Marketing & Sales

A Moment Of Truth For New Home Demand: Will Cancel Rates Rise?

To date, even as interest rates and inflation began to take a toll on qualified new-home buyers, builders remain confident their order backlogs will hold, with reinforcement buyer prospects waiting in the wings. Will that hold up?

Three rates of change have pivoted to reset strategic focus from playing on offense to a more defensive mode for the balance of 2022, as caution signs flash a growing disconnect between some would-be homebuyers and their quest to own.

- Interest rates

- Inflation rates

- Talent retention rates

When rates change fast and steep as they are now, strategies, just like that, start looking a lot like tactics.

For homebuilders and their cohort of partners on the design, construction, manufacturing and distribution, real estate, investment front, tactics boil down to three key survive-to-thrive focus areas for whatever period of adjustment or softness lies ahead.

Money coming in and money going out, and the talent it takes to increase the first dollar stream and minimize the flow of the second.

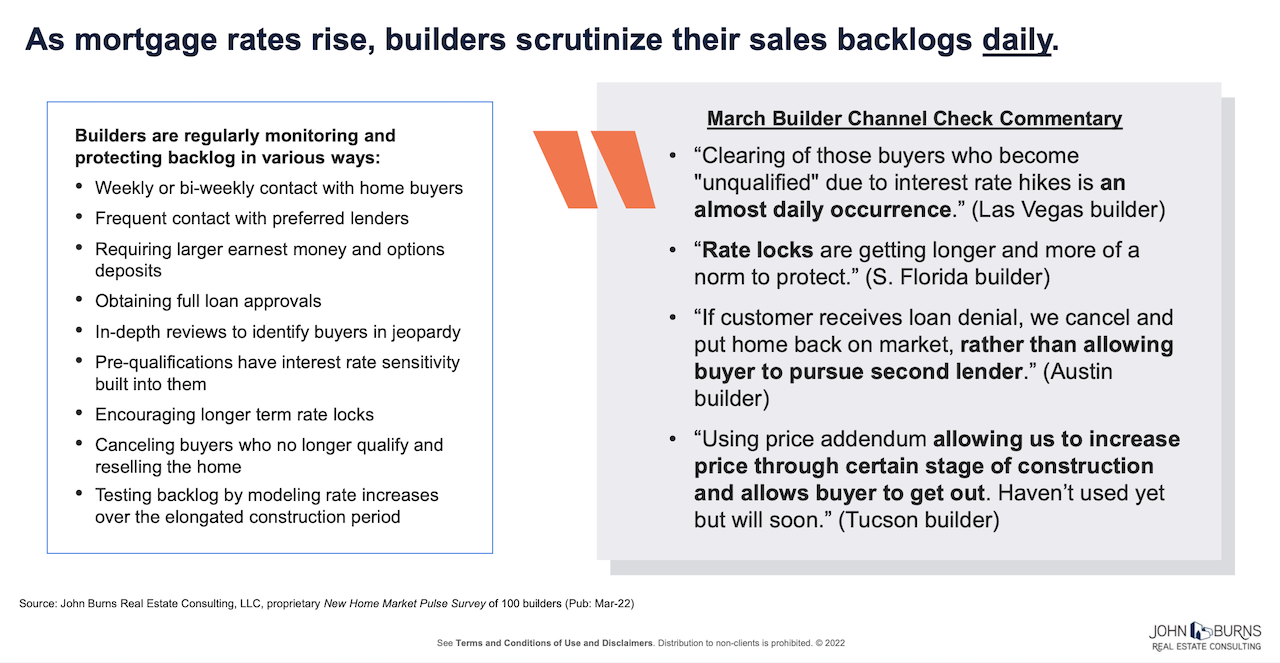

A closely-watched barometer of the impact of steep changes in the first two bullet points – interest and inflation – will be the telltale of homebuilders' order backlog.

A John Burns Real Estate Consulting analysis, shared with The Builder's Daily, notes that as 30-year fixed interest rates head north from 5% and a cost-price neutral tack continues, order cancellations could surge, a datapoint that could start to flash a warning as April through June results come through. JBREC notes that although cancellation rates – across a spectrum of builders in its sample – currently are clocking in at 7%, which is well below historical levels of 10%, builders are keeping a weather eye on how they're trending.

In commentary on a strong Q2 earnings report yesterday, D.R. Horton officials addressed questions regarding a 1% uptick (100 bps). They stated that, even as they look at recent surges in interest rates, albeit at 16% is well below historical D.R. Horton cancellation rates levels in the high teens or low 20s – and their impact on their backlogged homebuyers' ability to qualify for mortgages – about 10% of the buyers in backlog might be at risk.

What's more, Horton strategic executives expressed confidence that any fallout to current backlogged orders would be offset without missing a beat by buyers who can qualify and who are equally keen to own one of D.R. Horton's new homes.

D.R. Horton chairman and ceo said:

One of the things that ... impressed me back in 2018 when you saw a rapid rise in rates, demand ... was significantly reduced. And then after the rate shock to -- after the rate shock was mitigated, we saw demand come back and come back strong.

But through this cycle, which is in even more rapid rate increases, yes, we've had people that don't qualify anymore, but the demand side is still very strong. So just the desire to own homes, and it may be the fact that prices have escalated very fast and rents are escalating even faster than the price of new homes and all the talk about inflation and then locking in your housing costs for 20 years. I mean, it is -- homeownership is a cherished thing today. And the people coming out ... -- millennials coming out or even individuals relocating from other markets to where the growth is taking place. It's just they want to own a home, they want to lock in their housing cost, and they want to get in the neighborhoods that they can raise families in.

Auld's view is one shared widely among homebuilding strategic peers. It's a "this time's different" assertion, supported by the sheer heft of demographic patterns, and a pandemic era-boosted macro migration pattern toward more affordable, economically vibrant secondary and tertiary markets.

These factors – both pragmatic and intangible – may withstand volatility on the housing finance front and, as some predict, gain a stronger footing as an offset to inflationary impacts on the costs of consumable goods and services.

They're technical tailwinds, at best, and headfakes at worst.

A strategic approach to both securing and preserving order backlogs through a bumpier period ahead would be to prevent their ever reaching historical cancel rate levels, for then it would mean a slippery slope of concessions, incentives, and capitulations that will only lead to compressed margins and a need to take costs out somewhere.

To do that, don't get fooled by the notion that, for every buyer you have in your backlog, there are two or three buyers who want to be there, and who'll happily click-to-buy should one of your "orders" fail to qualify or opt out for some other reason. Add one headwind to the array that already challenge buyers, their wherewithal, and their sense of timing, and you may see that robust pool of reinforcement demand backing up your backlog suddenly diminish.

Why not, instead, give yourself as much insurance with your order backlog as you can by getting on that tactical drill of weaning out ones who no longer qualify, and working as hard on the customer care and satisfaction front as possible to keep those with the means on track toward closing?

That means that for every item on the checklist you make to monitor the order backlog and ensure it's de-risked of cancellation exposure, there's an equally crucial item on your team member talent front as your eyes and ears, smart decision-makers, and effective service providers, as customers get jittery in these more turbulent months ahead.

Join the conversation

MORE IN Marketing & Sales

Wray Of Light: Here's How To Keep Pace As Headwinds Stiffen

More than four out of five consumers think it’s a bad time to buy a home; here are seven strategies builders and developers can deploy as a more effective marketing plan to win sales.

These 5 Time-Tested Tips Will Jump Start 55+ Resident Referrals

When managing 55+ community homeowners associations, builders and developers need to meet and overdeliver on the high expectations of a particularly discretionary consumer group.

How A Homebuilder Stands Out In Florida's Fierce Competitive Arena

"Investing in your brand doesn't give you a direct return on investment immediately. It takes a long time, but over time, branding successfully does increase financial value." -- Alex Akel, President, Akel Homes