Marketing & Sales

From Survive To Thrive: Dial In The Data To Ignite Precision Selling

A 2024 State Of Housing Report maps a nuanced supply and demand landscape that demands alignment on six strategic fronts to get product and sales right in each submarket arena.

Beneath January New Homes Sales' headline of a seasonally adjusted annual rate of 661,000 homes – a 1.5% increase from December 2023 and a 1.8% increase over January 2023 – lie keys to a locked secret. They may reveal exactly what kind of period full-year 2024 and beyond will be for homebuilders.

The secret is embedded here in two passages, one in the analysis Calculated Risk's Bill McBride uses to cover off on a chart below. The other is in commentary from National Association of Home Builders Assistant VP for Forecasting and Analysis Danushka Nanayakkara-Skillington on the Census's New Home Sales release.

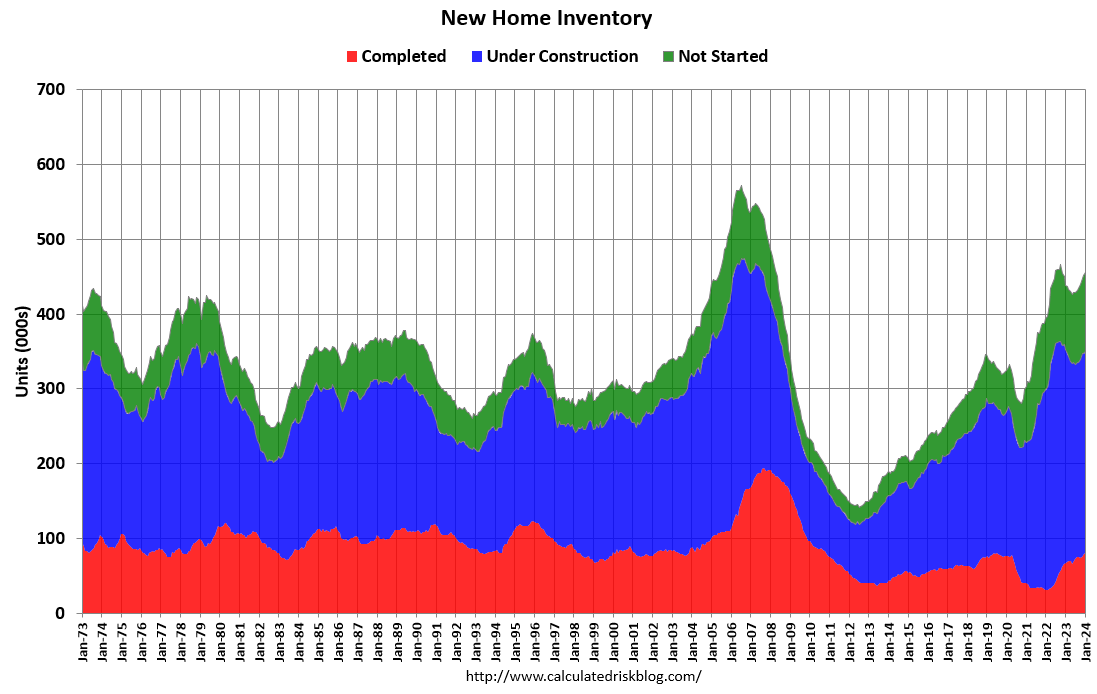

Passage One: Inventory

The inventory of completed homes for sale (red) - at 80 thousand - is more than double the record low of 32 thousand in 2021 and early 2022. This is close to the normal level of completed homes for sale.

The inventory of homes under construction (blue) at 270 thousand is very high but is about 15% below the cycle peak in July 2022. The inventory of homes not started is at 106 thousand - this is the all-time high."

Passage Two: Pricing

The median new home sale price in January was $420,700, up 1.8% from December, but down 2.6% compared to a year ago. In terms of affordability, the share of entry-level homes priced below $300,000 has been steadily falling in recent years. Only 15% of the homes were priced in this entry-level affordable range, while 34% of the homes were priced above $500,000. Most of the homes were priced between $300,000-$500,000."

The message contained in the first passage is that homebuilders' confidence in the solidity of their orders – for specs, under construction, and not-started – has grown now. As Nanayakkara-Skillington writes:

A year ago, there were 72,000 completed, ready-to-occupy homes available for sale (not seasonally adjusted). By the end of January 2024, that number increased 19.4% to 86,000."

Builders believe 2024 is set up to be a strong year for them. They're counting on 1) continued selling advantages vs. resale due to ongoing hesitancy among existing homeowners with below 4% mortgages to sell, 2) continued efficacy of incentives – mortgage buydowns for monthly-payment-sensitive buyers and cash-back at close, upgrades, and added options for more discretionary purchasers, and 3) no further Federal Reserve rate scares for the balance of 2024.

A new 2024 State Of Housing Report from New Home Star lays out three lynchpins that nail down current conditions for homebuilders within an expansive context of demand and supply data drivers.

- Consumers are now focused on monthly payments as opposed to the total purchase price of a home. This is because buyers have had to reevaluate what they can afford each month due to rising interest rates.

- New construction's share of the market has skyrocketed due to limited resale options. New home sales historically account for 10% of total home sales inventory, yet recently have inched closer to 30%.

- The rising cost of material goods and labor shortages have contributed to the increasing price of homes this year. It is unclear if there will be much relief in 2024.

Beyond those macro takeaways, the New Home Star report cautions homebuilder strategists from over-confidence in a "rising-tide-lifts-all-ships" mentality. As they lean into 2024 selling conditions, homebuilding businesses will encounter supply and demand variations, nuance, and potential stumbling blocks, especially given a prevailing affordability challenge that seems to swing repeatedly from being a relatively benign risk toward exerting a major threat to business plans and expectations.

The actionable nitty-gritty of the State of Housing Report, for both executive level strategists and homebuilding marketing and sales business leaders alike, comes with the conclusions, or "strategic alignments" as they're called in the report. There are six of them, ranging from focus on audience target, to watching that spec inventory count, to pricing aggressively, and so on.

And to wrap it in a bow, three final recommendations aim to spur homebuilder business leaders to set themselves apart from peers by rising above. Here's how that looks.

We were fortunate this past week to get time with New Home Star Market Analyst Dan White to explore the key insights of the 2024 State Of Housing Report.

You can check out our conversation on TBD Player here:

Here are a handful of Dan White's high-level remarks in excerpt form so that you can get a feeling for the robust strategic and tactical insights in the 2024 State Of Housing Report from New Home Star.

State Of Housing Report Overview

Dan White

Typical questions from our strategic and business client leaders helped craft the shape of this report. Without oversimplifying, it really all comes down to supply and demand. There are multiple metrics and elements we looked at within each of those two buckets. We looked at the supply side from the builder perspective: Their ability and desire to continue to build homes. From the consumer demand angle, it is their ability and desire to move forward with the purchase. That was the framework that we used for this, and the creation of some of the specific KPIs helped to drill down into those sub-buckets that make up that framework. Now, a builder or sales leader can take these metrics we've outlined and basically grade their own market – their own immediate environment – against these. One can pull the data, look at each of these items, and ask one simple question about each one: 'Based on what we know, what we feel, what we've been told, and the resources that we have available to us, do we think that this metric is going to improve or get worse?' Quickly, you're able to create a scorecard for your market."

The Consumer Lens

Dan White

We looked at home price trends across the country, and as we looked at the impact of affordability, we checked a couple of different affordability indexes that reflect buyers' ability to purchase a home. We looked at wage growth, though, as it ties into their ability to participate as buyers, and job creation. We looked at all the factors that play into inflation data. That's the centerpiece of a lot of the conversations right now. Then, we look at consumer confidence. That's our last bullet point: On the demand side, it's consumer confidence. On the supply side, it's builder competence. That goes to the heart of regardless of what the data says. Are consumers confident in their job security? Are they confident their wages will continue to increase? That they'll be able to afford this home that they're moving into? Or is this confidence merely about the overall economy and market?"

Action And Alignment

Dan White

There's a reason 'alignment with your target audience' comes first among the six recommendations. We focus a lot on TCP: Target consumer profile. Having a customer segmentation model to work with is paramount moving forward. Gone are the days of buying a piece of land because it has a great price, putting a product on it, and then hoping to find buyers for it because the numbers make sense on our paper. It's kind of reverse engineering idea of putting a bit of a square peg in a round hole, really within these constraints in environments where affordability is the core of the factor. If you don't start every conversation about a community with, 'Who is my customer, and how can I tailor their entire experience from when they first interact with my website to when they're in the field working with my team members? To when they're building the home to win the closing, or furnishing their warranty?' builders are certainly missing the mark. Other builders place more emphasis on the customer. And there's a difference between just focusing on the customer and then knowing who they are intimately and tailoring the entire environment experience to them. That's why this is our very first consideration for builders moving into this year."

The Spec Dilemma: How Much Or Too Much?

Dan White

Well priced, well-positioned spec homes are selling very well right now. With all the uncertainties of the moment, the idea of signing a contract and locking into a home, a lifestyle, etc. that's under construction and going to be many months down the road, with so much chatter from the media etc., can be a daunting task. Builders that have been able to push their levels of risk and have been able to appropriate the levels of capital nicely to build additional spec homes have been selling really well. Builders who elevated that risk tolerance towards the end of last year are going to have spec homes available for the spring selling season. They're going crush it. The spec home is, as it's been said, a proxy for the existing home market right now."

Competition: It's Not Just Homebuilder Rivals

Dan White

In an inventory-constrained environment, where affordability is the crux of the conversation, your competitive sphere gets very large. Customers – when they look themselves in the mirror and differentiate between wants and needs – see their backs against the wall. We're seeing folks who would normally be a great prospective buyer for a builder say, 'It just makes more sense to rent.' Maybe that builder hadn't even considered that the alternative to their product would be a rental product, or a resale down the road where typically they don't have to worry about them as perceived competition. Those black-and-white landscapes of who are and who aren't your competition blur into one another in an environment like this. So a builder who wants to stay on top of that needs to expand that mindset, and needs to consider what potential customers regard as competitors. Put yourself in the customer's shoes. 'Oh, this really is competition right now. This is an attractive alternative.' Builders need to make sure marketing collateral and operations for the sales side are all dialed in to make sure that they're building the value appropriately."

Catch the TBD Player videocast with Dan. And download the New Home Star report here.

MORE IN Marketing & Sales

When Homebuyers Pull Back, Builder Brands Must Step Up

In markets under stress, consistency, empathy, and value-driven messaging provide builders with a critical edge among today’s cautious buyers. Advisor Barbara Wray gets real about the path forward for homebuilders today.

What Separates Homebuilders Thriving Amidst 2025’s Chaos

Builders face rising stakes to unify tech, data, and operations or risk falling behind amid affordability, insurance, and labor challenges.

Here's Why Randy Mickle Has Joined Drees At This Moment

The new Southeast Regional President brings big, national builder experience to a multigenerational homebuilder with bold goals for its centennial.