Capital

Homebuilding's Newest Public Goes Live Day One On Nasdaq

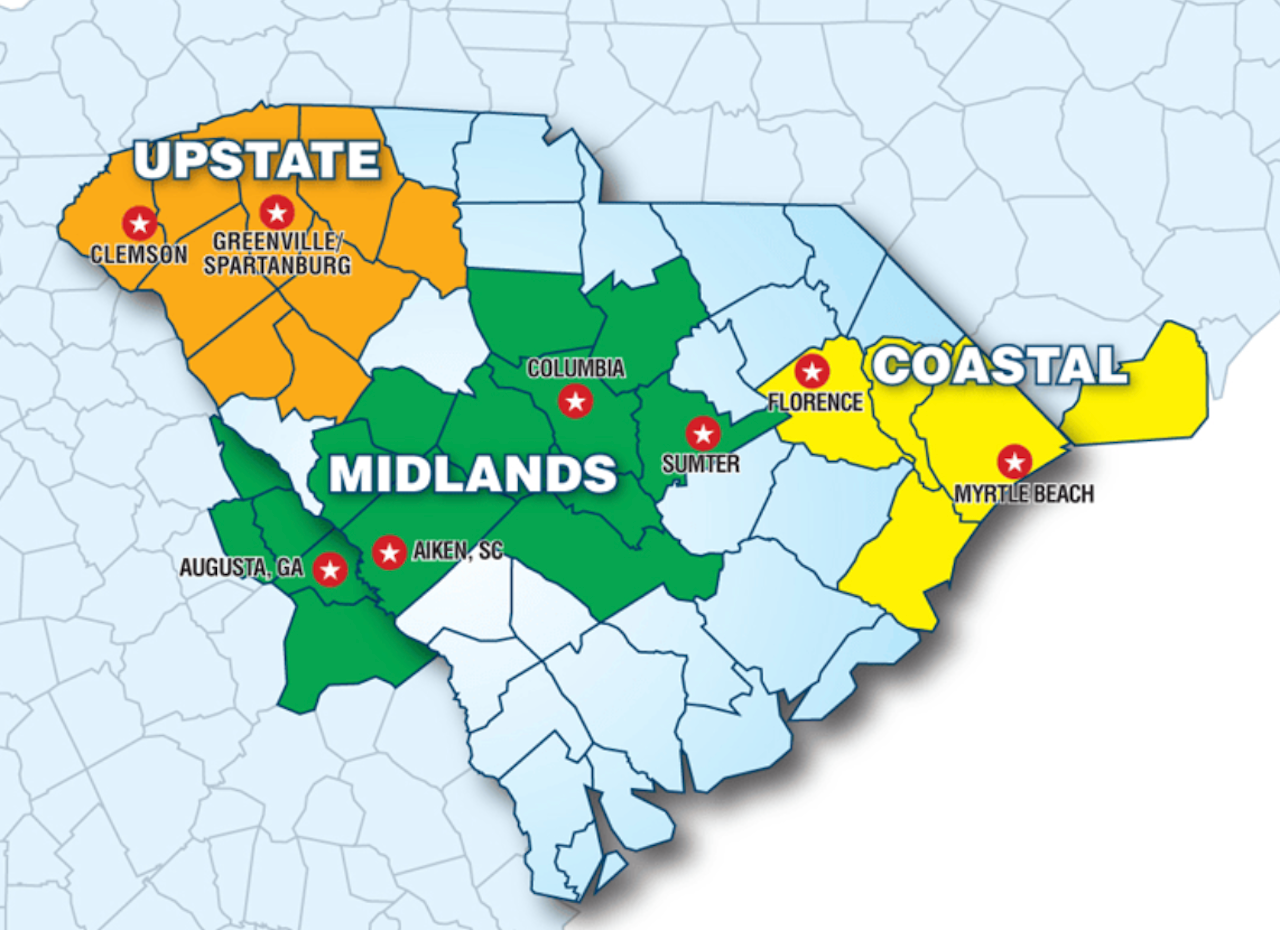

While it took more work and time to cross the finish line as a listed enterprise, the premise and promise of Columbia, S.C.-based United Homes Group, up-to-now a regional powerhouse, remains undeterred and poised for a launch.

The path was rockier, more financially treacherous, and – like so much of homebuilding production over the past two years – more prone to delays than initially anticipated. However, United Homes Group, the nation's latest entrant into the ranks of publicly traded homebuilders, goes live this morning on The Nasdaq Stock Market, trading as UHG.

Still, while it took more work and time to cross the finish line as a listed enterprise, the premise and promise of the Columbia, S.C.-based up-to-now regional powerhouse, remains undeterred and poised for a launch.

Get ready for blast-off, as one of the nation's ripe-for-growth regional power players taps its deep operational capability culture, and proven best-of-breed execution on the more affordable, entry-level product, now gets a solid green light to expand its program and footprint.

As we wrote this past September – when plans for Great Southern Homes to combine with special purpose acquisition company Diamond Head Holdings Corp. to form United Homes came to light with a deal then valuing the combined company enterprise at around $572 million – despite near-term speed bumps and hiccups, the future looks bright. We wrote:

Reasons for the timing of the bold eve-of-uncertainty de-SPAC transaction owe to an alignment of stars that starts with DiamondHead chairman David Hamamoto's interest in Michael Nieri himself, as well as an array of plusses around Nieri's land-light operational model, geography, market segment, price-point, mobility and migration economics, in a backdrop of fundamentally strong demand over the next decade. In both Hamamoto and Nieri's assessment – with the support of Antara Capital's Himanshu Gulati – Great Southern Homes is a mega-regional powerhouse waiting-to-happen, and now the wait is over." – The Builder's Daily

Fed interest rate hikes, and a high-inflation stretch have done a number on both new home builders and on SPACs, a double-barreled challenge for the fledgling public homebuilding enterprise. In December, Bloomberg correspondents Bailey Lipschultz and Lydia Beyond reported:

At least 80 special-purpose acquisition companies, which have raised $24 billion in total, face a wall of investor meetings that will give clients the chance to exit ahead of a new US tax that could hurt their returns. At least 32 SPACs holding roughly $18 billion are looking to close up shop and return capital over the coming 2 1/2 weeks, data compiled by Bloomberg show." – Bloomberg

It took some intestinal fortitude – and trust in the pedigree and capability of the founder and sponsor teams – to get to this morning's Nasdaq listing, where premarket, share prices "rocketed 182.9%." In January, proxy filings in advance of a Special Meeting of stockholders note that the enterprise's leadership needed to secure approval for an "Extension Amendment," beyond a previously set deadline of January 28, 2023, which set out two alternative scenarios:

(i) consummate a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination involving the Company and one or more businesses, which we refer to as a “business combination”, or (ii) cease its operations if it fails to complete such business combination and redeem or repurchase 100% of the Company’s Class A common stock included as part of the units sold in the Company’s initial public offering that was consummated on January 28, 2021

This request for more time – to a new deadline – for both the deal consummation, plus a recommendation to adjourn the "special meeting" itself [moved to March 14th], met with shareholders' approval, allowing for the business combination to close this past week.

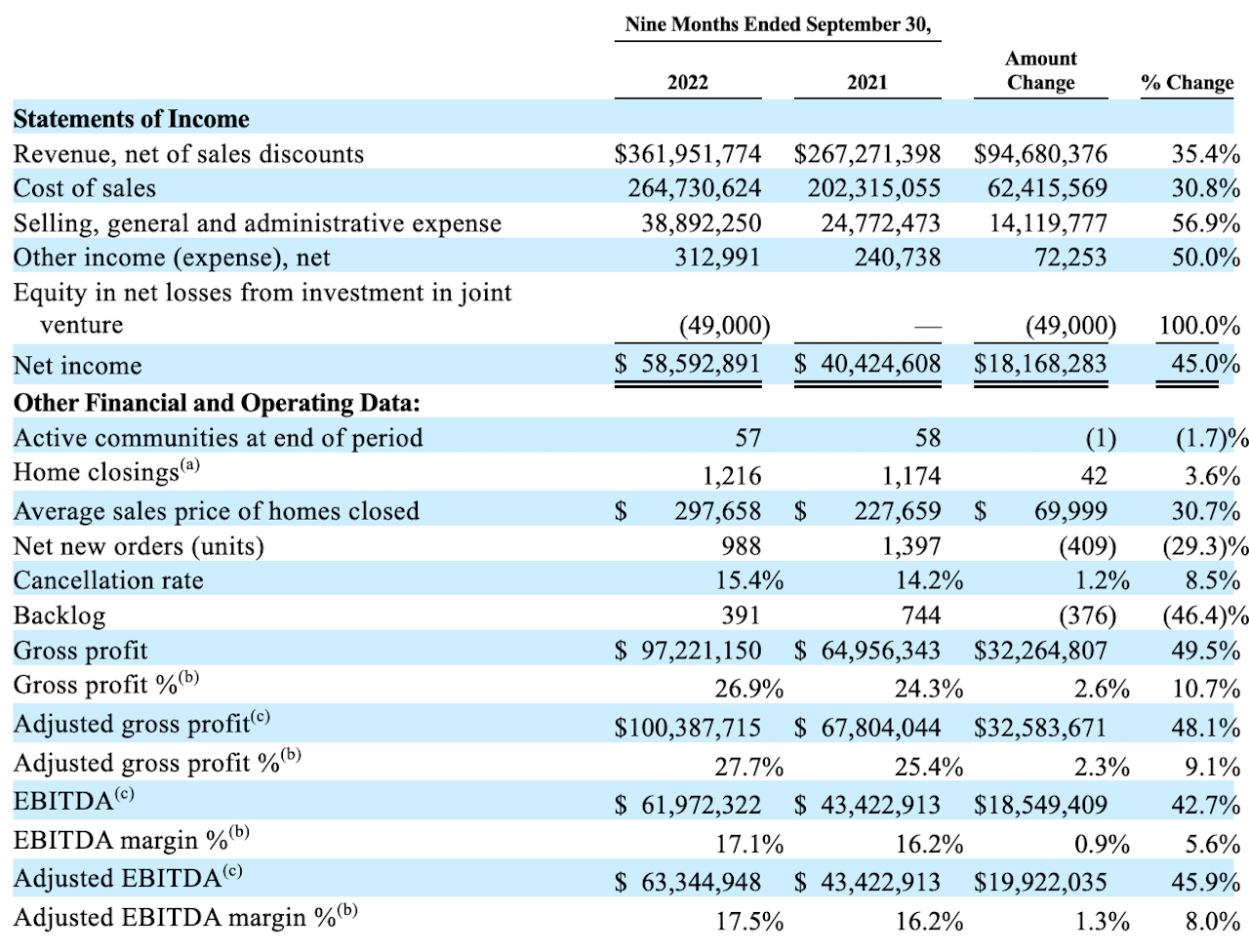

On the operations and execution front, the Great Southern Homes team muscled through a 2022 calendar year challenged by rising interest rates, higher input costs, materials supply snags, elongated construction cycles, and iffy demand. Record revenues, $100 million-plus in adjusted gross profits through the first nine months of 2022, and record closings despite the headwinds reflect the deep-seeded staying power and executional focus of a team whose bootstraps culture dates back to 2004, when founder Michael Nieri launched the company out of an old pickup truck.

What's ahead now for United Homes Group -- accounting for a backdrop of near-term volatility, the ongoing threat of a recession, and otherwise tricky operating conditions – is an ambitiously steep arc of growth. The focus is three-pronged:

(1) market expansion, mostly via acquisitions

(2) built-to-rent building-as-a-solution services

(3) mortgage and other consumer value enhancing services

Already, Hamamoto and Nieri have gotten the M&A engines running, looking for deals private single-market and regional homebuilding firm matches, that fit the bill for business culture, footprint, customer segment, and upside growth opportunity criteria:

and putting out word through some of the nation's prolific matchmakers. An announcement to potential seller clients went out on the heals of the UHG closing from Builder Advisor Group, timed to appeal especially to private homebuilding firms that may want or need capital to navigate a complicated 2023-24 marketplace:

This combination introduces one of the country's fastest growing builders as a publicly listed company and provides the United Homes Group with an influx of new capital to expand into high-growth markets of the Southeast. The company is already the 45th largest builder in America, delivering over 1,700 homes annually in communities across South Carolina.

United Homes Group is looking to deploy their newfound capital by acquiring builders throughout the Southeast.

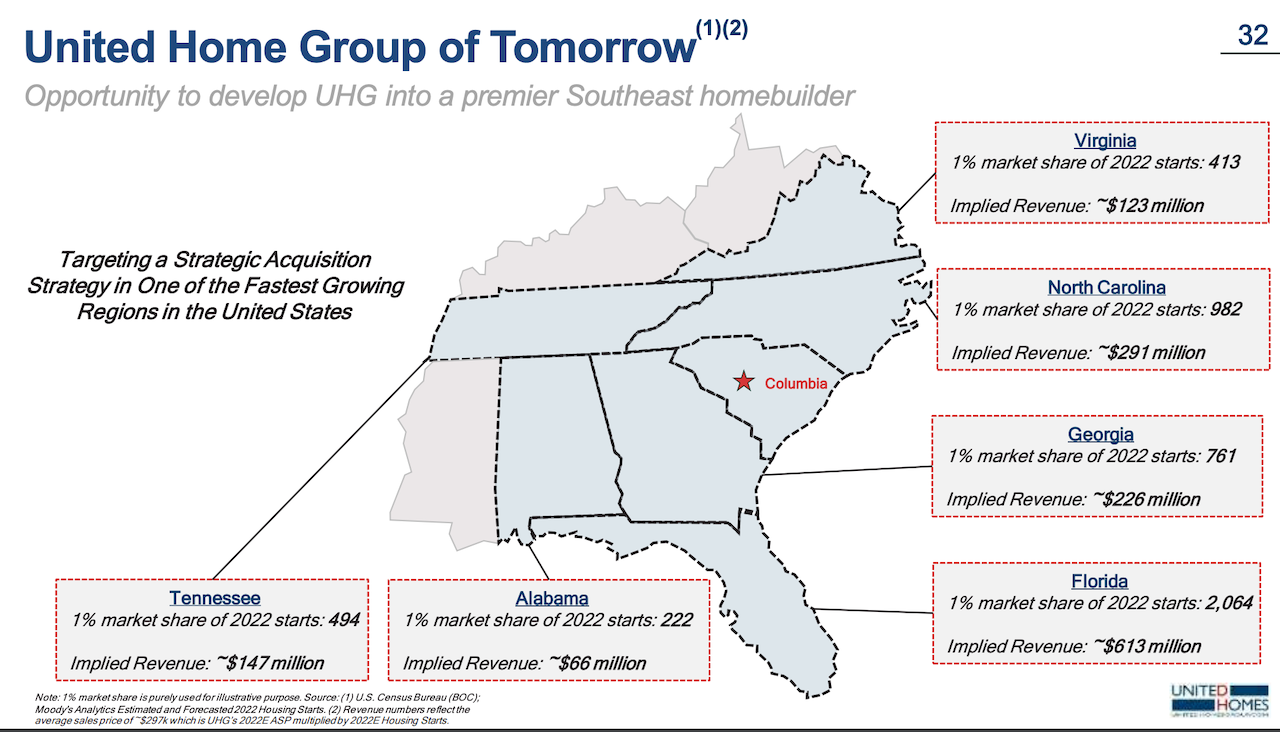

UHG calculates that as it plays out a near- and mid-term accelerated expansion arc in six Southeastern states – Alabama, Florida, Georgia, North Carolina, Tennessee, and Virginia – by taking just 1% share in each of those states, it could increase revenues by upwards of $1.5 billion, on home volume growth of nearly 5,000 closings per year.

At midday on Day One of trading on Nasdaq, shares were pricing at $20.21 per share, up 59.38% from the day's lows, trading at mid-range for the day.

Welcome, team United Homes Group, to the big list. Now it's go time.

MORE IN Capital

A $33 Million A&D Loan Propels A 494-Home NJ Deal Into High Gear

This transaction, particularly during economic turbulence and constrained traditional credit, underscores the resilience and adaptability required to navigate the current market conditions.

Recently-Acquired Firms Better Hit Their Growth Plans, Or Else

The Big Wait: As the Fed maintains a cautious approach toward an eventual pivot on interest rates, homebuilders deal with a seasonal slowdown and an indefinite timeline to the endurance test of stalled demand.

Why Access Private Credit To Secure A&D Financing? Why Now?

Investment in new housing takes many forms, and private credit funds are now a huge part of it. Here's a primer on the whys and wherefores of one of homebuilders' flexible channels to access capital.