Marketing & Sales

Why Marketing Matters More During An Early-Stage Downturn

The temptation to look at marketing — and customer research — costs as an expense-savings opportunity as unit volume and revenues decline is growing. Here's a case for looking for something else to cut.

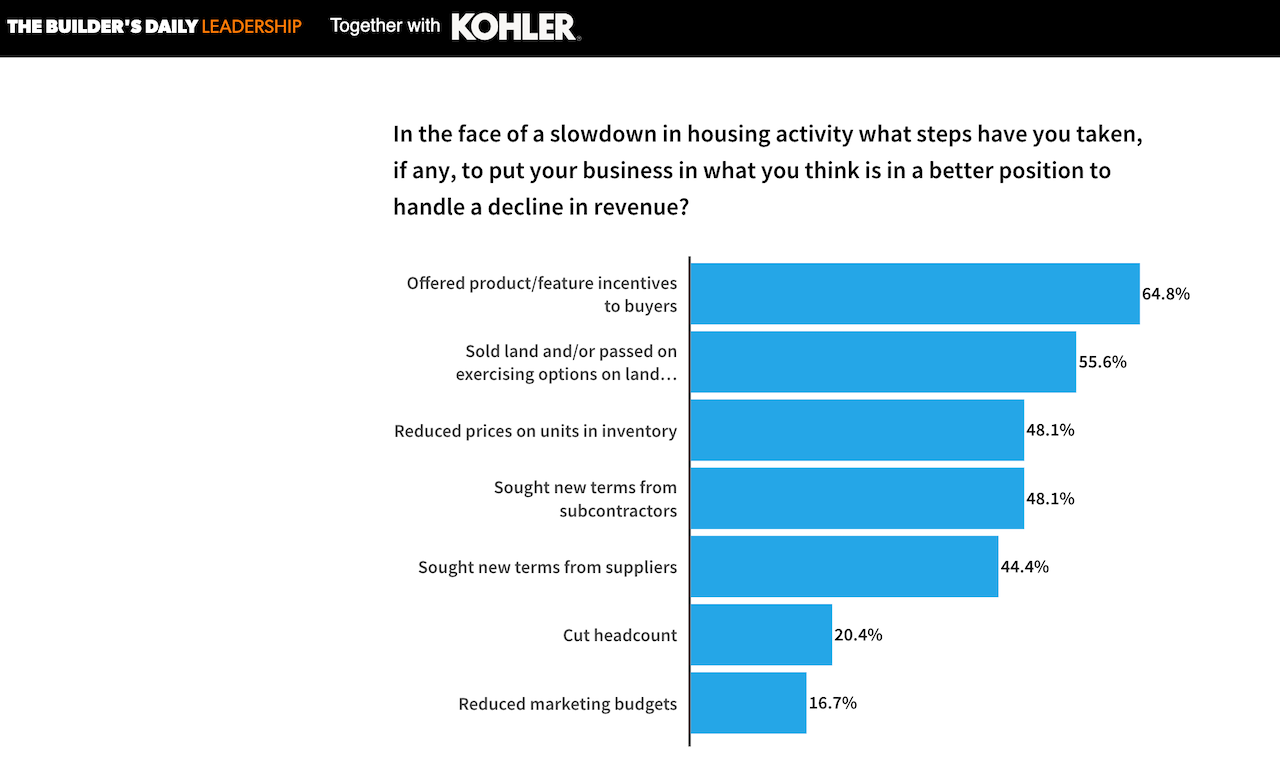

The lead of today's story is at the bottom of this graph.

According to data gathered from The Builder's Daily's 1,800-plus homebuilding business community leaders in late-July, fewer than one in six homebuilding strategists considers ongoing softening in both backlogs and forward orders as a time to cut marketing spending.

That response, the conviction behind it, and the actual behavior that takes place will get its first real stress-test in the late-Summer early Fall budget planning process as The Great Normalization plays its hand. Still, the rationale – to keep the story of each prospect's access opportunity to new-home value that far eclipses a first-cost outlay – makes sense, especially when consumer inflation rates have "eased to only" 8.5%.

- Mobility and migration rates, from high-cost to lower-cost housing markets, will remain elevated as Millennial adults push relocational boundaries within a tech-powered work-from-anywhere macro trend.

- Rental refugees, seeking to shield asset values from inflation, will continue disproportionately to opt for ownership as a forced-savings and equity value creation personal financial strategy.

- Technology – data, artificial intelligence, sensors, and microprocessing power – continues exponentially to evolve "location, location, location" in ways that only marketing can touch, amplify, and activate.

A strategic advisor to several multi-regional homebuilding firms tells us:

Reducing marketing budgets is usually the first thing builders do as revenue declines, ... which is the exact wrong thing."

Another provides perspective as to why five out of six of our homebuilding strategists would take at least six other tactical measures to bring average selling price and business expenses back into sync before they'd do anything to defund marketing.

There is a silver lining in this projected mild recession! Those who are prepared to revise their marketing and sales budgets upwards and take advantage of new land acquisitions from developers who are panicking will be the winners!"

A business leadership issue calls out: where to find operational cost reduction opportunities to pay for what homebuilding strategists suggest will net out to a 10% to 15% broad based Average Selling Price reduction – that is, after market-clearing price cuts that may run deeper than that to diffuse the risk of standing inventories through the balance of 2022 – during a slowdown that may take 12 to 18 months to work through.

The dilemma – dumbed down – looking at the marketing line item may come across as an "either/or" bind as strategists and their accounting, finance, and business leader teams look to pare expenses faster than deteriorating revenue forecast trends – and, at the same time, find an new ASP sweet spot to reignite pace.

Either it's cut marketing, the thinking goes, or business profitability is at risk, due to a then-bloated marketing dollar-per-revenue ratio. Or else, either cut marketing, or we can't cut our asking price.

It may be long enough now since the last downturn that some business leaders may have forgotten and others may never have learned that marketing – particularly in this day and age where the buyer's journey, the consideration set, and purchase decisions themselves are predominately online digital pathways and experiences – drives revenue, not the opposite.

Killing marketing won't, at the end of the day save money, but it will kill revenue.

The trap for business leaders – whether it's in homebuilding or any other high-ticket consumer durable in a high-inflation, high-volatility, and a high borrowing cost macroenvironment – is in "either/or" decision-making logic.

What – at a time of fleeting, capricious, contradictory, and unpredictable forces – speaks to enduring self-improving value so much as a home, that "machine for living" as people choose to live as their best selves?

That value goes beyond shelter. Likewise, the value of your marketing goes beyond an Excel line-item.

A Harvard Business Review contributed piece from Marianne W. Lewis, dean of the University of Cincinnati’s Lindner School of Business and a professor of management, and Wendy K. Smith, the Emma Smith Morris Professor of Management and academic director of the Women’s Leadership Initiative at the University of Delaware’s Lerner College of Business & Economics, gets at this point. Lewis and Smith write:

Either/or thinking leads to intensifying overcommitments and polarizing infighting.

Great leaders adopt a different approach. They recognize the paradoxes that underlie their tensions and instead adopt both/and thinking. Rather than choose between the options, they embrace competing demands simultaneously.

As is often the case, there's hardly better a source of wisdom in this matter than Seth Godin, who writes:

“When do we get to the marketing part?”

It was early in the development of a new product, and someone asked this question.

I’m not sure the word “marketing” means what you think it means.

Later, we will get to the promotion and advertising part.

But right now, this is marketing. All of it.

The product. The warranty. The team. The color choices. The pricing. The way it feels in your hand. The urgency we have to tell our friends…

If you wait until you’re done before you do the marketing, you’ve waited far too long.

When homebuilders and community developers do what they do best, "the urgency we have to tell our friends" goes with the turf.

Join the conversation

MORE IN Marketing & Sales

When Homebuyers Pull Back, Builder Brands Must Step Up

In markets under stress, consistency, empathy, and value-driven messaging provide builders with a critical edge among today’s cautious buyers. Advisor Barbara Wray gets real about the path forward for homebuilders today.

What Separates Homebuilders Thriving Amidst 2025’s Chaos

Builders face rising stakes to unify tech, data, and operations or risk falling behind amid affordability, insurance, and labor challenges.

Here's Why Randy Mickle Has Joined Drees At This Moment

The new Southeast Regional President brings big, national builder experience to a multigenerational homebuilder with bold goals for its centennial.