Leadership

Spring Leaning: Pulte's Plan To Excel, Adjust, Reset, And Roll

The burning question: How it is the Pulte team manages to improve on its gross margin edge over peers, and on the other hand projects it will continue to drive pace amidst building price and margin pressures in the horizon.

My dad gave me a lesson in performative narrative when I was in first grade.

How did your spelling test go?" he asked.

It was easy, dad. I think I got them all right," I replied.

"Never say the test is easy," he said, as gently as he was capable of being. "Always answer that the test was very challenging. Then, when you get the test back, and it's a 100% grade, you'll feel doubly proud that you aced such a hard test."

More than one reason might account for not scoring 100%, he'd advised. Maybe a trick question on the test. Maybe I just thought I'd gotten it all right. Maybe I was careless in my haste to finish the test first and got some wrong inadvertently. All of the above and more could alter the outcome I expected.

At any rate, the advice has proved valuable. It can mitigate an unforeseen disappointment and can add a blush of pride to the moment of anticipated triumph. Managing expectations and then over-delivering on them is a life-lesson gift that keeps on giving.

Reminders of this lesson come in a constant flow during a public company earnings reporting cycle featuring a running theme: A look back with awe and pride and a look forward with guarded confidence that – despite headwinds and uncertainty galore – "we got this."

Yesterday, Pulte Group, M.D.C., and NVR all reported historic full fiscal 2022 earnings like their peers – Lennar, KB Home, D.R. Horton – before them, marking an operating period where a blend of tailwinds and overachievement in the front part of last year far eclipsed the impact of weakness during '22's latter months.

We're going to take a look at a sampling of the companies reporting through the cycle. We'll scrub for what they may show us about conditions for staying power and success, as well as details that may impact other homebuilders – public and private -- competing in a few, some, or most of the geographical and customer segment markets of the of subject of our focus.

A running performative narrative – managing expectations in the hopes of over-delivering on them – is one of the default tactics, both as a decoy for what may be known and air cover for a number of unknowns.

We'll start this process – expected to continue through the week and into next – with the Pulte Group, which is showing up as an outlier among peers for a few reasons Wall Street analysts were intrigued about and trying to fathom.

Before we plunge into the burning question – how it is the Pulte team has managed to improve on its gross margin advantage over other top 5 ranked public company peers and projects it will continue to do so despite building price and margin pressure in the horizon – let's remember the context.

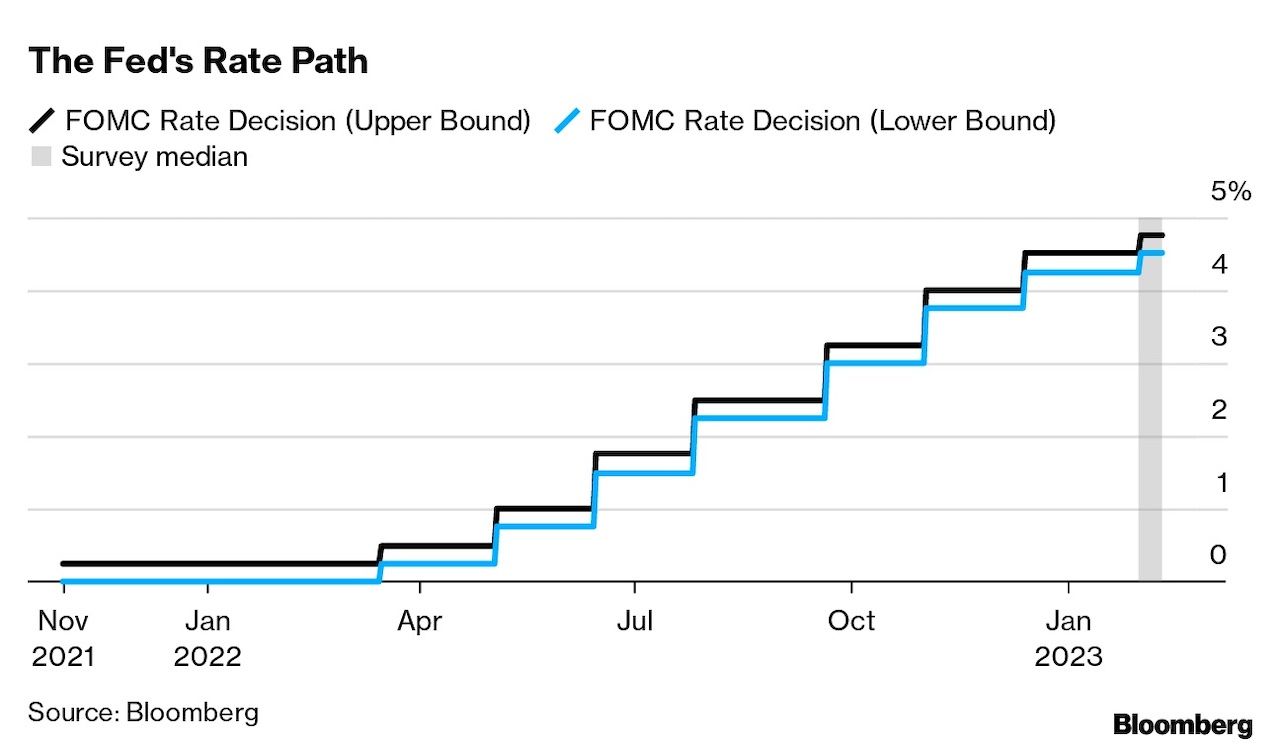

It looks like this:

The Fed today and after today will have everything to do with new home buying and selling conditions homebuilders will contend with. Today's expected step up by a quarter percent – and commentary on future plans and priorities – feathers out into every area material to builders' books of business.

Following on that context, PulteGroup President and CEO Ryan Marshall has this to say:

What's really driving kind of the sales trajectory right now is affordability, and rate is part of that equation. We've also done things in the way we've repriced, the way we've created incentive loans that have helped so affordability as well.

Will 2023 look like 2022, only in inverse? Like many investors propelling the early year "feel-good rally," builders strike us as extra-focused on all that's positive, and more obtuse about the negatives and potential negatives that are real.

We'll wait – probably beyond April 1 through the end of May – to understand exactly how 2023 will sort.

The fascinating part about the Pulte story is that its C-suite executives suggest its financial outperformance to date stems from both strategic and operational competitive advantages as an explanation. We'll explore this in their own terms, with help from the transcript from yesterday's earnings call with equity investment research analysts.

First, a look at the high-level numbers for Q4 2022 that PulteGroup reported yesterday (from its press statement):

- Reported Net Income Increased 48% to $3.85 Per Share• Adjusted

- Net Income Increased 45% to $3.63 Per Share

- Closings Increased 3% to 8,848 Homes

- Home Sale Revenues Increased 20% to $5.1 Billion

- Homebuilding Gross Margin Increased 200 Basis Points to 28.8%

- Company Repurchased 2.4 Million Common Shares in the Quarter for $100 Million

- Year End Cash Balance of $1.1 Billion and a Debt-to-Capital Ratio of 18.7%

In yesterday's call, two PulteGroup executives, Ryan Marshall, President and CEO, and Bob O'Shaughnessy, Executive VP, CFO, did most of the substantive talking and response to the questions. So, below, we'll have a sub-headline for Ryan Marshall and Bob O'Shaughnessy that uses their first and last name as the source of the quoted insight.

The presentation and Q&A – following a standard format – addresses matters of financial performance, strategy, operational issues and priorities, market observations, including latest-month commentary and color.

From a topline take-away standpoint, here's what jumps out most:

- Signs of life started in December as mortgage rates eased, pricing and incentives took hold, and economic and consumer confidence held up. In, January, those early signs began to gain momentum, hinting at a relative seasonal uptick in demand.

- Broadly, ready-to-own spec homes far outperform build-to-order homes, reflecting the impacts of volatility on buyers' ability to qualify as well as discretionary buyers' willingness to commit now versus being patient.

- 55-plus demand for PulteGroup's Del Webb held up better than expected, while move-up customer segments underperformed during the latest downturn months.

- Geography matters: While commentary notes that incipient demand has materialized across PulteGroup's all-regions U.S. footprint, particular focus on Florida and the Southeast as overachievers gets credit for some new levels of confidence.

- Final take-away: Optionality and pan-cyclical financial balance-sheet strength and depth give operationally rigorous players like Pulte leverage with both what they will continue to pay for key resources – land, materials, labor, etc. – as well as what they'll do to price their new-home products.

Let's listen to what President and CEO Ryan Marshall and EVP, CFO Bob O'Shaughnessy have to say directly in answer to some of the topic-based questions raised by the analysts. What the analysts were most trying to understand is what appears to be a question of how Pulte can continue to generate exceptionally strong margins even as its forward pace of absorptions has slowed dramatically.

Margins: Why So Much Better Than Peers?

Ryan Marshall

I think everybody is aware that we've implemented a number of really important kind of changes in the way that we operate our business that has driven higher returns over the housing cycle, and certainly, higher margins have been part of that. Those initiatives have touched everything from the way that we design our homes and communities to how we price and sell homes. And a really big part of it is the quality of the dirt that we're buying.

... And the way that we have evaluated and underwritten risk and the associated requisite returns that we ask for as part of the risk associated with those communities. So I think you're seeing that pay off. We have highlighted on this call, in my prepared remarks, the way that we are going to run the business in this environment, which is a tougher operating environment. We really feel it's important to turn our inventory to get good flow-through and to sell and define kind of a market clearing price.

So while we believe that the operating model that we have is a great one, and we are really reaping the rewards from it, we won't be immune to some of the market pressures that are certainly out there. But we think that we are an efficient homebuilder, and we are going to continue to be very disciplined and prudent in the way that we are making pricing decisions."

... About the comment I made last quarter about not being margin proud, that's still 100% accurate. And we've tried to reflect that in the way I laid out, we are going to be operating our business, which is to find a market price that will allow us to maintain a predictable and consistent turn of our inventory. It's the way that we can keep this business running efficiently and deliver the high returns that Bob talked about. So while we are -- we would certainly endeavor to do much better from a comparable sales standpoint than what we had in the fourth quarter. I think relative to our peer set, you can see that we are selling homes. And we are going to continue to make sure that we are priced competitively with our market offerings.

On Bringing Building Costs Down

Ryan Marshall

It's going to be tricky. I will break down a couple of components that we are looking at on the cost side. We've talked a lot about affordability being the biggest challenge that we've had over the last several quarters. And I think affordability is going to continue to be the theme as we move through kind of 2023, not just in housing, but I think in all consumer spending, consumers are feeling the affordability pinch, and it's part of the reason that we've worked so hard to find prices that we believe help to address some of that affordability pinch. With that comes the cost side that you're appropriately highlighting.

We have certainly seen and we've gotten very positive reception from our trade partners around the front end of the house as they've started to see a slowdown in new starts and kind of permits pulled. We've been collaborative in talking about what we're seeing and hearing from consumers. And they really -- they've worked to help reduce costs kind of as we've reduced our prices as well. We've seen a lot of progress with lumber. That's certainly a commodity and those things can kind of change. So we'll keep an eye on that.

Probably the thing that I would tell you is going to be hardest on the cost side is the labor side of things. And that's the piece that I think will be sticky. Those wage increases have been real, and I think once those wage increases have been provided or given, they're hard to get back. Not impossible, but the material side -- not saying the material side will be easy, but I think we will likely have more success or easier success on the material side than we will labor. So time will tell as the year plays out. As I highlighted in some of my remarks, we've got some really aggressive goals that our procurement teams are working on to reduce overall costs.

... We are going to continue to maintain a level of production that allows us to retain those trades on our job sites.

Bob O'Shaughnessy

Our lumber load was down about $10,000 in the deliveries. Q1 will have that benefit in it. That obviously impacts the margin guide that we gave. I think you heard Ryan say that labor is actually likely to be a little bit stickier so we don't really know if we're going to be able to drive those costs down. So -- and Ryan, I think, said it well. Lumber is a commodity. We typically have the pricing of the lumber impact our closings two quarters in the future, right, because when we order then build the house so the pricing we feel in the market, we feel in our income statement two or three quarters later. And that's true for most of our commodity pricing.

And I would tell you, other than lumber, it's been an inflationary market, so we've seen pressure on pricing. Again, Ryan talked about labor being a little bit sticky. Obviously, we are working with our trades, and it's how we build, where we build, can we help them be more efficient in order to offer us a better price, and that's what our procurement teams are working on right now.

And as we highlighted in the prepared commentary, that process, whatever it yields, will impact our margin profile likely late in '23 or even into early '24 by the time those price changes get negotiated and then start flowing into houses that would close with a 6- month build time, again, two, three quarters from now."

Mix Shift – Entry Level To Active Adult – Ahead?

Bob O'Shaughnessy

You heard a couple of things hopefully from us. 60% of our sales have been spec. Our spec inventory is largely in our first-time communities. Our community count, which was up 8% year-over-year, the preponderance of that is in first-time communities. The mix of our lots looking forward is a little bit richer towards first time. So I wouldn't call it a big shift. But yes, I would tell you that first-time has been -- even if you think about the sales paces in the quarter, the decline was the lowest in that first-time space. So that's where the activity is today."

Ryan Marshall

We are really proud of our Del Webb business and what it adds to kind of the overall mix of our portfolio. You highlighted that buyer tends to be probably most reactive, positive and negative, to volatility within the broader market. And there's certainly been a fair amount of kind of volatility lately. That tends to cause that buyer to maybe pause as opposed to stop.

On the positive side, you highlighted it's a thin resale inventory market. And so I certainly think that buyer has been able to sell their home. They've been able to sell their home, but I think at pretty good price. And on the buy side, they're not necessarily looking for a mortgage or the mortgage they're looking for is pretty small.

So there are some puts and takes. A couple of other things that I'd highlight, relative to the other two buyer groups that we serve, they were -- the active adult was in the middle. They weren't quite as strong as the first-time buyer. Again, I think because they don't have to move, they've got options, they can be a little more patient. They were certainly more strong -- or did better than the move-up buyer, I think, mostly driven by the fact that they're not as rate sensitive. So on balance, we feel pretty good about the active adult space, kind of all things considered. And I think it will continue to be a strong benefit to the overall enterprise.

On Land ... And Land Risk

Ryan Marshall

I think we, on average, [have] been buying 3 to 4 years of land. When you add in development timelines, land is going to be hanging around in the neighborhood of 4 years. And so if you think of that, pre-pandemic land would be kind of working its way through the system now.

In response to the impairment question, obviously, we do impairment reviews every quarter. We are coming from a pretty strong margin position, but we always look and, for instance, in this most recent quarter, we actually looked at 16 communities for impairments and impaired 4 of them for about -- it was about $2 million in costs that flow through the quarter, the other 12 did not.

Absent some real structural shift in the market, I wouldn't anticipate a widespread kind of remark of our book. I think you will continue to see us as we look at this, evaluate communities one by one. And depending on the market conditions for that community, if we are in a position like we were with these four communities in the quarter, we'll adjust.

... We've got 211,000 lots that we control, half of those are owned. We've highlighted with the amount of land that our land spend for the year, which is going to be down substantially from 2022 with the lion's share of kind of what we're going to spend in 2023 be in development. Soon stuff that we've owned and we've purchased and we've underwritten and we're -- and we've got it in the kind of entitlement pipeline, we are going to spend the money to get those communities developed and open. So assuming the market cooperates and we see continued strength, I think that we've got the land pipeline such that we can ramp our production in concert with the consumer behavior.

On Better Cycle Times – Down From 6 Months

Ryan Marshall

There's less production overall in the supply chain. So I think we can be more efficient with the labor that's there. And then the biggest issue that contributed to an elongation of cycle times over the last couple of years was impacts to the pandemic. A big part of that was supply chain related. There was also a decent sized piece of it in terms of the work environment, work-from-home, safe work environment, less inspectors in the job sites -- on the job sites, less permit reviewers in municipal offices. I mean it was really a combination of things, but probably the biggest variable that is really -- I don't want to declare victory, but it's probably better than it's been over the last couple of years as the supply chain environment is healing.

On Managing Expectations ... Overdelivering

Ryan Marshall

We are optimistic and encouraged, not only based on what we saw things kind of progressed through the fourth quarter, which, as I mentioned, is pretty atypical to see the fourth quarter build strength, but we've certainly seen that strength also continue into January. So cautiously optimistic and rates in that period have certainly been lower. So we think that has contributed. We will see kind of what the Fed does here in the next meeting. But all things considered, the operating environment, which we've [noted] is going to be more difficult. We are pretty pleased with what we are seeing in the sales for [now].

We'll stay tuned.

MORE IN Leadership

C-Suite Leaders Will Gather To Chart Homebuilding’s '26 Reset

The Builder’s Daily announces the speaker lineup for this October’s high-impact leadership summit in Denver, where the best minds in homebuilding operations, marketing, and technology will explore how to lead through the now and build for what’s next.

Century Communities' People-First Edge Is No Soft Strategy

Century Communities EVP Jim Francescon unpacks how trust, transparency, and a people-powered culture fuel high performance — even in a volatile 2025 housing market.

Sumitomo's Timber Complex Sharpens Its Edge Of Integration

The $29M Teal Jones acquisition solidifies Sumitomo’s strategy: Develop and own the lots, control the materials, manage the build cycle ... and thereby reshape the market.