Capital

Talking Housing Bubble? Start Talking Turkey ... And Talking Taper

Global house prices reached unprecedented peaks at historical 12-month rates of growth. Is there a taper-tantrum in oaur near future?

Click your heels three times and repeat.

Demographics. Underbuilding. Job and income growth.

The wildcard of interest rates and other monetary and fiscal stimulus, notwithstanding, the fundamentals are there.

Supportive too, is the dramatically, measurably de-risked systemic financial condition of households, whose incomes and debt maintain an entirely saner relationship to one another than in the intoxicated 2000s.

Still, right now, if you remove the interest rate wild card from the equations that allow monthly payments and home price tags to jive with one another, there's a growing sense that something's got to give.

This morning, Bloomberg correspondent Faris Mokhtar reports that homebuilders' queasy sense that the days of unabated surging demand for new homes at nearly any price may be numbered put them in good company around the world.

Housing prices worldwide are rising the most since before the global financial crisis, following a market frenzy seen in places from New Zealand to Canada to Singapore during the pandemic.

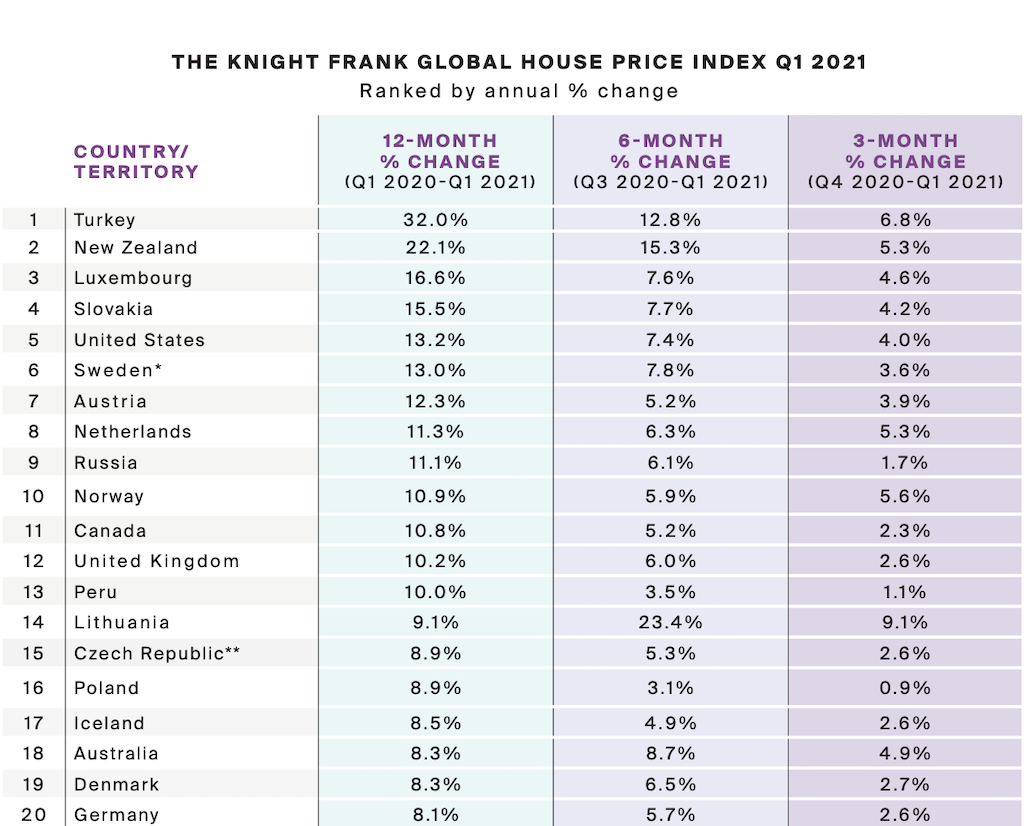

Average prices jumped 7.3% in the 12 months to March, the fastest pace since the fourth quarter of 2006, Knight Frank’s Global House Price Index report showed Thursday. Turkey topped the list, registering 32% growth, followed by New Zealand at 22.1%. The U.S. took fifth spot at 13.2%, its steepest increase since December 2005.

Click those heels again.

The Federal Reserve's position, that may impact the housing market's wildcard – mortgage interest rates – may be poised to shift.

Who can forget the last time "taper" entered the cocktail party lexicon?

Are we there yet?