Marketing & Sales

Buck The Trend: Find The Buyers' Whose Best Time To Buy Is Now

A "soft landing" calculus for homebuilders in 2023 – based on eventually lowering input costs, transferring some of those savings plus some gross margin points to lower asking prices, and re-securing an absorption rate – is the story many operators and principals are sticking to right now

Is risk off?

Now that mortgage rates and consumer price inflation have peaked and headed downward, can builders exhale?

"How about some good news?" the chatter goes on social channels, to talk up isolated instances or mini-trends of improvement in complexion, pre-indication, or even a smidge of an uptick in behavior.

It's human nature to want new year to signal a fresh start. Everybody wants – or needs – an end to what was an awful stretch of time – the whole of the last half of 2022 – for many homebuilders and their partners in many markets.

Still, remember "green shoots?" That was early 2009. There was a lot of misery left in the tank, and its toll on homebuilders continued through that year and the year after that.

Economic and housing benchmark indicators – some lagging, some leading – have come in mixed, with a tilt to the negative. So, other than the readings that what was getting worse is no longer doing so, and that homebuyers are clocking in opportunistically in a fitful way, it's hard to look ahead and read stabilization, or uptick, or momentum.

Bloomberg analyst Conor Sen characterizes the early 2023 Selling Season dynamic between many homebuilding enterprise sellers and potential new customers as in a tacit agreement with one another to stay tuned for a better moment to clock in with an earnest money deposit. Sen writes:

There is a message the homebuilders are sending to analysts and investors that would-be buyers can use as well. Because of still-elevated order backlogs, builders either don't need to or can't afford to cut prices yet as much as they would in a more-normal operating environment. At the same time, their costs are now coming down rapidly, which will make it easier to cut prices later on while still providing an acceptable profit margin. It's just going to take a little more time before they’re willing to do so." – Bloomberg

This "soft landing" calculus for homebuilders in 2023 – based on eventually lowering input costs, transferring some of those savings plus some gross margin points to lower asking prices, and re-securing an absorption rate – is the story many operators and principals are sticking to right now.

Thanks to the whiff of cooperation from the interest rate gods and an uptick in consumer confidence, they're largely confident that a still-unsatisfied maw of demand powered by macro demographics faces a historically underbuilt supply pipeline of homes – new or used.

For that reason, many homebuilding operators believe the following condition doesn't pose existential risk or threat:

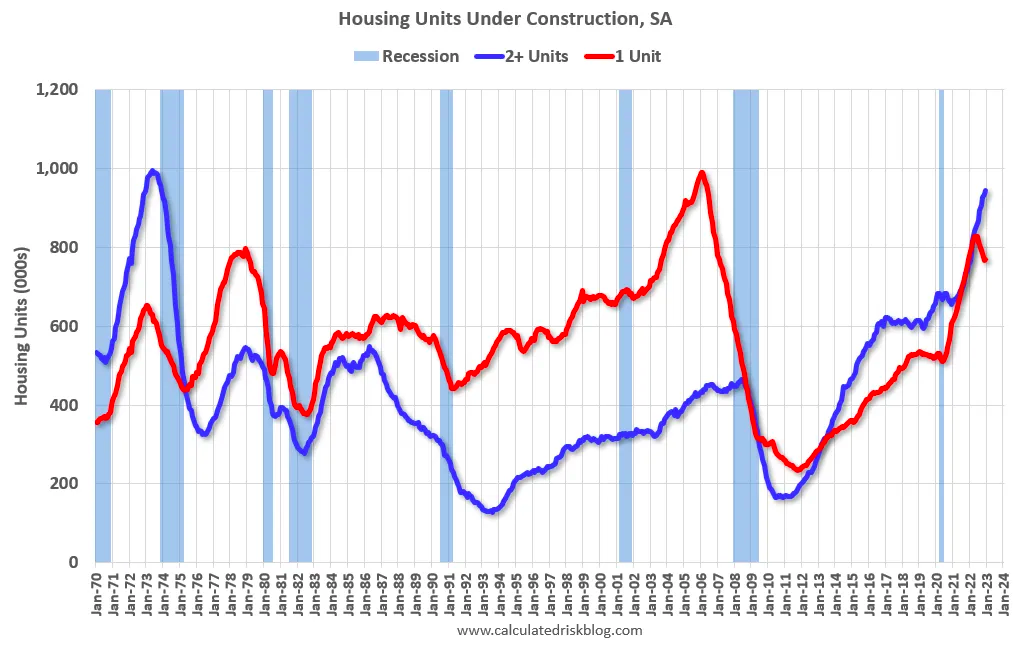

Red is single family units. Currently there are 769 thousand single family units (red) under construction (SA). This was up slightly in December compared to November, but 59 thousand below the recent peak in April and May. Single family units under construction have peaked since single family starts are now declining. The reason there are so many homes under construction is probably due to supply constraints." – Calculated Risk

As improvements to those supply constraints occur, Calculated Risk's Bill McBride notes, a surge of deliveries from this backlog of 769,000 homes will come in 2023. What it takes to close on them will be the make or break question of the year.

Potential impacts to the aggregate ability to "clear" that pipeline of new homes under construction may start with the bedrock belief that baseline undersupply means demand is both fundamentally sound and has both wherewithal and motivation to buy in 2023.

However, additional impacts to that clearing event could plausibly interfere with even such a fundamental supply-demand imbalance.

They include:

- What happens to 3.5% unemployment rates over the next six to 12 months, and specifically, what happens among professional class jobs that power new home demand?

- How will expanding back-to-office policies impact demand in markets that got a boost from pandemic remote work trends that may be doing a 180?

- Apart from shorter-term economic dynamics and their impact on employment, what happens to fundamental household income and family-formation driven demand when – consistent with a longer-term trend of technology's disruption of work and livelihoods – we see new artificial intelligence capabilities begin to impact staffing and careers?

A piece in The Atlantic, taking stock of the enormous buzz Microsoft's ChatGPT has created in "everything everywhere all at once" notes:

For years, tech thinkers have been warning that flexible, creative AI will be a threat to white-collar employment, as robots replace skilled office workers whose jobs were once considered immune to automation. In the most extreme iteration, analysts imagine AI altering the employment landscape permanently. One Oxford study estimates that 47 percent of U.S. jobs might be at risk."

This phenomenon, and its potential effect, seemed until now so far off. Now, however, it has secured its place as one of the spinning plates of current potential impacts to ground-up market-rate for-sale and rental housing. This owes in part to the real ways its applications stand for the ability to eliminate headcount positions in so many kinds of going concerns.

The smarter approach to 2023 will be one that assumes that on balance, broader trends will stay on the hostile and adverse axis of the headline continuum, and that succeeding will mean bucking the trends, and breaking ranks with peers.

You know that for some individuals, couples, families, etc., the time to buy a home is the time to buy a home. They're not part of a trend. The teams that will successfully weather 2023 will be better than the rest at finding them and providing value that will convince them they're making the smartest decision they can make in a lifetime. Right now.

MORE IN Marketing & Sales

Why Homebuilders Should Stop Ignoring the Move-In Moment

Buyers don’t just want a new home — they want a seamless handoff into it. Concierge services may be the zero-cost amenity that becomes a new industry standard.

When Homebuyers Pull Back, Builder Brands Must Step Up

In markets under stress, consistency, empathy, and value-driven messaging provide builders with a critical edge among today’s cautious buyers. Advisor Barbara Wray gets real about the path forward for homebuilders today.

What Separates Homebuilders Thriving Amidst 2025’s Chaos

Builders face rising stakes to unify tech, data, and operations or risk falling behind amid affordability, insurance, and labor challenges.