Leadership

Builder CEOs: Demand Attests To New Homes As Buyer Safe Havens

Here's a baker's dozen — verbatim — homebuilding enterprise C-level strategists forecasting demand in light of some of the market's quickly moving challenges.

Seeing is believing.

It's hard to believe what you don't see. It's even harder to believe in a scenario for, say, tomorrow that contradicts not only what is happening today, but also directly contradicts what's more than likely to happen if conditions got somewhat worse. Believing in the opposite of what you see going on everyday would be illogical.

A belief system is a construct to interpret everyday reality. Here's a case in point for what homebuilding company strategists are seeing, right up through this week – the end of the first month of calendar second quarter of 2022 – and the conviction that adding up all the negatives in play, their plans for growth in 2022 are on pace to weather the storms:

- There are immediate takers for virtually every new home builders can offer for sale, even when prices on those homes have been raised within the past couple of weeks, and even when interest rate increases have added $500 or more to monthly payments

- For backup, just in case current contracts fall prey to either financing snags or cold feet, there are strong indicators that for each one of those immediate takers, reinforcement buyers – one-, two-, three-deep or more – wait in the wings for their shot at one of the few new offerings due in the next six, or eight, or 10 months time.

Further, what those homebuilder strategists see – and believe based on the buying behavior they're witnessing – is that it's precisely the headwinds, the turbulence, and the rapidly shifting economic, social, geopolitical, business, health, and technological forces that add up in ways that solidify, even elevate the intrinsic and growing value of every new home they can bring to the market.

Those negatives, they assert, are at the end of the day drivers of sales as those with wherewithal trigger – on a household basis – their personalized flight to safety.

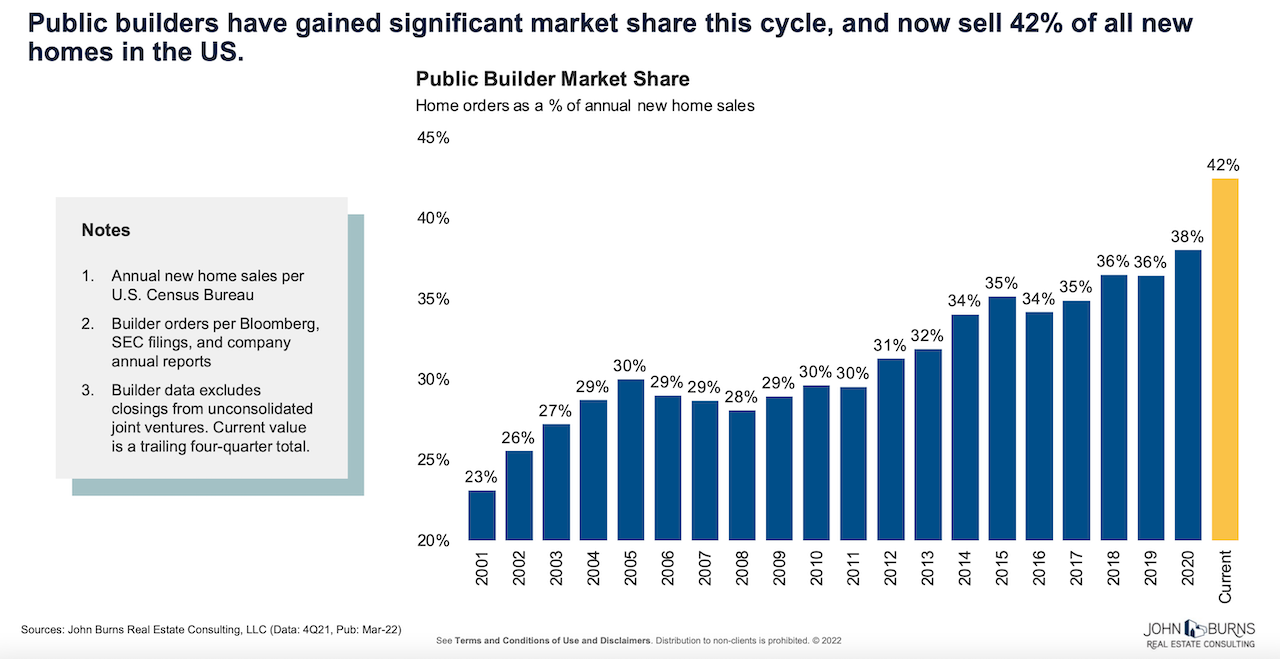

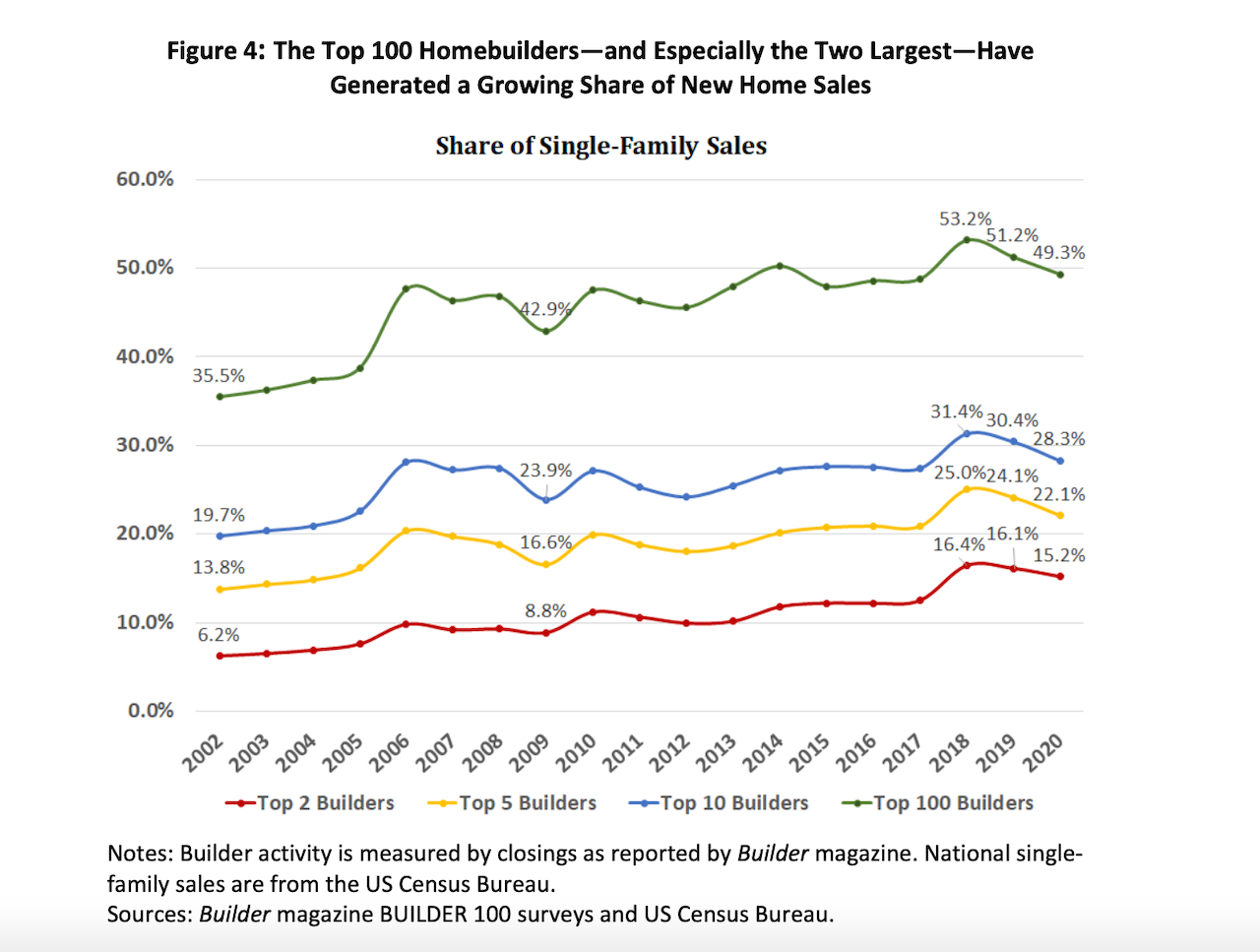

That's what comes through clearest in the verbatim commentary from CEOs of America's public homebuilding enterprises, a group that collectively accounts for more than two of every five new homes, and a blue-chip subgroup of the top 100 homebuilders – whose share of new home activity is now upwards of 50% annually.

All this by way of saying that all of the knowns and the known unknowns hammering away at the macro economic and financial investment c0mplex right now convince the people in the best position to recognize whether or not their market is being derailed that – instead – it's anything but.

Rather, each and everyone of them interprets an everyday reality made of a foundational rule that more people forming families is more demand, and fewer places for those families to live is less supply. That much – given the heft of the Millennial adult cohort and given the lack of new home production for the past decade – can not be logically disputed.

Beyond that, these strategists, based on a belief system that the Animal Spirits sluice gate that opened as 2020 got underway, and then resumed after a very brief convulsive stall in February and March of that year, has taken on a life of its own. What's more, the animus fueling that wave only gains momentum as forces like inflation and interest rates signal a Fear of Missing Out urgency to act.

So, let's mark now as a moment to chronicle, to concretize in a moment of time we may one day look back at as an inflection the belief system of the senior strategists, the C-Suite, of enterprises who have as big a stake in not only believing that they see but being prepared and resilient for what they don't as part of securing the best outcomes for stakeholders in their ventures.

Here, verbatim from transcripts of the latest batch of quarterly earnings calls with investment analysts are how each of the top strategists at each company characterizes what he or she sees and what he or she believes about buyer demand. We'll start back in early March of this year, when Hovnanian Enterprises chairman, president and ceo Ara Hovnanian spoke to fiscal Q1 earnings, and flow through to this past week's cohort of public company commentary.

Call this, "keyword demand" in the late-pandemic, early Ukraine War period.

March 1:

Ara Hovnanian, chairman, president, ceo of Hovnanian Enterprises, Q1, 2022:

Over the 60-plus years that we've been building homes, we've observed in numerous rising mortgage rate environments, rates certainly impact how large of a mortgage consumers can afford. But time after time, we've seen homebuyers adjust their expectations for how much they can afford to buy. When mortgage rates increase, consumers typically will either buy a smaller home or choose fewer options and upgrades. To-date, we have not seen much evidence of our customers taking those steps.

March 2:

Jim Brickman, CEO, Green Brick Partners, Inc., Q4, 2021

It's a tough time actually to be a consumer. We don't really see that shifting at all. So demand is very, very robust and we don't see it being anything but strong ... yes, house prices have gone up, but wages have also significantly risen in our markets and in a typical rising interest rate market, we would typically see the buyers looking for smaller square footage homes and basically trying to keep their payment the same. We are not seeing that at all right now. We're seeing buyers want bigger homes.

March 10:

John Ho, CEO, interim CFO and director, Landsea Homes Corp., Q4 2021

On the demand front, we continue to see a deep pool of motivated buyers in our markets, thanks to the ongoing housing supply shortage, but also as a result of favorable demographics, rising incomes in migration from other high cost areas in a cultural shift in attitudes towards homeownership brought about by the pandemic. We believe these demand drivers will be in place for some time and will provide a tailwind for our industry for years to come. We also believe Landsea is well-positioned to deliver growth in excess of the overall industry's rate, thanks to the positive fundamentals and the markets in which we build our entry-level focus and appeal of our high-performance homes.

March 17

Stuart Miller, executive chairman, Lennar Corp., Q1 2022

Demand trends remain strong, as family formation continues to rise. As our team from around the country reviewed our weekly sales starts and closings on Monday for our regions and our divisions, the unanimous view was that our sales pace range in each market from strong to very strong.

Buyers are seeking shelter and they are seeking shelter from inflationary pressures as scarce rentals see rents escalating and escalating housing costs can be controlled with an owned home with a fixed rate mortgage, while wages are going up, so too our housing costs. So with employment strong and home prices rising, it is best to fix these costs.

Additionally, the home is ever more the control center or hub of our customers' lives and frankly, geopolitical stress makes the security of home all that much more comforting.

March 23

Jeff Kaminski, evp and cfo, KB Home, Q1, 2022

Our biggest challenge today is completing homes, not selling them, as demand continues to be robust. Favorable demographics provide an important tailwind as the largest subset of millennials is nearing the peak age for first-time homeownership and the oldest of the Gen Zs are entering their home-buying years. In addition to demographics, employment and wage growth have both continued to improve, and the shift to working from home is another factor supporting demand.

April 21

Doug Bauer, ceo Tri Pointe Homes, Q1, 2022

Demand continues to remain robust and all of our markets in the first quarter, even as mortgage rates have moved materially higher. The homebuyers in our backlog are well qualified and are pre-qualified through our mortgage affiliate prior to purchasing a home. They have an average debt to income ratio of 39% and an average FICO score of 749. An average loan to value of 82%, and average annual household income of $189,000.

The majority of our homebuyers are millennials, and this cohort continues to be a strong source of demand for the industry, driven by needs based life changing events such as marriage, a growing family or a job relocation. This sizable population of buyers is in the prime home buying phase of their lives, and the homebuilding industry stands to benefit from their participation in the markets for years to come.

Demand has also been fueled by what we believe will be the long-lasting transformation of homebuyer preferences and needs brought about by the pandemic. Whether it's born out of a desire for more living space, the ability to work-from-home, or a need to feel more in control of one's living conditions, the pandemic has created a heightened desire for homeownership in our country.

April 26

David Auld, president & ceo, D.R. Horton, Q2 2022

The [interest] rate increase is -- it's eliminating some people from the home buy experience. But we still have more people qualify buyers trying to buy homes than we can produce today. One of the things that has impressed me, back in 2018, when you saw a rapid rise in rates, demand was significantly reduced. And then after the rate shock to -- after the rate shock was mitigated, we saw demand come back and come back strong.

But through this cycle, which is in even more rapid rate increases, yes, we've had people that don't qualify anymore, but the demand side is still very strong. So just the desire to own homes, and it may be the fact that prices have escalated very fast and rents are escalating even faster than the price of new homes and all the talk about inflation and then locking in your housing costs for 20 years. I mean, it is -- home ownership is a cherished thing today. And the people coming out of the -- millennials coming out or even individuals relocating from other markets to where the growth is taking place. Its just they want to own a home, they want to lock in their housing cost, and they want to get in the neighborhoods that they can raise families in.

April 27

Sheryl Palmer, chairman and ceo, Taylor Morrison Homes, Q1 2022

I would like to share a few notable takeaways from our consumer surveys, which included feedback from over 1,500 home shoppers in the first quarter. First, in response to how higher mortgage rates would impact their home surge, only a single-digit percentage of all respond and said they would stop their search if affordability became a constraint, instead opting to modify their plans either by reducing their down payment or slowing down their search. This is quite different from what surveys indicated as rates increased in 2018, when shoppers were twice as likely to say they would stop their home search at that time, suggesting current demand is much more determined to move ahead.

Slicing the data by location, shoppers looking in core markets are 2x more likely to continue their search than shoppers in new emerging markets who indicate they would stop their search, reinforcing our concentration on prime land positions with proximity to employment, schools and amenities. In fact, only 10% of our communities would be considered emerging markets according to our internal rating system.

The feedback also reveals different levels of resiliency among consumer groups and income levels. For example, more than half of shoppers in our active lifestyle communities indicated that higher rates would have no impact on their home search as compared to just over a quarter of all other home shoppers. Given their lower rate sensitivity and the above average gross margin and revenue we generate in this segment, our active lifestyle business, which accounts for about a quarter of our total sales, is an important and attractive element of our portfolio strategy.

April 27

Robert Schottenstein, ceo and president, M/I Homes, Q1 2022

Demand for housing continues to be very robust. Although mortgage rates have increased considerably since the beginning of the year, demand for new homes across our markets remain strong. Many of the reasons behind the strong demand are well documented, including historically low inventory levels and an ever-increasing number of millennials moving to homeownership.

Moreover, the quality of our buyers continues to be very strong with average credit scores of 747 and average down payments above 16%. Basically, the quality of buyers that we're seeing in terms of creditworthiness is the best we've ever seen.

April 27

Dale Francescon, chairman and co-ceo, Century Communities, Q1, 2022

We've really seen no pushback on pricing as we said in our prepared remarks, each month during the quarter, the sales actually increased. And throughout the quarter, we continue to raise pricing and we have not seen any pushback from that. Now at some point, that's going to stop. Also, as we said in the prepared remarks, what we really believe is that as the interest rates continue to increase that, that's going to impact our ability to raise prices. At some point, as the year progresses, we expect to see incentives come back into the market. But at this point, everything remains very positive.

April 28

Ryan Marshall, president & ceo, PulteGroup, Q1, 2022

On the demand side, consumer interest in purchasing a new home remained high throughout the quarter. With few exceptions, demand was strong across all the price points, buyer groups and markets that we serve.

The U.S. housing market continues to benefit from favorable demographics, a strong economy, an outstanding job market and a rising wage environment. New home sales are also benefiting from ongoing and significant increases in rental rates for single and multifamily dwellings.

According to John Burns Real Estate Consulting, their numbers indicate that rental prices for single-family homes increased by upwards of 5% in 2021, while multifamily lease rates were up by approximately 13% over the prior year. Forecast point to further increases in 2022.

Even with today’s higher prices and rising rates, owning a home can still make clear economic sense for many consumers. Not only can homebuyers get a comparable or even lower monthly payment, but that payment is more stable over time.

April 28

Larry Mizel, executive chairman, M.D.C. Holdings, Q1 2022

As we sold an average of 5.4 homes per community per month in the quarter, demand was broad based from both a geographic and pricing standpoint with the millennial age buyer continue to being the driving force behind our sales success. This large population of buyers has reached a prime phase in their lives when home ownership became a much higher priority, whether due to changing family dynamics, a chance to build equity or the desire to put down roots. Another driving factor that we have witnessed in our markets is the ongoing migration from high to low cost areas by both companies and individuals.

Factors, including taxes, affordability and overall quality of life are weighing more heavily into where business operates while the emergence of online and remote work capabilities have given employees more freedom to live and work from where they choose. At MDC, we have positioned our company to take advantage of these trends by investing in the markets that are benefiting from this migration and by opening communities that appeal to millennials with innovative homes at more affordable prices. We believe that the demand forces we see today are long-term in nature and will continue to support the new home markets for the foreseeable future.

After years of historically low mortgage rates, buyers are now being faced with higher financing costs for their perspective home purchase as the average rate on 30 year fixed rate mortgage has moved approximately 200 basis points since the beginning of the year. While current mortgage rates are still attractive from the long-term historic perspective, it is natural to expect that this move higher may have a near-term impact in our business as buyers adjust to this new reality.

April 28

Allan Merrill, chairman, president & ceo, Beazer Homes, Q2 2022

Any discussion of the industry's longer term outlook should start with the demographics of demand and the practical realities on the supply side. In the interest of time, we've summarized it in two charts: first, there continues to be a structural gap between the demand for housing and the total supply of housing. The age and ownership preferences of the demographics are compelling, but there is no practical way for the supply of lots, labor or materials to meaningfully reduce this gap in the next several years.

Second, the level of unsold inventory of both new and used homes is at historically low levels. In fact, there is only a quarter of the unsold inventory that existed in 2006, which helps explain the strength in the current pricing environment even as rates have risen. The other macro factor that bears watching is the mortgage market and more specifically the risk of foreclosures, defaults or the removal of liquidity that could disrupt the housing market.

The news on this front is pretty good, because the mortgage market is in a very healthy place. The credit quality of the loan book is high, loan-to-value ratios are near historical lows, and importantly there are almost no adjustable-rate loans with looming pricing resets. So considering demand, supply and the mortgage market, we think the multiyear context for new home activity, it's pretty positive.

There you have it, a baker's dozen of a sampling of the homebuilding industry's highest-level leaders, confident to a person in saying that for every new home in every new community that their organizations can put up for sale this year, qualified, ready, willing, and able buyers are securely in hand amidst a host of uncertainties and known headwinds.

Seeing will be believing.

Join the conversation

MORE IN Leadership

Westwood-Hippo Deal Raises Stakes On Home Insurance Trust

A landmark deal expands embedded insurance capabilities, aiming to ease closings, manage climate risk, and restore buyer trust.

From Afterthought to Dealbreaker: Why Home Insurance is Now Key to Sales

By working with the right insurance expert, builders gain short- and long-term advantages in keeping current deals on track and making sure their business thrives into the future.

How Outlier Homebuilders Build An Edge, Even In a Slow Market

Focus On Excellence 2025 reveals what top homebuilding leaders are doing now to separate—and stay ahead—for 2026-through-2030 and beyond.