Leadership

Capitulation, Yes, But Resignation? Not Happening

Sentiment is not the same as resolve. Sentiment is not the same as determination and cunning, and a next-batch of survival steps many homebuilders know by heart.

Wall Street investors continue to deny and defy the grinding gyre of the Federal Reserve and its all-in all-out blitz to rid the economy of inflation. Wall Street Journal staffer James MacIntosh reports "Markets Zoom Toward Collision Course With The Fed."

Not so, homebuilders, who – judging from a sobering take-away from today's release of the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) – are in full-capitulation mode, not as companies but rather as companies able to conduct business as usual when consumer demand has so profoundly and dramatically fallen off.

We'll come back to that important distinction in a moment. First, though, here's what capitulation – in the sense of a business community's "court vision" that the Fed's not going to relent on its plan to bring down inflation anytime soon – looks, sounds, and feels like.

NAHB chief economist Robert Dietz writes:

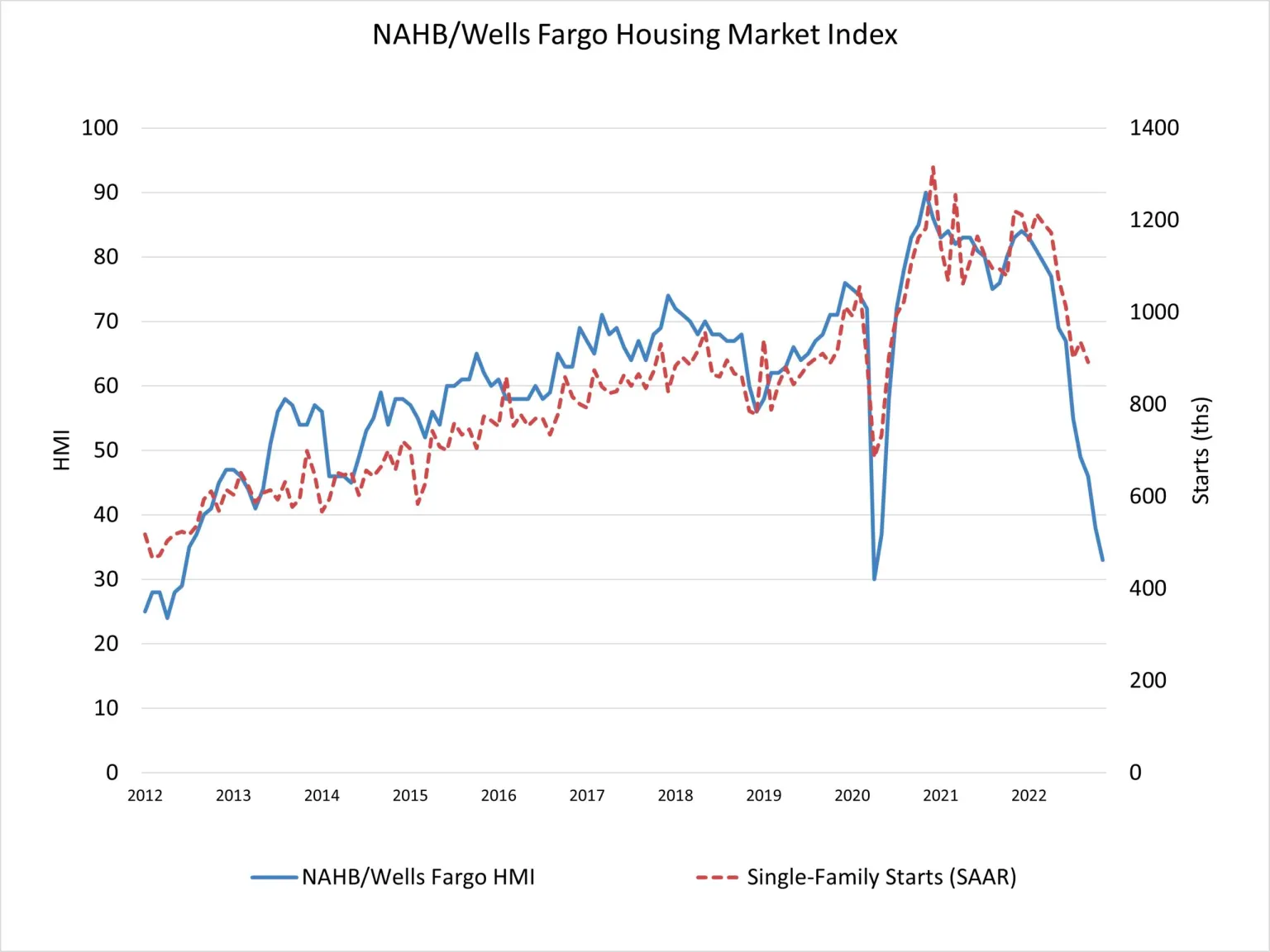

Builder confidence in the market for newly built single-family homes posted its 11th straight monthly decline in November, dropping five points to 33, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This is the lowest confidence reading since June 2012, with the exception of the onset of the pandemic in the spring of 2020.

Here are a couple of additional perspectives on the level of capitulation showing its colors in the homebuilding community's negative sentiment and outlook measures. Truman Patterson, Wolfe Research homebuilding and building products equity research analyst keys in particularly on deteriorating traffic signals in the HMI report. He writes:

More discouraging is the "continued decline in the 'Traffic' reading to 20 from 25, which likely weighs on December sales. We will be watching intently for a sequential improvement in the 'Traffic' reading next month given the slightly improved rate landscape. At the height of the GHR, we remind investors the Traffic reading fell to the HSD range for several months toward the end of 2008/early 2009. The 'Traffic' component averaged 30 in 2006, 21 in 2007 and the low teens in 2009 through 2011.

The October HomeSphere/BTIG builder survey corroborates weak and still worsening selling conditions and forecasts among operators:

- Sales and traffic trends are extremely soft: Only 7% of builders reported higher YOY sales vs. 42% in October 2021. 71% saw a YOY decrease in orders vs. 63% last month and 23% in October 2021. Only 11% reported an increase in YOY traffic vs. 12% last month. 70% saw a decline, compared to 61% last month.

- Sales and traffic relative to expectations also continue to weaken: A survey record-low 7% of respondents saw sales as better than expected, while a survey-record high 55% saw sales as worse than expected. Just 12% saw better-than-expected traffic, with 45% seeing worse-than-expected traffic.

- Price cuts and sales incentives are at survey record highs: The number of builders raising prices decreased to a survey record low and the number of builders lowering prices increased to a survey record high. 12% of builders raised some, most, or all base prices in October, from 24% last month, while 47% cut some, most or all base prices vs. 33% in August.

A homebuilding owner/principal of a enterprise on pace to recognize $800 million in revenues in 2022 tells us:

We think that, for us, what's going on now is worse than what we had to deal with going into the housing collapse in 2007," this privately-held chief executive says. "Back then, there were early warnings, and a slow, but sure signal that things were deteriorating. This time, the speed with which the market turned from a deep supply of high demand to nothing has been a shock. And even if the rate increases slow down, we're not going to see anything much below a 6% mortgage rate for sometime, so I don't see a quick comeback. We're going to go through a tough 2023."

The operative term here is this:

We're going to go through ..."

Sentiment is one thing. And in the face of an unyielding Federal Reserve effort to wring both inflation and its behavioral and psychological drivers – as well as their effects on cost-of-living – out of the economy, a bleak outlook among homebuilders mirrors consumer households' crisis of confidence when it comes to committing to most of their lives' most pricey and precious purchase.

That said, sentiment is not the same as resolve. Sentiment is not the same as determination and cunning, and a next-batch of survival steps many homebuilders know by heart. Many of them started their companies precisely at times like now, or steered them through the throes of other bumpy, discouraging times, and have lived to tell the tale again and again.

One top 200-ranked multimarket homebuilding enterprise ceo writes:

Over the last 8 years or so ... I’ve read a lot of articles and attended a lot of conferences. And I’ve heard a number of so-called 'experts' proclaim that residential construction is a backwards, archaic industry that is ripe for disruption. What those experts fail to understand is that we deal with disruption all the time! In fact, we experience sharp downturns like this regularly, and we’ve built ourselves as an industry to weather those storms. There aren’t many businesses out there that need to plan for that kind of contingency, and I think a lot of industries wouldn’t survive the circumstances that we’re dealing with right now. We are surviving it, and we’re going to continue to do so in the future, but it doesn’t mean that the process of surviving won’t involve painful decisions.”

... I must say I am weary of hearing over and over how backward we are. We are a resilient and nimble industry. How many so-called 'forward' industries could handle what we face? With only a blip on the economic horizon for them, have you taken a look at the tech industry? Wow!

Importantly, homebuilder sentiment and homebuilder capability and staying power amount to two entirely different things. The HMI's validity is in its measure of the strength and signals of demand for new homes. It does not measure the canny, time-tested ways – lowering their costs, cutting their prices, simplifying products, refining their sales targets, reeling in their land holdings, etc. – leaders, owners, and stakeholders in homebuilding firms respond to shocks and stresses, frequently coming out stronger.

MORE IN Leadership

C-Suite Leaders Will Gather To Chart Homebuilding’s '26 Reset

The Builder’s Daily announces the speaker lineup for this October’s high-impact leadership summit in Denver, where the best minds in homebuilding operations, marketing, and technology will explore how to lead through the now and build for what’s next.

Century Communities' People-First Edge Is No Soft Strategy

Century Communities EVP Jim Francescon unpacks how trust, transparency, and a people-powered culture fuel high performance — even in a volatile 2025 housing market.

Sumitomo's Timber Complex Sharpens Its Edge Of Integration

The $29M Teal Jones acquisition solidifies Sumitomo’s strategy: Develop and own the lots, control the materials, manage the build cycle ... and thereby reshape the market.