Land

For A Tougher Time Ahead, Spottier Opportunities Will Rule

Precision segmentation, sub-market nuance, and specific tactics to meet the needs of moving target buyers will soon take the place of an everything-works-everywhere homebuilding and development business environment.

We see what happens when you put $12 trillion in M2 money supply growth together with twelve generations of Moore's Law since the late Great Recession in 2010, shake, stir, remove all the friction and then add the blend into history's largest generational cohort – 26 year-old to 41-year-old Millennials – progressing into careers, forming households, starting families.

Everything's great.

The Great Migration. The Great Resignation. The Great Reset. It seemed to be all about technology's ability to untether jobs from workplaces, the sudden clout of personal leverage in an uber-tight employment market, the future of work and the new geography of living in a world of constant discretionary connectivity. The arrival of COVID-19 in early 2020 catapulted the whole enterprise into a new dimension of velocity and trajectory, restrained only by the reduced capacity to fully feed the machine. Easy money and hard-to-get-goods set us on course for a price rocket ride.

Now, the Great Inflation overshadows some of those other Great phenomena that stood to transform the life-work-play-connect axis, cut loose the anchors of job center-centric planning and economics, and free up residential real estate markets to behave more dynamically than before.

Then boom! We hear from Lennar co-ceo Rick Beckwitt in Q2 earnings commentary with institutional investment analysts, you've got trouble in River City, so to speak. Or more specifically, seven formerly high-flying markets that have quickly chilled as Americans' cost-of-living crisis collided head-on with the Fed's urgent need to stifle inflation as fast as it can without collapsing the economy. Beckwitt, speaking to an overall strong Q2 performance in all of Lennar's rolled-up KPIs, lifted the hood for a view of what's going on locally beneath the surface of all those glowing performance outcomes.

Lennar's markets during the quarter, Beckwitt said, fell into three categories of market dynamic:

One, markets, reflecting [indiscernible] minimal impacts; two, markets reflecting modest impacts; and three, markets reflecting more significant impacts. During the second quarter and so far in June, we had 19 markets continue to perform well. These include our six Florida markets, New Jersey, Maryland, Charlotte, Indianapolis, Chicago, Dallas, Houston, San Antonio, Phoenix, San Diego, Orange County and the Inland Empire.

...

Our category two markets, which reflects a modest softening in pricing and a slowdown in the markets, includes 10 markets. These included Atlanta, Colorado, Charleston, Middle Beach, Nashville, Philadelphia, Virginia, the Bay Area, Reno and Salt Lake City. In each of these markets, traffic had slowed and we've seen an uptick in cancellation rates.

...

Our category three markets, which reflect a more significant market softening and correction, includes seven markets. These include Raleigh, Minnesota, Austin, Los Angeles, The Central Valley, Sacramento and Seattle.

As Beckwitt's color commentary of the markets attests, a "whole" upcycle housing market is splintering swiftly into all its divisible parts. It begs a question: What if, after all, the next stretch is not about a great anything? Great everything has been, frankly, exhausting. Our exceptionalist fixation with hype may have run out of juice.

What if a meritocracy-fueled American Dream is mostly about people picking a place to go and live and work where it's possible to make a go of things, save some money, raise kids, put them through school, and live a life where they enjoy the fruits of their work and give their children a shot of living even better? People who want to work and live an evolving, financially upwardly mobile life affordably find now that everything being Great leaves them fewer options.

What if the next patch of housing's important dynamics shifts markedly from a broad sweep of homogenous activity to a meaner, leaner, spottier map of puts and takes, opportunities and risks, upticks and declines. Households' cost-of-living struggles are different in different places and those degrees of difference will define where the biggest pain and the biggest gain will be over the next couple of years. It would take better, more intentional, more precise commitments and investments in making homes and communities to succeed. That might be an overall win from a difficult and painful time for U.S. households.

Broadly, the national characterization of that cost-of-living crisis, is grim.

Zillow Research marked the beginning of Summer 2022 with the headline:

Housing Affordability Hits 15-Year Low as Prices, Mortgage Rates Rise

Payment power – whether it's for a monthly mortgage or a monthly rental payment – has been a casualty of all of this Greatness going on for the past several years. Cost-of-living, after all, outran all that Greatness.

Data evidence from a new analysis from Freddie Mac chief economist Sam Khater and macro economics housing director Kristine Yao – during on 14 million loan applications submitted to Freddie's Loan Product Advisor underwriting system, 2 million of which were home purchase applications -- show a pandemic-era America in fierce pursuit of housing payment power as a foundational element of household financial strategy.

Topline conclusions of the analysis were:

- Homebuyer migration patterns using Freddie Mac LPA data show a population in pursuit of affordable housing.

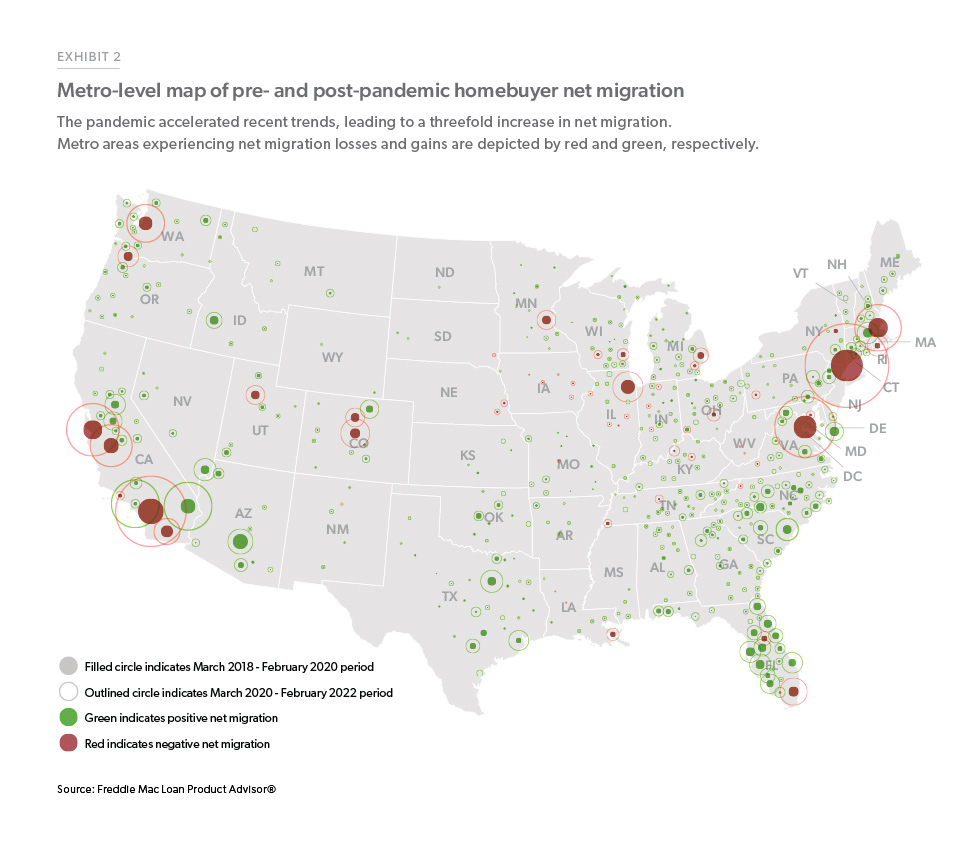

- The pandemic amplified existing urban deconcentration by threefold, from large, expensive metro areas to smaller, more affordable destinations.

- In fast-growing metro areas, the continued shortage of housing and high house-price-to-income ratios eventually lead to increased out- migration as homebuyers seek more affordable destinations.

Instructive for a moment where housing may pivot from an everything-works-everywhere easy money mode to a more selective, choppy, spotty mode where builders will need to be vigilant as to each market's specific array of drivers and opportunities is this insight from Khater and Yao:

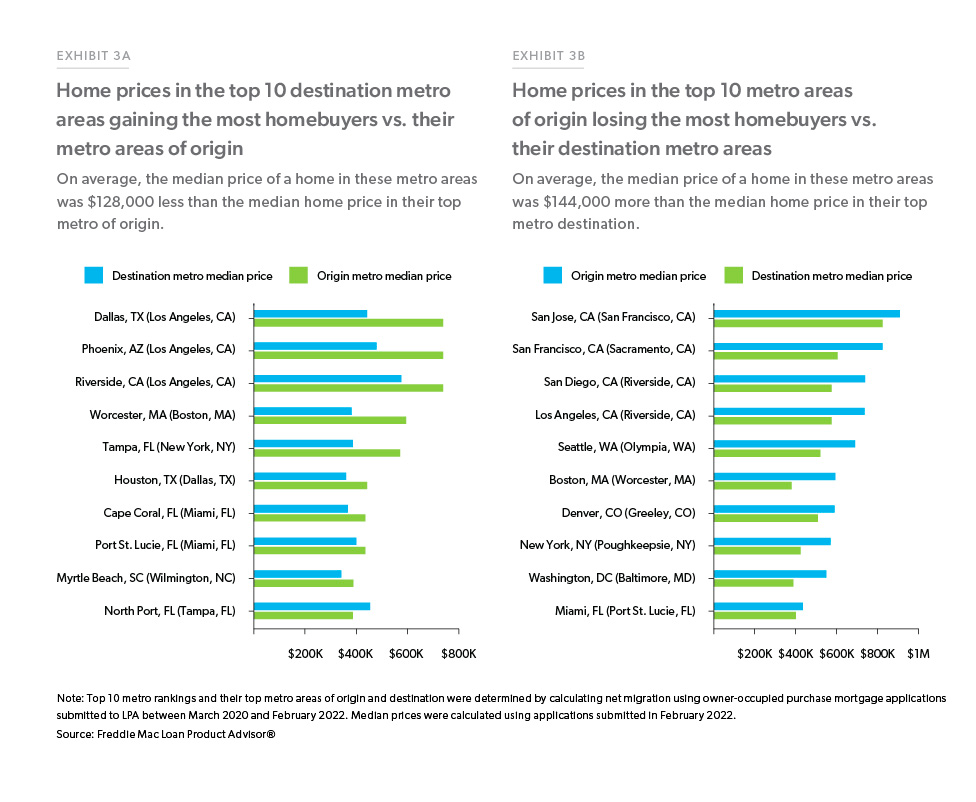

Between March 2020 and February 2022, the top ten metro areas gaining the most out-of-metro homebuyers consisted of more affordable interior markets and Southern beach destinations. On average, the median home price on loan applications submitted in February 2022 for these top 10 destinations was $128,000 less than the median home price in their metro of origin3 (Exhibit 3a).

The only exception was North Port-Sarasota-Bradenton, FL, with its median home worth $68,000 more than the median home in Tampa-St. Petersburg-Clearwater, FL. For this market, it is worth noting that the second top metro of origin was New York-Newark-Jersey City, NY-NJ-PA, where the median home price exceeded that of North Port metro by $115,000. During the same two-year period, the top ten metro areas losing the most out-of-metro homebuyers consisted of the country’s largest and most expensive markets (Exhibit 3b). The median home price in each of these metro areas exceeded the median home price in the destination metro areas by an average of $144,000.

Digging into the survey, fascinating nuggets that paint a distinctly "pandemic-era" picture around some of the more important mobility and migration data. Here's three:

- People moved for housing [affordability and choice] rather than for work:

In 2021, CPS ASEC data reported that for inter-county moves, the number of housing-related reasons surpassed employment-related for the first time since 2005. With more employers offering remote work and the number of job openings at its highest since 2001, motivations for migration have shifted to factors affecting housing.

2. People exited mega- and large – 1 million-plus – urban metros, while the remaining, i.e. midsized, small metros and micros – experienced in-migration that has accelerated through the present:

As of February 2022, while the pandemic seems to be abating and people are returning to some form of hybrid work, inflows into the remaining midsized metro areas and less populated places remain elevated. The persistence of the trend seems to suggest some form of suburbanization may be here to stay, which would have major implications for our economy, society and culture.

3. People moved – and continue to move -- from high-priced markets to more-affordable markets, which then became high-price-growth markets:

The highest homebuyer net migration losses have occurred in high-cost, inelastic markets located in coastal areas. Metro areas experiencing the most gains in homebuyer net migration are found more inland and to the South. The map also shows a remarkable threefold increase in homebuyer net migration between the two-year period occurring before and after the first confirmed case of COVID-19 in the country. The pandemic intensified existing migration patterns of homebuyers, driving housing demand to levels far exceeding that of supply. In 2021, the Freddie Mac House Price Index (FMHPI) reported that while house price appreciation rose to historical highs in the United States, the fastest rise occurred for those metro areas which experienced a surge of migrant homebuyers.

Going back to the Lennar example, the company has 36 markets, 19 of which have yet to get tugged into the Great Swoon of 2022, and 10 markets that may go either way, and seven that have succumbed to "fire and ice" economic shocks, requiring a toolkit of pace and price interventions.

Likely what will emerge is that the motivation for payment power – that balance between what a household can take in in wages and where they can make those dollars go the farthest in housing costs – will continue to offer spottier submarket-by-submarket opportunity during an overall tougher macro housing market.

Join the conversation

MORE IN Land

Little Deal ... Big, Timely Product Pivot: Lokal’s Capital Play

A $12M facility fuels Lokal Homes’ swift shift into higher-margin homes and a smarter land strategy in a tough market.

Oversupply or Overreaction? DFW Market Needs To Hit Reset

Scott Finfer breaks down the DFW-area oversupply crisis: post-pandemic assumptions, slower job growth, and mispriced inventory. Across the U.S., high-volume markets face similar risks. Finfer outlines five strategic moves to cut through the noise — and seize ground as bigger players pull back.

Land, Capital, And Control — A New Playbook In Homebuilding

Five Point Holdings’ acquisition of a controlling stake in Hearthstone points to the direction of homebuilding strategy: toward lighter land positions, more agile capital flows, and a far more disciplined focus on vertical construction, consumer targeting, and time-to-market velocity.