Land

UHG Picks Raleigh-Based Herring As Its First Step In An M&A Spree

The move comes in a homebuilding and development business environment vibrating now with mergers and acquisitions courtships, particularly in America's domestic migration and regional economic growth magnets.

Illustration by TBD's Maggie Goldstone: (left) Michael Nieri, CEO, United Homes Group, Brian Herring, President, Great Southern Homes, Raleigh

Looking to ignite a built-to-scale business model that has already proved itself in an algorithmically-growing South Carolina-Georgia axis, America's newest public homebuilder has now established a Raleigh, N.C. beachhead to the north.

United Homes Group announced this morning that by acquiring Raleigh-based Herring Homes, it's planting a flag in one of the U.S.'s top-20 new-home marketplaces, with opportunity to strike at as much as a third of the market's share of new-home real estate and construction business not already tied down by public and multi-regional private homebuilders clawing for their own deeper scale.

The move comes in a homebuilding and development business environment vibrating now with mergers and acquisitions courtships, particularly in America's domestic migration and regional economic growth magnets, adrenalized by emerging hybrid home-office workplace patterns, a flight to more-financially manageable costs-of-living, and equally strong desire for higher-quality of livability.

Sun Belt "crooked-smile" states that run clockwise from the U.S.'s mid-Atlantic region down through the Southeast and Florida, west across Alabama to Texas, and up a wide cut of the Western Region, including New Mexico, Arizona, Colorado and Idaho across to California and the Pacific Northwest, are a hive of potential matchmaking among a gamut of strategic and financial player. Would-be acquirers and potential sellers alike are drawn to deal-making's dance floor motivated along a spectrum that spans from sheer opportunism to urgency to desperation.

Publicly-held homebuilders -- whose ranks UHG just joined this past Spring and now must compete with head-to-head in the big leagues of market strategy and tactics – have built stores of dry powder, and are ready to pounce with it at every opportunity to seize profitable marketshare in the nation's active markets. These organizations' investors are notoriously impatient to clear, sustainable, and elongated horizons of earnings growth into 2024 and beyond.

In these dynamics, single-market private operators – even especially competent ones such as Herring Homes – may have begun to feel increasingly boxed out or boxed in by big national publics muscling their way to greater marketshare by any means at their disposal. For some well-run and distinguished private operator strategists' options narrow to three choices:

- go on a growth tear by tapping a larger capital partner

- sell now, while the land-asset base for owned- and controlled lots is as strong as can be, and waiting longer will mean diminishing returns

- go it alone and risk getting crowded out by multiple larger organizations fighting for larger shares of land-buying opportunity, trade and construction front-liners, distribution channel dominance, and home-buying and renting customers prone to respond positively to "a better deal across the street."

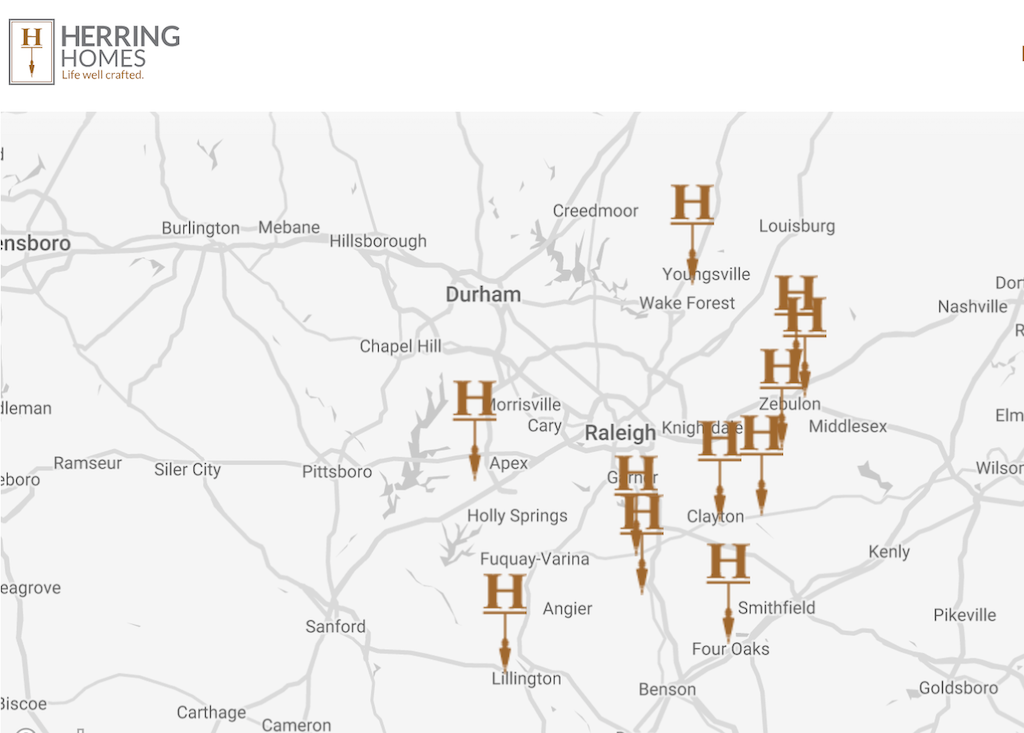

Founded by Brian Herring in 2019, Herring Homes currently markets 11 actively selling suburban communities girding Raleigh's downtown area. Whelan Advisory acted as the exclusive financial advisor to Herring Homes.

Rather than a new outpost extending the reaches of UHG's geographical footprint, company strategists regard the Herring team, their reputation, and their relationships to be a launching pad to fuel a daisy chain of growth opportunities that spoke outward in all directions, with Charlotte, Durham, Winston-Salem, and Greensboro to the west, Wilmington to the east, and Richmond to the North. A 1% market share of North Carolina markets alone [modeled to 2022 data], according to SEC filings by UHG, represents an implied unit volume increase of 982 homes and $291 million in added revenue.

This morning's statement reads:

'We are very pleased to begin executing our growth strategy with this move into the Raleigh market with an established team that brings a pipeline of lot inventory and established relationships with local developers,' said UHG Chief Executive Officer Michael Nieri. 'Raleigh is the 10th largest market in the nation over the last twelve months, with significant migration into the area and a very healthy job market. Our strategy is focused on high-growth markets in the southeast, and Raleigh certainly fits the profile for our expansion plans.'

'I am thrilled to be joining the UHG/Great Southern Homes team,' said Herring. 'Getting to be part of such an exciting new company is something that doesn’t happen very often. I believe the focus on the affordable segments of markets in the southeast, combined with the ‘land-light’ business model, makes us a builder with a bright future.'"

The UHG acquisition fits the fledgling public builder's playbook to a tee. We'd written about the key focus points of that playbook here, with emphasis that at a moment UHG's clout may not equal that of the big national publics, earning an "acquirer of choice" distinction through cultural alignment, trust, a focus on local values and trends, and entrepreneurial zeal, is where UHG could take an upper hand:

What's ahead now for United Homes Group -- accounting for a backdrop of near-term volatility, the ongoing threat of a recession, and otherwise tricky operating conditions – is an ambitiously steep arc of growth. The focus is three-pronged:

(1) market expansion, mostly via acquisitions

(2) built-to-rent building-as-a-solution services

(3) mortgage and other consumer value enhancing services

Already, Hamamoto and Nieri have gotten the M&A engines running, looking for deals private single-market and regional homebuilding firm matches, that fit the bill for business culture, footprint, customer segment, and upside growth opportunity criteria:

The Herring Homes acquisition, then, is the first of a spree of deals just like it that UHG has its sights set on as part of its masterplan to become a Southeastern "mega-regional" powerhouse.

Brian's going to take responsibility from Raleigh east to Wilmington, N.C., and really actually lead as our fourth division head," Jack Micenko, president of UHG tells The Builder's Daily. "We're excited it's a way to get market intel and market knowledge in a capital-efficient way in a market we want to be in that Brian and his team gave us the opportunity to enter. As we talk with others about combinations, we're almost exclusively talking folks that, like Brian, are in their 40s that one that want to stay involved in the business, but need capital need a bigger foundation underneath them, right. And that's kind of exciting. And that's what we want to do, right? We want we want to bring folks into the fold that can grow with us.."

Additional states UHG has targeted in particular for an accelerated path to regional critical mass include its current strong position in South Carolina, Georgia, North Carolina, Virginia, Tennessee, Florida, and Alabama.

We've noted:

By taking just 1% share in each of those states, it could increase revenues by upwards of $1.5 billion, on home volume growth of nearly 5,000 closings per year."

In a recent SEC filing, UHG notes:

Of the four main U.S. regions, the south experienced the most favorable migration patterns, with more people moving in than moving out domestically between 2021 and 2022, according to the U.S. Census Bureau."

Now, that's part of the good news as a sustainable demand stream expected to continue non-stop through the end of the 2020s and beyond. It's also part of the particular challenge to UHG and its own urgencies to activate its pan-regional scale strategy on a fast-track. Prior to Covid, algorithmic economic and population growth trends were beginning to pop up on a wider radar of opportunity, but still regarded as a "better-kept-secret" compared with the glare of the spotlight the region is now experiencing.

For UHG, these acupuncture-style first acquisitions in the early-going will be super important to get right, integrate fast, and begin replicating the same velocity and operational excellence the original Great Southern Homes group has been known for.

Expect more to come on the M&A front as UHG chairman and ceo Michael Nieri and his growing time strive to make their grand vision a reality. The critical thing is that with each new "family-member" addition, the roll-up needs to get better as it gets bigger.

MORE IN Land

We Engineered This Housing Crisis — It Didn’t Just Happen

Metro housing policy has become a self-defeating maze. The Builder's Daily contributor Scott Cox helps us with data, wisdom, and courage to map the math, myths, and real path forward.

Lone Star Diamond In The Rough: A Case For 'Why Weatherford'

Longtime Texas residential land strategist Scott Finfer opens up his land scouting manual to explain the stark difference between speculation and data-backed, applied vision.

Little Deal ... Big, Timely Product Pivot: Lokal’s Capital Play

A $12M facility fuels Lokal Homes’ swift shift into higher-margin homes and a smarter land strategy in a tough market.