Capital

Can A Bubble Boil With All The Toil But Not The Trouble?

Soft-landing scenarios ... we've heard them before. Here's ways leaders can control where their firms wind up coming out of price-shock bottlenecks in the months ahead.

A summer of hustle, a summer of patience, the Summer of 2021 may bring all things to those who can wait ... except those things somebody else beats them to or can outspend the rest.

Waiting and using Ninja skills to encourage patience up and down the demand chain, may be the season's most effective hustle of all, for it can amount to trust.

Inflation – as real as it is – may still work out to be a bottleneck blip in the scheme of things, with price spools upward due to government largesse. But, still, the thinking goes, they'll concede to gravity once more of the economy's normal switches and levers are fully engaged.

Lumber executive sees further relief in sky-high prices, says delaying building projects makes sense

Lumber industry veteran Kyle Little told CNBC on Tuesday that it’s a sensible decision to hold off on beginning discretionary building projects due to high wood costs.

“The jobs that you have coming up, don’t expect us to go back to what we saw the previous 10 years. That being said, if you can wait, there’s no reason not to,” the chief operating officer at Sherwood Lumber said on “The Exchange.”

“We do see some relief over the next six to 12 months, still albeit at prices that are much, much higher than prices we’ve experienced in the recent past,” added Little, who’s spent more than a decade at Sherwood Lumber, a privately held New York-based wholesale distributor. He’s also a former lumber trader.

Of all challenges to have to battle, marketrate homebuilders and residential developers and the complex of livelihoods and value streams that interweave in their building lifecycle face ones they'd rather have versus ones they'd dread.

- Surging demand

- Low Supply – ahem, by as many as 4.35 million houses by 2022

- An increasingly testy and tenuous relationship with would-be buyers' ability to pay

Credit Uncle Sam for an above-the-title marquee role in the first two of those favorable forces – which is not to say that demographics and underbuilding for a decade don't share star billing.

Still, assuming that banner-year demand was more than a likelihood even before the onset of the novel coronavirus pandemic early in 2020, the Federal government's trillions of dollars of bounty – both in stimulus and in declaration that homebuilding and multifamily development were essential businesses – stoked the engines of demand as imaginations, aspirations and trepidations bounced around within the four walls of many a household.

A pulled-forward cohort of You-Only-Live-Oncers and Fear-Of-Missing-Outers coalesced with the pent-up cohort of empty nesters, which in turn converged with a swelling cohort of biological clock, and voila!

Collective conscious, Animal Spirits, what have you, flicked the switch, practically overnight – and most likely within the span of five horrifically frightening days and nights of lockdown in April of 2020 – it became a good idea to live in a new single-family home with a yard, room for flexible full-time live-work-learn-sleep-play-rinse-repeat, and a semi-well-stocked supermarket nearby.

That was then.

Now roaring and frothy house prices, which have been busy decoupling with many would-be prospects' household wherewithal, are hitting a point where sheer thrust meets gravity-free drift.

And, just as good old Uncle Sam might get a grateful hat tip from the residential real estate and construction business sector for the role in demand fever, an at least equal measure of thanks may be in order for how stingy supply levels currently stand.

That much-cursed "credit box," which so constrained who mortgage lenders could qualify over the past decade or more coming out of the housing and financial meltdown of 2007 and 2008, now surfaces as an enormous risk delimiter looking forward.

Speaking to whether today's housing price bubble means '07-style trouble in the offing – a contagion of delinquencies, defaults, foreclosures that could spiral into broken land deals and deflation – Bloomberg staffer Peter Coy writes:

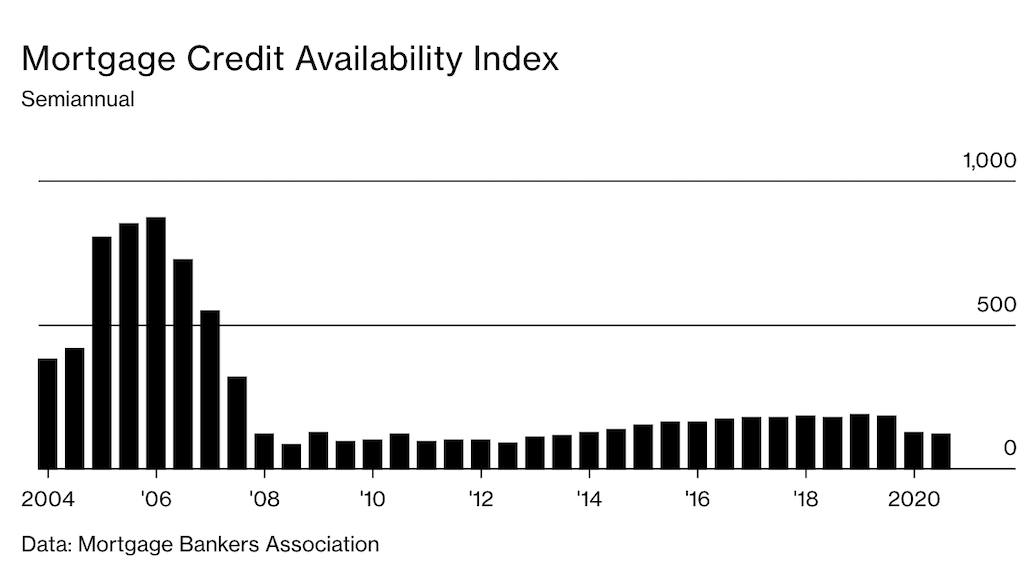

There’s one very big difference between then and now, though: Mortgage loans are much harder to get. An index of mortgage credit availability reached almost 870 in June 2006. This March it was just 125. Lenders have raised lending standards even beyond the requirements of the Dodd-Frank Act of 2010, which was passed in response to the financial crisis. Loans are smaller in proportion to house values and borrowers’ income. Borrowers’ average credit scores are higher. And you can’t bluff your way into homeownership with a no-doc or low-doc loan—i.e., one that allows you to attest to your creditworthiness without providing full documentation.

Coy goes on in his "housing-is-bubbly-and-frothy-but-don't-worry" piece to say that underbuilding, skyrocketing input costs, and a growing group of failed-bid house hunters may cool, but not totally undercut the market.

If house prices flattened or fell, some shoppers would undoubtedly hold off to see if they could get a better deal, exacerbating the downturn. On the other hand, conservative mortgage underwriting limits the risk of cascading defaults. Houses are expensive, all right, but this doesn’t look like a dangerous bubble.

This "soft landing" scenario may feel like a bad-trip flashback to those of us more prone to worry.

Still, the logic makes sense, and its implications for strategists focused on opportunity and solutions at a time most peers are preoccupied with the relative impacts of producer price inflation's toll may frame out as follow:

- Time's value is underappreciated today ... builders and developers who can cultivate and manage time-released relationships with buyers that – via education, customer nurturance, credit management programs, and holistic customer financial journey-mapping – protract the buying and ownership process through the "bottleneck blip" of the next 6 to 12 months will emerge as market gainers.

- Innovators who succeed in ratcheting down the cost of assembling land, materials, people-power, and financing expense in any way that can re-ignite starter homes will also emerge out of the current fracas as winners. For example, if Phoenix, AZ-based Mosaic's ability to increase "throughput in the construction process for its partners by as much as 30%" can drive that 30% gain into savings on asking prices, a market-expansion like no other would be imaginable.

- Trust takes time to earn and care to keep. It's one of the fuzziest of business pillars, and perhaps one of the most consequential. The Summer of 2021, moving ahead into the rest of the 2020s, could be a brightline, turning point moment with respect to trust.

Harvard Business Review contributor Ron Carucci, co-founder and managing partner at Navalent, dispenses with all corporatese as he sums up an argument to commit focus on matters other than price inflation right now:

There is no currency in organizational life more valuable than trustworthiness. We can no longer presume we have it just because we believe we haven’t done anything to breach it. In times of unprecedented uncertainty, it’s critical to earn and keep the trust of others every day. If you hope to enjoy a career of great influence and impact, start by cultivating a trustworthy reputation. Remember, somewhere in your organization, a colleague is sharing a story about their experience of you at their dinner table. What story do you hope they’re telling?

Join the conversation

There are 3 poll questions below. Please click through to each one, and of course, leave us one of your great comments at the end, and tell us who you are: