Leadership

What Is Affordable? Do Market Rate Builders Need To Know?

Monthly payment power equates to how builders measure their ability to build and deliver affordably. Interest rates are the biggest stressor to this benchmark in the near future.

Could there be a more polarizing term in housing?

Affordable.

This term, it's said, originated in Old English:

geforðian "to put forth, contribute; further, advance; carry out, accomplish,"

It evolved into an expression we now know, "be able to bear the expense of, have enough money" to do something, in the 1300s.

What we know today is that it's a struggle to get people in housing's business community – as many as there are in a single room or around a table – to engage in the same conversation when the topic is "affordable."

Almost always, two separate conversations occur.

One, common to people who build market-rate for-sale homes these days, applies the expression to building affordably for the home-buyer universe, a household capable of bearing the expense of a $400,000 consumer durable.

Another, the societal framework for use of the word, applies to all adult households' access to shelter within their means.

Now household access to fair, decent, healthy housing is the affordability many have in mind when they attach that term to housing.

The opportunity for a working household to attain homeownership, and whether private sector construction and real estate firms can keep that opportunity open – and possibly grow it – is a whole other ball of wax.

Underlying both uses of the term, mind you, lies a similar challenge.

Who can and will pay?

A schizophrenic, sometimes divisive chasm separates the two entirely distinct senses of the word, sometimes differentiated by flipping the order – subsidized "affordable housing" versus market-rate "housing affordability."

That chasm accounts directly for profound differences in the measures of America's housing deficit, benchmarks of financial opportunity based on fundamental demand. The undersupply, depending on who you believe, ranges on the extremes of 5.5 million homes, to 3.8 million homes, to 2 million, to 1 million or so, all the way to a contrarian perspective that the U.S. may actually be overbuilt right now versus structural demand and where dirt cheap mortgage rates have fueled it.

Going back to the origin and meaning of affordability, monthly payment power – for a growing number of working households – is falling short of the ability to bear the expense of homeownership.

This piece this week sums it up this way.

Supercharged home prices in markets across the country are canceling out the impact of modestly higher incomes and historically low interest rates, two factors that typically make owning a home more affordable. Prices rose at a record pace for the fourth consecutive month in July, driven by a shortage of houses for sale. Higher prices require buyers to take out larger loans, essentially signing them up to make larger mortgage payments each month for years.

The Wall Street Journal article above is based on a new analysis from the Federal Reserve Bank of Atlanta, whose sobering headline reads:

Median-Income Buyers Priced Out

The key bullet points of the Altanta Fed analysis are these:

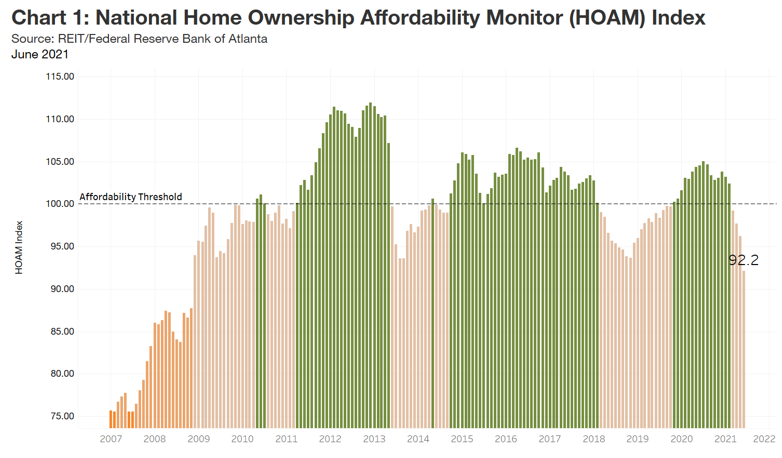

- The national HOAM index stood at 92.2 in June, its lowest level since 2008.

- National housing affordability fell 11.9 percent in June, the sharpest drop since 2014.

- Home sale prices were up 23.8 percent over the past year.

- On average, a median-income household would need to spend 32.6 percent of its annual earnings to own a median-priced home.

- Although demand for housing remains strong, steadily declining affordability is beginning to affect buying decisions.

Here's what that chart looks like:

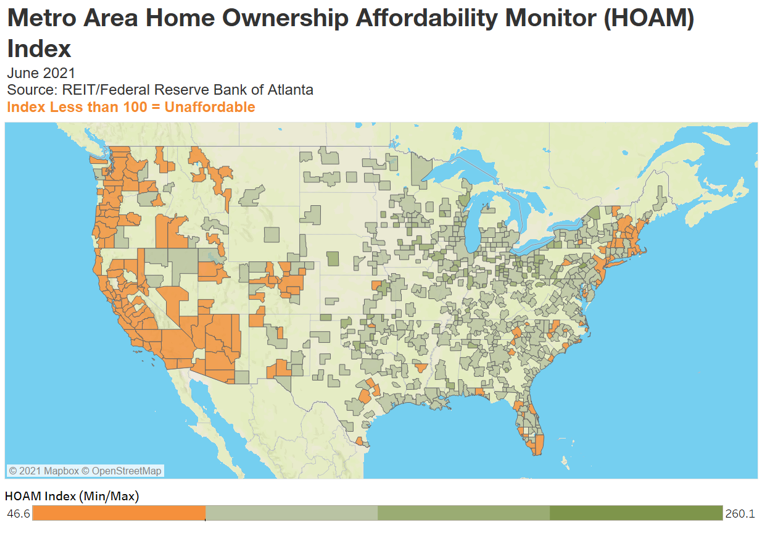

Geographically, this macro trend looked like this as of June 2021.

Make no mistake, for homebuilders, this is the affordability that matters, the monthly payment power that empowers a household to "bear the expense" of owning a home, and thereby, participating in a merit-based American Dream of homeownership.

This is the "affordable" that's meaningful and matters to market-rate builders. And it's taking a beating on both the input cost front, and on the recent pressure on interest rates. So, stay tuned as to what happens to demand.

Join the conversation

MORE IN Leadership

Westwood-Hippo Deal Raises Stakes On Home Insurance Trust

A landmark deal expands embedded insurance capabilities, aiming to ease closings, manage climate risk, and restore buyer trust.

From Afterthought to Dealbreaker: Why Home Insurance is Now Key to Sales

By working with the right insurance expert, builders gain short- and long-term advantages in keeping current deals on track and making sure their business thrives into the future.

How Outlier Homebuilders Build An Edge, Even In a Slow Market

Focus On Excellence 2025 reveals what top homebuilding leaders are doing now to separate—and stay ahead—for 2026-through-2030 and beyond.