Marketing & Sales

Homebuilders And Incentives: The Story Is Still A Work In Progress

It's no surprise that surveys of builders over the past several months reflect both a limbo of unknowing, and a blend of what's-going-on-on-the-ground and wishful thinking with respect to the Fed's next move and how it could positively jolt buyer momentum.

Gradually then suddenly."

The Hemingway quote – The Sun Also Rises character Mike Campbell's reply to drinking buddy Bill Gorton's query, "how did you go bankrupt?" – has been there for us for nearly a century now, a more-often-than-not accurate catch-all for things heading south.

In that context, conflicting signals emerge on homebuilders incentives.

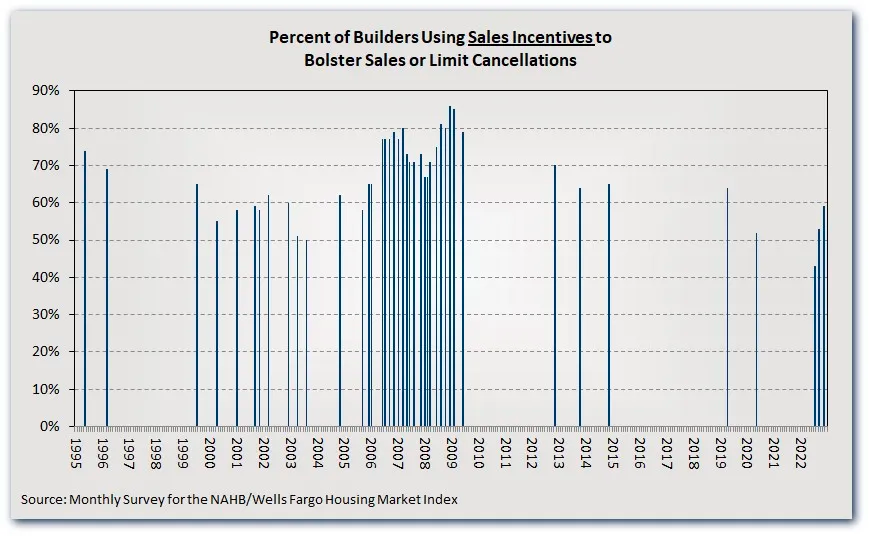

- A post from National Association of Home Builders' VP for survey and housing policy research Paul Emrath notes, Builders Are Cutting Prices & Offering Incentives, But It’s Not 2008

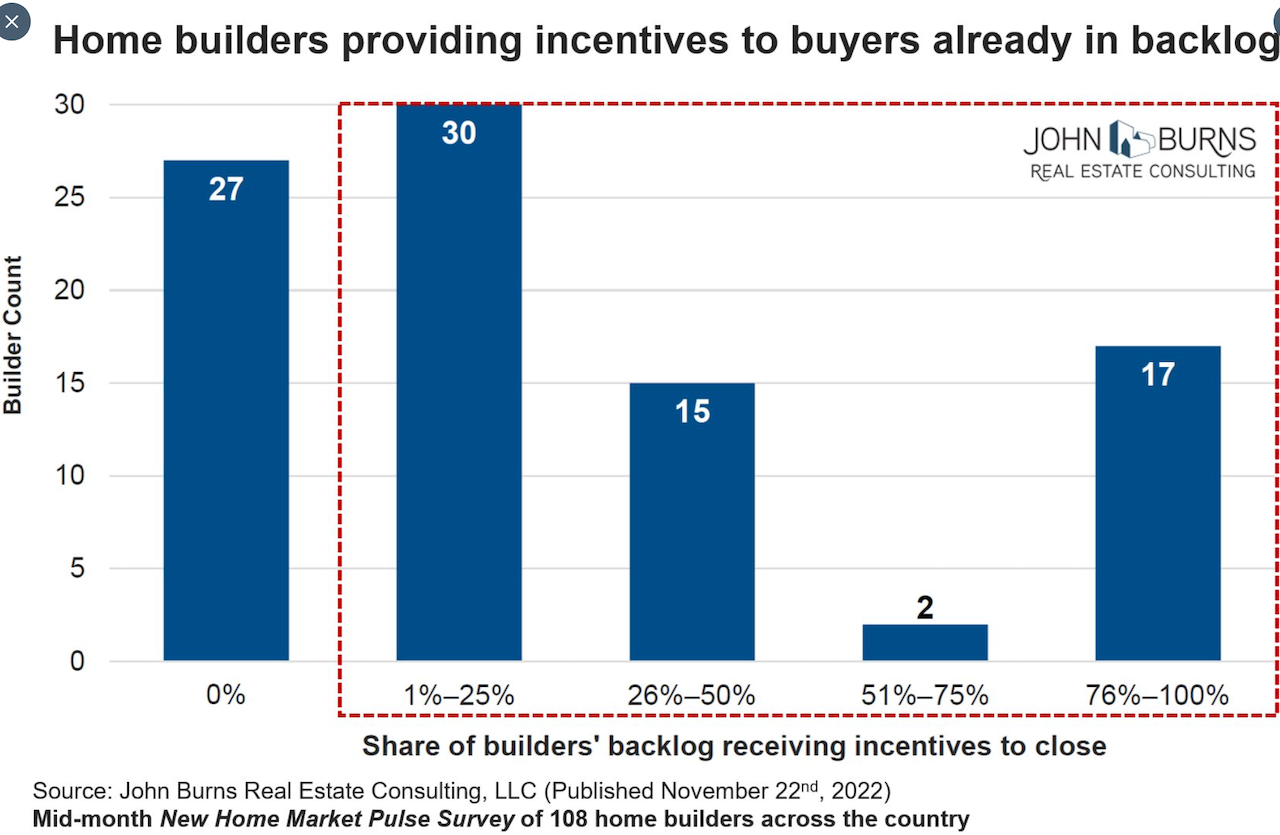

- A November 30, 2022, Twitter post from John Burns Real Estate Consulting director of research Rick Palacios Jr. notes, "Home builders don't typically throw incentives at buyers already in backlog, but it's happening now. 70% of builders we spoke with in mid-November did exactly this to avoid cancellations. Implications for margins compressing faster than usual."

It's no surprise that surveys of builders over the past several months reflect both a limbo of unknowing, and a blend of what's-going-on-on-the-ground and wishful thinking with respect to the Fed's next move and how it could positively jolt buyer momentum.

The limbo period we're currently in has several moving-parts features, one of which Palacios touches on here.

- "Ton of homes in backlog waiting to close still due to stretched build cycles."

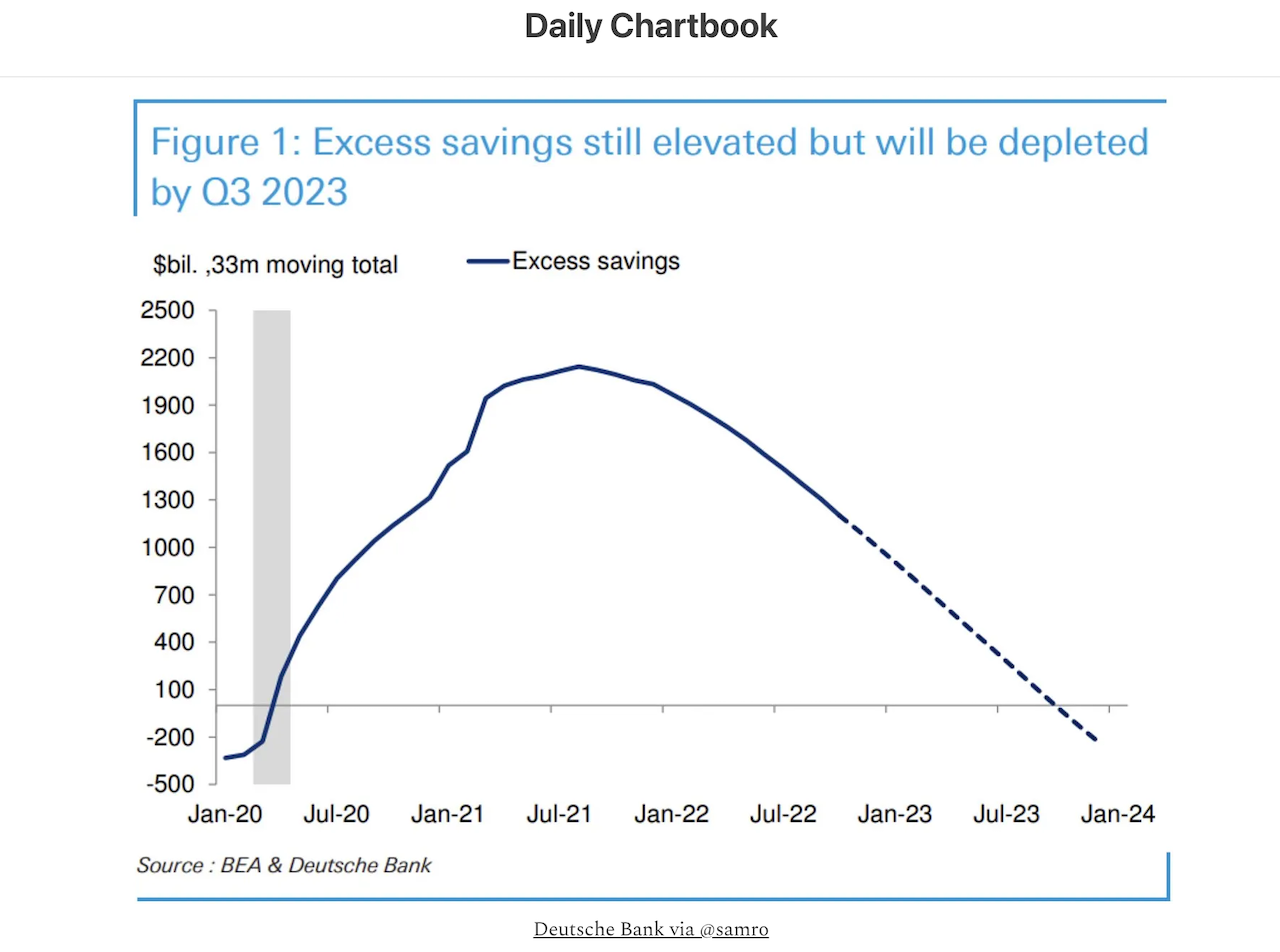

- The clock is ticking on the depletion – accelerated by consumer price inflation – of households' excess savings, reported to run out sometime in Q3 2023. Further, "What’s left of excess savings are now 'concentrated in the top quartile even if this is the group seeing the largest erosion from the peak.'"

Here's a peak, from Daily Chartbook at what that looks like:

- The latest jobs report – with a strong headline number reflecting solid growth in payroll employment and wages – has "mixed bag" components, including downward revision of the prior two months, and growth concentrated in a narrowed set of sectors.

- Unknowns include timing, trajectory, and duration of a Recession in 2023, and whether it – and a cluster of global economic disruptive factors that could impact professional class job security – will register in a big way in home prices or demand.

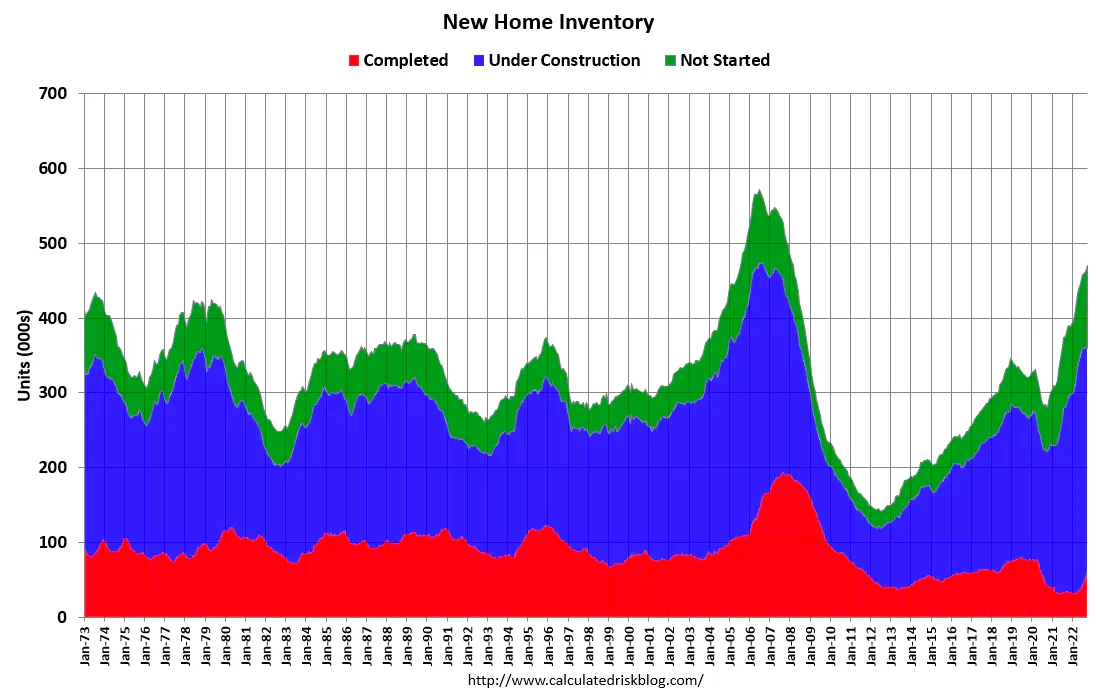

Here, with just under three weeks remaining in 2022, the force factors that will drive builders incentives to their last and final characterization and comparability to history involve the geography, price-points, wherewithal, and ultimate disposition of the following two buckets of new home inventory in the pipeline:

The inventory of completed homes for sale (red) - at 61 thousand - is up from the record low of 32 thousand in 2021 and early 2022. This is getting close to the normal level of completed homes for sale and increasing.

The inventory of homes under construction (blue) at 298 thousand is very high, and about 6% below the cycle peak in July 2022. The inventory of homes not started is at a record 111 thousand. – Calculated Risk

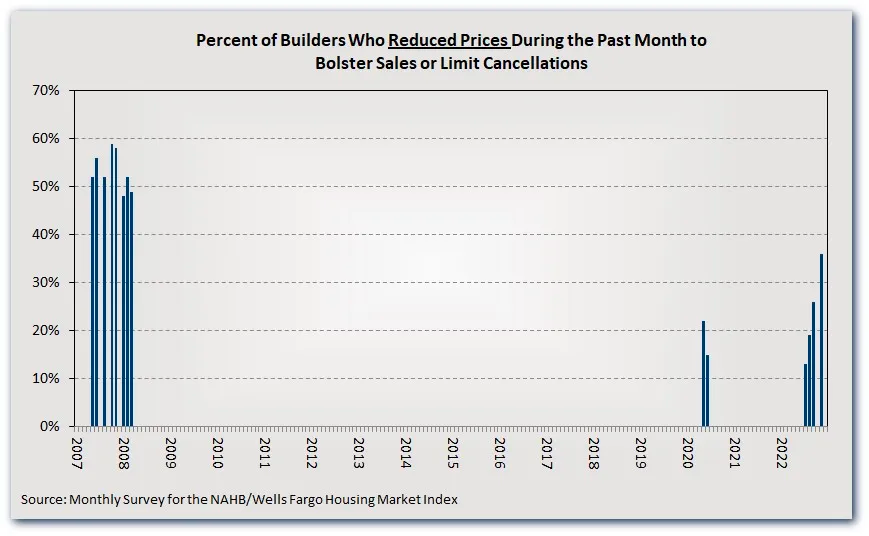

For perspective, let's go back to the NAHB data, where Paul Emrath notes that current incentive practices and discounts barely hold a candle to the levels seen as the Great Recession took its greatest toll on housing during the years 2008 and 2009.

Here's how the current "levels" compare with the extensiveness of incentives builders activated in 2007 and 2008.

Emrath is accurate when he compares the two time periods, and observes, we're not back in the worst of times.

However, maybe – given all we do not yet know about what's going to play out that impacts how and when more than 350,000 completed and under construction will finally be in the hands of buyers – it's better to compare the past few months of 2022 not with 2007 and 2008, but with the couple of years earlier that led eventually to the rout builders went through as they finally sold their homes in 2007 and 2009.

Emrath's research actually shows such a comparison here in the longer-view perspective.

If you look at the "percent of builders using sales incentives to bolster sales or limit cancellations" in late 2005 and early 2006, you'll see levels quite comparable to that which has gone on over the past few months.

So, while we don't know what 2023 and 2024 will look like yet, the need to "clear" more than 350,000 new completed and under construction homes in the next several months will set the rules for describing, comparing, and contrasting the 2022-23 cycle versus any other.

What would not surprise us in the least would be that, when we one-day look back at what ultimately happened beginning in early 2022 and continuing well into the next year, maybe more, someone may use Hemingway's line one more time to describe how it all went down.

Gradually then suddenly."

MORE IN Marketing & Sales

What Separates Homebuilders Thriving Amidst 2025’s Chaos

Builders face rising stakes to unify tech, data, and operations or risk falling behind amid affordability, insurance, and labor challenges.

Here's Why Randy Mickle Has Joined Drees At This Moment

The new Southeast Regional President brings big, national builder experience to a multigenerational homebuilder with bold goals for its centennial.

Rate Buydowns: Temporary Fix, Long-Term Risk For Homebuilders

Financial incentives like mortgage rate buydowns may boost sales today, but builders using them broadly risk margin erosion, mispricing, and long-term strategic misalignment—especially those without Lennar-scale flexibility.