Leadership

Homebuilding's Backlog Logjam Weighs On 2022 Forecasts

It's crystal ball time in housing, and a number of factors bedeviling homebuilders' production and value cycles remain stubbornly resistant to modeling a plan. Welcome to a new normal of de-risking 2022 operations for uncertainty ahead.

Forced to sell only what can be produced rather than selling based on upping production to swelling demand creates a business cultural challenge for those whose livelihoods spring from the value-chain of making shelter and community.

It's not normal, typical, nor sustainable as an enterprise model. The back half of 2021 and at least the first several quarters of 2022 look as though the "sell-to-production" constraint will weigh heavily as a business risk for homebuilders large and small – and consequently all of their investor and supplier partners.

In an economic environment defined by volatility, uncertainty, and considerable odds that all best-laid plans for at least 2022 are prone to the whims, swings, health and safety-related scares, and remaining snarls of upended capability and clouded visibility, budgets, their underlying assumptions, and their business-health and resiliency markers are being set.

So how does the business of homebuilding and development get right with its enterprises' 2022 forecasts, when its distinctive industry-sector model presupposes enormous upfront investment – of equity capital and debt – for reliable long-term performance results that now show greater vulnerability to supply and capacity shocks?

A new residential construction machine that entered 2020 – and after a brief cataclysmic crash in February through March – making the sound "glug, glug, glug" as buyers thronged every physical, virtual, and digital portal, absorbing new homes as fast as they could be permitted, has these past eight or nine months, made an altogether different sound.

Capital galore is already in place or actively seeking placement in residential property development, each new property a microcosm – a lot-purchase-to-entitlement cycle-time, a development cycle time, a construction cycle time, each with its array of pre-inflationary cost basis, now subject to uncertain post-inflationary changes.

Each of those timelines and input cost models have been effectively swallowed up by the great flux that defines Episode Two of our pandemic era economic and financial story, one recently complicated by the emergence of a possibly more transmissible variance of Covid-19. In this frame, an economy – made up of tens of thousands of mini-economies of geography, business segment, and household consumption behaviors – tries to get back on its own two feet after a staggering shock in February 2020 and a supercharged, all-points Federal Government and Central Bank stabilization and rescue program response.

A stark reminder of how daunting that challenge – restoring the U.S. and global economy to a next normal, unaided, household spending and private enterprise-fueled dynamic growth period – will be comes through in yesterday's National Association of Home Builders analysis of the release of U.S. Census Construction Spending data as it reflects a homebuilding production sector throttled by capacity constraint.

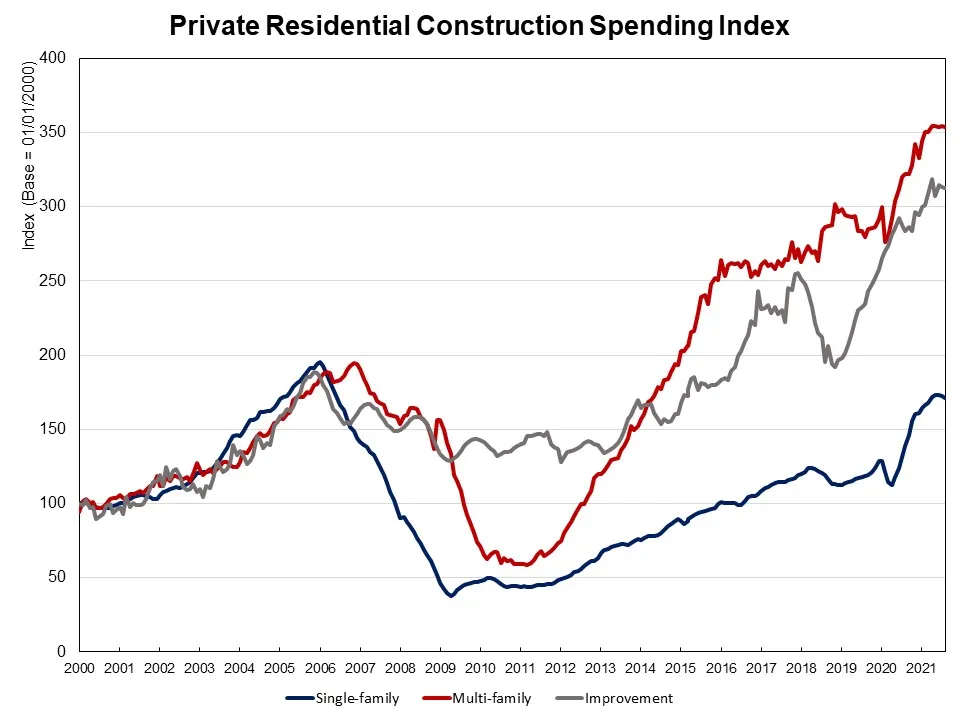

Spending on single-family, multifamily constructions and improvements all declined in October, as homebuilding is still facing the supply chain issues, the rising material costs and labor shortages. Single-family construction spending decreased to a $412.1 billion annual pace in October. It was down by 0.8% after a dip of 0.2% in September and down 0.3% in August. Multifamily construction spending dipped 0.1% in October. Compared to a year ago, single-family construction spending was up 23.1% and multifamily spending increased 9.9%. Spending on improvements dipped 0.2% in October, after a decrease of 0.5% in September. However, improvement spending is 10.2% higher than a year ago.

The NAHB construction spending index, which is shown in the graph below (the base is January 2000), illustrates the solid growth in single-family construction and home improvement from the second half of 2019 to February 2020, before the COVID-19 hit the U.S. economy, and the quick rebounds since July 2020. New multifamily construction spending has picked up the pace after a slowdown in the second half of 2019. Under the pressure of supply chain issues, construction spending on single-family, multifamily and improvements slipped down a bit from the third quarter of 2021."

Clearly, a peak capacity new home investment, development, entitlement, and production phase – expanding the new home attainability pool and spreading multiplier-effect demand across dozens of goods and services sectors – might both ease housing-related inflationary dynamics and power macroeconomic growth as a structural support of a post-stimulus, private-sector and consumer-led recovery.

With that scenario in mind, policymakers and private sector leaders might consider a "post-emergency powers act"-style approach to unpacking some of the chokehold constraints on the human, materials, and land-use/zoning resources that have been thwarting a "build to demand" rebound.

Until and unless that happens, you'd better have a pretty damned special crystal ball if you're predicting capability and capacity will reach any kind of norm in the next six to nine months.

The business culture challenge of the realities of a "build to production" present and foreseeable future, however, involve brute honesty, transparency, and a sector-wide level-set that both manages expectations and lifts the potential to exceed them.

When it comes to budgeting and forecasts, better to reckon and reset strategy much closer to current actuals rather than look at them as unachieved opportunity – i.e. "transitory" challenges – in the way of promises for much rosier results in the next quarter, or the next quarter after that.

In 2022, the only surprises investors, lenders, and other partners may reward will be for outperformance of the most reality-checked, de-risked benchmarks builders and their partners can deliver on. Underperformance "misses" will cost a great deal more.

Join the conversation

MORE IN Leadership

C-Suite Leaders Will Gather To Chart Homebuilding’s '26 Reset

The Builder’s Daily announces the speaker lineup for this October’s high-impact leadership summit in Denver, where the best minds in homebuilding operations, marketing, and technology will explore how to lead through the now and build for what’s next.

Century Communities' People-First Edge Is No Soft Strategy

Century Communities EVP Jim Francescon unpacks how trust, transparency, and a people-powered culture fuel high performance — even in a volatile 2025 housing market.

Sumitomo's Timber Complex Sharpens Its Edge Of Integration

The $29M Teal Jones acquisition solidifies Sumitomo’s strategy: Develop and own the lots, control the materials, manage the build cycle ... and thereby reshape the market.