Capital

How Smaller Builders Say They'll Navigate Higher-For-Longer Rates

Capital lending, investment, homebuilding, and development professionals face a no-choice moment to digest and game-out impacts of a higher-for-longer interest rate regime. For smaller players, it may be a selling decision time.

The "new-highs," "new-lows," "never-befores," and "not-sinces" feed the headline machine in, around, and under the 2023 housing market on a non-stop basis.

Here's three examples from the past 24 hours:

- housing affordability

- mortgage interest rates

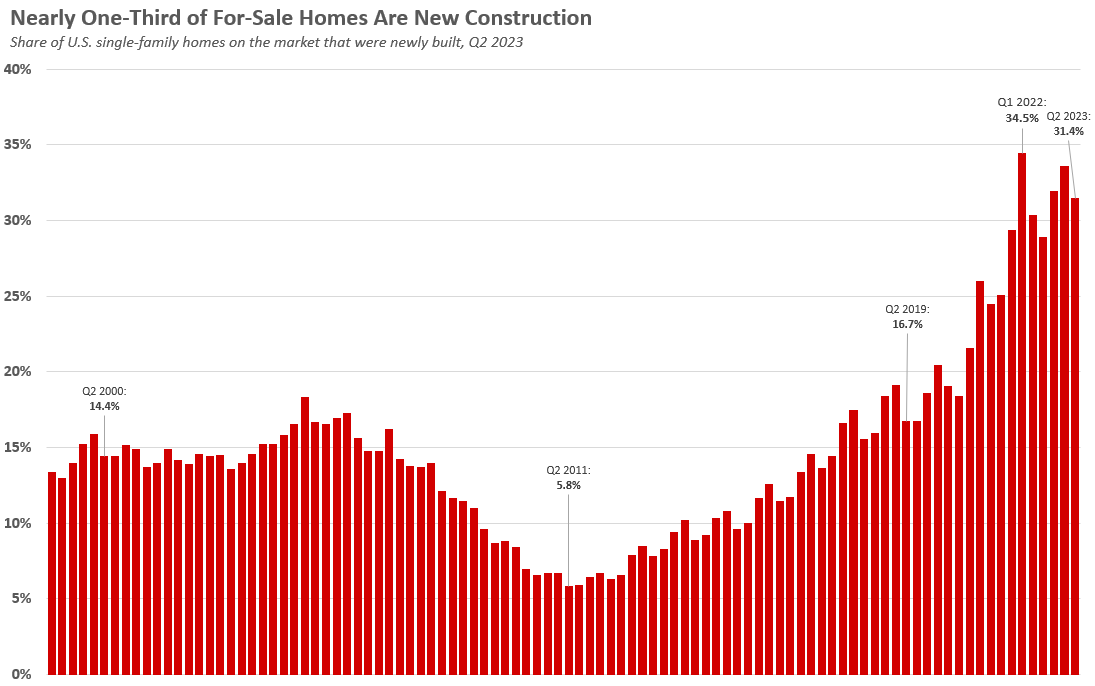

- new-homes share of total home sales (and how that looks below)

Each measure – anomaly or record-breaker or not -- obeys a set of forces that explain why it's so. In hindsight, they make sense, much of it stemming from overly constrained supply vs. demographically-fueled demand. Still, many current conditions play havoc with those who try to predict how those conditions will behave next. A slew of "iffy" plausibilities could stall, reverse, add forward momentum, or blow up what's going on now.

Meanwhile, capital lending and investment, as well as homebuilding and development professionals face a no-choice moment. They've got to digest and game-out impacts of a higher-for-longer interest rate regime.

One of our residential real estate senior-level strategist friends writes a paragraph that betrays – among other things – how vexing the particular array of economic riptides are right now to decipher and plan around.

I really have no idea where the economy is going. You could convince me that services inflation will be stubborn, and we have a soft or no landing. I also still suspect that we had low rates for so long that now we're like a big sand pile that has reached criticality. Impossible to tell which grain of sand will collapse it, but collapse it will.

It's worth thinking about, as the economy has become less reliant on bank debt and had more bond debt, fund debt, etc, that the response to rate changes might be slower than in the past. Which is different than saying it's not a problem.

Perhaps we all just have underestimated how long it will take for the rate hikes to ripple through the economy? If that's true, then we're all way too comfortable with the idea we've survived the worst of it. If it's the former, then you have to ask, why would the Fed drop rates if we're not having a recession?

The reason routinely given is the Federal Government can't sustain itself over the long run with rates at this level. But I'm not sure the Fed is willing to take on that responsbility, especially if it means painting itself into a corner again -- where rates are so low it has to take extraordinary measures to deal with any new problem. So I think that means either we skip the recession (to my surprise), but inflation stays stubbornly above target and rates stay up.

Or we don't realize we've skidded off the road in a snowstorm, but haven't hit or seen anything yet. But a soft landing and significantly lower rates sounds like unattainable perfection to me."

Borrowing rates that stay elevated as a norm mean different things to different operators, especially among the thousands of homebuilding operators that traditionally tap banks, friends, family members, and their own resources as their primary capital sources.

A big vs. little us vs. them asymmetry among competitors is on track to become even more intense and imbalanced, favoring the large publics along with maybe as many as two-dozen multi-regional private powers. They are bent on one thing now, which is earnings powered by volume and margin expansion that come from market dominance. Owning active new-construction and real estate markets -- buyers, company talent, land sellers, building trades, capital streams -- has none-too-subtly made homebuilding competitive like it's never been. The iffier things get, the more market share makes sense.

Smaller players are cautious, a good number of them more so than they were this time last year. That's because they'd put their balance sheets through rigors, gotten the best possible terms they could on their debt and credit lines, taken land exposure chips off the table, optimized their margins, and focused on their backlogs. By cutting their land spend they could run profitably.

For a while. Now those smaller single- and multi-market private builders are looking at having to replenish land pipelines, and cash they've conserved in 2022- and 2023 is not going to go far when it comes to landing those new parcels for growth beyond 2024. Banks and syndicated lines of bank credit – under greater stress and scrutiny in light of continuing bank depositories resets – will have no tolerance for anything but the strictest adherence of pace-, price-, completions and settlements covenants.

This could get even trickier after year-end and in early 2024, as a higher-for-longer rate norm stands even as economic and consumer resiliency starts to give way to weakening on the jobs and consumer spending front. As is plainly evident, most builders had what it took to weather a year or so of turbulence and tougher times. A year or two more ahead of bumpy, choppy, and iffy conditions may be more than some can endure.

The principle owner of a fast-growing homebuilding operator we spoke with recently noted as much:

We're being cautious. We've pulled because we built that inventory into the Spring market. I want the Mortgage Bankers Association to be right when they forecast that 30-year rates will fall below 5% in 2025. But we've pulled our foot off of the accelerator. As we work into the fourth quarter. We'll see what happens with the Fed. Everyone's saying that the next quarter-point raise in interest rates is baked into the market, and then they'll start taking their foot off the gas in terms of raising interest rates. So, we're going to be cautious. You can't get over your ski tips."

Something had to give, starting way back in early 2020 when Covid hit.

Three years later, it may not have given yet, but it still has to.

As our friend in the trenches says:

I'm still counseling clients that we can count on long run supply shortages, but have no idea what the short and intermediate term holds. So wake up every day, focus on tactics for existing projects and strategies to be attainable on new ones. Execute the crap out of it. Skip the prognostication on CNBC."

MORE IN Capital

Timing Demand: Why Investors Choose To Buy Apartments Vs. Building

A construction slowdown today is setting up an undersupply tomorrow. Opportunistic, patient investors are already pivoting to seize future market growth catalysts.

Little Deal ... Big, Timely Product Pivot: Lokal’s Capital Play

A $12M facility fuels Lokal Homes’ swift shift into higher-margin homes and a smarter land strategy in a tough market.

Land, Capital, And Control — A New Playbook In Homebuilding

Five Point Holdings’ acquisition of a controlling stake in Hearthstone points to the direction of homebuilding strategy: toward lighter land positions, more agile capital flows, and a far more disciplined focus on vertical construction, consumer targeting, and time-to-market velocity.