Marketing & Sales

Discretionary Buyers — AKA Baby Boomers — Reclaim Focus

Both "younger" and "older" Baby Boom buyers in the market tend to be classic discretionary purchasers, versus adult "rental refugee" households looking to cross the Rubicon to homeownership, or ones compelled to seek larger living space due to expanding family formation.

Numbers may not lie, but they sure do play games as they determine whether to be helpful or not.

A corollary: Demographics [numbers again] may be destiny, but if they are, then how come so often these household patterns and the businesses that try to make money from them wind up in different places?

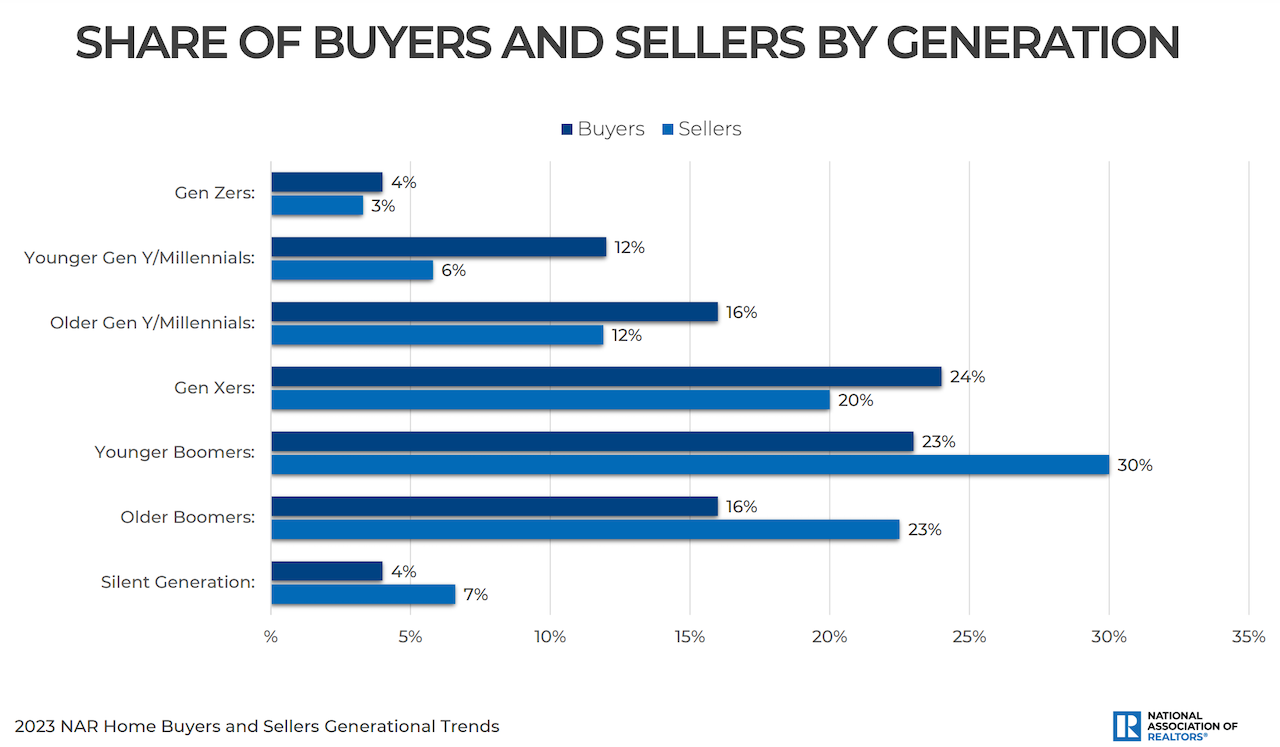

Consider data just released by the National Association of Realtors as part of its 2023 Home Buyers and Sellers Generational Trends report that reveals a big one-year swing in generational home purchase percentages, with Baby Boom (58 year-old to 76-year-old) buyers swapping for the top spot among cohorts with Millennials for the first time in nine years:

The combined share of younger boomer (58 to 67 years old) and older boomer buyers (68 to 76 years old) rose to 39% in 2022, up from 29% the year prior. Younger millennials (24 to 32 years old) and older millennials (33 to 42 years old) have been the top group of buyers since 2014, but they saw their combined share fall from 43% in 2021 to 28% last year.

There should have been no difficulty at all forecasting this pivot. Baby Boomers, after all, had piled up generational equity gains in their homes during an extended period of dirt-cheap mortgage interest rates, low new-construction rates, and peak income cycles during the past decade or longer.

By the time Covid and its fiscal, monetary, and stimulus policy aftermaths and repercussions evolved into a high-inflation-high-interest-rate inflection, Baby Boom-aged householders found themselves to be in one of the few enviable positions of leverage in a highly volatile, softening housing economic backdrop.

- They could choose to sell their existing home – in seven or eight cases out of 10 – at a profit, leveraging both equity gains and scarcity on the sale

- They were less prone to employment insecurity at the end of their careers, or past retirement

- They'd experienced high-interest rate periods in their lifetimes, so from both a psychological and a financial standpoint, they're – to a larger extent – less -interest-rate sensitive when it comes to the post-Fed step-up.

- They also have greater geographical flexibility, allowing them to move to both more desirable and more affordable destinations than other adults, even semi-tethered to job centered options.

- Not to mention, that in many cases, their financial wherewithal, credit access, and ability to commit higher cash deposits gives them greater sway in today's markets.

In other words, in most ways, , or job relocations, or other life-stage changes that require a move.

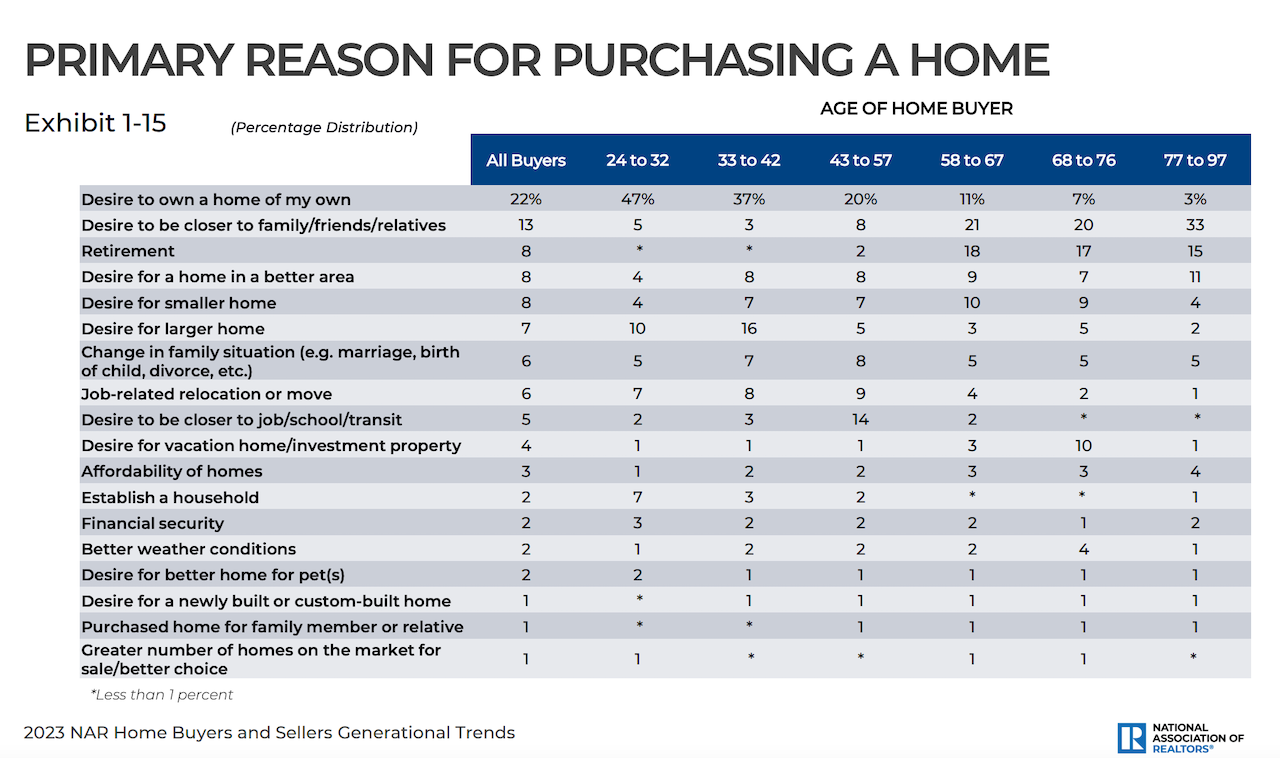

This becomes clear in the following table, which punches through "18 reasons why" people report as motivations for their homepurchase. For the 58 to 67-year-old group and the 68- to 76-year-old column, "desire" weighs more significantly as the operative catalyst.

The compelling question – going back to the first two assertions in this story – is less about what the numbers say, and more about what they mean. And following on that, how that translates to risks and opportunities ahead for residential neighborhood developers, architects, engineers, planners, and builders.

In other words, will the pivot to older, wealthier, less employment-centered, more flexible homebuyers come and go as a one-time phenomenon? Or does a higher-interest-rate, higher cost economic backdrop suggest instead an inflection to a longer run of mix-shift in customer segments toward the 55-plus part of the segmentation pie?

Our guess is that a 55-plus tipping point – despite a still-enormous opportunity on the younger-adult household formation spectrum over the next decade – will remain in the top spot among generational cohorts for several years to come. They have the most to trade, the most leeway in their options, and the fewest quotidian demands on their time.

Boomer homebuyers, 55+, and Active Adult are the segment that is — in terms of controlling the majority of wealth and equity in the U.S. – 'able' to buy," says Deborah Blake, principal at Phoenix-based strategic advisory firm The Ipsum Group. "We need to design communities, lifestyle, and homes that compel them to move."

What this implies for architects, marketers, land planners, community developers, and homebuilder and investor partners is that a discretionary buyer – where desire and preference trump urgency and need – will remain an outsized opportunity area as the consequences of Covid, the money-manufacturing glut, and hyper-low interest rate excesses work themselves through a volatile and complex stretch ahead.

Two parting ideas as thoughts in response to Deborah Blake's statement that Baby Boom householders – since discretion's on their side – need a "compelling" reason to move.

One is this: Rather than design homes and communities that lay out and package a wholly configured future – in features, functionality, and programming – for a potential buyer, how about community and home design planning that offers buyers an array of scenarios.

Borrowing from one of the godfathers of contemporary scenario planning, Peter Schwartz, as quoted here by Joseph Michelli:

Scenarios are not predictions; in fact, they are an antidote to predictions. They don’t tell us what’s going to happen. They acknowledge many possible outcomes; we can’t say with any certainty what the future will bring. They serve as a backdrop against which users can structure their thinking and consider their options." – Peter Schwartz, Wall Street Journal

How might architecture, engineering, technology, and construction integrate "scenarios" into 55-plus buyers' discretionary experience as homeshoppers, and in the livability they value?

Secondly, time back. Places – homes and communities – that bend, and yield, and free up time may be one of the more compelling value propositions new neighborhoods can possibly offer a purely discretionary prospective buyer. Builders and their partners have made strides on securing time-back from the shopping and purchasing journey. Now's the moment to make time an inseparable part of livability in the new home, new community benefits array.

MORE IN Marketing & Sales

When Homebuyers Pull Back, Builder Brands Must Step Up

In markets under stress, consistency, empathy, and value-driven messaging provide builders with a critical edge among today’s cautious buyers. Advisor Barbara Wray gets real about the path forward for homebuilders today.

What Separates Homebuilders Thriving Amidst 2025’s Chaos

Builders face rising stakes to unify tech, data, and operations or risk falling behind amid affordability, insurance, and labor challenges.

Here's Why Randy Mickle Has Joined Drees At This Moment

The new Southeast Regional President brings big, national builder experience to a multigenerational homebuilder with bold goals for its centennial.