Capital

Bubble Rap: It's Not What's Next That Matters Now; It's Who Can And Can't

Who's right about which prediction is exactly the focus area strategists would do well to dispel from their priority agendas right now. Instead of focusing on a bubble, redouble commitment instead to becoming listeners, learners, understanders of what customers feel, think, fear and do.

The issue now, for residential builders, developers, investors and partners, is not "who's right about what's coming next?"

Price tolerances -- at least in some markets and submarkets -- have peaked. Uncle Sam's firm helping hand on the mortgage interest front may even have stretched that elasticity too far.

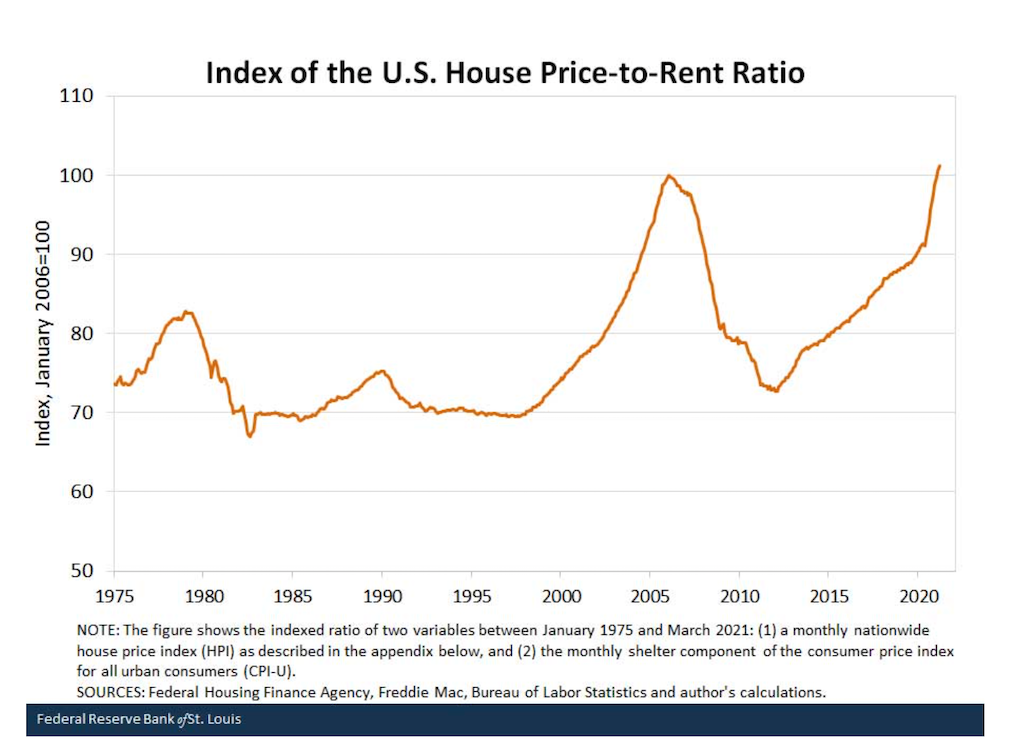

St. Louis Fed economist William R. Emmons notes, "House Prices Surpass Housing-Bubble Peak on One Key Measure of Value."

Here, CNBC's Jeff Cox reports that Dallas Federal Reserve president Robert Kaplan's vibrating as well about an overheated housing market, telling CNBC that "the $120 billion a month in asset purchases may be having 'unintended consequences.'”

"At this stage as opposed to a year ago, these mortgage purchases for example might be having some unintended consequences and side effects, which I think we need to weight against the efficacy,” he said during a live “Closing Bell” discussion. “So, I think some restraint and moderation as we move toward weathering this pandemic, I think, would be useful in mitigating some of these excesses and imbalances.”

Who's right about which prediction is exactly the focus area strategists would do well to dispel from their priority agendas right now. Instead of focusing on a bubble, redouble commitment instead to becoming listeners, learners, understanders of what customers feel, think, fear, gravitate toward, and, ultimately, do.

Here's how housing analyst and advisor John Burns focuses a lens of clarity on price elasticity, expectations, and cyclical risk:

NOT TRUE: Home prices cannot fall because supply is low. This is a very dangerous conclusion I am seeing far too often. Demand needs to stay strong. Affordability needs to be maintained. If either erodes, the number of homes available for sale could quickly skyrocket.

TRUE: We have an affordability problem for a rising number of people who are unwilling or unable to relocate.

NOT TRUE: We have an affordability problem for people who can relocate to an affordable area where they will also be happy. It is actually possible for many urban renters to become homeowners in more affordable areas and see their monthly housing costs decline.

The critical consumer insight, research, and analysis job for developers, investors, and builders, right now, has to do with a great rotation -- or not -- of people who can and will pick up and move for the blend of livelihood and lifestyle.

And who can't.

Who can't move is equally important for people in housing to learn now, as housing opportunity includes fewer people, and eludes more.