Marketing & Sales

15 'Must-Dos' To Set Your Sales Teams Up For Success This Fall

Will your homebuilding sales in the back-half of 2023 reflect a better than-, equal to-, or worse-than performance vs. historical seasonality? Depends on whether or not the team counts on mojo in demand pull, or pushes to keep driving demand.

The "not-so-bad" extended Spring Selling season of 2023 is now one for the books.

The next couple of weeks will feature a runway show of public builder strategic executives, more of them than not boasting better-than-expected results for their calendar 2023 second-quarter.

A John Burns Research & Consulting first-half recap from vp-Research Danielle Nguyen cuts right to the chase in highlighting what's been good and what that's meant, at least in the broad strokes, for homebuilders.

New home sales jumped to 763,000 units in May (+20% compared to last May), the highest seasonally adjusted annual home sales level since February 2022.

- Home builders are successfully stepping into the supply void, adding communities, and drawing buyers to the new home market.

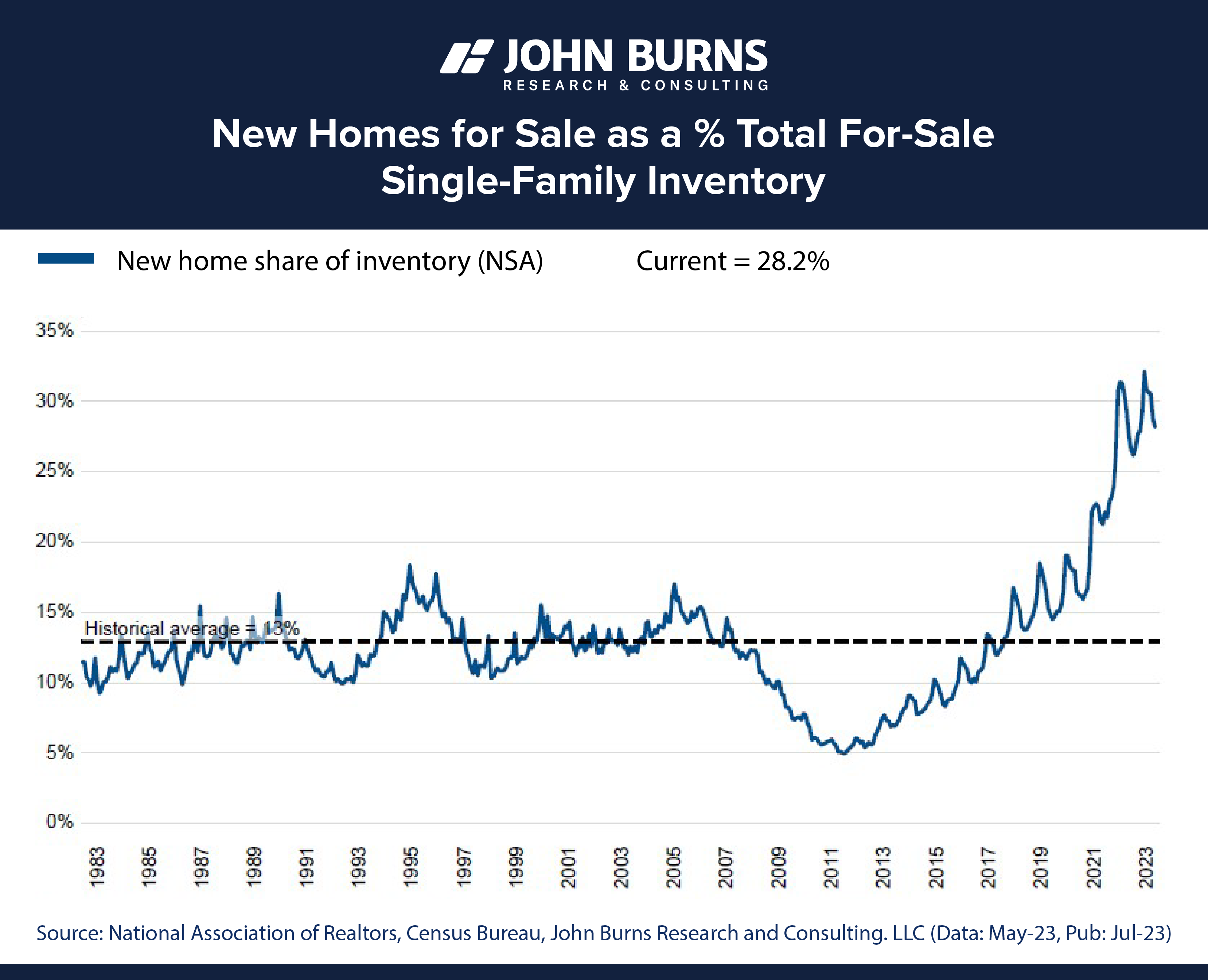

- Home builders now offer 28% of all the homes available to buy in the country, versus a historical norm of 13%. (See the below chart to view the spike in new homes for sale as a percentage of the total for-sale single-family inventory.)

The single note of caution in JBREC vp Nguyen's top line take-away is the question everybody's asking themselves, each other, and whomever may have a modicum of insight into how the broader U.S. economy and its markets behave during what continues to be a tricky, unpredictable collision of headwinds and tailwinds:

Will your firm do better than-, equal to-, or worse than long-term "seasonal" sales activity over the months considered to be, normally but not necessarily, slower than Spring's selling season.

A factor all but the largest homebuilders need to add into their raft of near- and medium-term risk assessments and back-up plans – known, unknown, and "unknown unknown" – includes a direct take-no-prisoners thrust in the next six months to two years from the top 20 or so national public homebuilding organizations. They – among them team D.R. Horton, whom we wrote about here last week – view the present moment as a critical, now-or-never moment to consolidate scale, operations, and the accretive power to expand sustainable profitability in their expanded operating arenas. They're playing to win zero-sum. In this environment – as opposed to prior era when there was so much more room for big, medium-sized, and smaller operators in most of the active markets – playing not to lose may in fact be doing just that.

It's no time for complacency, in other words. Whatever the size firm, the best game only is the one likely to assure both survival and thriving.

Team leaderships of single-market, regional, multi-regional, and national homebuilding operators now face three imperatives: (1) seize on unexpected momentum, (2) exploit the continued gaping "void" in the resale market, and (3) pivot from building cash on last-year's backlogs to growing a backlog pipeline for 2024 and beyond.

What this means is the opposite of a temptation to let demand mojo take care of itself, slipping into complacencies that tend to accompany a cyclical rebound.

Rather, if the "not-so-bad" surprise of first-half 2023 is to truly morph into a full-on housing recovery, enterprises and operators would better consider demand as less of a pull and more of a corollary response to a range of the right "pushes."

Homebuilder marketing and sales teams have better data tools, better processes, better training, and stronger regional, divisional operational support and resources than ever before to work with. They have greater agency to drive excellence and evolve up the strategic value chain from gatekeepers and order-takers to bona fide business and profitability development catalysts.

Here's how three top sales and marketing strategists at New Home Star – David Rice, founder, Nate Amidol, regional VP-sales strategy, and Austin Roff, senior sales director – look ahead. They've bullet-pointed a 15-item priority imperatives check-list every region, division- and community manager of every homebuilding operator should adopt, codify, and make accountable for marketing and sales team members across the firm, whatever the size:

Take care of what you already got," says New Home Star founder David Rice. "Get serious about backlog management. That might mean being thorough about collecting the rest of an earnest money deposit. Or it might mean working to remove any contingencies. It definitely means getting rates locked with buyer and their mortgage companies."

Here's a top-15 action imperatives enterprise leaders should do now to set sales and marketing teams up for success in the Fall this year:

- Prioritize backlog management - secure earnest money, remove contingencies, and lock in rates.

- Generate inventory for fall conversions - appeal to buyers seeking immediate move-ins.

- Drive affordability - explore strategies like de-spec'ing neighborhoods and partnering with preferred lenders.

- Repair brand image proactively - anticipate increased scrutiny and address issues promptly.

- Optimize inventory mix - analyze starts and cycle times for a well-balanced portfolio.

- Invest in a comprehensive promotional strategy - boost traffic with targeted messaging.

- Foster divisional engagement - organize fun contests and office gatherings for improved performance.

- Enhance customer engagement - revamp model communities to outshine competitors.

- Establish effective competition reporting - stay agile in a rapidly changing market.

- Cultivate positive customer reviews - strengthen online reputation to attract buyers.

- Review backlog rigorously - address qualification issues and ensure timely closings.

- Assess Unique Selling Position - align offerings with current target consumers' values.

- Nurture credit-challenged buyers - prepare for potential increased supply as rates reduce.

- Plan for Fall demand - anticipate buyers seeking new options.

- Prioritize strategic decision-making - align with current market trends and consumer preferences.

The summer often brings complacency and can show in the way our models and communities are presented," notes New Home Star regional sales director Austin Roff. "Consider a full audit to freshen things up and outshine your competition by having a tight marketing window when customers arrive."

In select circumstances in sports and other fields, it's said that "the best defense is a strong offense." It a moment where access to buildable lots, financial resources to keep a steady flow of specs, and margin discipline to keep nimble on pricing to sustain pace add up to a matter of survival, being able to play well on offense now is a builder's best defense.

Most of all, says New Home Star senior VP-sales strategy Nate Amidol, don't necessarily count on what's giving new homebuilders their greatest advantage right now to sustain itself indefinitely.

Get good at nurturing credit-challenged buyers," Amidol advises. With supply low, homebuilders are reaping the benefits. But if rates begin to shrink, it’s likely we'll have a pent-up supply from among people who want to sell their homes but who've waited because they don’t want to leave their low rate. As rates normalize lower, more of those homeowners will list their homes. If you have an ability to nurture credit-challenged buyers now, they become buyers you need when more options appear."

That's playing on offense, and if you don't, you may be playing a losing game.

MORE IN Marketing & Sales

Why Homebuilders Should Stop Ignoring the Move-In Moment

Buyers don’t just want a new home — they want a seamless handoff into it. Concierge services may be the zero-cost amenity that becomes a new industry standard.

When Homebuyers Pull Back, Builder Brands Must Step Up

In markets under stress, consistency, empathy, and value-driven messaging provide builders with a critical edge among today’s cautious buyers. Advisor Barbara Wray gets real about the path forward for homebuilders today.

What Separates Homebuilders Thriving Amidst 2025’s Chaos

Builders face rising stakes to unify tech, data, and operations or risk falling behind amid affordability, insurance, and labor challenges.