Leadership

Leaders' Playbook: As Housing Risk Brews, The Focus Is Forward

Headwinds, tailwinds, crosscurrents, and riptides ... they're the executional and operational stepping stones to the future of private sector housing success.

Three-quarters of a million new home sales in 2022 would be a great year for some homebuilders, a fair-to-good year for most, and a so-so year for all but a few of the rest.

What comes after is where leadership comes in.

For housing's private sector players, Spring 2022 is a moment, like any before it, about which it can be safely said, "This too shall pass."

It is a time of leadership. For it calls, like any time, for presence and persuasive powers, for steadfastness and for willingness to change, traits of business character and culture that leadership stokes.

Housing's private sector leaders can't be asked to know more than can be known, nor predict better than the rest what's impossible to foresee.

In ways, the sector's strategists – at all levels of the small- to mid-sized to enterprise continuum of firms – run in strong parallel with market-makers on Wall Street, with troves of both historical trends and real-time data to improve judgment, inform evaluation of options, and support decisions.

Like stock-market players, uncertainty itself has a left-half trajectory and a right-half, a parabolic curve with a duration distance in between. Ken Fisher writes in RealClear Markets:

Early 2022 ushered in seemingly ubiquitous uncertainty—which stocks famously hate. But don’t despair. The first-quarter fog—now widely pre-priced into stocks—will lift. Don’t fear today’s uncertainty—embrace it. Buy before the clearing haze sends stocks soaring.

The old adage that stocks hate uncertainty is true—but only partially. Stocks hate high and rising uncertainty. High but falling uncertainty, however, is the absolutely best stock market fuel anyone could ever ask for. And that is dead ahead now.

Dead ahead in this case refers to a clear-shot from rising uncertainty to falling. What dead ahead doesn't account for, and what it may be wrong or right to assume will be a sharp, fast turn, is the duration. Many have come of professional age in times of tight, severe, parabolic ups and downs. We might start to believe that's how they'll all tend to behave.

Today's consumer price index print from the Labor Department hit 8.5%, rising at its fastest rate since 1981, and notching six straight months of inflation over 6%. At least initially, markets reacted as Ken Fisher suggested they might, rebounding on the belief that inflation has peaked.

When Fisher tallies up the event-driven headwinds, offsets those with the structural tailwinds, and takes stock of how the financial markets have already priced-in risk to the downside, his recap sounds like this:

Maybe this is a V-shaped correction and we saw the bottom a month ago. Maybe it is a W-shaped one with the low still ahead. Maybe not. About a third of all corrections in history have been roughly W-shaped. But, either way, corrections lead to higher prices looking a year out."

Market-rate, single-family, for-sale builders view themselves in this time of uncertainty as playing from strength, even as – and maybe especially because – inflationary erosion of money's buying power, interest rate increases' erosion of monthly payment power, and other economic uncertainties pile up a wall of worry.

They point to February and March 2020, when COVID was supposed to end the world as we know it. What happened then was that demographics (i.e. Millennial adults), health and safety concerns, and financial policy lit up an intrinsic value high-ground for new home construction and new home communities.

Builders believe that high inflation and rising interest rates – not to mention ongoing surges of the variants and mutations of the novel coronavirus – will continue to light up that intrinsic value high ground and continue to stoke demand for every new home and new community builders can put out there.

Here's some conditions, however, that builders and their partners will need to both recognize and navigate, as they suggest that not every firm in every pocket of the new-home landscape will fare the same.

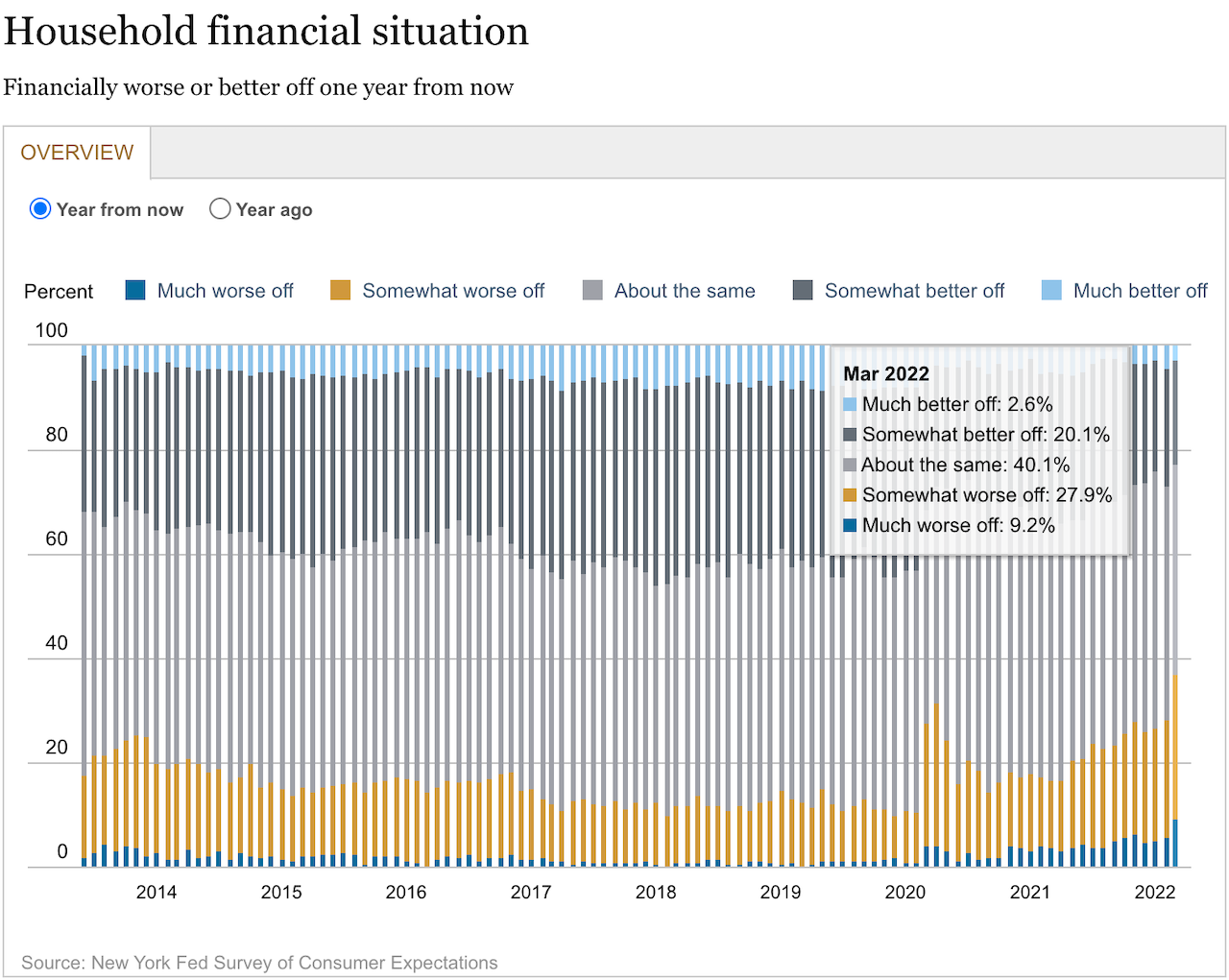

From the Federal Reserve Bank of New York

- Perceptions about households' current financial situations compared to a year ago deteriorated in March, with more respondents reporting being financially worse off than they were a year ago. Respondents were also more pessimistic about their household's financial situation in the year ahead, with fewer respondents expecting their financial situation to improve a year from now.

One way or another, private sector housing leaders now – and forever – find themselves having to draw on persuasive powers, to inspire, concretize, and motivate people around them to be their best selves, to both meet expectations, and to eclipse them by adapting to conditions on that parabola of fast-rising or quickly descending uncertainty.

In a timely piece, author and business advisor Bill Taylor's Harvard Business Review essay illustrates two approaches to today's leadership challenge – getting people to do what they don't want to do. Each method follows a classic formula for transformational improvement, either lowering the barriers to change, or raising the resolve level among people expected to change.

Taylor calls one approach, the "foot-in-the-door" method, where an initial, eminently doable, challenge serves to prime the organization's pump for the more profound change they'll need to tackle. He calls the alternative approach the "door-in-the-face" technique.

When it comes to life in organizations, the door-in-the-face approach is as much of a metaphor as a literal persuasion technique. The leadership lesson is not that you should routinely make demands that you know people can’t or won’t accept, or that it is acceptable to try to bluff your colleagues with phony goals in order to hit the targets you really have in mind. Rather, the idea is that by setting aspirations for performance and change that seem extreme or unreasonable, especially in organizations that suffer from active inertia, you can persuade people to consider innovations they would not have considered otherwise. Wharton professor Jerry Wind calls this “the power of impossible thinking” — and it can make big change a lot more possible.

If housing's private sector leaders fail to get their organizations to execute, operate at a high level of excellence, jump fences, and figure their way out of a host of issues, longer term future success becomes less relevant.

That's why many of them simply refuse any narrative that suggests ebbing demand. That's partly because ebbing demand is anybody's guess, and current demand – and trying to meet it – is the only practical pathway toward dealing with what will come next.

Today's focus is getting people in their organizations to do things – well – that they're apt not to want to do. At least not without that dose of leadership spurring them to strive.

Join the conversation

MORE IN Leadership

How Signature Homes Wins While Other Builders Pull Back

Sales are sliding for most private builders. Dwight Sandlin’s team is defying the trend with strategy, speed, and customer obsession.

HW Media Acquires The Builder’s Daily, Expanding into the Homebuilding Vertical

Strategic acquisition adds leading homebuilding publication and strengthens HW Media’s commitment to serving the full housing economy

C-Suite Leaders Will Gather To Chart Homebuilding’s '26 Reset

The Builder’s Daily announces the speaker lineup for this October’s high-impact leadership summit in Denver, where the best minds in homebuilding operations, marketing, and technology will explore how to lead through the now and build for what’s next.