Technology

Navigating Five Moving Targets Essential To 2023's Selling Season

A constantly-refreshed, scrubbed, and synched up set of operating and decision-support data becomes a staying power must-have in tricky cost, pricing, borrowing, and planning market conditions.

Spring selling season – accurate or not as a time-period within which most households inclined and financially able to buy a new home in 2023 will decide to do so – is a tale of three parallel realities for firms vying for their piece of the action ... and battling for dear life.

Based on who's losing sleep at night or who's resting well, everyone's fully aware that the filter that matters most right now in defining which reality you're navigating challenge, risk, threat, and opportunity is capital C Capital.

In two of those parallel universes, operators and enterprises either drawing on public equity and debt or undergirded by a patient deep-pocketed foreign-based or domestic corporate strategic angel. They're performing – albeit rigorously -- with optionality and staying power as a given.

Then, there are the rest. Hundreds, or perhaps thousands of operators that make up two-thirds or more of U.S. new home construction activity, are working with little to no margin for error, grinding each project, each day, each payment out, each booking of revenue in, with a weather eye on credit balances and the small print in their loan covenants. Strings attached to bank financing, privately accessed investment funds, friends and family, country club ... you name it ... are tugging nervously tighter.

They're only not under water if land – some of it purchased in vintages as late as this time last year – on their books proves to be worth what it was modeled at at the time it was purchased.

What binds every operator no matter what capital structure supports the model is the essential building-block of any market-rate homebuilding firm's viability as a going concern: the inventory turnover ratio. As in, without that, there's no business.

So, whether it's April 1st, or a few weeks before that, or, maybe a couple of weeks past that, every firm's principal strategists, owners, vested and invested stakeholders, leaders, lieutenants, and operating team members face a version of the same multivariable calculus problem as they try to keep their businesses fit and healthy and ready for an inevitable – but, who knows when? – market recovery.

The question, in theme and variations, is this:

If I lower my prices to a 'strike point' that restores an inventory turn ratio into motion for my business, what is my gross margin?"

Importantly, is there one sufficient to keep the lights on, keep creditors and [private and/or public] investors happy with payments and risk ratios, make payroll, and set enough aside to keep feeding the machine with lots that will turn in a market that resets to new rules of equilibrium.

Homebuilders – to generalize from 20 years of direct experience of the character, canny, and customer-focus among their leaders and ranks – have mostly lived, breathed, and excelled in the constant throes of spinning plates and moving targets.

Now, though, is now. What's hidden about just how a smattering of good vibrations – a jump in January orders and a slight blip downward in cancel rates – crosses paths with a broadly weakening economy, a worrisome surge in mass layoffs impacting professional class households, and ongoing severe ruptures in supply and demand worldwide due to a festering and growing world war and Covid is how bad, how long, or how resilient and how sustainable 2023 will work out to be for operators. That goes for individual firms and the sector as a whole.

In other words, until more time passes and more happens or doesn't, questions outnumber answers.

Amidst that cloak of unknowing – i.e. "things we can't control" – focus, priority, excellence, and impact need to sway at least the following spectrum of decision and action sets. Adding to the survive-and-thrive riddle, hyperlocality – community-level and competitive interplays – weighs into each layer of factors in motion and subject to volatility:

- Cost of sales increases – incentives, mortgage buy-downs, discounts, etc. – to close backlogs, finish and settle unsold homes under construction, and jumpstart new orders.

- Direct cost reset – negotiations on current and visible future pricing on building materials, products, labor, land etc.

- Build-cycle gains – legacy choke-holds, reverberations of supply chain glitches, raw materials shortages, global vs. local sourcing debates, etc. continue to stand in the way of construction cycles that predictably cadence as planned – on time and on budget.

- Market and submarket competition – namely, other for-sale communities, existing home sales trends, single-family rental options, etc.

- Product redesign and value engineering – both for marketing purposes to drive in-person or online traffic and to price-in more households, smaller, simpler, more dense, entry-level models may be needed to improve inventory turn ratios amid headwinds.

So, there we are. These five bedevillers – and more – are any homebuilding firm's dynamic obstacle course of knowns. Then there are the unknowns.

All of which speaks to the solutions-level value of a firm's embrace and operational practice of a common data hub – like that Constellation Homebuilder Systems is now introducing to homebuilders and their partners – from which every one of these crucial priorities can be synchronized, brought into a holistic balance, and deliver real-time fully-calculated answers to Spring Selling Season's single most critical question.

If I lower my prices to a 'strike point' that restores an inventory turn ratio into motion for my business, what is my gross margin?"

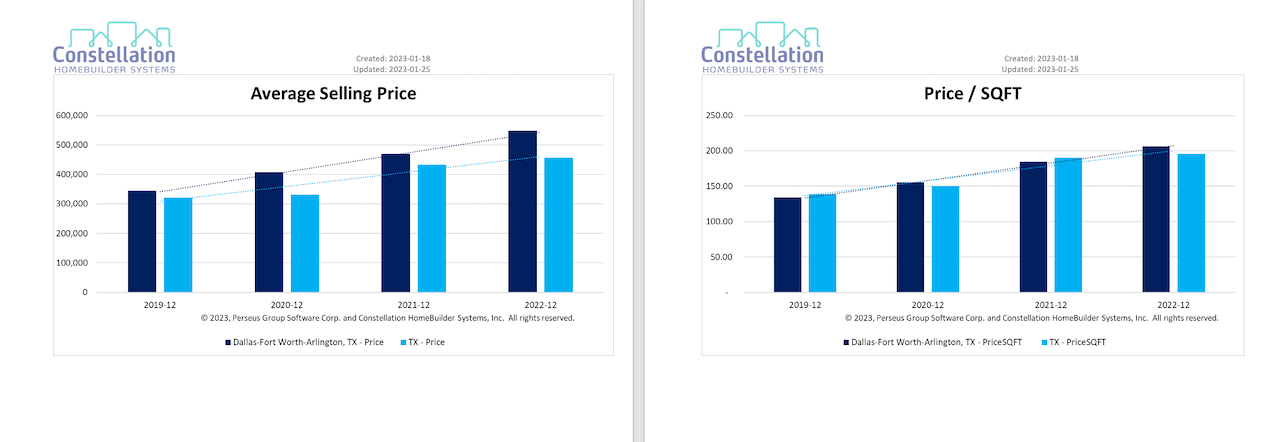

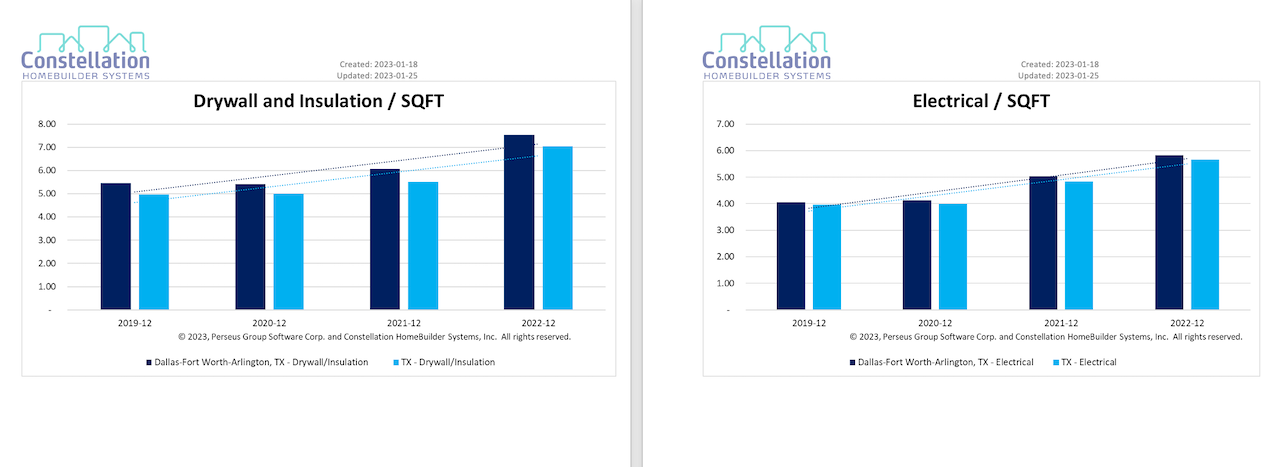

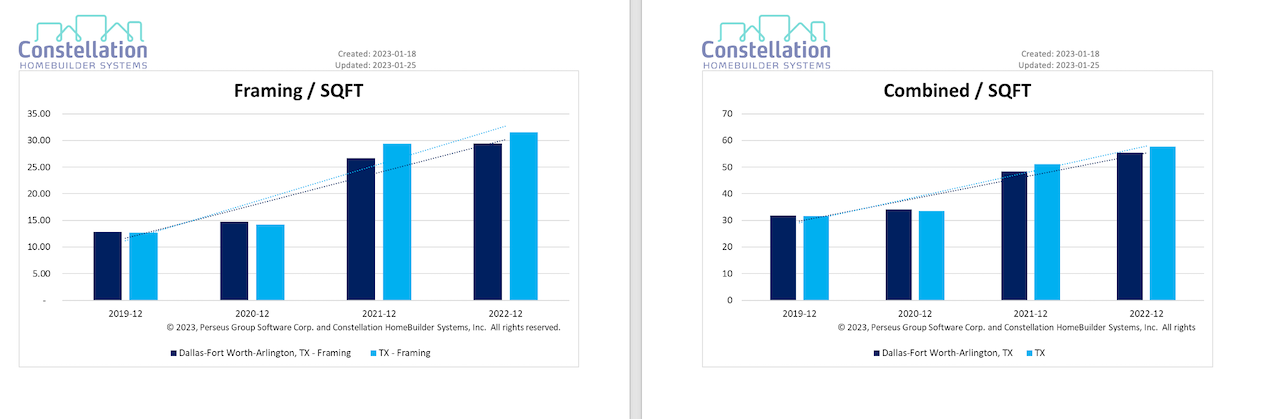

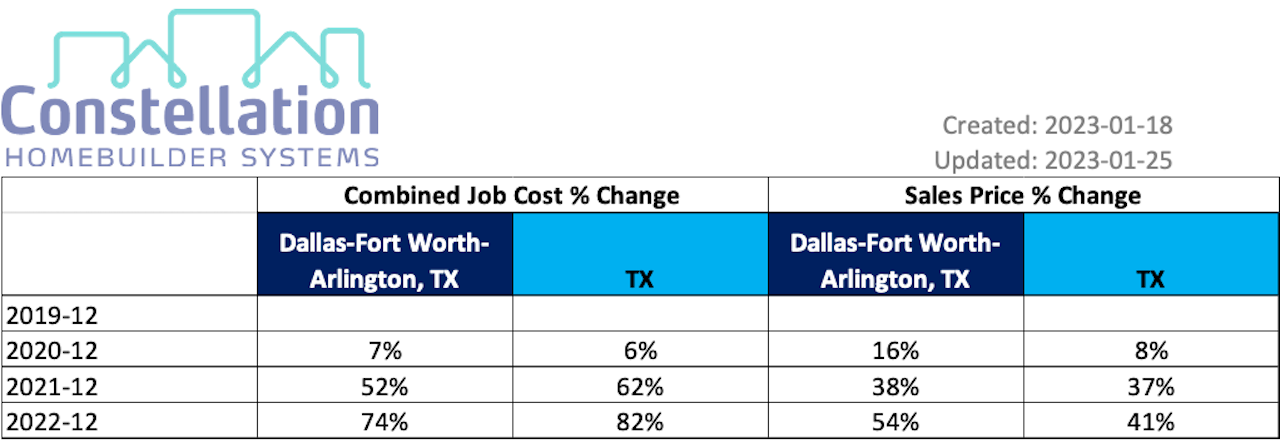

Constellation Homebuilder System's VP Data Strategy Paolo Benzan looks at some of the rapidly moving parts in homebuilders' ecosystem through a market-level lens – the Dallas-Fort Worth-Arlington, TX metro vs. the total Texas market – to illustrate the local nature of the Spring Selling Season riddle.

The following five pictures illustrate a sample set of the real-time, in-motion force factors builders need to solve in their Spring Selling business calculus:

Ultimately, when a homebuilder answers the question – "what happens to my gross margin when I price my homes to market?" – the construction cost calculus looks, at the start, something like this.

Here's Constellation's Benzan on a use-case for a range of strategic decision makers' benefits for adopting and integrating a common data model to help navigate current conditions.

Owner

As an owner of a company, I need to constantly evaluate the results of my business. I need to know that we are operating effectively, spending and investing wisely, and competing aggressively. Without accurate and timely comparisons, how do I know if my business is outperforming or underperforming. Relying on anecdotal information is not the way to go.

Using timely and accurate benchmarks, I can ask questions of my team, and challenge them on what they are doing to investigate, or improve the business. If I am underpricing my homes, adjusting quickly can make a huge difference. Similarly, I can improve gross margins when I know where my company is inefficient or overpaying."

Purchasing

When working with trades on bids or vendors on materials, it is always wise to benchmark the numbers against the averages for those market areas. For the most part, this is currently a manual process of calling purchasing folks that you know and asking what type of pricing they are getting. It can also be an exercise of reviewing competitive market analysis and backing into the underlying cost numbers. Both these methods are valid approaches, however, they are time consuming and they are estimates.

When reviewing benchmark data from the Constellation Data Services team, you are looking at pricing and cost data that have been aggregated at the market area level, across multiple builders. This benchmark data reflects what builders have entered into their purchasing platform and are timely and should reflect an accurate view of the reality on the ground."

Sales and Marketing

When looking to open a new community in a new market area, there is significant work done by the sales and marketing team to ensure they understand that competitive landscape. This includes product design, pricing, amenities, school districts, etc. These competitive market analyses take quite a bit of time to compile and are costly.

When using the comparative data from the Constellation Data Services team, the sales and marketing team can get a quick overview of any market area in terms of avg SQ FT, avg sales price, avg cost, and many other metrics in order to get a high level understanding of the landscape.

In addition, the sales benchmarks will provide timely insight into real-time changes in the market as it relates to pricing and absorption. This will allow the sales team to pivot when a market change occurs based on accurate data.

Finance

When looking to acquisition or expansion into new market areas, the finance team needs to know the operating dynamics (cost / ASP / GM% / absorption / Cycle time) in order to complete the proforma for the executive team to use as a basis for a decision.

The Common Data Model benchmark platform allows the finance team to review the aggregate metrics across all these dimensions in real-time for the given market area. They do not need to spend weeks working with consultants to research and document these findings, but instead can run several reports to get the underlying basis for the market area in question.

Information Technology

IT teams spend a significant amount of time managing integrations to 3rd-party platforms across an organization. For homebuilders, it is critical that the ERP has timely and accurate sales and construction metrics that are typically generated in 3rd-party tools. These integrations are business critical and there is typically a dedicated resource who manages these.

In an environment where the Common Data Model is used, Constellation will have a pool of connectors pre-built for the most common homebuilding 3rd party platforms. Constellation will own the development, maintenance, and operation of these connectors, thereby freeing up internal homebuilder IT resources to focus on value-add for the builder.

Constellation provides fully-integrated or standalone software solutions expertly engineered to manage the complete ecosystem of a homebuilder’s business functions and growth.

MORE IN Technology

Silos Kill Margin — Here’s How Homebuilders Can Fight Back

Texas-based Riverside Homes, Boulder Creek Neighborhoods, stand as proof cases in how platform integration cuts costs, clarifies performance, and transforms builder culture.

Design-Estimating Disconnects Cost Builders Time And Margin

Former builder-operators Brandon Pearson and Marcus Gonzalez share what’s broken—and how connected teams can win now and in 2030.

What Separates Homebuilders Thriving Amidst 2025’s Chaos

Builders face rising stakes to unify tech, data, and operations or risk falling behind amid affordability, insurance, and labor challenges.