Marketing & Sales

Volatility And The Myth Of Predictive Customer Data: A Tactical Alternative

A relatively better-than-expected and improving outlook among homebuilders – based on conditions and order trends and traffic and other tips builders get into the strength of their demand – may add up to yesterday's news.

Lags in data can be a tyranny or an opportunity.

The most wrenching example of the former comes through in the Fed's fight with the blunt fiscal and monetary tools it has to cool down inflation to an acceptable level.

Another example, closer to home – and market-rate single-family housing – comes through in Wolfe Research's high-level commentary on its Private Homebuilder Survey for February 2023.

Our contacts’ February Orders increased +13% sequentially (on a difficult Jan comp), slightly outpacing New Home Sales’ +11% average historical sequential performance. February’s sequential improvement follows January’s +46% and December’s +11% MoM improvement in sales activity. Further, contacts’ February Orders increased +2.6% YoY, a marked improvement from the -16% January result and the -40% to -45% YoY declines range during the final months of ’22. Clearly, the trends in February were healthy. Notably, 2022 Orders declined sequentially from March through May, creating relatively easy comps in coming months. Should our Private Builder Orders simply remain stable the next several months with February levels, which is below normal seasonality, our Private Builder March-May ‘23 Orders would increase in the 15%-to-20% range YoY.

The tyranny of these data points includes their one-time snapshot nature, a time-frame swayed by favorable trends on the mortgage interest rate front, a milder than normal weather pattern, and at least the possibility that both pent-up and pulled forward demand for new homes clustered into the date-range of the survey.

A valid question, knowing what we know now about a sudden new banking system crisis, continued international destabilization, a slowing economy, and any number of unforseen yet plausible events, is will last month's trends hold and form a floor, or will they vanish?

They did happen; and builders will take those positive trends as a win, having figured earlier they'd have been unlikely to be celebrating anything right now when they formulated budget projections in the Fall of 2022.

The Wolfe Research survey is not the only gust of positive results and a more sanguine outlook from homebuilders – especially comparing with what had been dismal expectations in anticipation of early-year measures. BTIG also conducts a monthly survey among homebuilding firms with partner HomeSphere, and has roughly similar top line takeaways from its data, so much so that BTIG analyst Carl Reichardt noted:

Although still sluggish, business conditions are showing some clear signs of improvement as we begin the spring selling season."

The HomeSphere/BTIG highlight reel of revelations map out as follows:

- Sales and traffic trends are still soft YOY but picking up sequentially: 23% of builders reported higher YOY sales vs. 13% in February and 44% in February 2022 and 51% saw a YOY decrease in orders vs. 54% last month and 24% in February 2022. 19% reported an increase in YOY traffic vs. 13% last month. 45% saw a decline, compared to 53% last month.

- Sales and traffic relative to internal expectations sees a noticeable change point: For the first time in 10 months, builders no longer see sales as worse-than-expected vs. better-than-expected. 27% of respondents saw sales as better than expected vs. 21% last month, while 27% saw sales as worse than expected, vs. 38% last month. Traffic was also up - 27% saw better-than-expected traffic, with 20% reporting worse-than-expected traffic (compared to 19% and 29%, respectively, last month).

- Builders continue to cut base prices and use incentives, but some are raising prices and reducing incentives: The number of builders raising prices increased to 27% of builders reporting they raised some, most, or all base prices in February, from 17% last month. 30% cut some, most or all base prices vs. 30% last month. Incentive use declined but remained somewhat elevated as 23% of builders reported increasing some, most or all incentives vs. 30% last month.

The Wolfe Research and HomeSphere/BTIG are partly intended to serve as a pre-release proxy to understanding how the National Association of Home Builders/Wells Fargo Housing Market Index, the association's own homebuilder sentiment survey will look.

The NAHB/Wells Fargo HMI picked up the same directional readings reflected in the Wolfe Research and HomeSphere/BTIG research, i.e. better-than-when-it-was-worse, still below par, but all-in-all – given what may have been expected – outperforming expectations.

And then there's the problem of the lag. For all of those surveys, the data they captured came in – mostly – before the seismic disruption of three major midsized regional bank failures, as well as an international financial institution's need for a rescue.

The relatively better-than-expected and improving outlook among homebuilders – based on conditions and order trends and traffic and other tips builders get into the strength of their demand – may add up to yesterday's news.

Also, yesterday's news includes:

- Consumer Sentiment fell for the first time in four months, per University of Michigan, a reading also based on data gathered prior to the recent banking crisis.

The University of Michigan's research may signal a wrong-direction, given that inflation expectations – while not as high as earlier – continue to foresee further erosion to family income and spending power, and financial security emerges as a bigger issue.

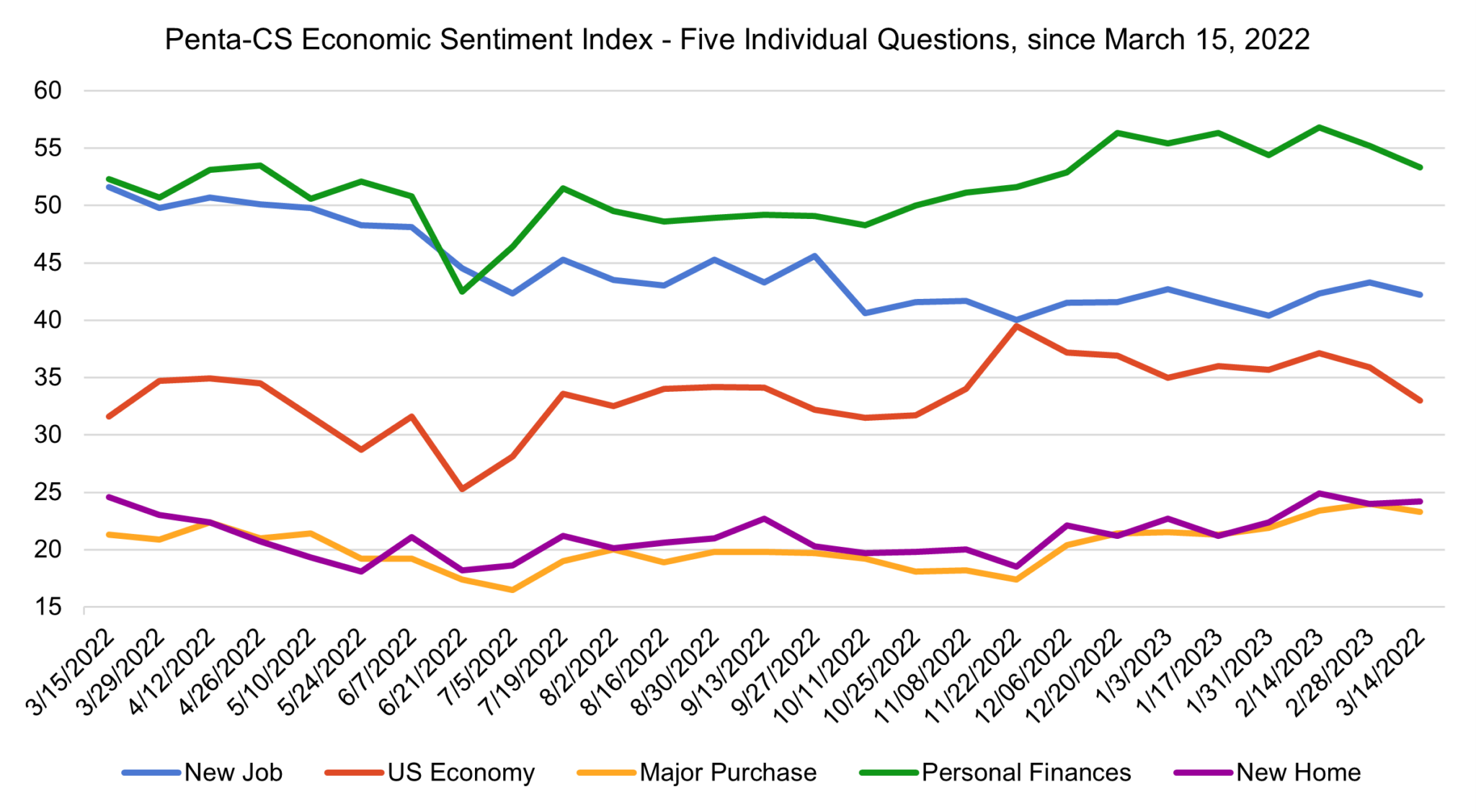

Further, a more recent pulse – i.e. today's news – on consumer household confidence and mood can be found here: The Penta-CivicScience Economic Sentiment Index (“ESI”).

Four of the ESI’s five indicators decreased over the past two weeks. Confidence in the overall U.S. economy dropped 2.9 points to 33.0—its largest single-reading decrease since June 2022.

—Confidence in personal finances fell 1.9 points to 53.3.

—Confidence in finding a new job fell 1.1 points to 42.2.

—Confidence in making a major purchase fell 0.7 points to 23.3.

—Confidence in buying a new home rose 0.2 points to 24.2.

Confidence in the overall U.S. economy fell as the U.S. was rocked by three bank closures.

The tyranny of the lags in data are evident. In moments of volatility like this one, we can finish up work on a Friday, and come back in on Monday to news that a major bank or two or three may have a new owner. It's that "everything's-on-the-table" kind of moment we lived through in 2007-08, and hoped never to have to live through again.

It's a very real-time kind of moment, with big events coalescing and playing out almost like surprises we should have known were going to happen.

This is where the opportunity shines even as data lags real-time insight. When we dead-reckon, signals become ultra important, and what matters most may be all there's time, resources, capability to focus on.

When trends are not your friends and when the playing fields you and your teams work so hard to tilt in your direction so that your customers can't help but come sliding in your direction are ultimately leveled, that's the real-time instant of opportunity.

There's no trailing data to mislead you. There's only today, now.

An old friend, author and futurist Chris Ertel, used to talk about one of the English language's most meaningless and counter-constructive terms: "Customers." And, he was a marketing maven! The term was a bad invention, he thought, because it depersonalized a kind of necessary relationship between buyer and seller as human beings exchanging value for value.

When operating and sales and revenue and business models run true to trend, and reliably sequence to trailing – and lagging – data, the term customers may apply, like units, or volume, etc.

When those operational projections fail to become reliable, and real-time outcomes determine whether you have a business or not, forget about customers. Their lagging behaviors, preferences, attitudes, etc. might send you in the wrong direction entirely, and existentially.

Focus on people and what they need that you have to offer them.

MORE IN Marketing & Sales

When Homebuyers Pull Back, Builder Brands Must Step Up

In markets under stress, consistency, empathy, and value-driven messaging provide builders with a critical edge among today’s cautious buyers. Advisor Barbara Wray gets real about the path forward for homebuilders today.

What Separates Homebuilders Thriving Amidst 2025’s Chaos

Builders face rising stakes to unify tech, data, and operations or risk falling behind amid affordability, insurance, and labor challenges.

Here's Why Randy Mickle Has Joined Drees At This Moment

The new Southeast Regional President brings big, national builder experience to a multigenerational homebuilder with bold goals for its centennial.