Capital

Bull Or Bear — Watch How Too Much Money Alters Balance

There is more than one kind of supply and demand. Here, we explore the collateral impacts of too much capital flowing into new homebuilding and development's capability-constrained system.

As the debate rages about the demand for housing and how many homes we need, we should also be at least as concerned with the intersection of that answer with capital supply and demand.

I don’t think I’ve ever seen this much capital in the housing space before. Single-family built-for-rent, traditional apartments, single-family for sale, master plan communities, you name it, there is a ton of money looking to be placed in it.

Public builders, private equity, hedge funds, debt funds, etc. Land banking is so competitive it’s becoming more common to see single-digit rates. For that to end well, you’ll need almost a perfect track record from beginning of the cycle to the end.

As recently as 2019, at least some types of capital were leaving the space, or at least getting more conservative, especially as it relates to project duration and exposure to entitlement risk. Lately, however, it seems bigger is better. Builders going longer, PE going longer, land bankers going longer. Master-planned multi-cycle projects receiving so many bidders there are multiple rounds and “best and final.”

Another element of an increasing acceptance of duration is more entitlement risk is being taken on. Builders these days typically buy projects with a portion of the approvals necessary to develop. Or, they put up non-refundable deposits to be used by others for processing. However, these projects are often still a long way from “shovel-ready.” While there is clearly a stop-loss if they haven’t closed on the land, it’s also a little disingenuous to say “we don’t take entitlement risk”.

Much of the capital world has decided the pandemic completely reset the clock on the housing cycle.

Maybe.

And maybe if it is a new cycle, we shortened it with the unprecedented price increases. None of us can know. We are all speculating.

Public builders are lowering gross margin hurdles on new deals and build-for-rent is putting significant rent growth in proformas. Markets that historically happily absorbed 2-3 homes per project per month are now assuming +4, because that’s “conservative” relative to the +6 in the last 12 months. So, we seem to be assuming pricing can and will stay high (I think probably true) but that absorption can also stay higher than normal (I doubt it).

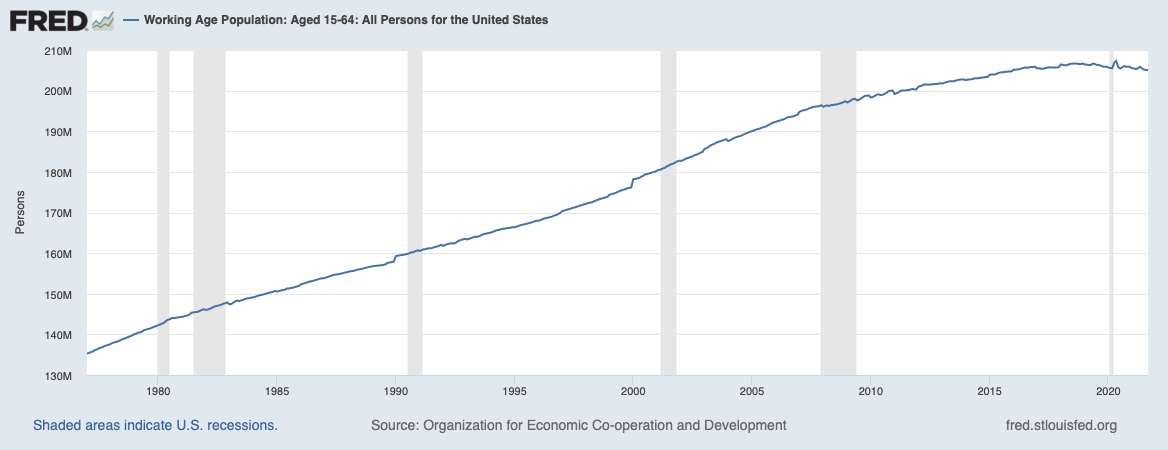

On the positive side of the ledger, rates are low, savings are great and Millennials are buying. But from an overall demographic perspective, immigration is low, birth rates are low and population growth is anemic. And the number of prime working age people is going nowhere, which is unprecedented.

I get it. Homes have been flying off the shelves and inventory needs to be replaced. Builders and developers are a hamster on a wheel. It’s hard to argue there is not a shortage (but don’t confuse your personal shortage with a market shortage) when things sell that fast. But price equilibrates. So, to assume things stay great is to assume we will equilibrate at an even higher level.

If the low-end estimates for demand are correct, it’s a lot less demand than is assumed in the business plans of most of the industry. I think it’s a bit more, as the lowest numbers have been calculated on a national basis which is “net,” while the “gross” would be a higher. You can’t move existing houses from places with out-migration to places with in-migration. But I’m in agreement it’s nowhere close to the bullish projections. And the intersection of way more money than good opportunities usually does not end well.

That does not mean there are no good markets or good deals to do. And when I discuss this with builders and developers what I almost always hear is “it’s way too competitive out there, but I’ve found a couple things that make sense.” Maybe, of course that’s what others are saying too. And it’s pretty hard to be successful when those around you are not.

I have no crystal ball (it shattered in March of 2020). And every market is different. But it’s well to remember just because you believe you are being prudent, that does not mean others are, and it will be critical to keep an eye the future pipeline in your area. If you are in a position that being right about pricing but wrong about absorption is disappointing but not tragic, it will probably be fine. If you need to be right about absorption, you should be nervous.

Excess money has a way of making things happen you did not expect.

Join the conversation

MORE IN Capital

Timing Demand: Why Investors Choose To Buy Apartments Vs. Building

A construction slowdown today is setting up an undersupply tomorrow. Opportunistic, patient investors are already pivoting to seize future market growth catalysts.

Little Deal ... Big, Timely Product Pivot: Lokal’s Capital Play

A $12M facility fuels Lokal Homes’ swift shift into higher-margin homes and a smarter land strategy in a tough market.

Land, Capital, And Control — A New Playbook In Homebuilding

Five Point Holdings’ acquisition of a controlling stake in Hearthstone points to the direction of homebuilding strategy: toward lighter land positions, more agile capital flows, and a far more disciplined focus on vertical construction, consumer targeting, and time-to-market velocity.