Land

What If? Land Impairments Were Unimaginable. Now They're Likely

"We currently do not believe the impairment process this time around will be as destructive as the last cycle in total, but acknowledge there are varying degrees of gray." — Truman Patterson, Wolfe Research

Like it or not, the axis is unambiguous although the progression is far from inevitable: Jobs, household wherewithal, sales volume, prices, broken deals, distress.

Repeatedly, early last year, when we began asking about the likelihood of land impairments hitting homebuilders' books and business as we played out the impacts of a Federal Reserve looking to eradicate inflation, we were told, "no, it won't come to that."

Now, with Selling Season in the front windshield, a big question mark suggests a different response.

Appreciating meaningful sales declines, accelerating homebuilder incentives/ discounts and outright price reductions starting in 2H22, a central focus of ours in the homebuilding sector is whether Impairments are a clear and present danger to future Book Value and homebuilder profitability. Obviously, the Great Housing Recession Impairment experience only serves to amplify our sensitivity, and rightly so, to this controversy as the public homebuilders from 2006 through 2011 wrote- off ~$32B of land pre-tax (65% of ’05 land inventory), or a combined after-tax 61% of 2005’s Book Value at the onset of the downturn. Moreover, the carnage was widespread with individual builder write-downs ranging from 36% to 99% of 2005 equity." – Truman Patterson, CFA, Wolfe Research

The Pandemic Wake cycle – economic, business, investment, housing – enters yet another test of intestinal fortitude in the next three-to-nine months as what's "perfectly obvious" contests and contrasts sharply with what's "common sense."

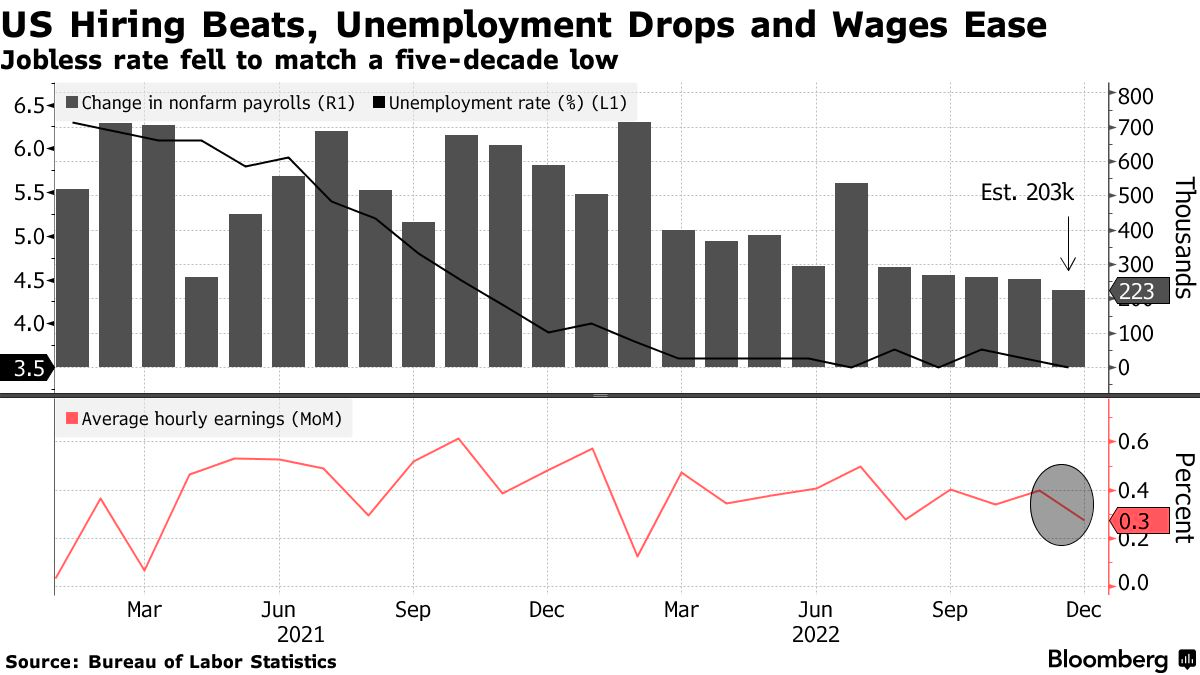

Today's release of a December 2022 employment report from the Bureau of Labor Statistics whose headline numbers – 223,000 new payroll jobs created, and an unemployment decline to 3.5% – comes as the latest mixed-signal proof.

In one fell swoop, it's a "strong report of labor demand," a "positive sign of cooling household income growth," a "sign of weakening jobs and economic growth," etc. It both beat consensus expectations on overall hiring, labor participation, and unemployment, and calmed jitters about wage inflation and its impact on the Federal Reserve's hawkish course of action to snuff it.

Today's snap-shot BLS employment situation release has something for everybody, essentially setting up as a classic instance of the "blind men and the elephant" parable. For every data benchmark and its surface-level interpretation, a "yes, but ...' array of inverse implications surface and with varying levels of validity.

What the report – taken in isolation – obscures is a full appreciation of both the now-sustained [4 months in a row] and accelerating rate of growth decline, and the disproportionate impact of jobs dislocation now going on at an alarming clip among earners essential to homebuilders' near-term fates and fortunes: the professional class of high-earner households.

The glaring headlines have focused mostly on tech.

As a demand boom during the pandemic rapidly turns into bust, tech companies shed more than 150,000 workers in 2022, according to tracking site Layoffs.fyi, a number that is growing as growth in the world's biggest economies start to slow." – Reuters

Disruption in professional class jobs, incomes, income security, and, ultimately, household wherewithal has not been confined to the technology sector:

Recent rounds of layoffs at large U.S. companies mark a departure from the usual pattern as executives navigate fears of an economic slowdown: This time, white-collar workers have been among the first and hardest hit.

Demand has fallen sharply for professionals in technology, legal, scientific and finance fields, and companies that ramped up staffing during the pandemic, including tech firms, are slowing down hiring or cutting jobs as they close down some projects or scale back others. – Wall Street Journal

In an evolving, Fed-contoured-and-engineered economic slowdown, central bankers are doing their level-best to perform economic acupuncture – hitting a few areas hard, like housing and big-spending consumer households – to soften as much as possible the impacts and scope of a slowdown.

The Wall Street Journal has even coined a term to characterize who and how much harm the turbulent stretch ahead will bring.

If the economy enters a recession in 2023, or even if it manages to narrowly evade one, it might be the well-heeled who take a bigger hit than usual.

Call it the richcession.

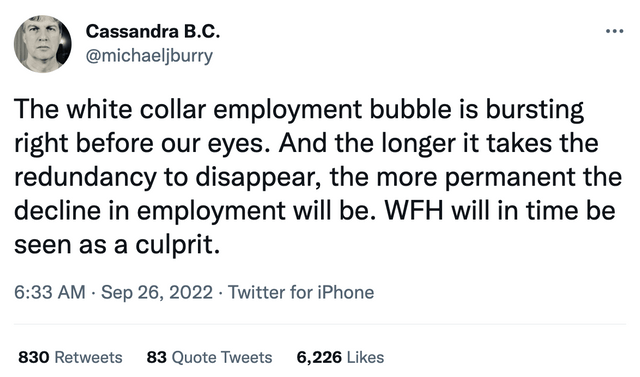

Renowned investor and hedge fund manager Michael Burry of "Big Short" fame goes even farther than that in measuring the impact of a professional class that navigated history's longest economic run-up in the wake of the GFC totally immune to its bumps and bruises:

Here is his Tweet from this past September:

Here's commentary on what Burry means in his remarks by "redundancy."

(1) Work from home. The work from home trend is threatening office jobs because it reduces the need for many traditional office roles like secretaries and receptionists. On top of that, it is also making it less appetizing for companies to hire white collar employees given that such employees are increasingly demanding the ability to work from home, which is beginning to show evidence of reducing overall productivity.

(2) Increasing automation. While increasing automation is also expected to deal a blow to blue collar jobs eventually, many of these technologies are not here yet. For example, autonomous trucks are expected to deal a death blow to the truck driving profession, but this technology is unlikely to be broadly implemented until at least the middle to late years of this decade. Furthermore, while restaurant, retail, and even factory workers are all expected to be ultimately replaced by robots that tech companies like Tesla (TSLA) are producing, this technology is even further away from being widely deployed, with some predicting these machines to not be meaningfully impactful until the end of this decade.

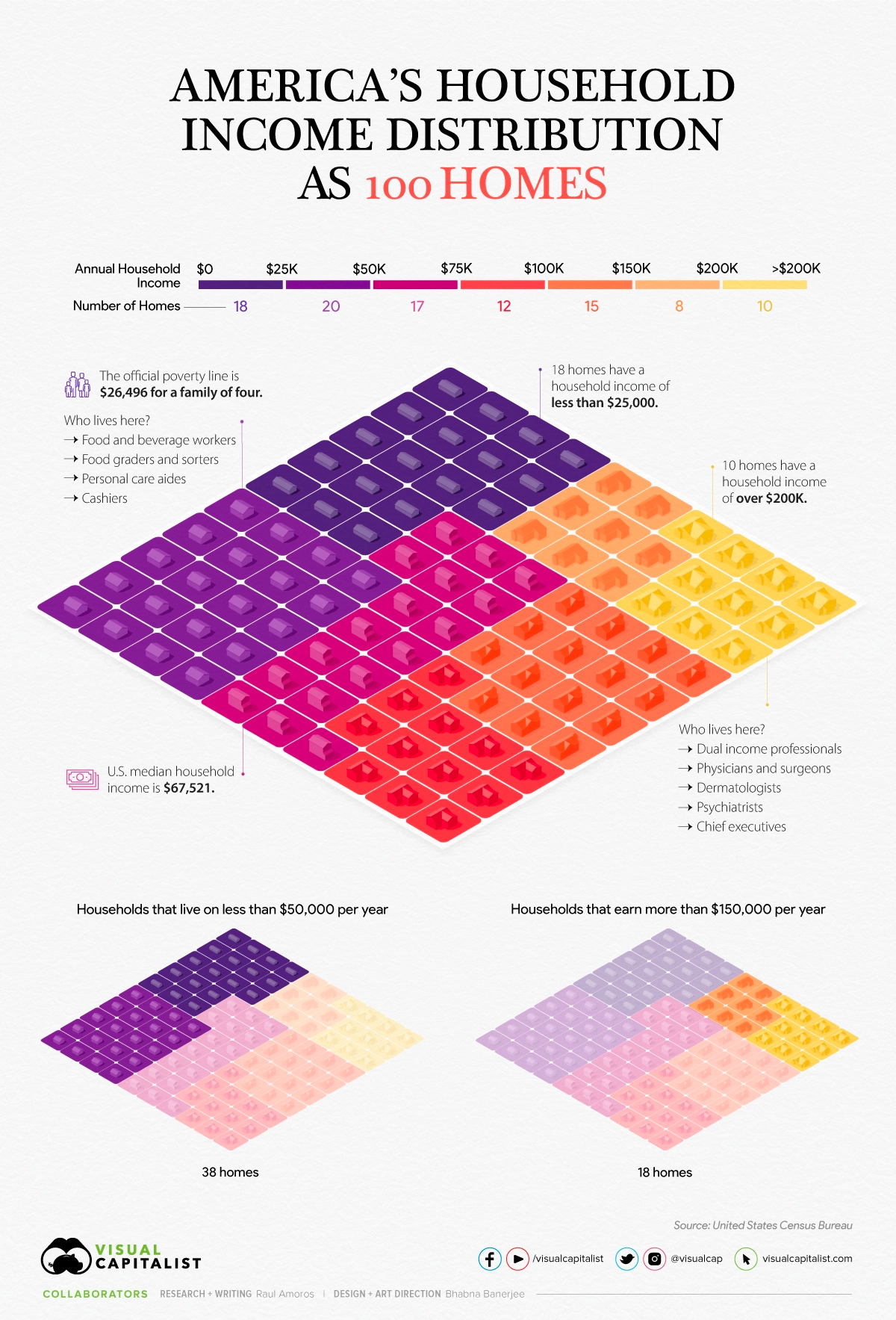

Now have a look at a fascinating visualization of America's Household Income Distribution As 100 Homes, from Visual Capitalist:

Suffice to say that as much as homebuilders' efforts to price their standing inventories of permitted, under-construction and ready-to-occupy homes to market will include "pricing-in" as many of the 44 households regarded as middle income as possible, the 18% of high income households is crucial.

If the next two to three Employment Situation reports begins to peel back statistical job and income destruction in this up-to-now cushioned professional class, a harder landing for housing – including its land value chain – becomes likely.

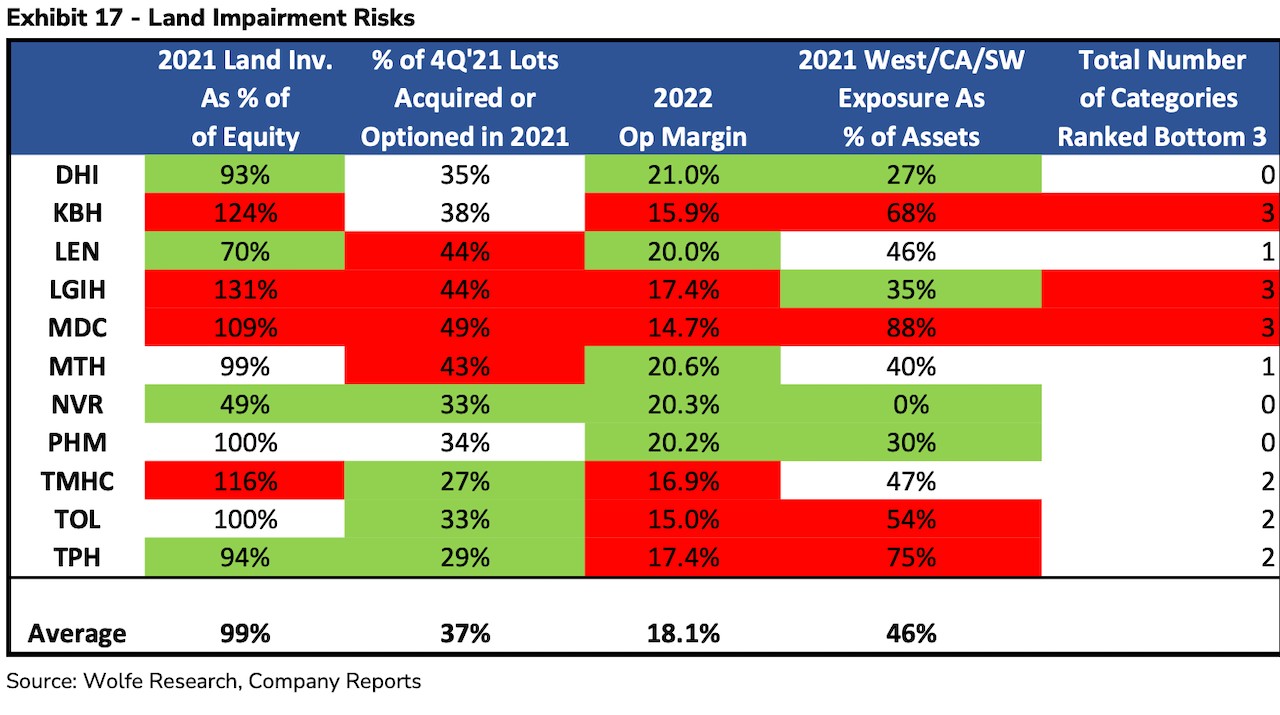

Wolfe Research's Patterson notes:

In our opinion, we currently do not believe the impairment process this time around will be as destructive as the last cycle in total, but acknowledge there are varying degrees of gray, which is the reasoning behind our 4Q05-4Q07 analysis. Clearly, there is certainly risk the housing market (pricing) continues deteriorating, in part, as economic headwinds from a potential recession have yet to reveal negative impacts."

Patterson cites four key factors as common characteristics of greater risk to impairments in the prior housing meltdown, and suggests that they still apply:

(1) elevated exposure to the West, which experienced the greatest home price contractions 2) Builders having higher Land Inventory balances as a % of Equity, or greater exposure to recourse JVs 3) Lower Operating Margins and 4) Relatively newer vintage land banks.

Here's his color-coded visualization of how that exposure looks today:

More will be revealed.

MORE IN Land

We Engineered This Housing Crisis — It Didn’t Just Happen

Metro housing policy has become a self-defeating maze. The Builder's Daily contributor Scott Cox helps us with data, wisdom, and courage to map the math, myths, and real path forward.

Lone Star Diamond In The Rough: A Case For 'Why Weatherford'

Longtime Texas residential land strategist Scott Finfer opens up his land scouting manual to explain the stark difference between speculation and data-backed, applied vision.

Little Deal ... Big, Timely Product Pivot: Lokal’s Capital Play

A $12M facility fuels Lokal Homes’ swift shift into higher-margin homes and a smarter land strategy in a tough market.