Marketing & Sales

The Clearest Lens Of New Home Demand Ahead: The Kitchen Table

The 'this time's different' truism that's trenchantly true this time is inflation, which is running higher and hotter even than mortgage rates for the first time in at least six decades.

When you boil down structural household demand to a kitchen table, it's got to look and sound a lot like this these days.

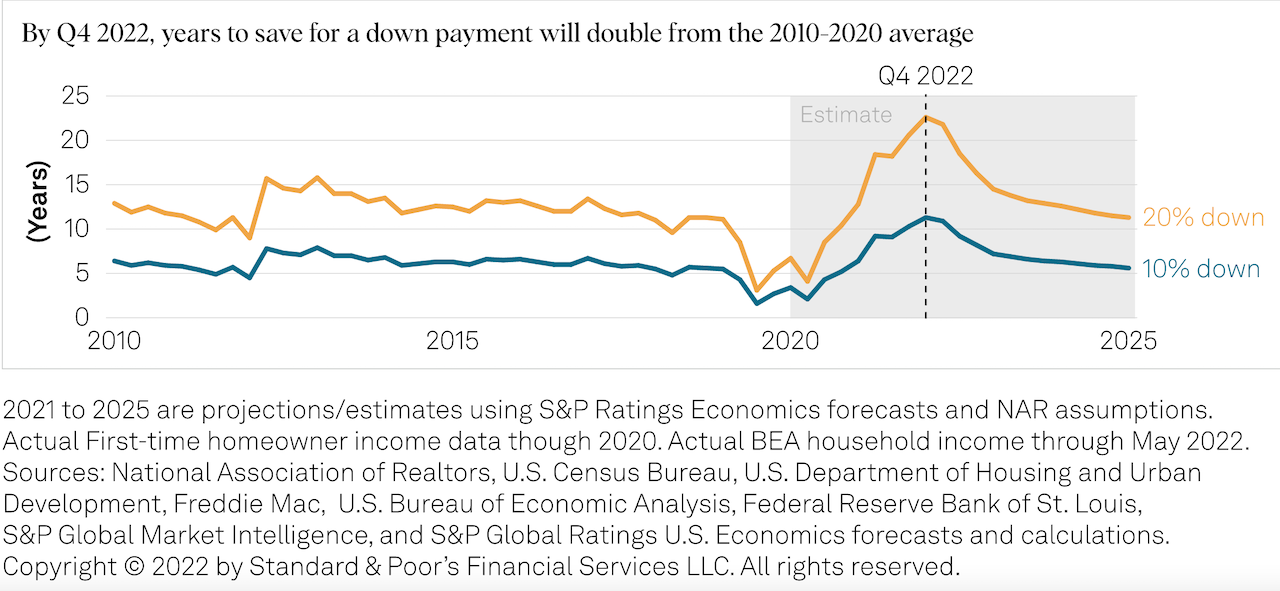

By fourth-quarter 2022, it will take 11.3 years for a first-time homebuyer with median income to save for a 10% down payment. It will take this homeowner 22.6 years to save for a 20% down payment. Both are over twice their pre-pandemic rates of five and 10.6 years, respectively. – S&P Global Ratings

Minus the rocket fuel of the Blackstones, the KKRs, the Starwoods, etc. buying every piece of residential property they could lay their hands on, and the firehose of Federal policy-powered money supply, that kitchen table now measures both the span and depth of the abyss out ahead and the bridge across it for those whose livelihoods are making homes and neighborhoods.

Again, think of it. It takes double the time in years for those people at that kitchen table to save up for a down payment, and again, that change took place in just 36 months!

The "this time's different" truism that's trenchantly true this time, of course, is inflation, which is running higher and hotter even than mortgage rates for the first time in at least six decades.

The kitchen table, the basic building block of market-rate housing's constancy as a source of one of every five Gross Domestic Product dollars, is the keyhole view of housing's next upcycle. It's also the lens into who survives and who thrives and who goes away, and how, and where for the homebuilding operators who've been leaning heavily into the fits-and-starts pressure cooker of overwhelming demand and constrained supply of the past 30 months.

Inflecting demand trends are – and for the foreseeable future – the common denominator fixation that will shape, contextualize, and inform what we're listening to and what we make of it.

This one little term, just three words, contains multitudes. What to know about it, what it means, why it matters in a broad sense is that tens of billions of dollars swing in its balance in the space of 12, 24, 36, or 48 months.

The crux, of course, is not uncertainty around raw household formation demographics – which in and of themselves assure plenty of demand – but the payment power, present, anticipated, and actual, of those households.

Payment power, we learn, is not simply a function of selling prices and the ability to bend those costs downward. Equally, payment power is a household's income, its expectations, and its sense of security around those earnings.

Uncertainty has worked its way into the kitchen table.

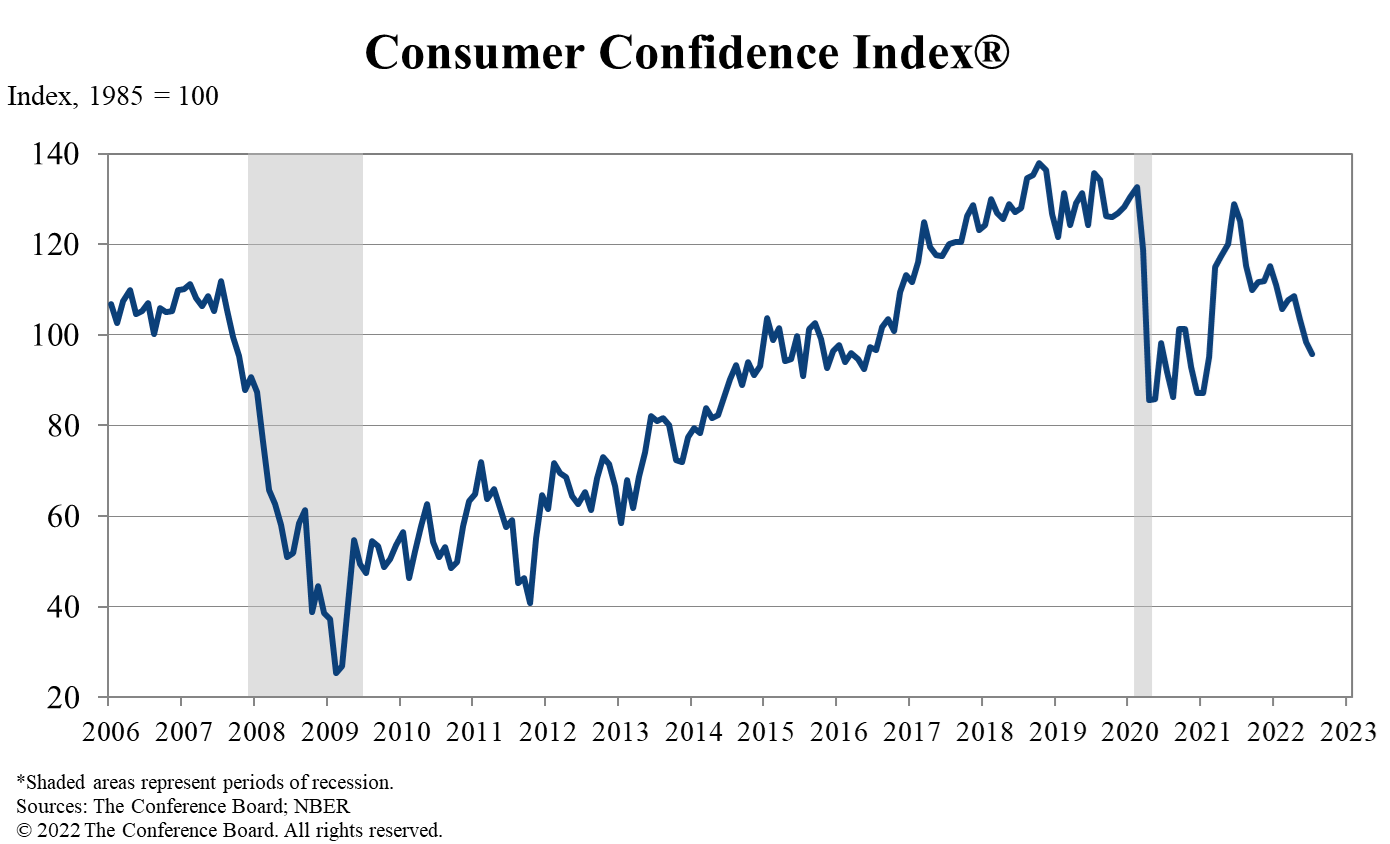

We see that clearly here:

Expectations Six Months Hence

Consumers were mixed about the short-term business conditions outlook in July.

- 14.0% of consumers expect business conditions will improve, down from 14.6%.

- Conversely, 27.2% expect business conditions to worsen, down from 29.7%.

Consumers were also mixed about the short-term labor market outlook.

- 15.7% of consumers expect more jobs to be available, down marginally from 15.9%.

- Conversely, 21.4% anticipate fewer jobs, down from 22.2%.

Consumers were more pessimistic about their short-term financial prospects.

- 14.7% of consumers expect their incomes to increase, down from 16.1%.

- 15.7% expect their incomes will decrease, up from 15.3%.

Consumers – i.e. the kitchen table – pre-indicate either a headwind or a tailwind for the broader economy and the housing economy. Right now, it's a headwind.

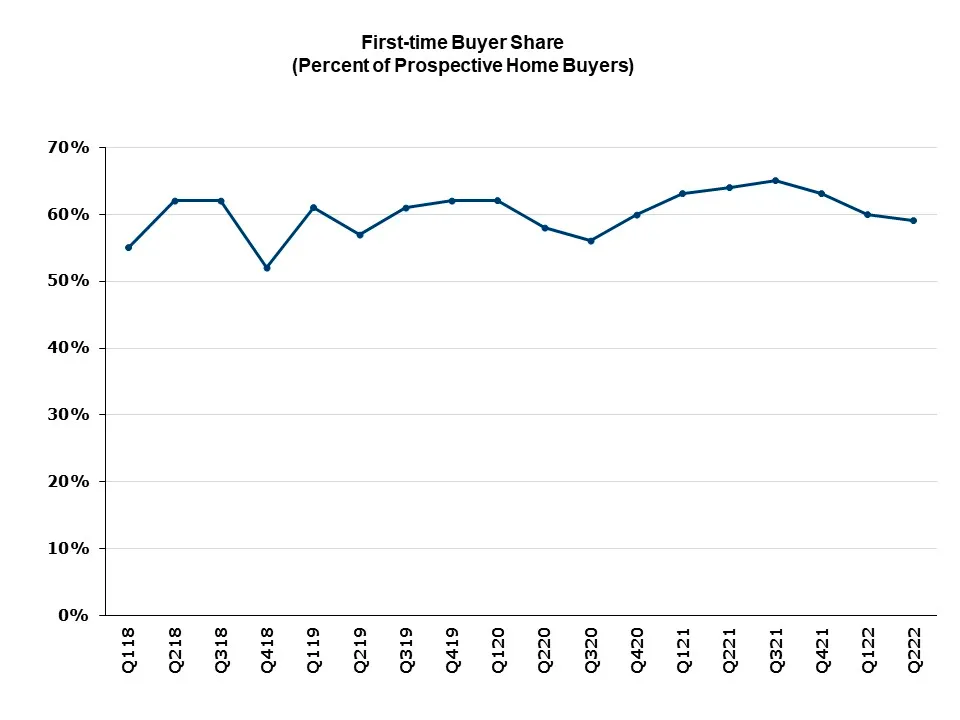

The National Association of Home Builders this week offered highlights of its Q2 Housing Trends Report, which carries across a demand outlook that's sideways after making several steps down from a peak Q2 a year ago. Although demand on aggregate ran about flat with the first quarter of this year, first-time buyers – the kitchen tables most susceptible to erosion due to mortgage rate increases, consumer price inflation, and high home prices – drifted down quarter to quarter.

NAHB Economics' assistant vp for survey research Rose Quint notes:

Part of the reason housing demand has decelerated is that 1st-time home buyers continue to retreat: their share of all prospective buyers peaked at 65% in the third quarter of 2021, followed by three straight declines to reach the current 59% – its lowest point in almost two years (56% in the third quarter of 2020).

Confidence at that kitchen table level has taken a hit.

Uncertainty, one of humanity's No. 1 motivators of hesitation, is still a growing storm. Yet, confidence, it turns out, works as its own source of greater confidence. It's also an important part of the artillery in the war on inflation.

This makes it all the more important for homebuilders to keep eyes on the prize, people at their kitchen tables. The more builders succeed in stabilizing and eventually restoring payment power at that level – by doubling-down on price and value creation adaptability – the sooner we all cross that bridge to a market ahead that everyone knows will be bursting again with buoyant demand.

Join the conversation

MORE IN Marketing & Sales

When Homebuyers Pull Back, Builder Brands Must Step Up

In markets under stress, consistency, empathy, and value-driven messaging provide builders with a critical edge among today’s cautious buyers. Advisor Barbara Wray gets real about the path forward for homebuilders today.

What Separates Homebuilders Thriving Amidst 2025’s Chaos

Builders face rising stakes to unify tech, data, and operations or risk falling behind amid affordability, insurance, and labor challenges.

Here's Why Randy Mickle Has Joined Drees At This Moment

The new Southeast Regional President brings big, national builder experience to a multigenerational homebuilder with bold goals for its centennial.