Leadership

2024's Top 10 Trends In New Homebuilding: No. 1 Share Wars

Here's food for thought from a fresh analysis of market share – both for new vs. existing, and for large, deep-pocketed nationals vs. local and regional privately-capitalized operators. Where's all this leading?

From the way-back machine, let's look at where our understanding of the word "share" comes from.

Middle English share, from Old English scearu "a cutting, shearing, tonsure; a part or division, a piece cut off," from the source of sceran "to cut," from Proto-Germanic *skeraz (source also of Old High German scara "troop, share of forced labor," German Schar "troop, band," properly "a part of an army," Old Norse skör "rim"), from PIE root *sker- (1) "to cut." – Etymonline.com

Now what happens in a world where corporatization and global capital investment begin to upend – or at least dramatically refine – one of real estate's bedrock laws of value and valuation: Location, location, location?

The rules and rewards that come of this longtime given – that "all real estate is local" – start to evolve faster when big players have what smaller players don't have as much of, time and money.

This means the "cutting, shearing, tonsure" of new-home development and construction in the United States' most-active new residential real estate markets goes in bigger chunks to those bigger players.

We've written about this recent post-Pandemic, post-easy-money era as an inflection point for the acceleration of concentration of new homebuilding development and construction among fewer, more powerful national players.

Now, here's food for thought from a fresh analysis of market share – both for new vs. existing, and for large, deep-pocketed nationals vs. local and regional privately-capitalized operators – from the Wolfe Research homebuilding and building materials team led by senior analyst Truman Patterson.

It's on you to draw conclusions, prepare, concern yourselves, or choose to focus or not on competition vs. on standards of operational and strategic excellence that have nothing to do with competitors.

We'll just give you a couple of high-level data points and Truman's take on them, but to access the full Wolfe Research report you can click here and request access.

Market Share: New Vs. Resale

On a T9M basis, the New Home Market has increased market share of Total Home Sales (New & Existing) by +320 bps YoY to 14.0% from 10.8% in ‘22, which has been a material benefit for homebuilders nationwide. YTD23, NHS have increased +4.5% from 510K to 533K, which compares to a 21.1% drop in resale transactions. Absent this +310 bp market share shift, YTD23 NHS would have declined in the -19% range. We believe that strong household formation the past several years, as well as rate-lock more recently, is driving limited Existing for-sale inventory. We believe Homebuilders have a meaningful competitive advantage to resale—builders have available inventory, have the ability to buydown mortgage rates and shift their product offerings to combat affordability (smaller square footage floorplans, reduced specifications, etc)—and suggest the New Home market share gains should continue."

Patterson and the Wolfe Research team also provide sequential and year-on-year market share deltas for public homebuilders vs. private operators. Of great interest, the analysis plots out individual public builders' market share trajectories, both on a historical, 2007 to Q3 2023 basis, plus trailing-12-months, and calendar-year changes in the past three to Without giving away the ranch here's where Patterson ends up:

Market Share: Public Vs. Private Homebuilders

We expect the public homebuilders continue gaining outsized share from smaller privates given their favorable access to fixed-and-lower- rate debt with long maturities (and more prevalent use of mortgage rate buydowns) as banks tighten lending to smaller private builders for land acquisition/development and spec building."

With the benefit of an even longer-term lens, Home Builders Network president Al Trellis leaves us today with this perspective:

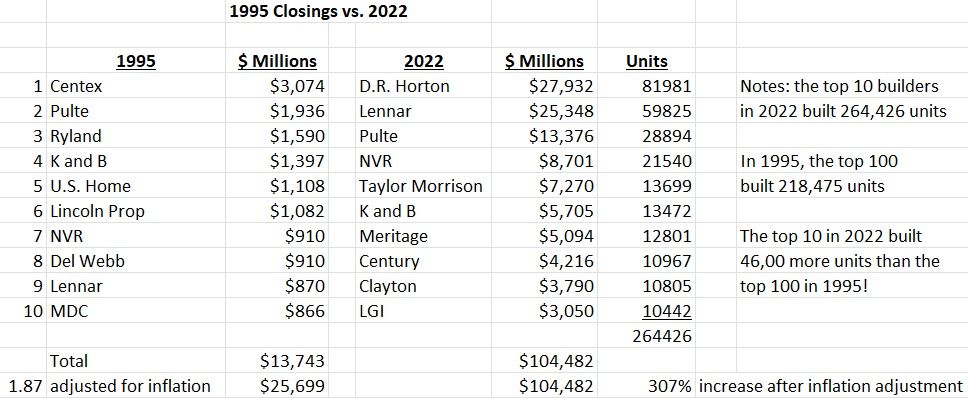

I was discussing with one of our long-time clients how the landscape has changed for smaller builders with the rise of the national and regional builders, in a world where land is hard to come by and access to capital matters more than ever. I wrote in the 1990’s that the nationals would take a bigger and bigger share of the market and predicted in the 20-teens that they would begin to move into the secondary and tertiary markets (where else could they go to grow). I put together the chart below to show the contrast between 1995 and today."

Here's Al's chart:

We'd echo Al's parting comment:

I'd love to hear your feedback."

Welcoming any and all comments to: john@thebuildersdaily.com and/or alantrellis@earthlink.net

MORE IN Leadership

Westwood-Hippo Deal Raises Stakes On Home Insurance Trust

A landmark deal expands embedded insurance capabilities, aiming to ease closings, manage climate risk, and restore buyer trust.

From Afterthought to Dealbreaker: Why Home Insurance is Now Key to Sales

By working with the right insurance expert, builders gain short- and long-term advantages in keeping current deals on track and making sure their business thrives into the future.

How Outlier Homebuilders Build An Edge, Even In a Slow Market

Focus On Excellence 2025 reveals what top homebuilding leaders are doing now to separate—and stay ahead—for 2026-through-2030 and beyond.