Leadership

Communities Grand-Open For Builders Into A Challenged Market

As many as 5,000 new neighborhoods are due to come online — representing hundreds of thousands of new-home lots already fully-invested in — and builders' next big challenge is to activate them come what may.

Events for which "there's no playbook" for leaders are a thing now.

Homebuilding's leaders got through one of them, COVID-19, in Spring 2020, with flying colors. They hoped they'd never have to resort to such dire strategic calculus ever again. Surprise! Within the next six months, decimation of supply chains – people, materials, manufactured items, and the mechanisms to move all of it from here to there, and from start to finish – became the next wave of "uncharted waters" shock and stress. Again, a year of Whack-A-Mole mini-crises may have been tiring, but homebuilding's leaders and their teams prevailed, by and large, and navigated to historic-level business performance.

Now, midway through 2022, a widening and worsening cost-of-living crisis has begun spooling out in the face of 5,000 or more "Coming Soon" newly active new home neighborhoods, containing hundreds of thousands of new-home lots that have been paid for or borrowed on, and penciled for sales prices that 65% of homebuilders concede may now reflect unsustainably high levels.

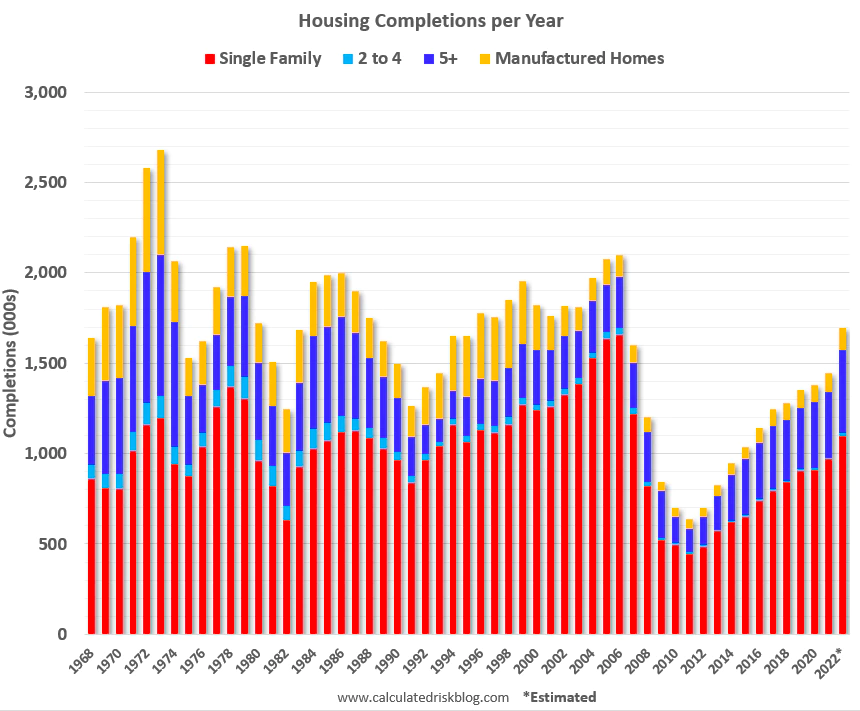

Now, in the throes of new-home price elasticity that has stretched to its tolerance limits, a surge in completions – some sold, but not closed, and others still to come onto to the market in brand new communities, subdivisions, and projects calendared to come online in the Summer and Fall of 2022. Calculated Risk's Bill McBride estimates that by year-end, there'll have been a record number of new single-family completions since 2006.

"Coming Soon" – all of those neighborhoods and phases and tracts builders expected until a few months ago would grand-open to a clamoring, around-the-block, swelling river of demand – now gets a reset under the force of two vastly altered behavioral and business drivers. One is a "no-more-easy-money" era, and the other, an "everything's-costing-me-more" era. One driver impacts access to non-income financial resources, and the other is a direct hit to take-home earnings.

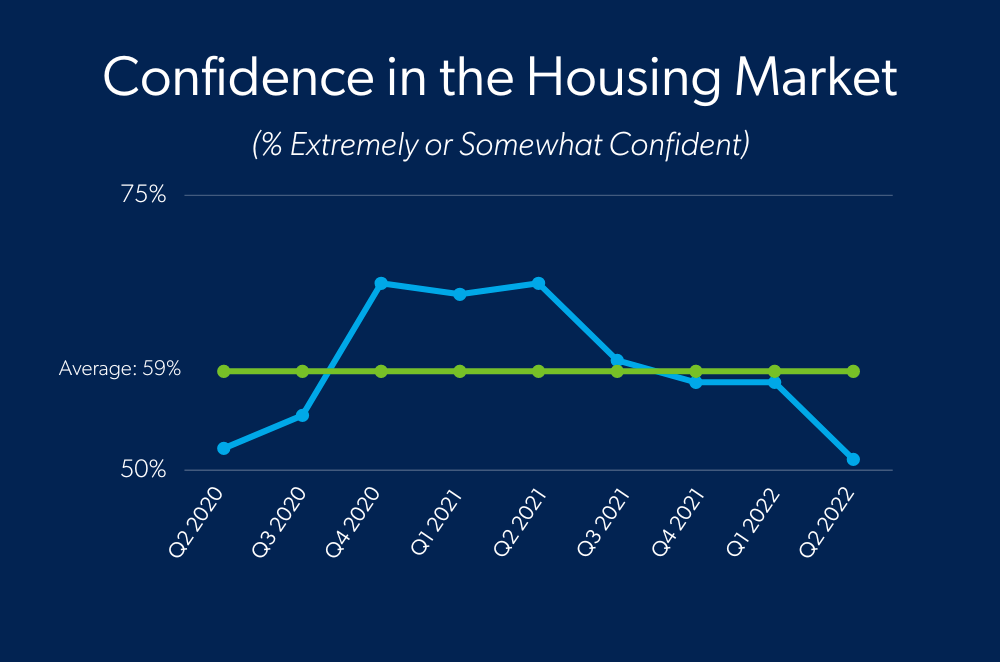

Here's what those two drivers' impacts look like now from 40,000-feet, with an eye to how consumer households feel about the housing market, from researchers at Freddie Mac:

Market Confidence

- 51% are confident the housing market will remain strong over the next year. This is down 7 percentage points from last quarter.

- Confidence in the housing market at 2Q 2022 is the lowest its been since the start of the pandemic

Housing Affordability

- 56% of renters and 24% of homeowners spend more than 30% of their monthly on income on housing.

Payment Concerns

- 51% are concerned about making housing payments, up 4 percentage points from last quarter. This is true for 68% of renters (a 10-percentage point increase from last quarter) and 38% of homeowners (a 3-percentage point decrease from last quarter).

Market Activity

- 24% are likely to buy a house in the six months.

- 17% of homeowners are likely to sell in the next six months.

- 23% of homeowners are likely to refinance in the next six months.

In other words, the pulse of consumer sentiment on housing is weakening, and has hit a pandemic-era low point. Will it go lower, or stabilize where it is? So far, leaders have referred to the chilling of the housing market as "normalizing." Do they know that the trajectory of deterioration will not descend farther? If they knew, would it be in any of their interest to say?

The answer is anybody's guess. What's more, Coming Soon communities face another challenge by nature. They have to start at square one, as dirt, which makes it psychologically tougher to carry across a sense of FOMO urgency, and to sell the virtues of a community that's already showing signs of character and value.

Second only to the risks to builders' hundreds of million-dollar sales backlogs should cancellations rear up as fallout to surging interest rates, unabated household costs, and warning signs that jobs and incomes may be in jeopardy, this fresh supply line of new communities are a crucial threshold for homebuilding businesses to cross successfully. Given all the money and resources invested in those yet-to-be-launched neighborhoods, they're literally the next stress-test for enterprises.

The leaders' "special" playbook for when there's no playbook goes like this:

- Secure the company's future ... identify contingency reductions in expense, streamline monetization of assets, draw on inexpensively priced debt, roadmap operations through varying severity level scenarios through the turbulence

- Elevate core customer focus ...

- Listen, over-communicate, and double-down on being present with team leaders, managers, and field folks

Grasping quickly and without preconceived judgment or bias what the current crisis demands of an organization that's capable of adapting, is what every business leader gets tested on, again and again. This time's no different.

To truly build resilience in your organization, you must recognize that two things can occur simultaneously: Individuals can build a reservoir of resources, such as optimism, vigor, and established social support networks, to draw on to help them be resilient while organizations offer proactive resources and create changes that help to protect employees. Individual employee resilience cannot replace organizational improvement and support.

Another challenge of the moment is a hard one, because both leaders and their teams have run on adrenaline now for three straight years. But here it is. "Keep it going." It's an innate skill, a trait, and a point of character in many of the homebuilding leaders we've come to know. But, we've also come to know that sometimes they themselves forget it ... that succeeding in this business is never a sprint, and it's always a marathon.

Read this piece from Morgan Housel, and make sure you watch the video at the end of the piece. Here's a teaser.

The most important investing question is not, “What are the highest returns I can earn?”

It’s, “What are the best returns I can sustain for the longest period of time?”

Compounding is just returns to the power of time. Time is the exponent that does the heavy lifting, and the common denominator of almost all big fortunes isn’t returns; it’s endurance and longevity. “Excellent returns for a few years” is not nearly as powerful as “pretty good returns for a long time.” And few things can beat, “average returns sustained for a very long time.”

That’s the biggest but most obvious secret in investing: Average returns for an above-average period of time leads to magic.

I think we’re seeing the flip side of that recently.

So many investors over the last five years have gone out of their way to maximize annual returns, squeezing every potential penny out of every opportunity they could find. The highest-risk investments, often fueled with leverage.

They did that because the opportunities were everywhere – everything seemed to go up, every asset, month after month.

Homebuilders are capable of learning to succeed as businesses in a "no-more-easy-money" era and an "everything's-costing-me-more" era. They may not know it right now, but it's "Coming Soon."

Join the conversation

MORE IN Leadership

C-Suite Leaders Will Gather To Chart Homebuilding’s '26 Reset

The Builder’s Daily announces the speaker lineup for this October’s high-impact leadership summit in Denver, where the best minds in homebuilding operations, marketing, and technology will explore how to lead through the now and build for what’s next.

Century Communities' People-First Edge Is No Soft Strategy

Century Communities EVP Jim Francescon unpacks how trust, transparency, and a people-powered culture fuel high performance — even in a volatile 2025 housing market.

Sumitomo's Timber Complex Sharpens Its Edge Of Integration

The $29M Teal Jones acquisition solidifies Sumitomo’s strategy: Develop and own the lots, control the materials, manage the build cycle ... and thereby reshape the market.