Policy

As Prices Flash Crisis, Here's 2 Paths To Building More Affordably

New home square footage and precision-focused easing of costly regulatory burdens could bring average selling prices on newly built homes back to more attainable levels for homebuilders and developers.

50%

The handwriting is already on the brick wall that I’m afraid the housing industry is going to run into before long.

It says: HOUSING PRICES ARE OUT OF CONTROL.

Let me put that more fulsomely by explaining the 50% “headline” that introduces this column. In the last year housing prices have increased by a little more than 20%. At the same time rates on a 30-year fixed rate mortgage have increased by more than 2 full percentage points. Taken together that means that the monthly principal and interest payment to buy a median-priced home has increased by about 50% compared to the same time last year.

That 50% increase might explain this very troubling number: 30%. That’s the percentage of Americans who says it’s a good time to buy a house. Gallup has asked that “is it a good time to buy” question since 1978, and this is the first time the percentage has been less than 50%. That means the percentage is even lower than it was in the depths of the last housing recession when housing prices were in free-fall and the industry was at a standstill.

The Federal Reserve has already signaled it will raise the Federal funds rate by .50 basis points at least 2 more times year. So nobody can expect mortgage rates to decline.

That means there’s only one lever to push to make housing more affordable: Housing prices. And I can only think of two ways to reduce housing prices: Reduce housing size and housing regulation.

Size matters

Somehow thinking about average new-home size, which right now sits at about a record 2,500 square feet, got me thinking about SUVs, the current darlings and economic backbone of the auto industry. Think of an SUV and you think big. But in fact the mid-sized Chevy Traverse SUV outsells it really big brother Suburban by 4 to 1. Ford’s Explorer outsells the much bigger Expedition by 3 to 1. BMW's sort of diminutive X3 outsells the hefty X7 2 to 1. And the rather petite plain Jane Honda CR-V outsells the gargantuan, showy Cadillac Escalade by more than 10 to 1.

My point being that size, even combined with all the bells and whistles, doesn’t carry the day in the auto industry. Price matters too. A lower price married to the right features can often beat bigger and more expensive. The right features in the SUV market include sitting higher than in a sedan, ample cargo space, and a sort of rough and tumble demeanor.

I think the same dynamic would hold for housing, in this difficult market especially. A 2,200 square foot house with the right features (a great kitchen, a cool master suite, indoor/outdoor living, for example) and a lower price and the lower monthly payment that comes with it would hold real appeal to buyers suffering from sticker shock and discouraged by onerous monthly mortgage payments. Sure, profits are likely to be less on smaller, less expensive houses. But the automakers, who are having a great year, are proof-almost-positive that bigger isn’t always better. Builders should take note, now.

Regulatory burden on buyers

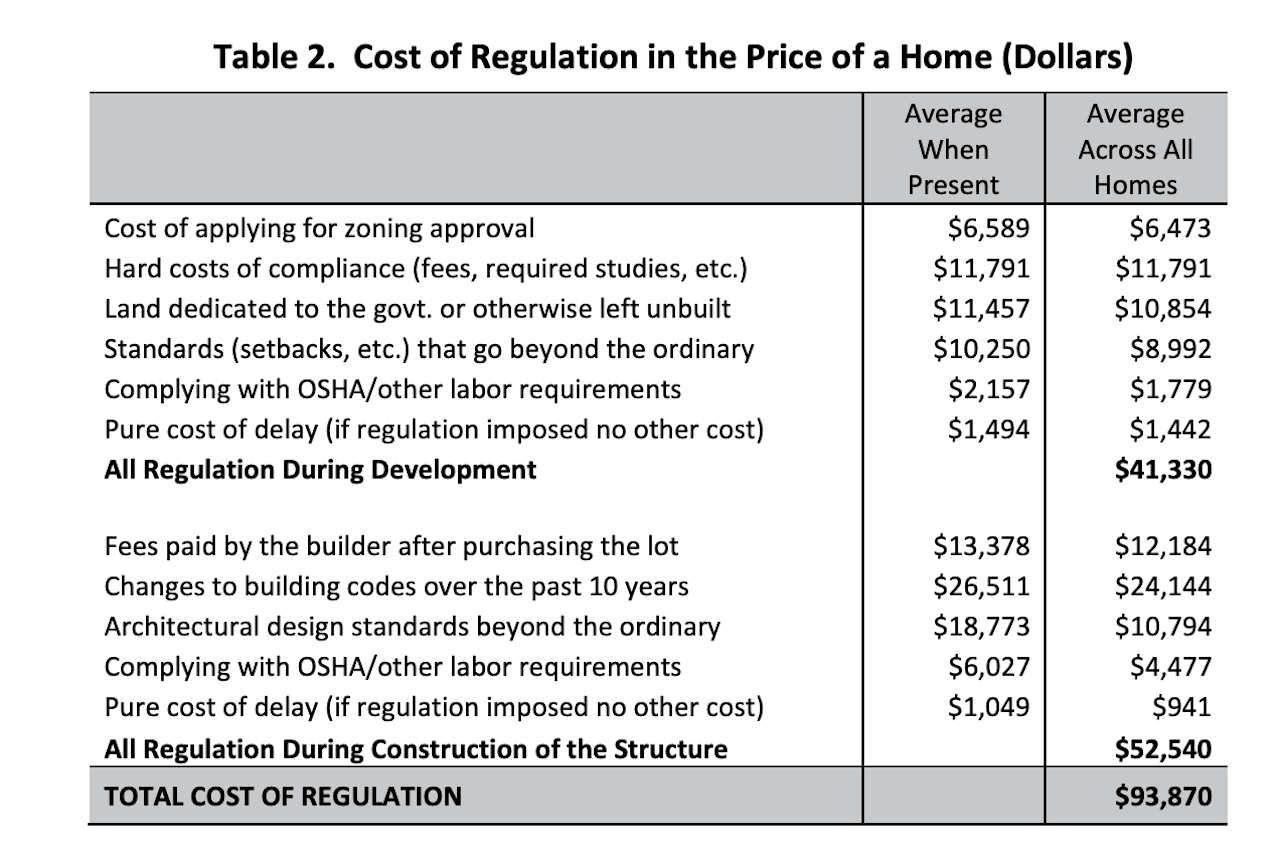

Regulation, or as builders often say over-regulation, is a thornier and bigger problem. A National Association of Home Builders study found that regulation imposed by all levels of government account for an average of $95,000, or about 20% of the cost of a new home.

Nobody is saying that all regulation is unnecessary, but maybe it is time for a hard-edged cost/benefit analysis of which regulations should stay (or maybe even be made more stringent) or go (or made less onerous).

And maybe it’s time for builders and dealers and building product manufacturers to stop doing battle with so-called NIMBYs and instead become supporters and allies with an emerging group of consumers called YIMBYs (Yes In My Back Yard) who see development not as a necessary evil but as an essential, positive part of making all communities more inclusive and more vibrant and more affordable. It’s time to tear down the brick walls that make home ownership more costly than it need be.

Join the conversation

Since 1873, Kohler Co. has been improving the level of gracious living by providing exceptional products and services for our customers’ homes and their lifestyles.

MORE IN Policy

Can Ditching the Car Unlock Pent-Up Housing Demand?

A car-free lifestyle could help homebuyers afford more — and give developers a powerful new lever near transit hubs. It's part of a 'missing middle' solutions set.

California Breaks CEQA Barrier To Reignite Housing Production

Championed aggressively by Gov. Gavin Newsom, the historic environmental law reform unlocks the potential for infill housing—and could become a model for other high-barrier states.

Governor’s Veto Derails Connecticut Upzoning Push

State leaders aim to regroup for a fall special session after a housing bill faces resistance from local zoning defenders.