Marketing & Sales

When Prices Peak And Stall, How To Keep Customers Happy

During delayed construction cycles, constrained volumes, and constant price increases, now's the time to sew the seeds for stronger post-purchase, ownership relationships with new homebuyers.

When could fear of missing out begin to blur into fear of being taken for a fool?

Unless you don't believe in Newton's laws of gravity, this becomes an issue in a market rate for-sale new home real estate and construction business. As demand runs hotter and hotter compared with a market's capacity to meet it, prices reach their elasticity limit, and stall out.

When that happens, customers fueled by FOMO to ante up the last best phased price increase become a risk category. They're in new communities. They're going to start hearing their new neighbors abuzz about the great incentives, discounts, down-payment buy-downs, free options and upgrades, etc. they get after the frenzied musical chairs game takes a necessary pause.

A senior-level strategic residential real estate investment executive confidante tells us:

We traditionally worked hard to have sustainable price increases. Makes buyers happy, locks in the backlog, and moves people off the fence. This bidding process worries me. For one, we're going to have some very unhappy buyers/owners someday when the music stops and subsequent sales are materially lower. And how will we give confidence to the next buyer?"

Here's data Zillow recently brought to light. Three out of four homebuyers who bought a home in the past 24 months suffer at least some sting of buyers' remorse. According to its survey findings, "the top regret cited by recent buyers is purchasing a home that needs more work or maintenance than expected." Here are a couple of other noteworthy top lines that may be of greater relevance to producers and sellers of new homes that aren't as prone to needing maintenance at the outset:

- Nearly three-quarters of successful buyers wish they had done at least one thing differently; nearly 40% wish they had taken more time searching for a home or weighing their options.

- Most recent home shoppers faced buyer burnout, pausing their home search at least once during the process.

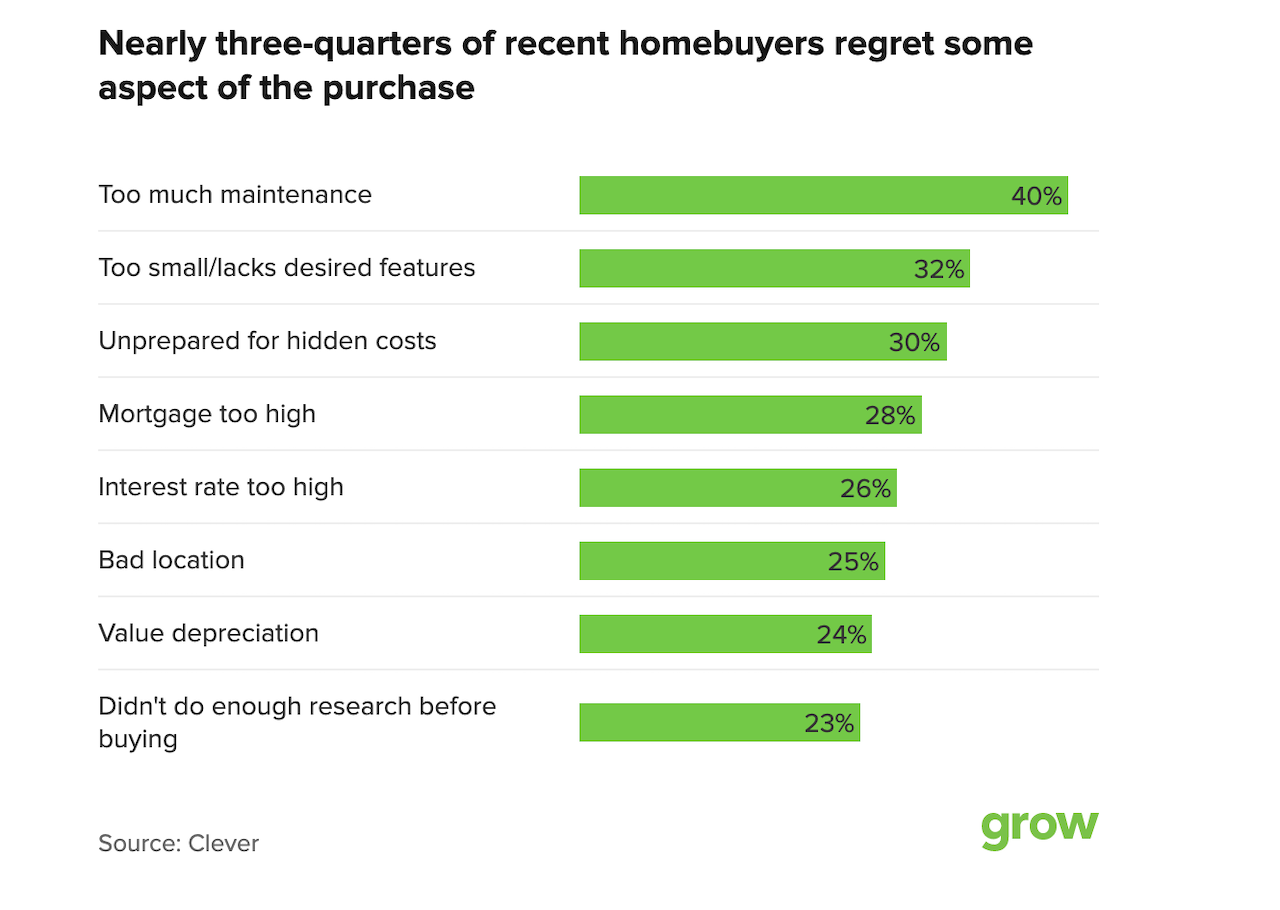

Similarly, real estate website Clever found that more than seven out of 10 recent buyers relate to this eight-item check-list of regrets.

Clearly – and this should carry a note of warning to new homebuilders and community developers – buyers' remorse is not confined to used homes.

Now, there's a quote from prolific author Donald E. Westlake:

If buyers' remorse ever accomplished anything in this world,' he said. 'We'd all still be living in caves."

Still, FOMO's power as a collective unconscious, Animal Spirits housing activity turbocharger clearly kicked into gear the moment the pandemic era took its K-recovery shape of the medium-term future in Spring 2020.

FOMO worked like a wake-up-call everybody got at once, especially people given to the appeal of health, financial, and lifestyle alternatives to where they were, what they were doing, and why they were doing it.

The rocket fuel of FOMO worked especially powerfully in the past 18 months. That was because others -- countless others – felt it and acted on it simultaneously, igniting urgency, competitiveness, in some cases, desperation. For many people hunting for and bidding to buy a home, agency and control went out the window as they got swept into the housing market's vortex of low inventory and high – and getting higher – demand.

Most homebuilding firms are led by strategists who build and sell their homes to what markets will bear, and have been tracking "sustainable price increases" in this torrid pandemic era for three reasons:

- They can, due to scarce inventories of for-sale properties vs. a value proposition

- They have to, to absorb and sustain margins versus spiraling costs

- They want to, to try to meter or mute demand to the home volume levels they can produce

Access to the customer focus, care, and experience issues here starts at the pivot point of value, and where her, or his, or their homebuilder fits into that pivot point.

Relatively recent appreciation of a homebuyer's journey and where and how to engage with a potential customer early on in that journey map was a good start for gaining access to that pivot point.

Few are better at unpacking the challenge and opportunity that comes with understanding that a homebuyer is not a transactional deal-maker, but rather, increasingly, somebody who wants a relationship than author Joseph Michelli.

Have a look at a recent piece that digs into customer experience writ large, and opens a door to recognizing how that may apply in light of an inevitable juncture ahead for builders ... when their price increase rates soften, flatten, and perhaps need to track downward in order to sustain pull on their offerings.

Michelli writes about that instant of engagement early on in a customer's journey map, as a moment of arrival:

From a customer's perspective, their arrival (on our website, phone, chat, social media, or in-store) resolves many important questions. Specifically, they are determining:

Do I belong here?

Do they care that I am here?

Am I safe?

Are they competent?

Now, the real opportunity comes in understanding that your customer's experience and journey flows not only from well before the moment of transaction, but well after it. A new homebuyer more times than not is a new homeowner. That experience of "arrival" recurs again and again and again throughout the ownership experience.

Most homebuilders' relationship with their new buyers practically ceases to exist after the settlement, except insofar as builders ensuring that warranty and repair commitments are delivered.

What time better than now to anticipate that FOMO will one-day, perhaps soon, run its course? From another well-stream of human experience will c0me another wave of Animal Spirits, this one the opposite of FOMO – Suckerphobia.

The opportunity is to carry through on customer focus and the customer journey to actual customer care into the ownership experience. That feeling of arrival, and its potential to be an entry point for builders to continue to platform services and solutions that go with owning a home in a new neighborhood, can work in builders' favor even as prices hit their ultimate limit and start obeying laws of gravity.

Join the conversation

MORE IN Marketing & Sales

Wray Of Light: Here's How To Keep Pace As Headwinds Stiffen

More than four out of five consumers think it’s a bad time to buy a home; here are seven strategies builders and developers can deploy as a more effective marketing plan to win sales.

These 5 Time-Tested Tips Will Jump Start 55+ Resident Referrals

When managing 55+ community homeowners associations, builders and developers need to meet and overdeliver on the high expectations of a particularly discretionary consumer group.

How A Homebuilder Stands Out In Florida's Fierce Competitive Arena

"Investing in your brand doesn't give you a direct return on investment immediately. It takes a long time, but over time, branding successfully does increase financial value." -- Alex Akel, President, Akel Homes