Leadership

Pivoting Too Far To SFR? A Red Flag Warning To For-Sale Builders

Short term gains could run lead to long-term pain if builders shift too far from their promise as pathways to owner-occupier access to homeownership.

Homebuilders and their partners face a dos and don'ts challenge.

Do ... relentlessly continue to work make new homes and communities for buyers of varying payment power to strive and achieve the dream of homeownership

Don't ... detach business goals and operational models from an essential promise to make that dream attainable as a core strategic principle.

This is a reflection at a critical moment, on the eve of the Federal Reserve's vaunted "lift off."

One macro assessment worth taking a look at – from the Harvard Business Review – notes:

An enormous humanitarian atrocity in Europe has triggered an unpredictable global financial and economic conflict that will see consequences ricochet. Though new risks have emerged, and uncertainty is higher, at present the main impact of the crisis on the U.S. economy is the exacerbation of existing pressures and risks. The path of inflation, and the policies to contain it, remain the main threat to the cycle.

Pressures and risks telescope in their impact, as well as their capability to be resilient: the world, the U.S., regions, companies, localities, and households.

For homebuilders and their partners, do and don't challenges hinge on who they are as companies, and who they want to continue to be. That is their choice, obviously, and that is up to their leaders to resolve.

Up to and through the 2020s, new home and community builders have won deserved recognition as platforms that empower people to earn their way to upward mobility, part of that reflected in homeownership.

Three fresh data points help illustrate.

- U.S. single-family rent growth increased 12.6% in January 2022, the fastest year-over-year increase in over 16 years, according to Core Logic.

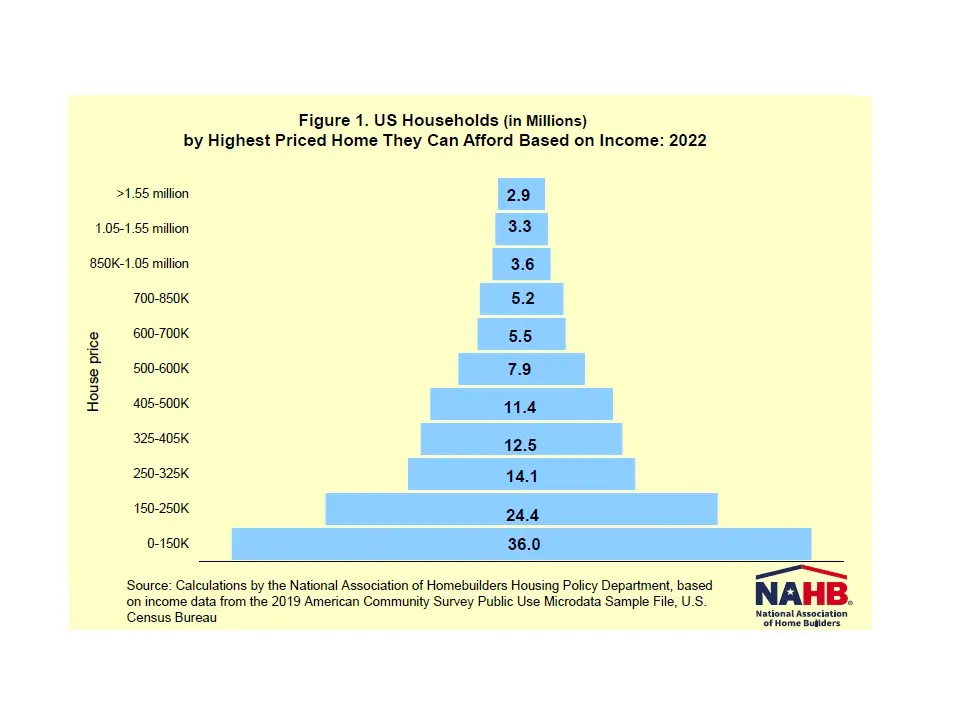

- The minimum income required to purchase a $150,000 home is $36,074. In 2022, about 36 million households in the U.S. are estimated to have incomes at or below that threshold, according to National Association of Home Builders analysis.

- The other – less a statistical point than a reality of the market -- is that homebuilders serving as a building-as-a-service to single-family-built-to-rent developers have noted they're getting full retail price for new homes from these big investment backed property developers. Often at greater profitability.

One friend with direct experience in dealing with multiple business stakeholders in real estate and construction notes:

The benefits of building and selling 1000 homes over several years to one or two institutional buyers – rather than 1000 individual homebuyers – have led many small regional builders to abandon – or curtail dramatically– for-sale offerings to absorb more B2R work.

Advantages:

- Less headaches (home buyers, sales management, marketing, mortgage approvals, etc.)

- Smoother process with even-flow releases of 20 homes at a time

- Longer and more consistent runway for trades and vendors

- Staffing: attractive move for on-site builders tired of dealing with frustrated (angry) customers.

The do and don't challenge comes by way of the experience as it hits directly home for our senior level executive in the field.

Everyone in our industry is making money off the SFR/BFR explosion. That said, with so many existing homes and/or new construction going to institutional investors, it’s a benefit for first time home 'renters,' less so for first time 'buyers.'

I’m seeing it first hand as we try to help my 24 year old son find a home to buy. Unless he wants to live 20 miles out, the price of admission is $300-350K.

The NAHB "pyramid" that accompanies the second bullet point above notes that there are 75 million households in the universe "priced out" of homes with a price tag of $325,000 or higher.

At a recent residential real estate conference event – with its inevitable hyper focus on built-to-rent business, investment, and operational plans – word is a principal with major land development firm said something like this:

Home ownership is one of the foundations in America. When institutional investors are buying and building so many homes for the rental portfolios it becomes much harder for people to purchase their first home. The BFR companies have become so dominant it’s impacting affordability and forcing them to remain renters if they want to live in a single family home.”

We come back now – in a moment in business time overflowing with spinning plates, moving targets, and crises du jour – to the dos and don'ts challenge for homebuilders and their partners, who have been an essential part of the fabric of the merit-based American Dream of homeownership.

We'll go back to the HBR piece with lists dos and don'ts for leaders at this time of converging uncertainties and risks:

-- Don’t rely on forecasts as extreme uncertainty prevails; flimsy in the best of times, they remain out of reach.

– Do build the capabilities to analyze and model the transmission of shocks and stress test using scenario planning.

– Don’t assume that shocks deliver structural change – they can, but in the fog of the moment the bar for inflection often appears deceptively low.

– Don’t assume that pricing power persists. As growth moderates and inventories build, firms may well return to defending market share.

– Do think of productivity growth as a sustainable source of competitive advantage.

Then we'd put it more simply. Don't be who you're not. Do double down on who you are.

Join the conversation

MORE IN Leadership

How Signature Homes Wins While Other Builders Pull Back

Sales are sliding for most private builders. Dwight Sandlin’s team is defying the trend with strategy, speed, and customer obsession.

HW Media Acquires The Builder’s Daily, Expanding into the Homebuilding Vertical

Strategic acquisition adds leading homebuilding publication and strengthens HW Media’s commitment to serving the full housing economy

C-Suite Leaders Will Gather To Chart Homebuilding’s '26 Reset

The Builder’s Daily announces the speaker lineup for this October’s high-impact leadership summit in Denver, where the best minds in homebuilding operations, marketing, and technology will explore how to lead through the now and build for what’s next.