Leadership

What The $4.9 Billion Blockbuster Sekisui House Purchase Of MDC Means

Our analysis of the impacts of homebuilding's mega M&A deal -- the largest since Lennar's October 2017 acquisition of CalAtlantic for $5.7 billion -- looks at what the combo means for 1) Sekisui House, 2) the nation's volume homebuilders, and 3) the macro homebuilding business cultural landscape.

A top-five-ranked U.S. homebuilding company doesn't happen overnight.

Except when it does.

In a global business marriage that promises not just to reset power balances among U.S. homebuilding's upper-echelon organizations, but – over the longer term – to alter residential construction's business culture and community of practice, Osaka, Japan-based Sekisui House Ltd agreed to by Denver-based MDC Holdings Inc. in an all-cash deal with an equity value $4.9 billion.

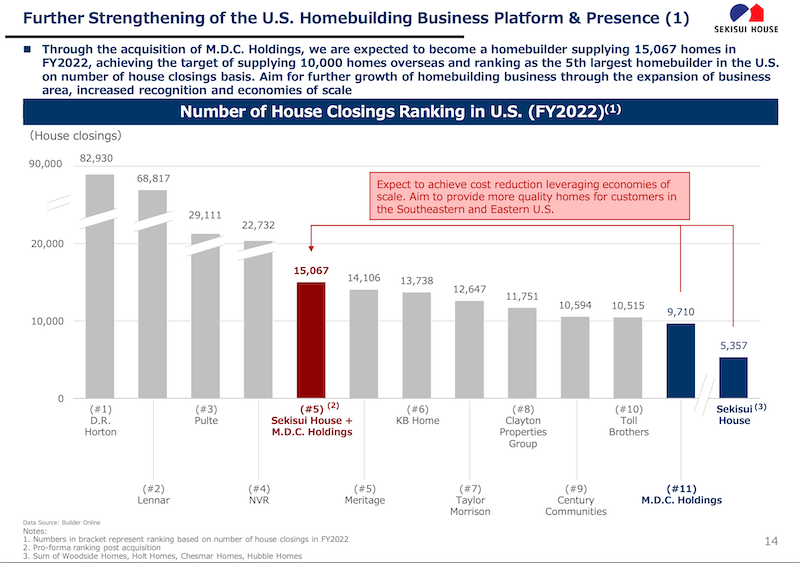

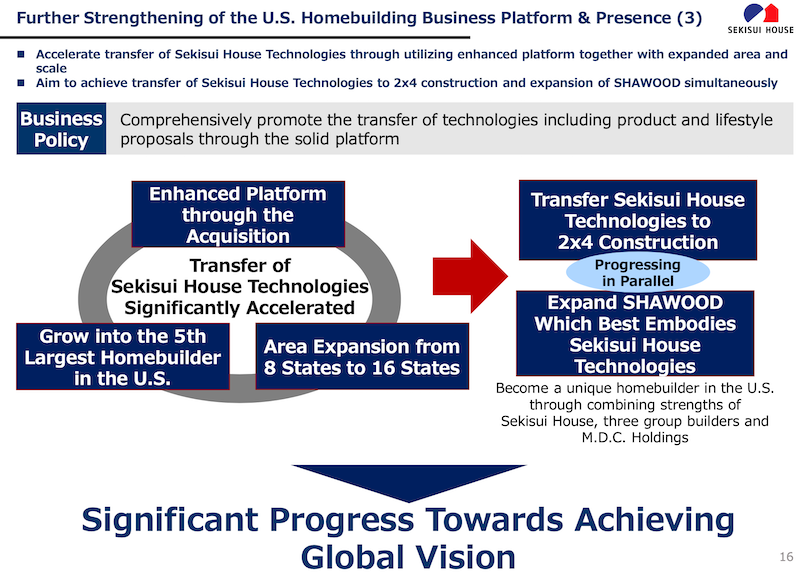

The short version of this homebuilding story-of-the-decade (so far) is that, literally overnight, the agreement – due to make MDC a wholly-owned unit of Sekisui House within the first half of 2024 – powers the Sekisui House US Holdings portfolio to leapfrog 13 companies into the No. 5 ranking among homebuilders by closings volume.

In so doing, Sekisui House fulfills one of U.S. homebuilding's boldest promises of the last decade, as we noted here:

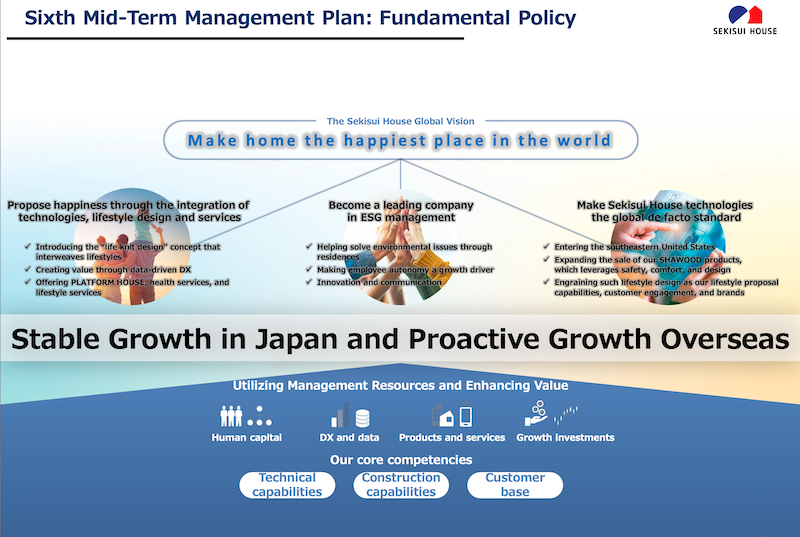

Among the business objectives as Sekisui House has outlined in its "Sixth Mid-Term Management Plan," combined U.S. and Australia revenues would reach the equivalent of $6 billion in 2025, counting on 67% growth in homebuilding deliveries in the U.S. alone over the next two years. As recently as June, Sekisui House's U.S. ongoing growth imperatives played out in the acquisition of Boise, ID-based Hubble Homes, a regional powerhouse with annual revenues of $300 million."

What's more, the acquisition of MDC delivers on that ambitious promise early. This morning's press statement notes:

Yoshihiro Nakai, Representative Director of the Board President, Executive Officer and CEO of Sekisui House, stated, 'This exciting acquisition of MDC represents a significant advancement of the Sekisui House strategy to expand our U.S. presence and bring the value of our technology, innovation and philosophies to U.S. homebuilding and ultimately to our customers. It will also allow us to achieve our goal of supplying 10,000 homes outside of Japan by FY2025, ahead of our initial expectations. This transaction directly aligns with our stated strategy for growth in North America and will create a more resilient portfolio for Sekisui House.'”

Our brief scope of the impacts and implications of homebuilding's largest M&A deal since the October 2017 acquisition of CalAtlantic by Lennar for $5.7 billion, will look at what the new combination means for 1) Sekisui House, 2) for the nation's larger public and private homebuilders, and 3) the macro business cultural landscape of new residential development and construction in the U.S.

What It Means To Sekisui House Ltd

To grasp what the MDC acquisition means to Sekisui House Ltd, no answer to the question "why" matters more than the Sekisui House strategic team's global vision, which overarches its worldwide operations and drives its business culture from top to bottom.

The dots between this global vision and the real-world operational drivers of the combination become clearer in the SHL press statement. Simply, the deal

Advances Sekisui House’s global vision to 'make home the happiest place in the world.' Sekisui House aims to create homes and communities that last for generations and is currently working to solve social issues through the integration of technologies, lifestyle design and services with a focus on health, connectedness and learning as it advances R&D into new technologies with a focus on the residential domain. Through the acquisition of MDC, Sekisui House will aim to achieve its global vision through providing superior quality homes that ensure comfort, security and peace of mind for customers across the U.S.

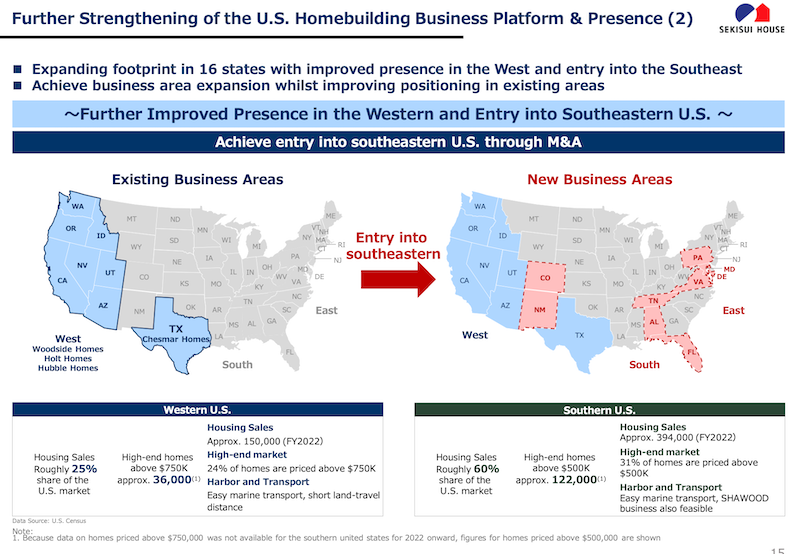

The scale, product diversification, geographical diversification, and access to customers and business partners that MDC bring to the combination all give Sekisui House the added volume and financial returns to evolve a distinctive position in U.S. homebuilding. The global company's business value proposition weaves together its shareholder return stewardship with equally strong commitments to customer care and value creation, employee care, business partner value creation, and environmental, social, and governance commitment and investment.

According to the press statement: Moelis & Company LLC and Mitsubishi UFJ Morgan Stanley Securities are acting as financial advisors to Sekisui House. Hearthstone, Inc. is acting as real estate advisor to Sekisui House. Morrison Foerster LLP is acting as a legal advisor to Sekisui House. Vestra Advisors, LLC is acting as exclusive financial advisor to MDC and Paul, Weiss, Rifkind, Wharton & Garrison LLP is acting as MDC’s legal advisor. Brownstein Hyatt Farber Schreck, LLP is also assisting MDC as a legal advisor.

The timing of the combination follows closely on the heels of a strategic leadership reset in late 2023, setting the stage for an ambitious next play for Sekisui House.

We wrote:

With an eye toward driving to an ambitious goal of producing and selling 9,000 homes or more in the U.S. by 2025, SH Residential Holdings elevated Toru Tsuji to CEO of Sekisui House's U.S. portfolio of homebuilding and residential development interests.

Mr. Tsuji, responding to a request from The Builder's Daily explains:

The main reason for sending the executive officer from the Japanese headquarters to the U.S. was to facilitate communication. After all, when you cross the ocean in the form of the U.S. and Japan, it is difficult to communicate well why Osaka makes such requests and why such decisions are made, and vice versa. Our main goal is to solve this communication gap. And the next most important thing is to expand the development of SHAWOOD. In order to achieve these two major objectives, we have created the Stakeholder Relations Office as a bridge between our headquarters in Japan and the U.S. and as a center for technology transfer, and we will integrate various sections to achieve our goals."

An ironclad connection in Sekisui House's commitments and investments to both business value creation and customer, partner, team member, and environmental value creation comes through in every dimension of the organization's operations.

The reason Sekisui House has found success in the US is that they obsess over the things that matter most, people and the earth," says FTS CEO Thomas Carpitella, in discussing the combination today. "In an industry where 99% of the competition only obsesses over unit counts and profits, Sekisui House speaks a different language than their competitors to their employees and stakeholders. As a result, they can resonate with household brands like MDC and demonstrate how that partnership will be noticeably different for their stakeholders. The integration of MDC into Sekisui’s family of builders will demonstrate the power of going all-in on the areas that yield the most results. This is an obvious 1+1 = 5 partnership and the MDC culture and homebuyers will without question dramatically improve as a byproduct of Sekisui’s business philosophies."

Further, the Sekisui House statement notes, the 54-year old, cycle-tested enterprise MDC's founder and executive chairman Larry Mizel and president, CEO, and director David Mandarich have led

... will help Sekisui House meet growing U.S. housing needs with enhanced capacity to deliver single-family houses and support customers’ increasingly diversified demands – from breaking ground to choosing the specification and finishes in their new homes."

What It Means For High-Volume Homebuilders

In a business and competitive context where deep local market share and scale represent the best path to assured growth and price power and where land and capital constraints disproportionately advantage smooth access to less-expensively sourced financial resource pools, the Sekisui House-MDC deal adds accelerant to an already smoldering M&A dynamic in homebuilding.

A Bloomberg analysis of today's Sekisui House-MDC deal notes:

Homebuilders in the US have ridden a wave of heightened interest in newly built properties as tight inventory leaves buyers fighting over scraps. But scale has been key for builders seeking to offer mortgage-rate buydowns and lure in customers. That’s fueled deals even among US companies.

Stay tuned, as the number of M&A deals that take place in 2024 could rival the most active deal-flow stretches in any recent era of homebuilding.

As an accompanying issue, valuations among homebuilding's mid-sized public companies received scrutiny, stirring investor interest among MDC peers in the space. Wolfe Research homebuilding equity research senior analyst Truman Patterson wrote:

We believe the sale is a little unsurprising and a function of the two founders’ (Mizel (81) and Mandarich (75)) estate/succession planning. Notably, the $63 per share transaction price implies a 1.33X ’24 BV multiple and 12.8X PE multiple, and we forecast MDC will generate a ’24 ROA of 6.5%. MDC’s all-time equity price was ~$60 during the fall of ’05. Considering there are a handful of smid-cap builders under coverage (TPH, MTH, TMHC, KBH) trading at 1.0X to 1.1X ’24 BV despite having projected ’24 ROA’s (7.5% to 10.5%) that are meaningfully higher than MDC’s 6.5%, we expect the transaction will generate some investor interest in these “undervalued” names. However, after speaking with contacts, we believe MDC was relatively unique, and the other smid-cap publics under coverage do not have a desire to sell. While it is certainly too early to tell whether the transaction may bring change operationally, MDC’s core markets that could see a shift in competitive dynamics from the combined, larger-scale builder include Denver, Phoenix, Las Vegas and S. CA.

The 1.33 times 2024 Estimated book value caught notice among senior strategic capital experts as a "very attractive deal for Sekisui House."

What The Deal Means For U.S. Homebuilding

Sekisui House's unapologetic embrace of a "stakeholder" value creation model, and its 64-plus year practice in executing that model strike unwavering balances of strategic and operational focus and commitment to its ecosystems of trade partners, customers, employees, and the environment. Key to its capability at keeping those priorities in balance, the firm has invested wholly in advancing building, management, data, and end-to-end residential development lifecycle technologies to capture efficiencies even as it elevates its customers' experience of value. The press statement notes:

Sekisui House has advanced technology cultivated through its operations in

Japan, while MDC has a strong track record of providing high-quality homes for more than 50 years in the U.S. Sekisui House will transfer its technology and innovation, including zero-emission homebuilding processes, to expand its offering of high quality, ESG-conscious products and lifestyle packages to MDC customers

at a time when demand for such products is growing. Over time, the transaction is expected to provide new opportunities for economic growth and job creation in the U.S.

The seismic repercussions of today's deal are likely to continue to show up in many ways over the coming weeks. However, it's the long-term impacts of Sekisui House's ever-more-powerful presence in the U.S. homebuilding landscape that we believe will be the most significant. We may have to be around at least until 2034 to recognize how important this deal really is and why it matters.

Sekisui House thinks and operates in decade time horizons," says FTS's Carpitella. "Most builders think and operate in quarters. The top 10 homebuilders are now forced to re-evaluate their approach to culture, decision-making, M&A, and product sustainability. Sekisui now gets to lead from the front on the main stage, and we fully expect builders to follow suit."

Staffing and recruiting done right. Fast Tracking Solutions specializes in delivering top talent in accounting/finance, construction, and technology operations.

MORE IN Leadership

How Signature Homes Wins While Other Builders Pull Back

Sales are sliding for most private builders. Dwight Sandlin’s team is defying the trend with strategy, speed, and customer obsession.

HW Media Acquires The Builder’s Daily, Expanding into the Homebuilding Vertical

Strategic acquisition adds leading homebuilding publication and strengthens HW Media’s commitment to serving the full housing economy

C-Suite Leaders Will Gather To Chart Homebuilding’s '26 Reset

The Builder’s Daily announces the speaker lineup for this October’s high-impact leadership summit in Denver, where the best minds in homebuilding operations, marketing, and technology will explore how to lead through the now and build for what’s next.