Marketing & Sales

What Do Homebuilders' Worries Say About Their 2024 Priorities?

Customers – and what it's going to take to both price them in and "excite them in" -- should always rank as both the No. 1 challenge and opportunity among homebuilders and residential developer partners.

Homebuilding strategists, owners, and key operators swear up and down to an age-old rule of anything and everything that guides "focus on the things you can affect."

Still, that never seems to sway them from spending a lot of their time looking back over their shoulder or peering into a not-yet-happened unknown at things they can't control.

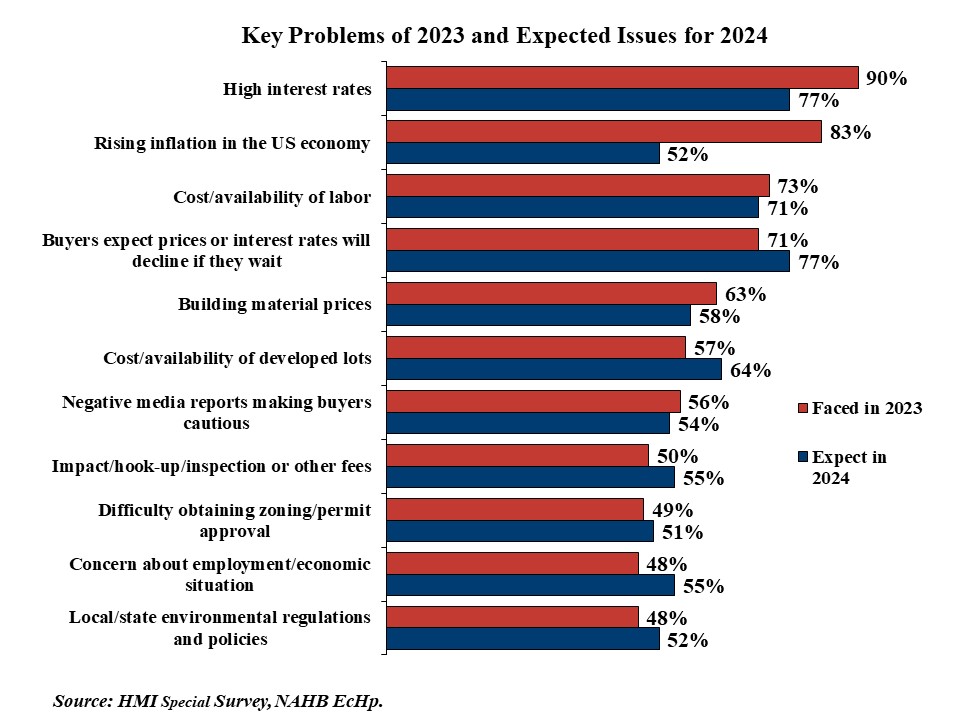

A bucket-list ranking of "Top Challenges" that emerges each year from the January fielding of the National Association of Home Builders/Wells Fargo Housing Market Index survey attests to this.

Thirty-eight separate "walls of worry" run the gamut, from high interest rates, to building materials prices, to local and state environmental regulations. Here are the top 11.

What's dismaying – among a group of business leaders who profess to prioritize the operational matters they and their teams can control – is that three of the top five focus points of challenge for 2024 have entirely to do with externalities ... areas they might prepare for, but have no control of.

Meanwhile, customers – and what it's going to take to both price them in and excite them in – only show up as you scroll down the list.

Higher-for-longer interest rates, and the fact that potential homebuyers may expect that by waiting, prices and or interest rates might likely bend in their favor rank as exogenous matters. The extent to which they present areas of operational opportunity and business outcomes improvement is very likely limited to a few mega players that can use their patience-lined deep pockets and extensive profit margins as shock absorbers, letting time and turbulence take their toll on less well-heeled rivals in their operating markets.

For most mortal players, not focusing on the challenge of demand – not just statistical, demographic household demand, but real-world home search and real-time order demand – and ways to keep it flowing despite uncertainty and bumpy going in the months ahead would amount to an operator's biggest mistake.

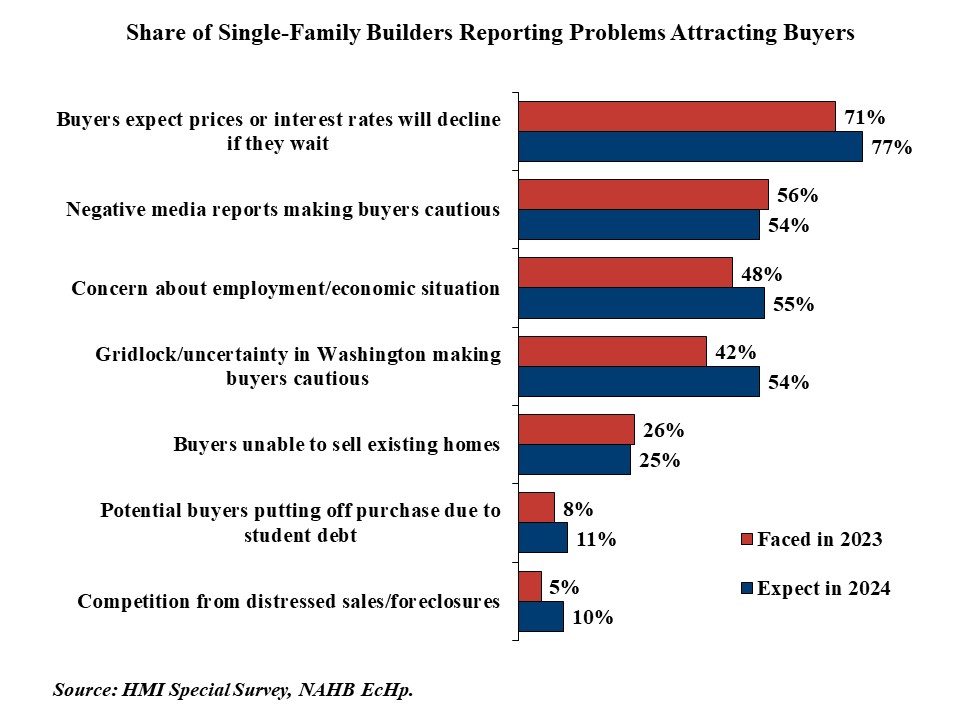

To some degree, the NAHB/Wells Fargo "worry list" does reflect that. NAHB senior economist Ashok Chaluvadi writes:

Compared to the supply-side problems of materials and labor, problems attracting buyers have not been as widespread, but builders expect many of them to become more of a problem in 2024. Buyers expecting prices or interest rates to decline if they wait was a significant problem for 71% of builders in 2023, with 77% expecting it to be an issue in 2024. Negative media reports making buyers cautious was reported as a significant issue by 56% of builders in 2023, and 54% expect this problem in 2024. Concern about employment/economic situation was another buyer issue for 48% of builders in 2023, but 55% anticipate this issue in 2024. Gridlock/uncertainty in Washington making buyers cautious was a significant problem for 42% of builders in 2023, but a larger 54% expect it to be a problem in 2024.

How many of our worries, especially when they focus on matters we don't control, wind up meaning a whole lot with respect to our business outcomes when you look back a year?

Collaborative Fund's Morgan Housel adds a great deal of wisdom – as usual – in a recent rumination.

There’s obviously a hierarchy of information. It ranges from life-changing good to life-changing disastrous.

That got me thinking: What would be the most interesting and useful information anyone could get their hands on?

Years ago I asked that question to Yale economist Robert Shiller. “The exact role of luck in successful outcomes,” he answered.

I loved that answer, because nobody will ever have that information. But if you did, your entire worldview would change. Who you admire would change. The traits you think are needed for success would change. You would find millions of lucky egomaniacs and millions of unlucky geniuses.

When the No. 1 "worry" for 2024 among homebuilder executives responding to the survey is "interest rates" and "buyers expect prices or interest rates will decline if they wait," those homebuilders have to ask themselves, "do I feel lucky?"

MORE IN Marketing & Sales

When Homebuyers Pull Back, Builder Brands Must Step Up

In markets under stress, consistency, empathy, and value-driven messaging provide builders with a critical edge among today’s cautious buyers. Advisor Barbara Wray gets real about the path forward for homebuilders today.

What Separates Homebuilders Thriving Amidst 2025’s Chaos

Builders face rising stakes to unify tech, data, and operations or risk falling behind amid affordability, insurance, and labor challenges.

Here's Why Randy Mickle Has Joined Drees At This Moment

The new Southeast Regional President brings big, national builder experience to a multigenerational homebuilder with bold goals for its centennial.