Land

Strong Private Builders Can Write Their Ticket In M&A Sweeps

A select group of sellers – whose backs may be viewed as against the wall purely financially, given their reliance on personally guaranteed bank lending for AD&C – have tremendous leverage on both options and terms.

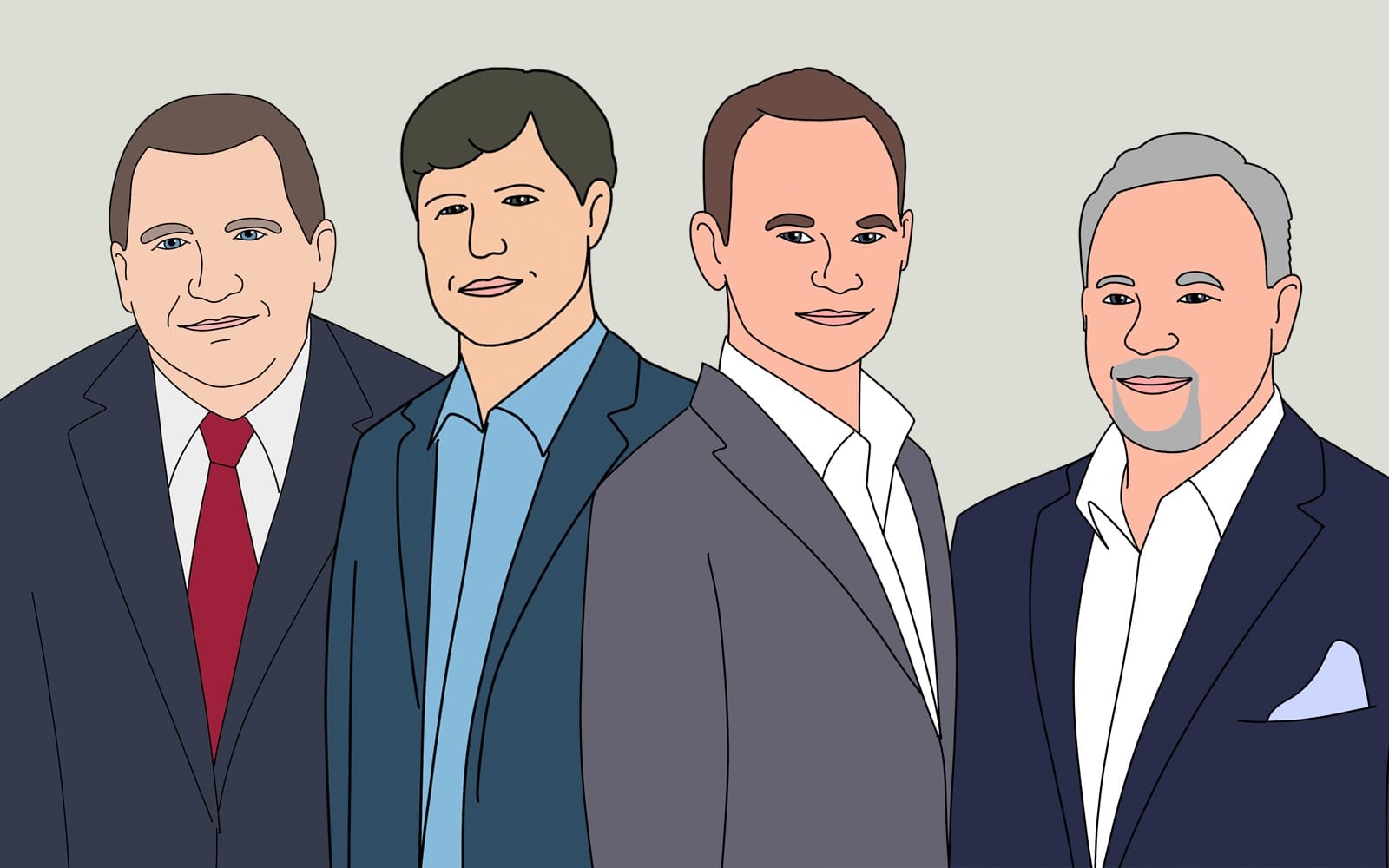

[Illustration by Maggie Goldstone, left to right: Ken Stricker, The Jones Company; Ted Terry, Crescent Ventures, Nick and Gary Wisniewski, Landmark Homes of Tennessee]

Has anyone figured out yet whether a higher-for-longer Fed regime will wind up in the trash bin of catchy, ephemeral buzzwords or as a painfully entrenched factual reality? Never mind. That doesn't stop investors from taking aggressive risk-reward bets on one or the other.

A whiplash of financial, investment, and economic volatility barrels along, begging the question for borrowers, lenders, sellers, and buyers of everything, including homebuilding companies as to the near-term future direction and strength of the economy and consumer households' resiliency in driving it as they have.

What's clear in homebuilding, however – especially after a multi-billion-dollar spree of early 2024 mergers and acquisitions whose accelerated cadence tracks back to about mid-year last year – is strategic homebuilding enterprises want to buy other builders. They want to do it decisively, with competitive juices raging.

What's more, in a higher-for-however-long rate environment that's been rough on any mortal homebuilding business owner whose capital lifeline is typically a bank or a syndicate of banks, lots of builders want or need to sell to other builders, and many of them want the timing to be soon.

An unappreciated driving factor – as we imagine an M&A deal flow pipeline in the next 24 to 36 months that could rival any three-to-five-year chapter in homebuilder consolidation and concentration in the last 25 years – is this: Who needs whom more right now, buyers or sellers?

Moreover, to answer that question conclusively, you'd have to answer a ride-along question with equal certainty and clarity. What means more when it comes to large-company acquirers' feverish pursuit of new lot pipeline springboards to market share and volume growth opportunity, money or people?

One perspective on that question comes through loud and clear here:

For a strong operator in a growing geographical market, this is as good a time as I've seen in the last 20 years," says Tony Avila, founder and CEO of Builder Advisor Group and Avila Real Estate Capital (AREC), a supporting partner of The Builder's Daily. "It's about similar to the valuations I saw in 2005."

For anyone who may need reminding, a 2005-06 era that would funnel pell-mell into the Global Financial Crisis saw scores of M&A deals, culminating in mid-2006 with Dubai-based Emaar's $1.06 billion purchase of John Laing Homes, a bygone Western Regional private powerhouse. Many of those acquisition deals bent or broke during the housing downturn that followed that, leading, memorably, to Hovanian chairman and CEO Ara Hovnanian's comment, "I wish I'd taken the year off."

Both the number of strategic buyers and sellers and the quality and character of the respective motivations to buy or sell have amped up in intensity within a macro backdrop of structurally bulging human demand in a collision with structurally constrained housing supply.

Understandably, organizations doing the acquiring get most of the ink and attention in the recent series of M&A combinations. It's their narrative trajectory that carries ongoing relevance. It's their story as an ever-shrinking number of ever-larger and more powerful national enterprises that is reshaping the future of homebuilding as we know it in the U.S.

What may be surprising, however, is that at least a select group of sellers – whose backs may be viewed as against the wall in a purely financial sense, given their reliance on personally guaranteed bank lending for acquisition, development, and construction – have tremendous leverage on both options and terms.

While strategic acquirers are looking for human, real estate, and operational platforms that will assure them of present and future competitive advantage and access to homebuyer customers, land opportunities, contractor competence and availability, and building materials and products distribution channel leverage, sellers, too, have negotiating and non-negotiable boxes they want to check off on as they go through the process of hearing acquisition offers.

As an example, Ted Terry, the principal owner of 15-year-old Crescent Homes, which agreed to a sale to Dream Finders Homes, carried four goals into the process JTW Advisors conducted on Terry's behalf to find a buyer: One was money that met a valuation threshold that befit a company that JTW CEO and managing partner Chris Jasinski noted eclipsed $380 million on 705 closings in 2023, and brought a backlog of 460 homes totaling $265 million in 25 actively selling communities, as well as an owned- and controlled lot pipeline of 6,200 lots.

A second goal, Jasinski says, was continuity of employment opportunity for the Crescent team. Third, Terry sought a structure that would give him a longer-ramp way stake – even a synthetic one – in the future of the operation of the Dream Finders division. And finally, Jasinski says, Terry wanted a "monetization event" for his family.

Traditional players were willing to kind of think outside the box in the process," Jasinski tells us. "We came up with numerous different solutions and Dream Finders felt like the right fit across the priorities Ted had set."

Creative structures and terms are – and have been – part of the M&A process, often providing operator sellers either a full exit, an ongoing operational role with opportunities around participating financially in future lot acquisition and inventory turns, as well as other profit participation incentives, says Builder Advisor Group's Tony Avila.

What's happening is not so much new on the structures part of it, but more creativity emphasizing efforts to incentivize and motivate key people to stay on board and keep delivering the same level of profitability or greater than when before the company was sold," says Avila.

One veteran executive notes that since the Great Recession, a dearth in next generation, highly capable land and operations strategists have come into the industry, tilting the balance somewhat as acquiring companies consider not only the owned- and controlled lot pipeline but the capability needed to sustain it.

We're certainly seeing more of a premium on ensuring that good people in place and incentivized to stay with the company, and do what they do so well with expanded resources to put into place," Avila says.

MORE IN Land

Little Deal ... Big, Timely Product Pivot: Lokal’s Capital Play

A $12M facility fuels Lokal Homes’ swift shift into higher-margin homes and a smarter land strategy in a tough market.

Oversupply or Overreaction? DFW Market Needs To Hit Reset

Scott Finfer breaks down the DFW-area oversupply crisis: post-pandemic assumptions, slower job growth, and mispriced inventory. Across the U.S., high-volume markets face similar risks. Finfer outlines five strategic moves to cut through the noise — and seize ground as bigger players pull back.

Land, Capital, And Control — A New Playbook In Homebuilding

Five Point Holdings’ acquisition of a controlling stake in Hearthstone points to the direction of homebuilding strategy: toward lighter land positions, more agile capital flows, and a far more disciplined focus on vertical construction, consumer targeting, and time-to-market velocity.