Marketing & Sales

What A Bottom In Inventory Means For New-Home Sellers

A tipping point in inventory tightness is not just a moment for financial reforecasts, but a time to double-down focus on customers -- who now will enjoy more buying options.

Among the week-to-week spectator sport homebuilders and related fields are riveted to most right now, the inventory vigil ranks right up there.

The comparisons, year-on-year say one thing, while sequential current week versus prior week comps are where the drama lies.

For instance, as Calculated Risk blogger and housing economics expert Bill McBride observes, 2021 will be a telling year directionally for the macro housing cycle, and a key metric – given the unknown unknown impacts of the pandemic – will hinge on whether the number of homes listed-for-sale increase or decrease this year.

This factor, and its change to the plus or minus, impacts:

- prices

- sales volume

- buyer payment power

- mortgage activity

- the remodeling and renovation market

- the new-home – residential investment – impact on GDP

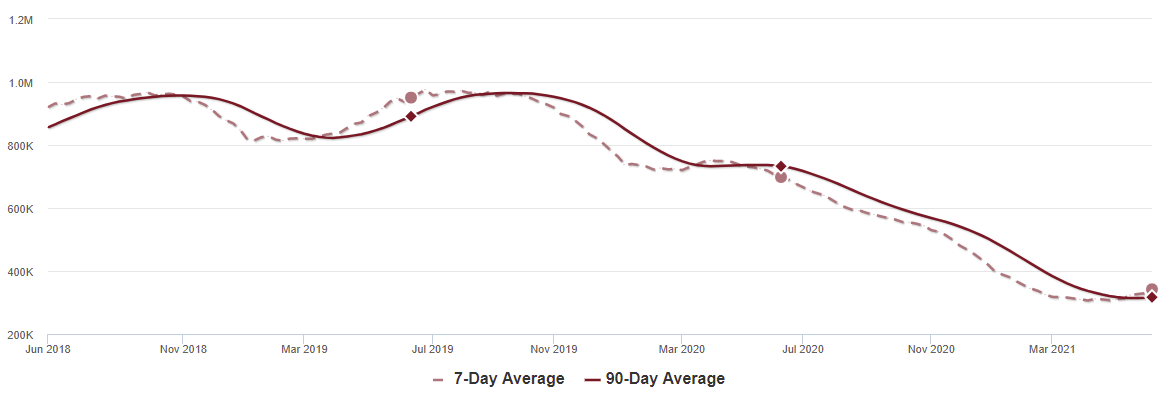

McBride points out that, compared with the same week's measurement period in 2020, the current inventory level in absolute listings is less than half what it was – 342,000 in 2021 versus 698,000, per Altos Research.

But it's the week-to-week change – up, down, sideways – that most fascinates the industry, especially as economic activity reboots and conditions strive to resume a norm of behavior.

Once second-derivative rates flatten and, perhaps, switch direction – from tighter inventory to an expansion – the new ratios alter a lot of current models, setting re-forecasts into scramble mode.

McBride, a master of analytic "flat affect" prose, writes:

A week ago, inventory was at 329 thousand, and was down 53.3% YoY. Seasonally, inventory has bottomed.

Inventory was about 11.6% above the low in early April.

What this chart means is that it's time to sharpen reforecasting pencils and get to work on models that – over time – reflect softening prices, perhaps a surge in resales, and less pronounced demand on the new-home development pipeline.

This is not solely a signal for finance and accounting types, but rather a moment to up the game in customer care and focus, as those customers' alternatives – at more price points – are about to expand.