Land

Encore In Music City: Dream Finders Lands Crescent Homes

The acquisition gives Dream Finders an immediate operational presence with an established, feisty, fire-in-the-belly-style entrepreneurial counter-puncher – Crescent Homes founder Ted Terry.

The roots-rocking Greater Nashville metro – as well as the humming housing markets in Greenville-Spartanburg and Charleston, S.C. – got word of at least a third major homebuilding mergers and acquisition deal announcement in the past 10 days: Top-15 ranked public builder Dream Finders Homes announced it has purchased Charleston-based, 15-year-old operator Crescent Homes.

[Update Feb 2, 2024] Dream Finders announced its confirmation of The Builder's Daily story here.

The acquisition will yield Dream Finders an immediately-bolstered operational presence – with an established, feisty, fire-in-the-belly-style entrepreneurial counter-puncher, Crescent Homes founder Ted Terry – in a Nashville market notorious for its tough regional land game gantlet. What's more, the Crescent operating footprint will now expand Dream Finders westward, from South Carolina's coastal/Myrtle Beach markets into both Charleston and the Greenville/Spartanburg market area.

Per the press statement:

Assets acquired include 457 homesites in varying stages of construction, a sales order backlog of approximately 460 homes with a value in excess of $265 million, and approximately 6,200 lots under control.

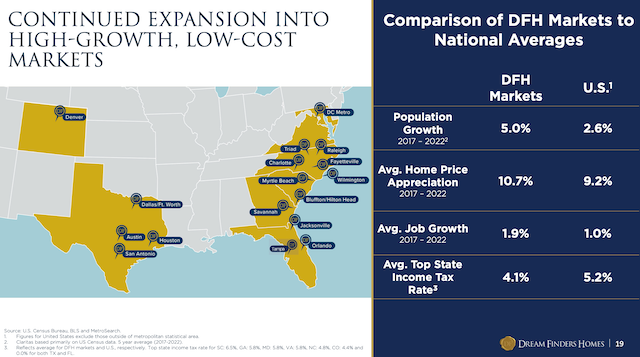

Dream Finders, like Columbia, S.C.-based United Homes Group – which announced it acquired Coastal South Carolina operator Creekside Custom Homes last week – pursues a strategic NVR-like land-light AD&C investment model that pulls profitability through on-demand, high-velocity inventory turns rather than through land future value appreciation factors.

A flurry of M&As, from single-market beachheads to regional launch pads, and from market expansion to deeper local scale, from a national platform to a macro business cultural transformation, has kicked off a record-breaking January in M&A from a revenue standpoint. Underlying and driving the feeding frenzy are strategic buyers thirsting for incremental and, eventually, explosive revenue growth, and sellers either wanting to ride that growth wave or needing to de-stress financial liabilities that come with personal guarantees on their own bank debt.

We wrote last week of a new home construction concentration trend we see striding leaps and bounds in 2024 and the next 48 months:

The backdrop of intensifying homebuilder M&A is a double-helix of acquirer motivators: 1) a worsening undersupply of vacant developed lots, particularly in some of the nation's most sustainably resilient and fastest-growing local economies, many of them in the more-affordable U.S.; and 2) a slew of advantages to deeper local scale for access not just to present and future lots, but to front-line contractor labor, materials supplies, not to mention home-buying customers seeking both affordability and lifestyle advantages.

At the same time, a slew of access-to-bank capital challenges have made competitive prospects all the more daunting for smaller private operators whose go-to for acquisition, development, and construction financing has typically been local and regional banks."

A non-negotiable for strategic acquirers in every case is sustainable capability on the local and regional land acquisition front. Tracing back to Global Financial Crisis-era local municipal staffing and resources reductions, chokeholds in permitting throttled an entitlement-and-approvals cycle that had already grown more constrained and oppositional on the local and community level. Add that cause of chronic undersupply of vacant developed lots to more recent pandemic-era gyrations involving both municipal planning officials and stiffer land-use rules, and you've got a full-blown land shortage in many of the U.S.'s most-active new residential markets.

In Ted Terry and his team at Crescent, Dream Finders has landed a fifth-generation homebuilder with a track record of being fleet-of-foot on opportunistic land deals, not to mention being a stickler for his reputation as a trusted, relationships-driven player.

The Dream Finders acquisition of Crescent, while not as large as its last major acquisition – the 2021 purchase of Texas-based homebuilder McGuyer Homebuilders, Inc. and related affiliates for $475 million – may be strategically as important. The Crescent platform – with an infusion of capital – could expand the Dream Finder's capability, powering it to ignite faster-growth in a Mid-Atlantic and Southeastern market growing both organically and due to in-migrating young adults, families and 55-plus households seeking affordability and lifestyle upgrades.

Per the Dream Finders press statement:

Crescent serves entry-level, as well as first and second-time move-up homebuyers with price points starting in the low-$300,000s, and has over 25 active selling communities."

Once Dream Finders took off in early 2020 as a public company, it leap-frogged scores of players into the heady competitive arena occupied by the nation's top 15 homebuilding enterprises. Its purchase of Crescent Homes illustrates that Dream Finders' ultimate goal under founder CEO Patrick Zalupski is no less ambitious than to play right alongside in the top five, with the organization that inspired its business model: NVR.

MORE IN Land

How Homebuilders Gain Ground Control With Digital Land Tools

Land banking is complex and costly. A new digital approach shows how builders can cut errors, speed deals, and stay competitive.

Lone Star Diamond In The Rough: A Case For 'Why Weatherford'

Longtime Texas residential land strategist Scott Finfer opens up his land scouting manual to explain the stark difference between speculation and data-backed, applied vision.

Little Deal ... Big, Timely Product Pivot: Lokal’s Capital Play

A $12M facility fuels Lokal Homes’ swift shift into higher-margin homes and a smarter land strategy in a tough market.