Marketing & Sales

What Happens As One-Person Households Reach Critical Mass?

Oops! They have! Almost 38 million of the U.S.’s 131 million households are one-person households. Compare that to the raw number of married-with-children-under-age-18 households: 23 million or so. That number’s falling.

One of housing’s biggest stress-tests of the 2020s will be a reality reset that trues-up household demography with, um, homes and places.

Still, the way things look now -- in terms of priority focus on generational stress-tests -- you’d hardly know it mattered.

Let’s zero in on part of this now.

Demographics is destiny. It has that truthy ring to it.

Housing and its business sector strategists live and breathe demographics, right?

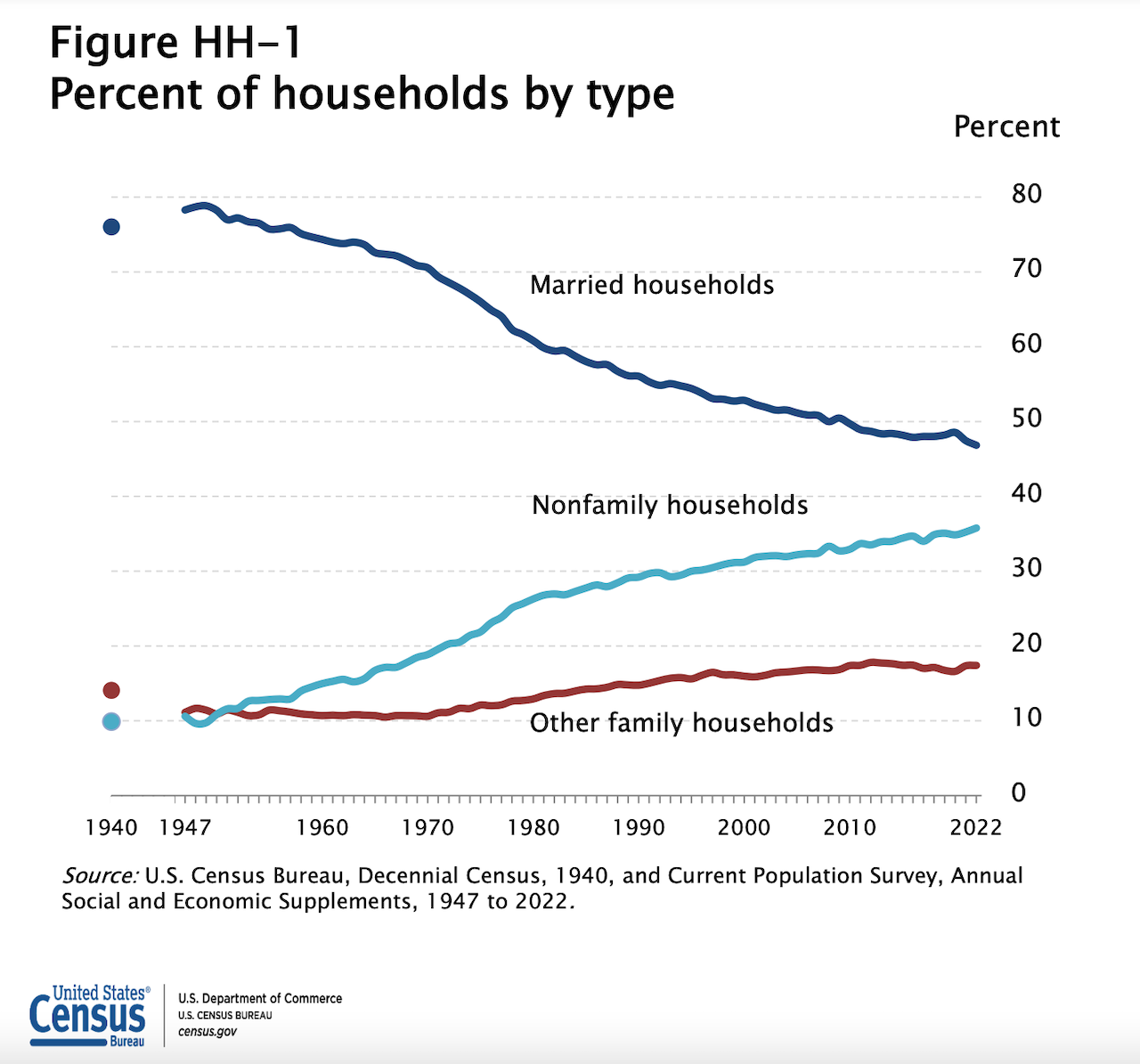

Why, one wonders, are more than half of new homes built today for married-couple-with-children-under-18 families, when they’re less than a fifth of all households? And, why are fewer than one in 10 new residences designed, developed, and built for a one-person household, which has soared to almost one of every three U.S. domiciles, and growing fast?

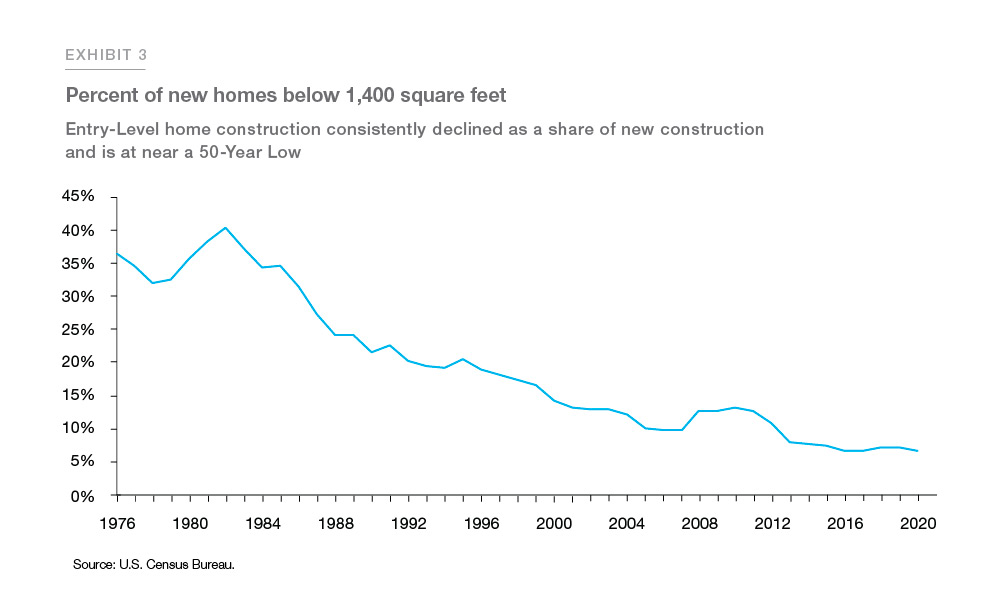

Here's a graph from Freddie Mac chief economist Sam Khater, roughly illustrating this logical break-down via the lens of homes' square footage.

If demographics is truly destiny, we’ve got a lot of people and money heading fast in exactly the wrong destination.

The disconnect, the related challenge, and the vast demographics-related opportunity all nest in a truth that causes discomfort. Call it a “feelings-are-not-facts” problem in setting navigational bearings to avert winding up with a demographic destiny that’s far, far from our intended destination.

Let's step back to get the big picture here, then zero back in on what we mean when we suggest that the issue builders, developers, architects, investors, and, most especially, city and local planning officials face is a "feelings-are-not-facts" crisis here.

To clarify, rather than the demographics-is-destiny trope, we'd rather describe demographics as a smart, stalwart, somewhat blunt data tool. Using messy, raw material inputs of household make-up patterns in motion over time, the tool can seemingly unlock coded secrets. Some humans, communities, policy-setters and the like mine them to great advantage as a clever way to look around marketplace corners or just over horizon lines of time.

Many blithely ignore them because maybe they know something others fail to grasp.

In homebuilding, residential development, investment, design, and manufacturing, smart, analytical people look at the contours, dimensions, scope, and impacts in the constructs we call trends and how they show themselves at any given moment – in society, business, culture, and community – and observe, invariably, powerful shaping forces of household patterns. Often, observers credit demography as an agent in the arc of business' success. In reality, the match between key household data fields and outcomes ranges from causation, to correlation, to pure coincidence.

This is a crucial matter for housing and its multi-trillion-dollar, profit-motive, private sector players, particularly at these crease-point in macro demographics, the proliferation of one-person households. This is because of the way residential investment, development, design, and construction vacuum up such enormous amounts of capital to put in place based on tea leaves, crystal balls, and demographics as evidence supporting these big, big bets.

Not since the emergence and dominance of the dual-income household in the early 1980s, when young-adulthood household and family formations of the then-largest generational cohort humanity ever produced – the Baby Boom – became GDP rocket fuel has a demographic macro trend carried so sweeping a set of ride-along consequences and implications.

In 1960, just 13 percent of American households had a single occupant. But that figure has risen steadily, and today it is approaching 30 percent. – New York Times

The sentence that follows that one in the NYT article is worth its own emphasis:

For households headed by someone 50 or older, that figure is 36 percent.

It’s an impressive step-change by itself. Consider, though, the flip-side of that coin through the lens of sheer household composition pivots. In 1960, 44% of U.S. households were made up of married couples with children under the age of 18, commonly known then as the very American “nuclear family.” So, in the same time frame we observe demographic change in one-person households – from 1960 to the present – doubling, we see this: Married couples with children under the age of 18 now make up just under 18%, less than half of their share in 1960.

Getting away from percentages for a moment, almost 38 million of the U.S.’s 131 million households are one-person households. That number’s rising. Compare that to the raw number of married-with-children-under-age-18 households: 23 million or so. That number’s falling.

Effectively, and in most locales, America's developing and building – even in the hot, new single-family build-for-rent development, investment, construction, and design communities – like there are 55 million (42% of U.S. households) married-couples-with-children nuclear families, not less than half that.

Demographically speaking, 30%-plus of houses and neighborhoods today need to be:

- Smaller and more comfortable for single living

- More cost-efficient for a single-income household

- Designed for one-person livability, sanctuary, privacy, and safety

- Land-planned intentionally both for the enjoyment of solitude and the need for connectedness to food, natural amenity, healthcare, and social interaction

The Times reporters Dana Goldstein and Robert Gebeloff get at the symptoms we see showing up in the intensifying mismatch between these distinct, verifiable, and growing household composition trends and the homes and communities being built these days:

In many ways, the nation’s housing stock has grown out of sync with these shifting demographics. Many solo adults live in homes with at least three bedrooms, census data shows, but find that downsizing is not easy because of a shortage of smaller homes in their towns and neighborhoods.

Compounding the challenge of living solo, a growing share of older adults — about 1 in 6 Americans 55 and older — do not have children, raising questions about how elder care will be managed in the coming decades.

At face value here we’re talking strictly about data and its path of change over time and what that means. In home and neighborhood development, investment, and construction, however, there’s other forces at sway that it’s hard to ignore.

As is too often the case, zoning and land use and all of their tentacles stand squarely in the way of much of what could and should be happening to re-route housing's path into greater alignment with household patterns' driving forces.

Nuclear families – despite making up a smaller and smaller slice of the American household demographic pie – still stamp themselves into the minds of 50-, 60-, and 70-year-old influencers of design, development, construction, planning, and policymaking as the quintessential American families.

It's true, the iconic paradigm of a young married couple and their children are a bedrock value to the culture and society and promise of America.

Still, lot size requirements, and minimum garage sizes, and other locality design guidelines are not going to bring back nuclear families in greater numbers to make up a bigger slice of the demographic pie.

Instead, demographics’ ultimatums include this one. A household stands as a household, not with our strong and powerful associations with a nuclear – two-parents-and-young-children – family as its defining composition.

Either the private sector learns ways to recalculate its route forward to realign with where people who form those households are headed, or demographic destiny and business investment will wind up in two parallel universes.

MORE IN Marketing & Sales

Wray Of Light: Here's How To Keep Pace As Headwinds Stiffen

More than four out of five consumers think it’s a bad time to buy a home; here are seven strategies builders and developers can deploy as a more effective marketing plan to win sales.

These 5 Time-Tested Tips Will Jump Start 55+ Resident Referrals

When managing 55+ community homeowners associations, builders and developers need to meet and overdeliver on the high expectations of a particularly discretionary consumer group.

How A Homebuilder Stands Out In Florida's Fierce Competitive Arena

"Investing in your brand doesn't give you a direct return on investment immediately. It takes a long time, but over time, branding successfully does increase financial value." -- Alex Akel, President, Akel Homes