Capital

The K Recovery Has Carved A Winner-Take-All Marketscape

CoreLogic economist Thomas Malone offers two counterintuitive takes on the latest home price and sales volume data trends, with a sense of what they mean for what's ahead.

The pandemic has played favorites among housing markets.

We'll come to that presently. Meanwhile, guess the operative word in this headline of an update analysis from CoreLogic economist Thomas Malone: "Home Sales Reveal New Insights into Current Recession."

For those of you who picked the last word – Recession – as the pivotal one, we would as well.

To add value beyond observing the obvious that market-rate housing writ large is on a healthy run (supported by both fundamentals and artificials), Malone zeroes in on two "what-you-didn't-already-know" access points in the CoreLogic data mine.

One comes as a reminder. Nationally, house prices and house sales tend to behave differently in recessions – prices remaining "sticky" and sales volumes falling. Malone plots the two trend-lines across four decades and six recessions to illustrate the norm with respect to the two.

The pandemic-precipitated recession, he notes, is atypical.

Prices have risen a lot in most places. There are several hypothesized reasons for this. First, mortgages rates at an all-time low are causing a spike in demand. Second, older owners have chosen to delay selling, restricting supply. Third, forbearance programs have delayed distressed sales. Fourth, the coronavirus pandemic has led to a shift in preferences and reallocated demand to less dense areas leading to more rapid price gains in suburbs, for instance. Combined, these factors have led to, on aggregate, a large increase in prices that is not typical recession behavior. However, sales volumes were down during the Spring, in line with typical recession behavior.

Again, Malone is nudging us to remember that, exception or not, we're in a recession. Some form of reversion to recession norms needs to figure into every scenario for 2021 behavior, nationally, and locally.

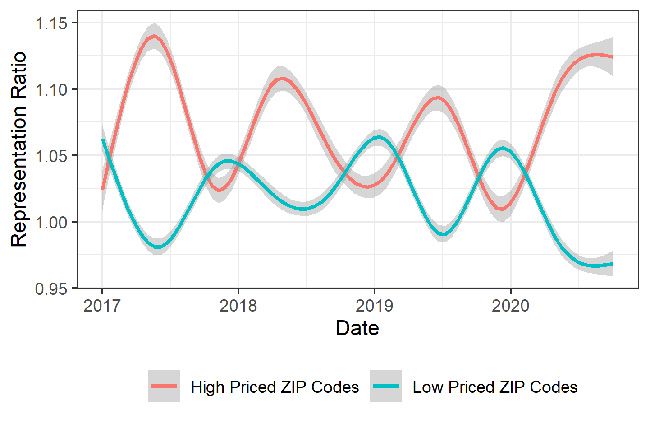

It's local markets where the value-meter jumps, where the data shows a "tale-of-two-markets" playing out beneath the blare of the housing-is-hot-everywhere narrative. What he illustrates is that properties that are selling most are higher priced, a skew that inflates pricing's broad-stroke rise, but masks off important observations about the inverse. He writes of a "mix-shift" ahead that could return pricing closer to norms.

"It is important to remember that prices show what happening in the submarkets that are selling right now, and don’t necessarily reflect what is happening in the markets that aren’t selling. The appreciation seen in the pandemic is a snapshot that is mostly showing what is happening in more expensive markets. As sales in lower priced areas pick up again, it seems hard to predict."

The two take-aways here? One is, "this time's different" may not play out despite the look and feel that this recession has spawned atypical price and home sales trends.

The other is this: the coronavirus hurts most where the most hurt. The K recovery – thanks to strong numbers among bigger spenders – may deceive many into believing that times are better across the board than they are.