Leadership

After Missing Timing, Trajectory Of Correction, Duration Is Next Test

Another 'hot' inflation benchmark may or may not mean the tipping point for Fed tightening may be at hand. Don't underappreciate the difficulty of timing the duration of the market disruption.

There's something about the people who make livelihoods of making new homes and communities for people. Corrections – as often as they come – aren't generally among their super powers.

Anecdotally – and frequently in response to what has been characterized as overly-worried and unreasonably negative in our coverage here – quotes like the following have regularly streamed in from trusted executive sources.

Don't know where you're hearing the negative news. We're still raising prices and selling everything we release for sale, and we're three or four prospective buyers deep on every unit that comes online."

Pace is off from the blistering absorption rates we were seeing, but we've still got multiple bidders as the market normalizes."

The media are exaggerating ... the negative hype is overblown, and those negative headlines impact consumer confidence. Still, most of our markets are still healthy and humming along."

We had a good month last month. The demand is still out there if you can make the math work."

What are you hearing out there about the market?"

This is an amalgam of market observations over the past eight to 12 months, from homebuilding executives, principals, vested, and invested stake- and shareholders. Yes, the mantra of why this time's different than the housing crash of 2006-07 – scarcity on the home inventory front and the absence of crazy lending and credit practices – is clear.

Still, you could cut and paste these quotations into the executive and strategic narrative in 2005 and 2006.

Have a listen here to John Burns cover off on the "housing bubble set to pop" infographic put together by the John Burns Real Estate Consulting team.

A business friend who happens to have a lot of clients who are privately held homebuilding company owners and presidents contextualizes the situation this way, and maybe the terrible, horrible, no good, very bad day we experienced first thing this morning with the release of the September 2022 Consumer Price Index, helps bear this out.

I'm telling my builders – and these are the ones with very low debt, no land overhang, and some good margins built into their operations, and a good backlog of sales into 2023 – the Federal Reserve Fund Rate is close to peaking, and after that, it's going to come back down. So, I'm advising them not to worry right now about selling houses, even into next year. Once rates begin coming down again, people will start coming back because it will be a good time to buy."

One might hope as much.

Fact is, even without the added stress and mathematical elimination process of higher interest rates' impact on monthly payments and tighter lending practices, part of what the Fed's very powerful quantitative tightening mechanism is doing is working to squeeze those profit margins and disincentivize people from buying until everyone with skin in the game takes their haircut.

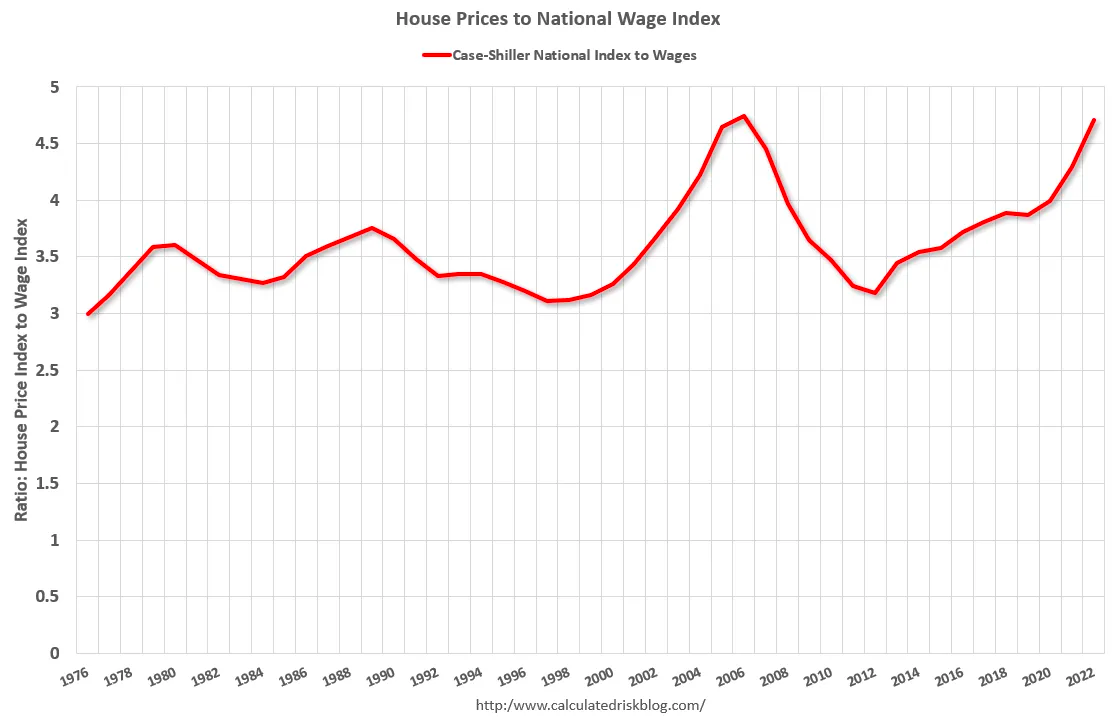

Calculated Risk analyst Bill McBride applied the latest data from the National Average Wage Index to national Case-Shiller house price data to look at housing affordability through a fresh lens here. His conclusion:

As of 2022, house prices were well above the median historical ratio - and at the level of the bubble peak - even though wages increased sharply in 2021. This suggests house prices are too high based on fundamentals, and I expect house prices to spend 7 years in purgatory.

In residential construction and real estate people's DNA, "down" is an essential ingredient of "up" when you add in time.

One year ago, The Builder's Daily published insight from Scott Cox, president of SLC Advsiors, that included this paragraph:

I have no crystal ball (it shattered in March of 2020). And every market is different. But it’s well to remember just because you believe you are being prudent, that does not mean others are, and it will be critical to keep an eye the future pipeline in your area. If you are in a position that being right about pricing but wrong about absorption is disappointing but not tragic, it will probably be fine. If you need to be right about absorption, you should be nervous.

Excess money has a way of making things happen you did not expect.

Three parts of a housing correction that prove difficult for vested and invested players in homebuilding to appreciate and safeguard their businesses and stakeholders.

- Timing

- Trajectory

- Duration

We've already seen reality of the correction prove that its timing, trajectory, and duration have taken on lives of their own – not under the sway of business leaders who wish they'd behave the way they should, given low, low supply, sturdy household balance sheets, and up to now, a strong, tight jobs and income economy.

A terrible, horrible, no good, very bad day on the CPI front may signal that the worst of the Federal Reserve's tightening measures – actions specifically taken to make more people, not fewer believe that for the foreseeable future, it's not a good time to buy a home – has come.

But here's what not to get wrong right now as you take steps to make your firm fit to weather the reality of the economic landscape that will one-day be appreciated as a "long-Covid" aftermath: Duration.

What the Fed does about rates, and when, is a future phenomenon, not something that can be mapped with certainty.

What we can not help but believe, based on our coverage of the homebuilding business carnage that took place during the Housing Crash and financial crisis of 2007 to 2011, is this: Preparing for a worse scenario – the worst case scenario – would have spared at least some of the 55% of homebuilders said to have gone under during the Great Recession.

A nugget from the dozens of pieces of wisdom in the latest Morgan Housel post on the Collaborative Fund blog, Little Rules About Big Things:

Unsustainable things can last longer than you anticipate."

MORE IN Leadership

How Signature Homes Wins While Other Builders Pull Back

Sales are sliding for most private builders. Dwight Sandlin’s team is defying the trend with strategy, speed, and customer obsession.

HW Media Acquires The Builder’s Daily, Expanding into the Homebuilding Vertical

Strategic acquisition adds leading homebuilding publication and strengthens HW Media’s commitment to serving the full housing economy

C-Suite Leaders Will Gather To Chart Homebuilding’s '26 Reset

The Builder’s Daily announces the speaker lineup for this October’s high-impact leadership summit in Denver, where the best minds in homebuilding operations, marketing, and technology will explore how to lead through the now and build for what’s next.