-home construction market.

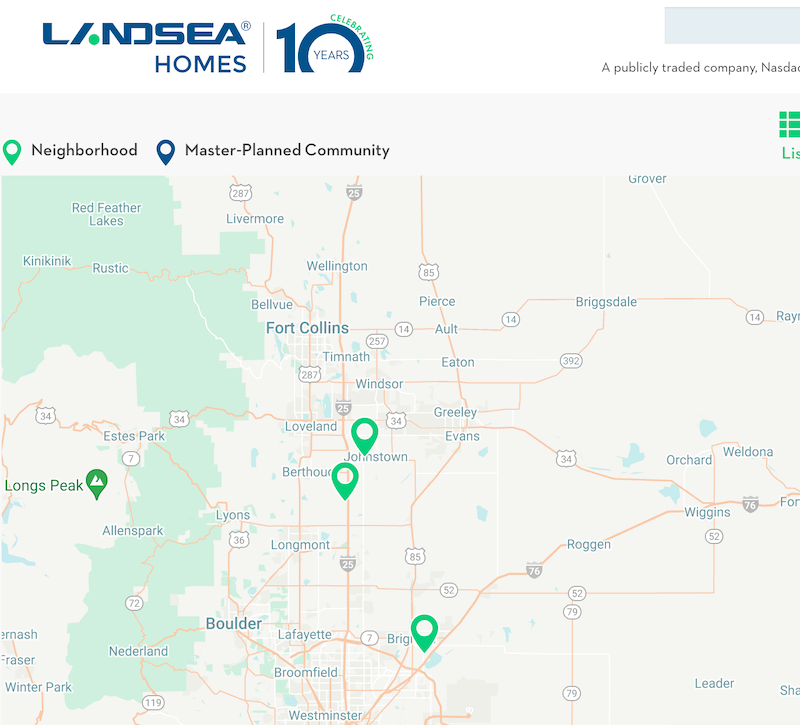

According to executive sources with knowledge, Landsea has expanded its operational footprint – currently including Florida, Texas, Arizona, and California – into Colorado, with the acquisition of Longmont, CO-based Richfield Homes, a highly-regarded, well-entrenched homebuilding operator whose communities range north of Denver, from the Boulder area to just north of Fort Collins.

[Editor's Note: On Thursday, Oct. 19, Landsea Homes announced its purchase of the assets and lot inventory of Richfield Homes, confirming The Builder's Daily's story here. We're refreshing some of the details, based on materials included in the press statement.]

Landsea executives, having announced plans for a November 2 release of its Q3 2023 earnings performance, are in a quiet period. They did not respond to The Builder's Daily requests for an interview about the acquisition. Richfield Homes managing member Will Edgington replied to our outreach, simply saying he was not able to discuss the matter by agreement.

Per a press statement from JTW Advisors, which served as sell-side advisor to Richfield Homes

Will Edgington and Serge Goldberg founded Richfield Homes in 2012 after previously running a successful homebuilding business in Texas. Lisa Wiebelhaus became a co-owner in 2016 and will subsequently serve as Landsea’s Colorado Division President. Over the trailing 12 months, Richfield closed 112 homes across 6 communities generating revenues of over $68 million."

At the same time, Landsea has posted "Coming Soon" communities that overlay Richfield Homes' footprint north of Denver, and the Richfield Homes site has been de-constructed, save for a referral on warranty matters to a third-party firm for recent homebuyer customers.

According to Landsea's Oct. 19 press statement:

Veteran Colorado homebuilding executive Lisa Wiebelhaus has been named President of the new Landsea Homes Colorado division. She joins Landsea Homes after working with Richfield Homes for more than seven years, most recently serving as Managing Partner.

Prior to joining Richfield Homes, she worked for twelve years as Vice President of Sales for Colorado-based Richmond American Homes, where she sold and closed upwards of 1100 homes per year. A graduate of Colorado State University, Lisa lives in Denver with her husband and their children.

"We are very pleased to welcome Lisa to the Landsea Homes senior management family," said [John Ho, Chief Executive Officer of Landsea Homes]. "With nearly two decades of homebuilding experience in Colorado, she has a wealth of strategic insight, strong management skills and deep local roots that will help us successfully launch this new division."

The impetus, for Landsea, has been evident now for a couple of years. We wrote:

The plan from Day One – per Ming [Martin] Tian, an early-on founder of China-based Landsea Green Properties Co., and driver of what has become the publicly-traded U.S. homebuilder – was unequivocally for big impact.

Our goal [is] to be a leader in the U.S. homebuilding industry with best-in-class, sustainable communities across some of the most desirable markets in the country."The deal – both opportunistic and of mutual benefit to both parties – pairs a deep-pocketed acquirer in Landsea, that is committed to becoming a very top-tier national residential construction and real estate force, with a deeply entrepreneurial operator with a great reputation among customers and an ecosystem of local vendors, suppliers, and partners.

The Landsea-Richfield combination is only the latest initiative – expect more M&A, sooner than later – in the Landsea team's execution on that grand strategy. With every puzzle piece Landsea assembles, what comes through most clearly is emphasis on trusted local relationships, capability, and the energized vision to keep making good things happen within a context of challenging real estate and business conditions.

Richfield has always been a people-first organization and as a result, they’ve attracted some of the strongest local talent in Colorado," says Thomas Carpitella, CEO of FTS, a supporting partner of The Builder's Daily. Carpitella, who's worked with both the Landsea and Richfield teams, adds, "It’s obvious that Landsea is tapping into a strong Colorado brand with some of the most experienced and successful managers and leaders in the space. This combination represents the power of strong cultural recognition with talent, a solid connection with their target audience, and a strong foot in the door to one of the most competitive homebuilding markets in the country."

From a Landsea strategy standpoint, the deal fits the M&A playbook to a tee:

- Targeting the "Right Markets:" Prudent approach of market selection based on macro trends and Company expertise

- Attractive Homebuilder Profile: Potential acquisition is not only in a high-value homebuilding market but also has a history and profile aligned to LSEA's core strategy

- Experienced Management Team: Disciplined review of the in-place team as well as LSEA's regional team to ensure deep experience in the regions we enter

We’ve seen Landsea use acquisitions as accelerated springboards into the most attractive markets, while simply building off the strength of the entrepreneur," Carpitella says. "We admire how Landsea has grown over the last 24 months via M&A. Particularly, the post-acquisition experience in each division seems to be extremely successful as they let their local teams continue as-is, only adding support and infrastructure. They've struck the balance of letting their acquired companies do what they do best with the seemingly tricky cultural integration into the larger Landsea fold.

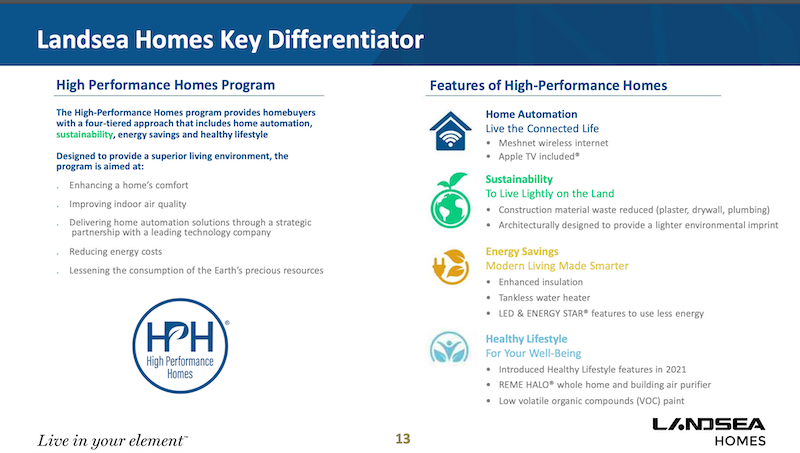

What's more, Richfield Homes' emphasis on its homes' quality and performance – energy, home technology, and healthy-home structure and systems – squares with Landsea's "key differentiator" criteria.

Landsea's push into a Colorado market that promises sustained allure as both an organic growth market and a domestic in-migration destination in an ever-more-technology powered work-of-the-future real estate pivot, comes on the heels of Trumark's acquisition of Wathen Castanos last week.

An intensifying homebuilding M&A cycle underlines streaks of new urgency and motivation, both among acquirers and sellers in a broader backdrop of uncertainty and risk.

At a high level, the present and near-term M&A theme reflects a sweeping consolidation and concentration driver, due in part to the disproportionate advantage larger, more deeply and patiently capitalized players hold in a tighter-credit, more-expensive borrowing cost environment.

Clearly, though, there's no shortage of those big or giant players that want to get bigger and more gigantic. They include strategic national publics including in this case, Landsea; Japan-owned private portfolio operators running under primarily the Daiwa House, Sekisui House, and Sumitomo Forestry Brands; Clayton Homes – which continues to delve into synergies between its expansive manufacturing infrastructure and real estate holding on-site homebuilding operators; as well as a handful of regional and multi-regional private companies on a race upward.

This acquisition exemplifies the ongoing evolution within the homebuilding industry. Larger balance sheets provide opportunities for growth and increased margins,” Mr. [JTW Advisors managing partner Chris] Jasinski said. “Within the dynamic landscape of mergers and acquisitions, it’s evident that quality companies, distinguished by exceptional management teams, healthy profit margins, and strategically robust land holdings in sought-after markets, hold a strong allure for a wide array of potential buyers.”

Company sellers continue to be motivated by three drivers.

- Succession planning due to age demographics among principals

- Desire to access deeper, more patient capital to add nimbleness and fuel to near- and mid-term growth opportunities.

- The need or desire to de-risk personally guaranteed financial exposure, especially as highly favorable debt terms expire and new, more onerous financing may make the next 12 to 36 months much more difficult to operate on all cylinders.

Homebuilding's deal flow machine is kicking in to a higher gear.

Staffing and recruiting done right. Fast Tracking Solutions specializes in delivering top talent in accounting/finance, construction, and technology operations.

MORE IN Land

Little Deal ... Big, Timely Product Pivot: Lokal’s Capital Play

A $12M facility fuels Lokal Homes’ swift shift into higher-margin homes and a smarter land strategy in a tough market.

Oversupply or Overreaction? DFW Market Needs To Hit Reset

Scott Finfer breaks down the DFW-area oversupply crisis: post-pandemic assumptions, slower job growth, and mispriced inventory. Across the U.S., high-volume markets face similar risks. Finfer outlines five strategic moves to cut through the noise — and seize ground as bigger players pull back.

Land, Capital, And Control — A New Playbook In Homebuilding

Five Point Holdings’ acquisition of a controlling stake in Hearthstone points to the direction of homebuilding strategy: toward lighter land positions, more agile capital flows, and a far more disciplined focus on vertical construction, consumer targeting, and time-to-market velocity.