Capital

Each 25 Basis Point Jump On 30-Year Fixed Bumps 1.3MM People

Here's why builders--betting heavily now on lots of fundamental running room for demand--are tense about interest rates.

Just like that, the menace of spiraling mortgage interest rates – and the mounting pressure fueling their rise – has the angst-o-meter notching upward even as demand measures point to plenty more momentum among buyers.

Although there's other culprits for homebuyers' cost curves bending in the wrong direction, builders tend to assign show-stopper blame to 30-year fixed rate spikes, as fluctuation there raises a big red flag on the monthly payment front.

It can – and does – go so far as to knock would-be buyers off the beam to qualify for a purchase loan based on household earnings levels.

From January to now, from 3.5 million to 4 million households that may have qualified for loans on new construction homes entered housing's "priced-out zone," where three out of five households – 75.1 million – can only regard new-home ownership as a pipedream.

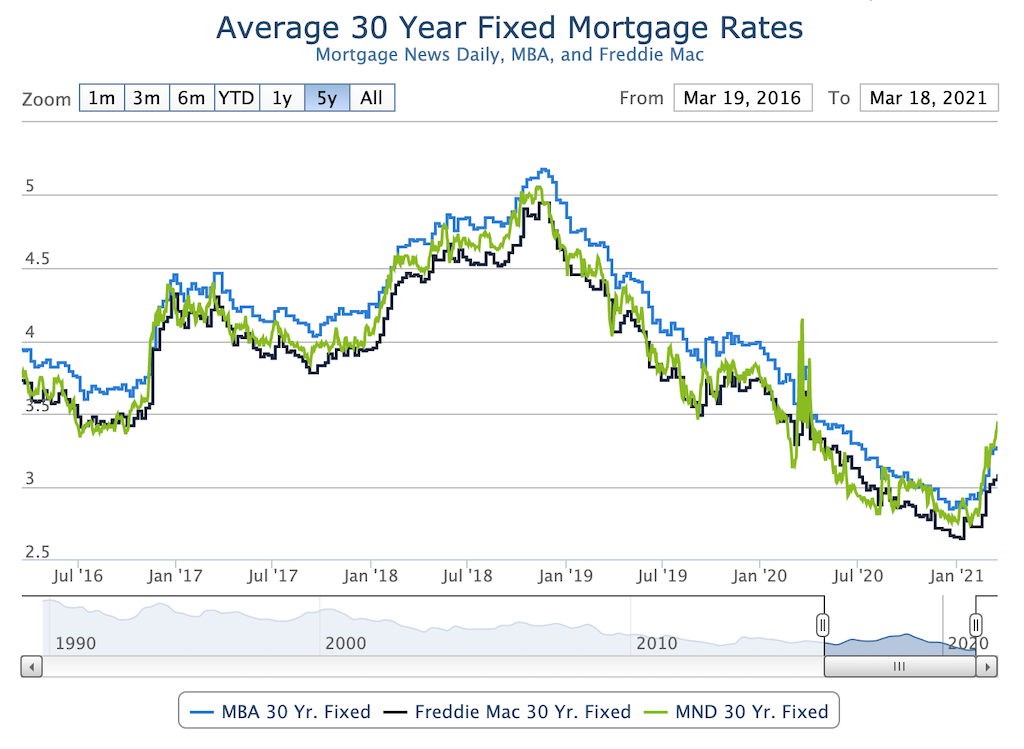

Here, CNBC real estate correspondent Diana Olick reports on the mortgage interest rate retrace from pandemic lows of 2.75%, to a year-earlier level of 3.45%.

She quotes Matthew Graham, chief operating officer at Mortgage News Daily:

“Since the beginning of February, the total damage is nearly 3/4ths of a percent, making it one of the biggest moves in any 6 weeks, ever.”

In this analysis, National Association of Home Builders senior economist Na Zhao has done, quantifies correlations – bip by bip, bips being basis-points – between rising 30-year fixed interest rates and their direct impact on the prospective buyer universe for new homes.

Zillow economist Matthew Speakman adds insight into reasons to expect continued upward pressure on rates:

Either way, upward pressure on mortgage rates is likely to remain, as increased economic activity and steeper inflation both tend to push rates higher. Further fueling this week’s increases was the implementation of a new policy from the Federal Housing Finance Agency. The policy places a cap on how the share of Fannie Mae and Freddie Mac’s portfolio that loans associated with investment properties or second homes can comprise. Lenders who had a larger share of those loans had to quickly raise rates associated with them to lessen their ratios.

Net, net all eyes intently focus on what goes into and comes out of next week's meeting of the Federal Reserve as Fed governors navigate a twitchy, mixed-signals pathway into recovery ground, but with a hell of a lot still to recover. The Fed's thumb on the scale of dirt cheap rates through 2024 is about as much as builders can hope.