Marketing & Sales

America's Covid Baby Bust Means The Future Has Arrived Early For Homebuilders

Demographics, the structural basis for long-range optimism in residential investment, real estate development, construction, distribution, and related manufacturing and partner businesses, has suddenly hoisted a Jolly Roger.

Demographers don't make for scintillating keynotes.

Their stock in trade is glacially-evolving zip-plus-4 and mailbox-level data. They thrill at the subtlest wrinkles in household patterns across 20-, 50-, and 100-year timespans, and are as fascinated by what happened in household composition, family formations, and consumer expenditures in the mid-t0-late 1970s, as they appear to be at what's going on across the generational cohorts we give names to today.

So, how did demographics suddenly elevate – particularly during and in the immediate early wake of Covid-19's sundering of assumptions that underlie business, society, science, and culture – to its current, ultra-cool cache?

As it turns out – and we've all become painfully aware – glaciers can alter velocity with the best of exponential transformations too.

Demographics, the structural basis for long-range optimism in residential investment, real estate development, construction, distribution, and related manufacturing and partner businesses, has suddenly hoisted a Jolly Roger. That's made demographics – normally, a back-burner theme in business planning – quite the topic du jour.

The Hill's Reid Wilson reports:

The number of American women who gave birth last year fell precipitously over 2019, as provisional government data shows a national baby bust getting worse during the coronavirus pandemic.

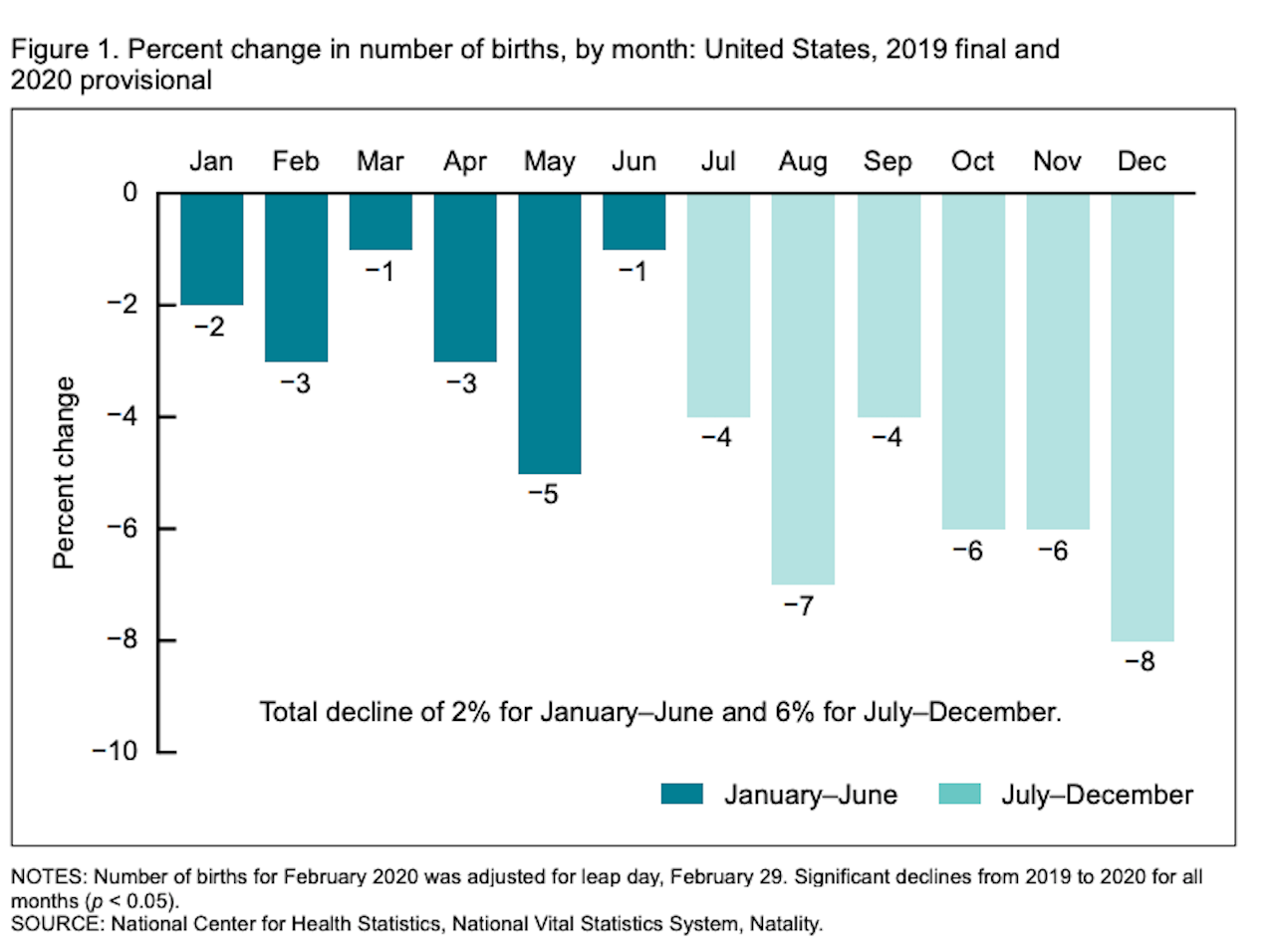

A new report from the National Center for Health Statistics at the Centers for Disease Control and Prevention (CDC) found births in the United States declined 4 percent between 2019 and 2020, the steepest annual decline since 1973.

But there is evidence that even before the pandemic struck, birth rates were on pace for a steep decline: Birth rates dropped in every month of 2020, compared to 2019 — including in January, before the pandemic struck, and in the early months of a pandemic, well after parents would have chosen to conceive.

The CDC source document Wilson's analysis springs from is here, citing a cause and effect connection between the pandemic and fertility trends in the past 12 months.

Larger declines in births were seen in the second half of 2020 (down 6%) compared with the first half (down 2%) of 2020. The number of births declined in both the first and second 6 months of 2020 compared with 2019 for nearly all race and Hispanic-origin groups, with larger declines in the second half of 2020 compared with the first half of the year. Births declined in 20 states in the first half of 2020, and in all states in the second half of 2020 (declines in 7 states were not significant). Changes in births by race and Hispanic origin and by state were less pronounced from 2018 to 2019; the number of births declined for 9 months by 1%–3%.

Now, if there's anything that can excite, energize, agitate, or worry housing and construction strategic leaders as much as a healthy economy, favorable interest rates, and solid job formations, it's babies, or rather, the absense of them.

Many builders and their manufacturer and supplier partners closely track bridal and baby registry activity as they journey-map homebuyer prospects across their buying, media, and social behavior in an attempt to engage, nurture, and eventually, convert them to new clients.

Expectations that 30-and-older something Millennials continue to represent an accelerating upward arc of demand for new homes and communities mostly count on family- and expanding-family formations as a key driver along with jobs, incomes, and household formation.

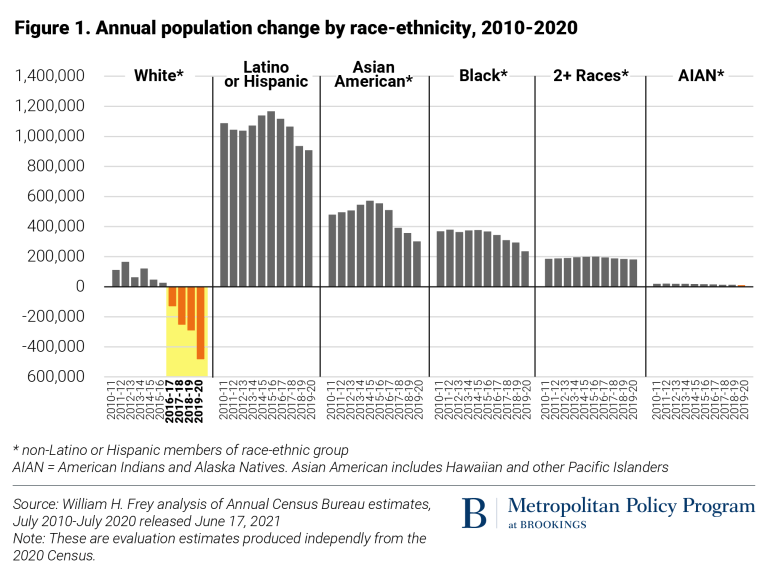

Further, as Brookings Institution fellow and University of Michigan-based demographer William Frey notes here that, tracing backwards slightly, a demographics supernova of change: The 2010s may well have tipped race and ethnicity's balance once-and-for-all, as "whites" actually lost population during the decade.

Annual white population losses over the four years between 2016-17 and 2019-20 were 129,000; 252,000; 290,000; and 482,000. Together, this loss of more than 1 million white people outweighs the white population gains of the decade’s six earlier years, leading to a likely first-ever decade decline of the nation’s white population when the final 2020 census results are tallied (Download Table A).

In contrast, nonwhite race and ethnic groups increased in size over each year of the decade, and were responsible for all of the nation’s population growth between 2016 and 2020. Latino or Hispanic Americans led all groups, with annual gains at or approaching 1 million a year. Asian Americans added between 300,000 to over 500,000 to their population each year, followed by Black Americans, persons identifying as two or more races, and American Indians and Alaska Natives.

So, while demographics may not be where charisma, inspiration, and motivation tend to coalesce in discussion and planning, it has become a critical path planning matter, not just for the far-out horizon, but now.