Leadership

Landsea President, COO Mike Forsum Shares What's Up Next

A strategic context to understand how the $250 million Hanover Family Builders deal fits into the ascent of one of homebuilding's two youngest public firms into the ranks — sooner than later — of the nation's big players.

A year ago to the week, Landsea Homes Inc.'s executive team rang the afternoon bell to close the NASDAQ market and open the door to the future of an enterprise that began trading as a public homebuilding enterprise on Jan 8, 2021.

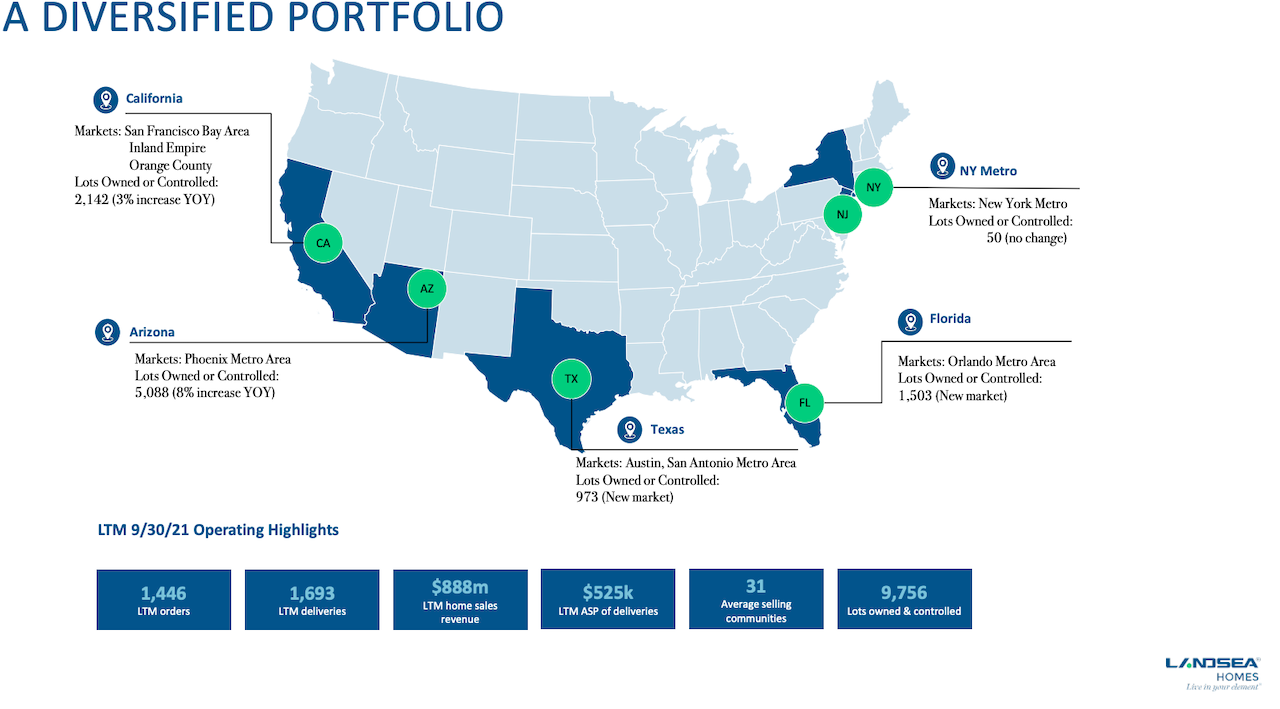

That same week, a day or so earlier, Landsea execs announced they'd closed on land deals that put more than 1,000 new home sites in the sizzling Phoenix-area markets of Mesa and Goodyear into the company's lot pipeline, an early glimpse at how that future would work.

The plan from Day One – per Ming [Martin] Tian, an early-on founder of China-based Landsea Green Properties Co., and driver of what has become the publicly-traded U.S. homebuilder – was unequivocally for big impact.

Our goal [is] to be a leader in the U.S. homebuilding industry with best-in-class, sustainable communities across some of the most desirable markets in the country."

Landsea president and coo Michael Forsum strikes an identically clear-sighted manifest destiny for Landsea in his framing of yesterday's announced acquisition of Orlando-area outperformer, Hanover Family Builders, for a combined $250 million in cash and the repayment of HFB debt.

We view the Hanover acquisition as a transformational one in that its platform of impact in a high-velocity market like Florida vaults Landsea into critical mass and scale with the leading public builder peers," says Forsum. "When you add up current community counts, backlogs, and our near-term land pipeline, Landsea's one of the top five or six in our Florida operating arenas."

Adding the Hanover juggernaut to the Landsea portfolio, and integrating its already-professional-investment-grade ERP, customer care, and operational efficiencies into the an increasingly meaningful Landsea Homes home and community brand, says Forsum runs consistent with the geographic and business growth pattern Landsea set in motion a few years ago as it set up its operating beachhead in Arizona, starting in 2018 with a de nova organic land buy as a learning and relationships building drill, followed by a smallish acquisition.

Speaking with me in mid-2019, when Landsea announced it had purchased Pinnacle West in the Phoenix market, Forsum talked then of how Landsea would step its way sequentially in to a greater level of impact, local scale, market-arena clout with landsellers, construction teams, and vendors, etc.

Pinnacle West works particularly well for us, because we were looking for opportunity to penetrate deeper into the entry-level price point here in Phoenix, where they've got the relationships and the reputation with masterplanned community developers to offer products for that customer segment," says Landsea Homes coo Mike Forsum. "They know how to do entry-level at a high-value, at price points in the $250s to $300s, and their operational model and cost-efficient processes are best-of-breed," Forsum says of the Pinnacle West team.

Forsum's remarks at that time now begin to clarify the pattern of organic entry, to small acquisition beachhead, to larger acquisition impact that's clearly playing out now in Florida.

Our Phoenix-area activities started organically, followed by our 2019 acquisition of Pinnacle West, and then stepped up to market impact with the addition of the Garrett Walker Homes team that catapulted us into a peer group among the top 15 builders," says Forsum. "In a similar way, we entered Florida organically, and early last year, we were able to add the Vintage Estate Homes team to learn more about the market and accelerate our ties on the ground, setting the groundwork for the Hanover team to take us geometrically up the chain to that leadership tier."

The pattern – organic, small acquisition, followed by a consequential market-share portfolio addition – has proven out. So, too, has the double-helix growth principle of entry-level homes in explosive-activity geographies.

And this begs the question, where and what next?

The near-term attractiveness of a deep and wide runway for growth in Florida, with the Orosz brothers and their team continuing their program with the aspirational power of the Landsea brand, and our laser focus on customer care, gives us a lot of opportunity right here," says Forsum. "As we continue to execute on the bigger plan – centered on entry level buyers in the hottest U.S. markets – Texas gets a lot of our focus right now as well. We're really working to grow our opportunity there, so stay tuned."

Viewing a 2022 landscape of structural demand for new homes offset by inventory scarcity and turbulence related to supply chain disruptions and an intensifying skilled-labor capacity constraint, Forsum notes that deeper local scale advantages weigh heavily in favor of bigger, higher-volume, more consistently active players versus those who can exert less clout, and depend on just-in-time procurement across the building materials, products, and skilled labor crew front.

The bigger, better-capitalized competitors are getting wiser at forward-buying, and in some cases warehousing certain commodities, and components, and products like appliances," says Forsum. "We're able to smooth out some of the chokeholds that way, cadence our sales order-taking to later in the building cycle, and keep talking our customers through this with their interests as a priority."

There's a silver lining on the production capability front, notes Forsum, which gives him at least a grip on confidence as he and the Landsea team focus on execution and customer care on their ascent up into homebuilding's more rarefied air among the 20 top national enterprises.

The only good news is that, up until recently, it was a reality that things were going to get worse before they got better," says Forsum. "I think we've reached the point where they're not going to keep getting worse, and from now on, we should see conditions flatten out, and maybe start to improve on the production front."

Join the conversation

MORE IN Leadership

How Signature Homes Wins While Other Builders Pull Back

Sales are sliding for most private builders. Dwight Sandlin’s team is defying the trend with strategy, speed, and customer obsession.

HW Media Acquires The Builder’s Daily, Expanding into the Homebuilding Vertical

Strategic acquisition adds leading homebuilding publication and strengthens HW Media’s commitment to serving the full housing economy

C-Suite Leaders Will Gather To Chart Homebuilding’s '26 Reset

The Builder’s Daily announces the speaker lineup for this October’s high-impact leadership summit in Denver, where the best minds in homebuilding operations, marketing, and technology will explore how to lead through the now and build for what’s next.