Land

Return-To-Work Measures May Stress-Test Wider-Radius Theory

In early Covid time, outer ring opportunity called like it was the Next Big Thing in residential planning and development. With the verdict still out on remote work, some bets are in question.

As more companies call employees back to the office, a real estate moment of truth emerges. Residential development bets on an outlook altered by the pandemic, heavily featuring telework and hybrid remote- and in-person work models get a reality levelset.

Will there or won't there be a new wider radius of suburban zones encircling at least some major urban downtown job centers for a 2020s and beyond hybrid workforce?

In the mid-2000s, the slam-dunk land investment strategy was in "path of growth" greenfield tracts, where rooftops were only a matter of time? Which is to say, sometimes the slam-dunk is not one.

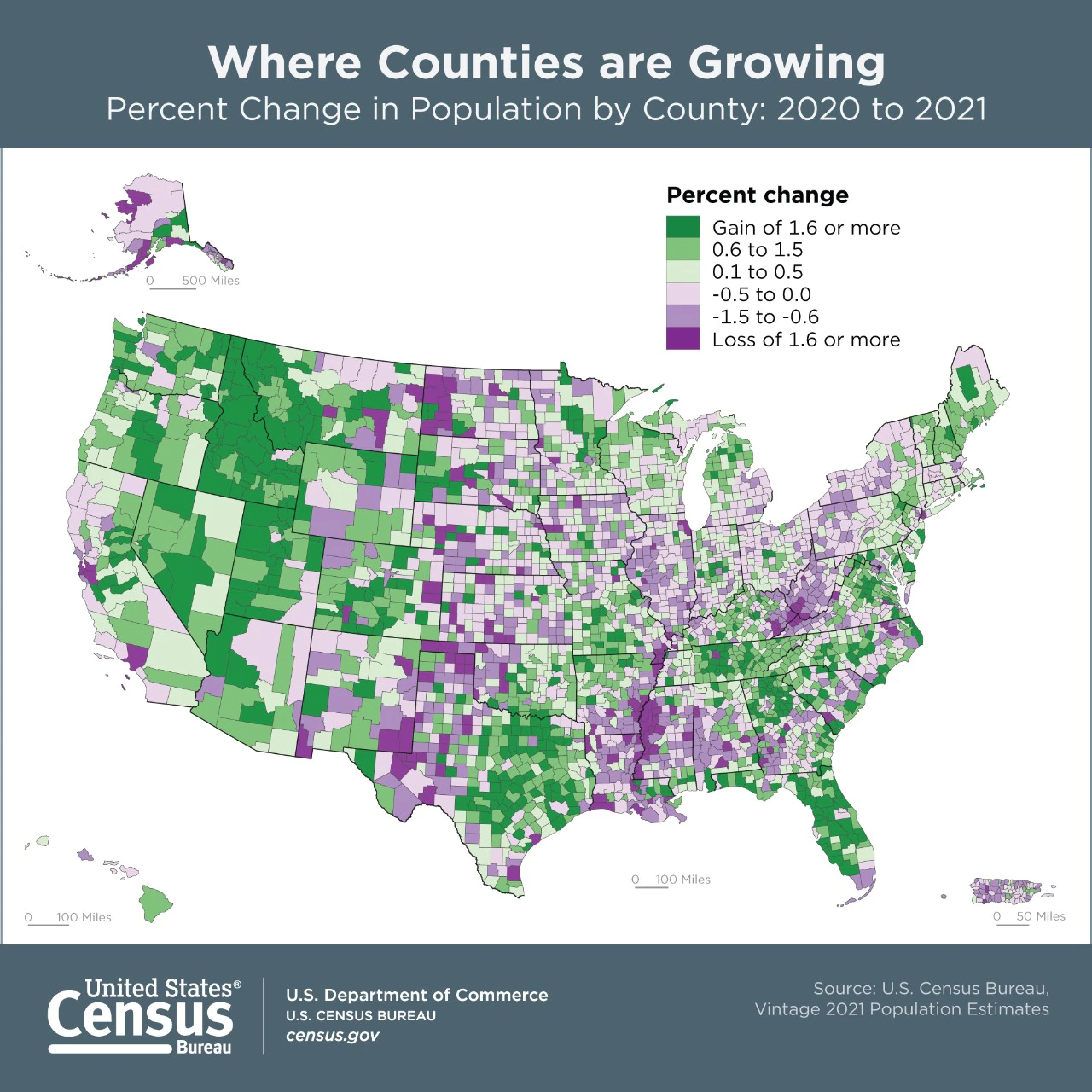

Call the Census Bureau the last ones to know what's going on with America's mobility, migration, and housing geography. Still, here's how the nation's population and household statistical research agency mapped mobility and migration's rocket-fueled change from 2020 to 2021.

Characterizing the movement and motivators, demographer Wendell Cox fixes on two broad, convulsive changes the maps and their underlying data reflect.

- One, is a dramatic exodus – negative migration -- from urban core counties

- Two, is an equally noteworthy increase in in-migration to outer suburban counties around major metropolitan urban core counties.

Cox writes:

There is increasing evidence that the increased metropolitan core migration losses could continue given the less than robust return to the jobs in the nation’s largest central business districts (downtowns). In San Francisco, it has been projected that ridership on the regional rail system, BART (Bay Area Rapid Transit) may not reach pre-pandemic levels for a decade. The hybrid work and remote work arrangements, that have made the five day work week a thing of the past and facilitated the decentralization are being embraced not only by employees but also by corporate leadership.

The other trump card evident in the Census map that are not taken up in Cox's analysis are the big gainers among 14 or so "Smile States." Smile states are where most new home development, construction, and investment is angling to be put in place, and they're where both risk and reward have spooled up as inflation, interest rates, supply chain disruptions, and land and labor constraints exert pain and anxiety.

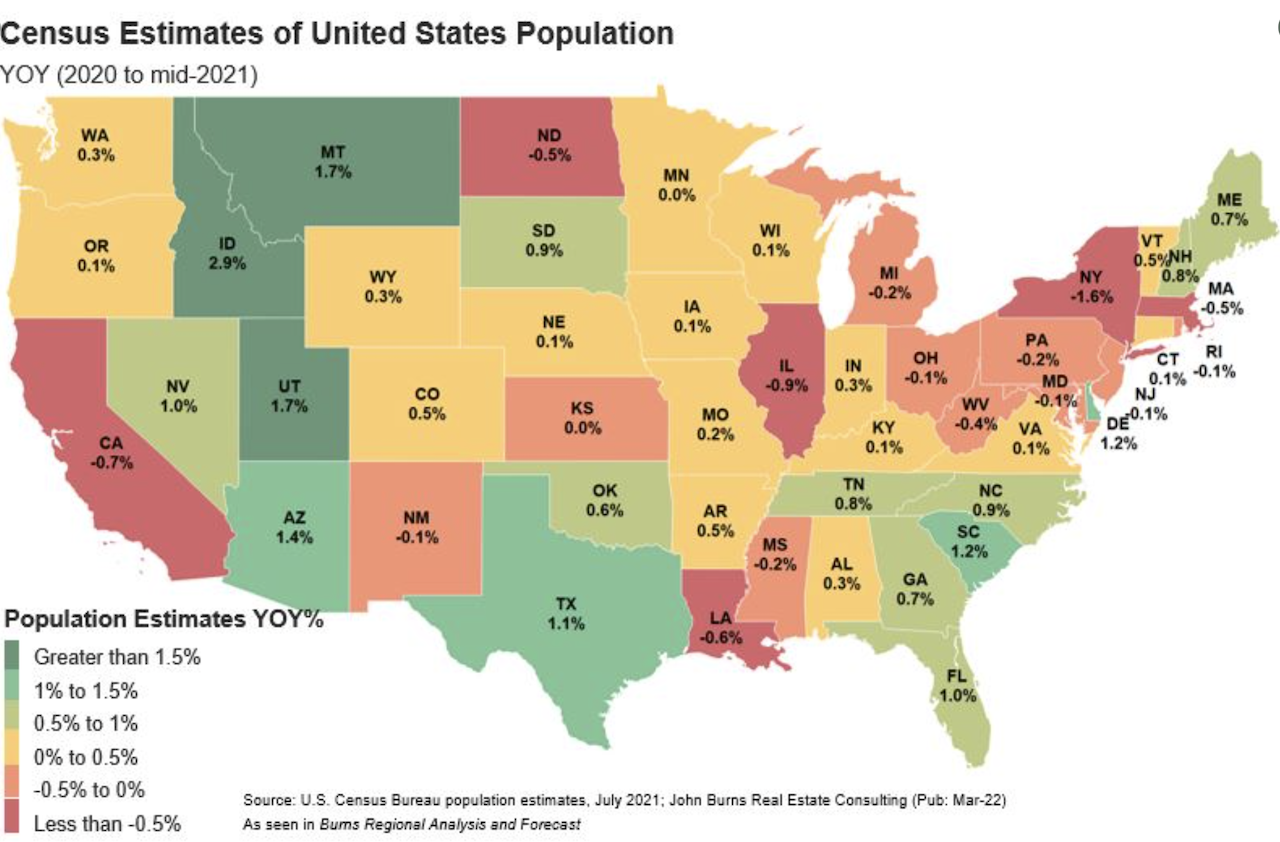

The research team at John Burns Real Estate Consulting took the county-level data to a state-level detail, and the map looks like this:

JBREC founder and ceo John Burns comments:

The Census Bureau's 1st year Covid relocation data is in. Everything looks right except I would have guessed even more growth in the Southeast. Idaho, Utah and Montana boomed the most. New York, Illinois and California saw the biggest.

Now that everybody's figured out, and many have bet heavily that a pandemic-era, new geography has reset housing's future mapping patterns, it may be worth taking a moment to double-check the math on how much investment in this new-normal end game will hit paydirt.

While there's time.

This pair of questions is never not relevant.

Is it a blip? Or, is it a trend?"

Its specific relevance today applies to magnet destinations for America's pandemic-era movers. Namely, do the catalysts that propelled an accelerated rate of migration morph ultimately into sustaining mobility drivers or not?

Which catalysts are we referring to?

- Latent millennial generation household-, family-, homeownership formation

- Exponential technology untethering people from offices

- Pandemic health challenges driving moves toward safety, security

- Housing finance policy stimulus driving mortgage rates to historical lows

In the throes of early COVID in late Spring 2020, the two questions evolved slightly. "Blip or trend?" became a pair of related questions that sound different because they don't suggest permanent or transitory nature, but share behavioral traits in kind:

Is this a new trend? Or, is it an longer-running trend that's been sped up by the onset of the pandemic?

Detecting what the global health crisis would alter radically, upend completely, change forever, ... or rather, merely accelerate adaptations already in motion gave a long-term-thinking perspective to what otherwise felt as an abrupt end of life as we knew it. The perspective dialed back the "freak out" reflex, and, instead limned out continuity and cohesion from before the COVID outbreak to what was going on and would go on afterwards.

Here's a big question mark. Are we all set on whether the hybrid in-office, work from anywhere current state is a blip or trend? Or maybe it's a trend that was in the works, but is now sped up? At any rate, will there be winners and losers in real estate based on heavy betting one way or another? You bet.

Bloomberg staffer Sarah Holder writes of such wagers

Supercommuters are defined by a more than 90-minute trip to work, either because they can’t afford to live nearby or because they’ve been seduced by a lifestyle they can have farther afield. While the U.S. workforce grew by 13% from 2010 to 2019, the ranks of supercommuters increased by 45%, according to Chris Salviati, senior housing economist at Apartment List, an online rental service.

Although his study used data collected before the pandemic work-from-home revolution, Salviati says new hybrid commute schedules will probably encourage people to expand the search radius between work and home. “There might actually be a lot of folks ending up in situations where now—because they’re not commuting every day—they’re willing to endure a longer commute,” he says.

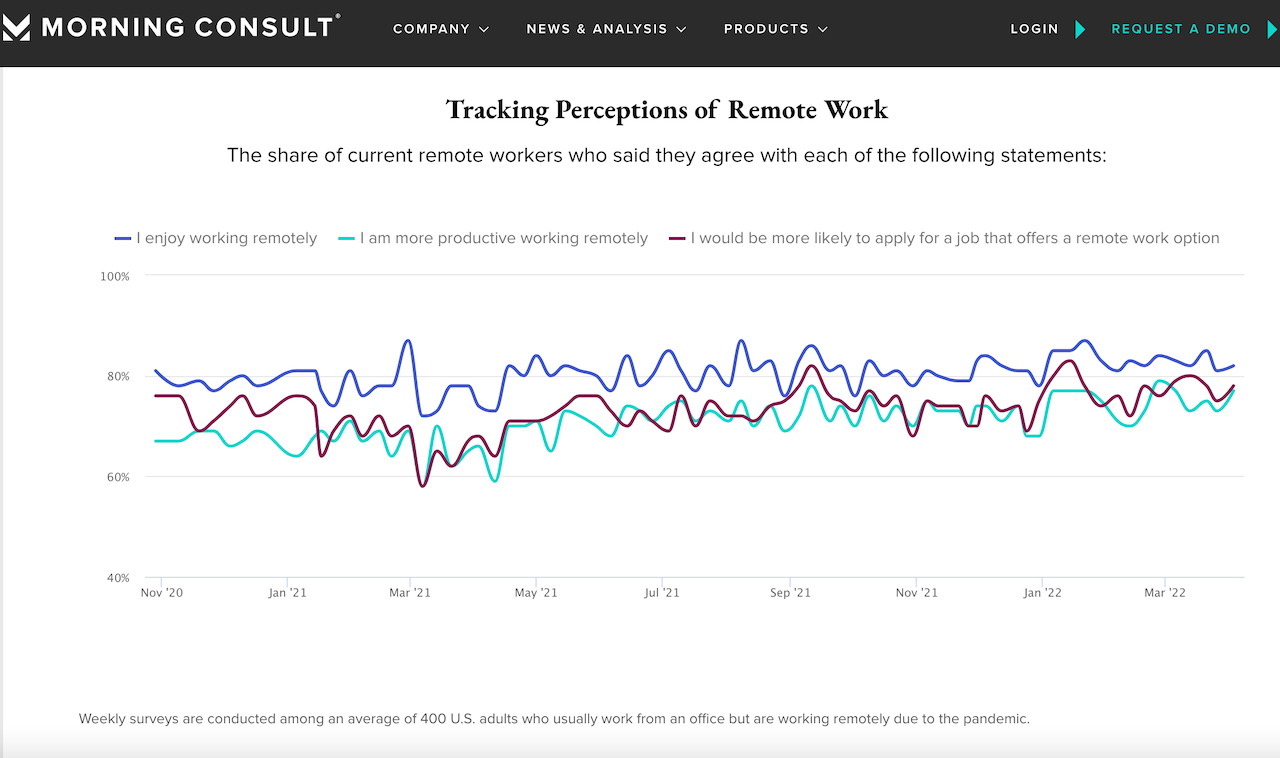

Have a look at Morning Consult data on the work-home split, and the prospects for a return to work.

Now here we are, and the big bets on new normal new geography appear to be these:

- Suburban growth within latter-day striking distance to major metros – allowing for hybrid in-person vs. work-from-anywhere flexibility, more attainably priced housing, and room for family formation.

- Smile States' appeal – for smaller-town, closer-knit community living, for attainability, for generally lower taxes and less regulation, for natural amenities like warmer climes – includes both larger uban metros in Florida, Texas, and California, as well as secondary and tertiary markets.

Not so different than pre-Covid. So, the answer to the question may be, what we first observe as a new trend is actually a blip and what we'd at first believe to be a temporary blip is, in fact, part of a longstanding trend.

Join the conversation

MORE IN Land

Lone Star Diamond In The Rough: A Case For 'Why Weatherford'

Longtime Texas residential land strategist Scott Finfer opens up his land scouting manual to explain the stark difference between speculation and data-backed, applied vision.

Little Deal ... Big, Timely Product Pivot: Lokal’s Capital Play

A $12M facility fuels Lokal Homes’ swift shift into higher-margin homes and a smarter land strategy in a tough market.

Oversupply or Overreaction? DFW Market Needs To Hit Reset

Scott Finfer breaks down the DFW-area oversupply crisis: post-pandemic assumptions, slower job growth, and mispriced inventory. Across the U.S., high-volume markets face similar risks. Finfer outlines five strategic moves to cut through the noise — and seize ground as bigger players pull back.