Leadership

Private-Public Homebuilder Divides Sharpen As Market Shifts

Builder sentiment takes a big hit as would-be homebuyers and their payment power fail to keep pace with price and interest rate shocks. Now builders begin to open their toolbox for rougher-going ahead.

Not little ones, either. Rather, 10% or 12% hurry-while-it-lasts discounts.

That's behavior, not mere words.

That's also submarket specific, not national. That's about keeping absorption rates on a per community per month basis normalized, not a rollover concession to a system-wide cyclical rotation.

What it is also is this: it's not raising prices, but rather the opposite. It's not even keeping prices flat, release over release. It's cutting them.

Before, it was, "grab this now, or someone else will get it," and now it's "these prices won't last long."

That behavioral inflection – a 180-degree turn from steadily aggressive price increases in virtually 100% of builders' selling communities – signals a strategic tipping point. Before, say mid-April 2022, builders almost universally could play on offense.

Now, on a spot market basis that has begun to define a new pattern and trend, they're shifting into a defensive posture.

While it's for analysts, economists, and industry observers to take note and try to project what may come next, it's for builders – leaders, strategists, operating chiefs, and their networks of contact points on the ground – to act. For shifts, pivots, tipping points like this, it's not a question of whether homebuilding firms and their teams are prepared. They've been rehearsing and squirreling away rainy day resources and taking chips off the table where they've been able to for three years or more now. Rather, it's how well prepared they are.

All eyes fasten on two highly sensitive indicators of business health right now, and for smaller, privately capitalized builders whose access to lending may be more exposed to recent tightening of money supply and increases in cost, that preparation had better have accounted for some rough-going ahead.

These bellwethers connect the dots between a momentum turn and company business management, and when everybody's playing on defense the squeeze on private builders – to make sales, deliver homes, close, and book the revenue – tightens as every loan repayment on principle and interest looms as a critical milestone.

- Price and pace of new orders, and the incipient need for discounts, incentives – i.e. free options and upgrades – and down payment assistance and other mortgage rate protection programs, requiring reprojections, reforecasts, and contingency plans on cost and revenue

- Cancelation rates, which have notched up from where they've been running since mid-2020, but still range below historical rates.

Here's commentary from homebuilding analyst Carl Reichardt, from this week's update to the BTIG/HomeSphere Homebuilder Survey on the latter:

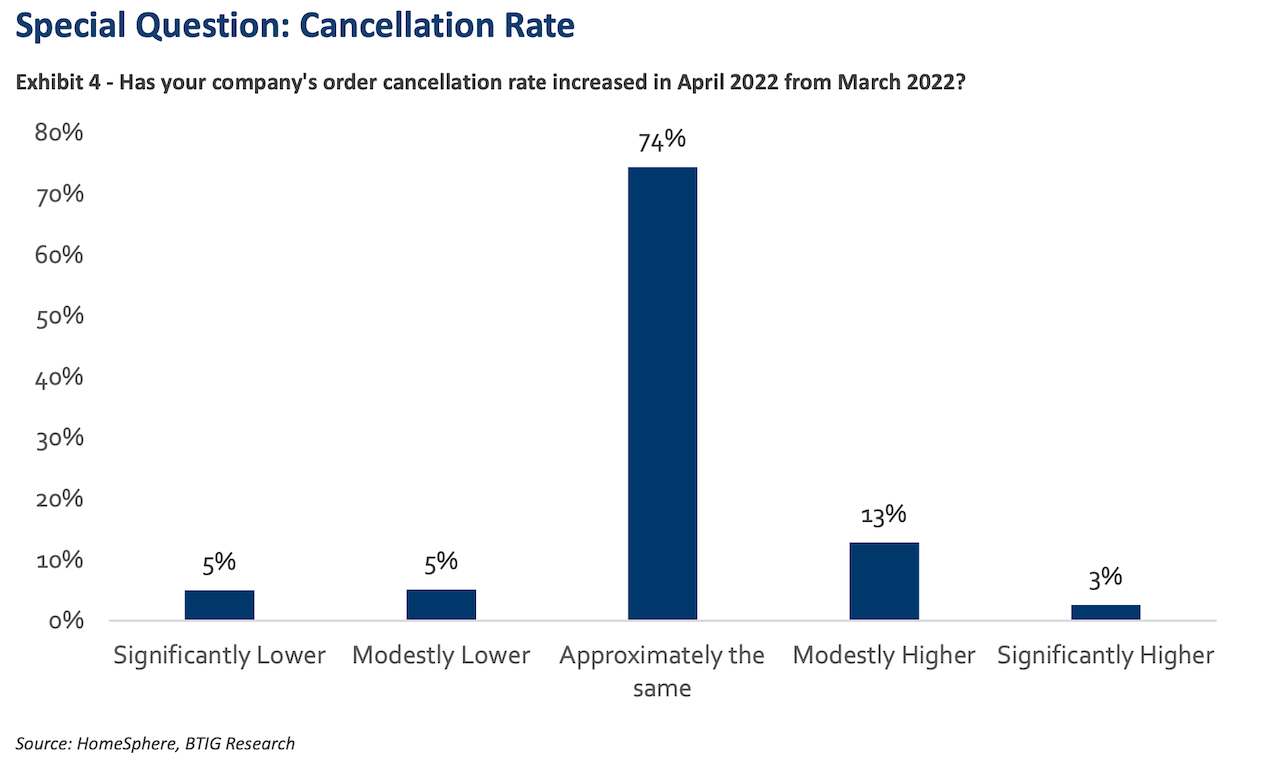

This month we asked respondents if order cancellation rates increased in April from March. Thus far, builders have yet to see a significant change. 74% of builders saw cancellation rates in April approximately the same as March. 16% responded that cancellation rates were higher, with only 3% responding "significantly higher". 10% responded that cancellation rates were lower, with 5% responding "significantly lower".

Now, appreciating that homebuilding as a cohesive national business and economic system is illusory is crucial right now.

Reality is that for leaders, what's particularly meaningful now – from a business resilience and sustainable viability standpoint – is less about homebuilding and more about homebuilders. They're as local as 10,000 or more subdivisions and neighborhoods spread out among 5,000 or so homebuilders who produce and sell nine of every 10 new homes in ranges from 10 or more per year to D.R. Horton's 81,000-plus.

Those two words, price cuts, mean a lot writ large. Still, they can be existential for builders whose operating and financial models run closer to the bone of real-time, especially if their lending or credit lines – dirt cheap a year ago – are pricier now that Fed funds rates have lifted off.

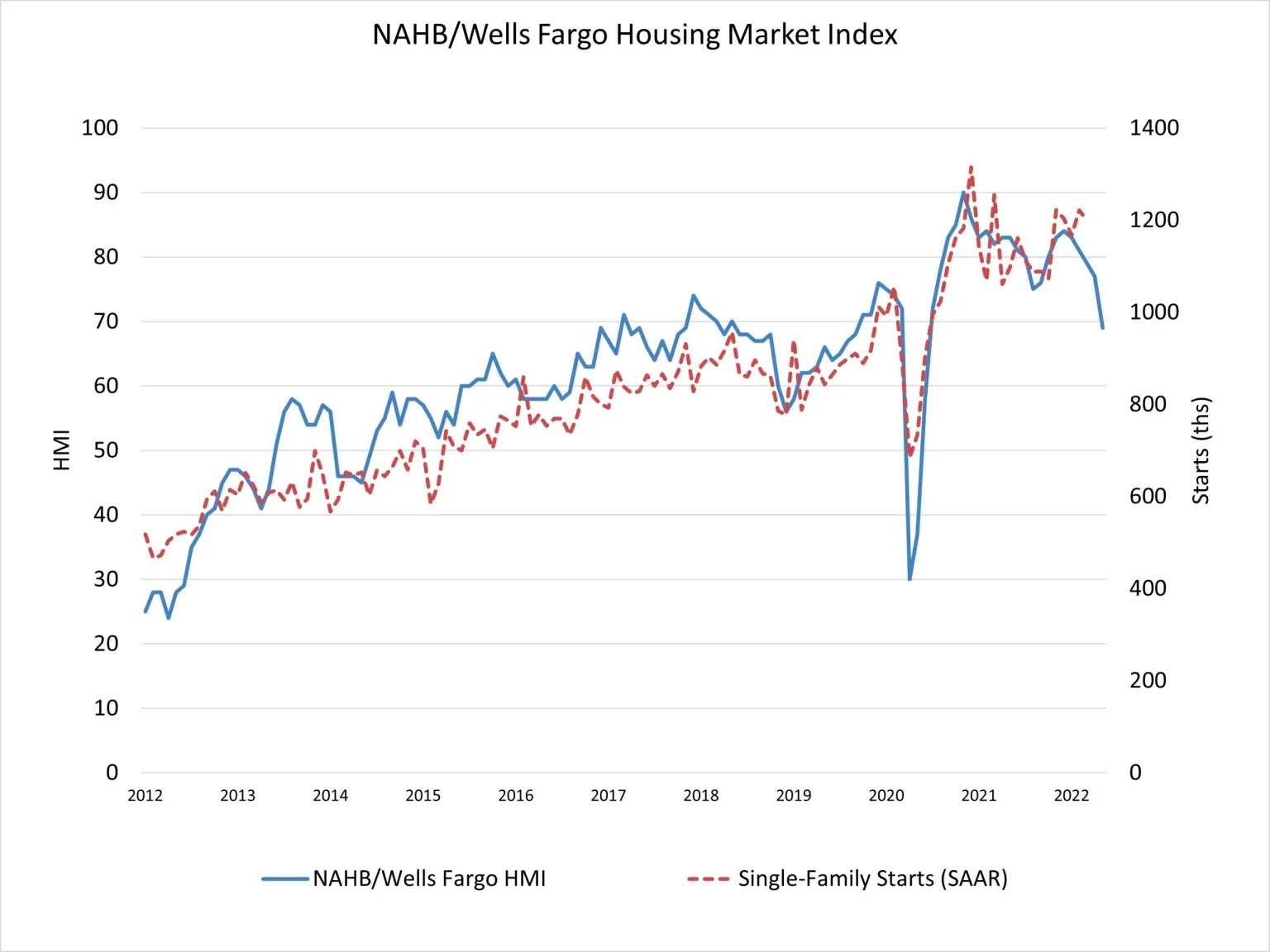

Today's print on homebuilder confidence – the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index – frames a look at rapidly deteriorating conditions, albeit from a height of exuberance in the wake of the pandemic that both fueled and ran concurrent with a broad demographic rotation into homebuyer demand. The one-two punch of skyrocketing prices and budget-busting interest rate increases – a pair of fast-moving phenomena impacting intentions, plans, and means – has started burrowing into builder sentiment.

NAHB chief economist Rob Dietz responded to some questions we had about the rate of change in builder confidence:

The HMI decline highlights the erosion and crisis for housing affordability, particularly at the entry-level. The interest rate shock affecting prospective first-time buyers is clearly large. Keep in mind one in three homes marketed for sale is now newly-built (or newly-will-be-built as the case may be). Historically that share is 13%.

As of May, the HMI is down 21 points from November 2020. This reflects the accumulation of challenges for builders, particularly with respect to the cost and availability of materials, as well as ongoing access issues with labor and lots. However, the HMI is still above 50, with many builders reporting ongoing solid demand despite the increase in rates.

That said, the combination of 5 straights months of decline and a 15 point drop since December 2021 confirm what we said last month – the housing market is at an inflection point and will soften in the months ahead.

The NAHB Economics forecast now includes a recession in 2023. That is, we are forecasting a hard landing for the economy as the Fed seeks to curb inflation by reducing consumer demand. Over the last seven decades, every time inflation has risen above 4% and the unemployment rate has fallen below 6%, a recession has followed.

Nonetheless, a housing deficit exists and demographics remain favorable over the long-run. However, cyclical factors will present near-term negatives as the buyers adjust to a higher path of mortgage rates.

The Biden administration has taken notice, issuing a housing supply strategy yesterday. It was not perfect. As an economist, I wish it had included more on homeownership, for-profit builder conditions, and addressing the materials supply-chain, but it did include some items NAHB has raised as concerns or opportunities in recent years.

To date, we've seen a couple of instances of single-market private homebuilders going bust.

The trip-wires of timing, money owed, and money coming in may start sending more privately capitalized firms into a risk zone as far as loan covenants, and the ability to keep drawing on their lines despite unavoidable delays in construction cycles.

Bigger may not be better. But it might feel more comfortable to more players right about now.

Join the conversation

MORE IN Leadership

Public CEO Compensation Averaged $11.5 Million In 2023

Here's The Builder's Daily annual scorecard and analysis of CEO, Executive Chair, and corporate President pay across the 21 U.S. pure-play public homebuilding enterprises.

Public Firms Seize Advantages; But Private Builders Hold An Edge

Often, private homebuilder leaders and their teams solve the problem of how to survive and thrive, just when all the headlines cry, "It's a bad time to buy."

D.R. Horton's Q3 Earnings Reveal A Case Study In Winning Market Share

A turbulent, volatile, uncertain demand market is not the only force making life difficult for 99% of homebuilding operators right now.