Land

Not All SFR Markets Are Created Equal: Many Thrive, Some Don't

On average, single-family-rental is one of housing's biggest winners of 2020 into 2021. How many markets will behave according to the law of averages?

The one constant in residential real estate and construction, ensuring a perpetually unlevel playing field for those who make a living this way, is that hardly anyone can do without it.

Paydirt happens when that unlevel field tilts upward to an even greater degree. Like when people, living in apartments in places where ambulance sirens screamed through the night 14 or 15 months ago woke up, and didn't need to go to an office, and thought: "a house with a yard would be good."

Thousands of them had that thought, almost instantly, almost simultaneously. And housing's unlevel playing fields – single-family for-sale and built for-rent – hit paydirt.

CoreLogic's Molly Boesel, principal, economist for CoreLogic in the Office of the Chief Economist, writes:

U.S. single-family rent growth increased 5.3% in April 2021, the fastest increase since May 2006, according to the CoreLogic Single-Family Rent Index (SFRI). The index slowed in 2020, but even when compared with 2019, rent growth is running above pre-pandemic levels. The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time.

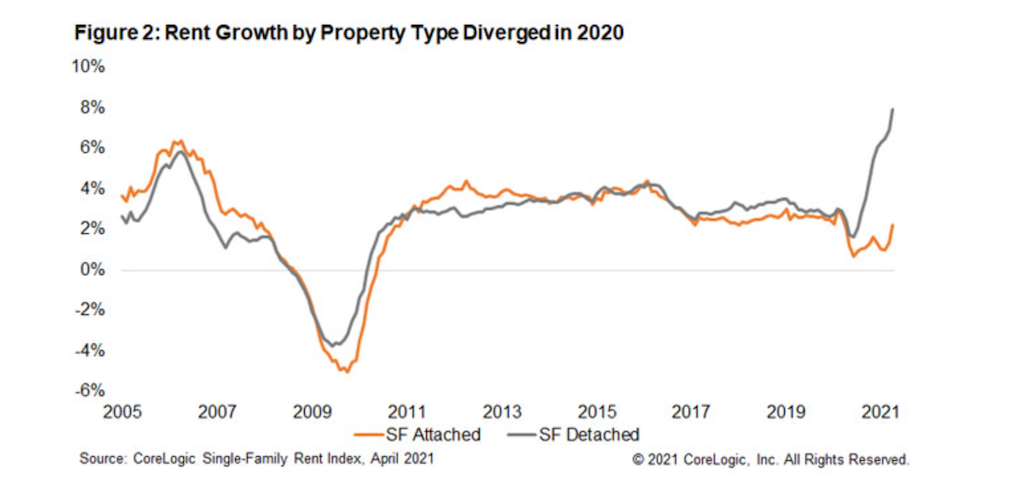

Boesel's take on the CoreLogic data highlights the SFR boom nine ways to Sunday, by price tier, property type, and market by market. Logically, rent increases showed a playing-field tilt from vertical apartment living to single-family at all rental price tiers, with the higher-rent tiers commanding the greatest year-on-year rates of increase.

Meanwhile, she notes:

Rent growth of detached properties was more than three times rent growth of attached properties.

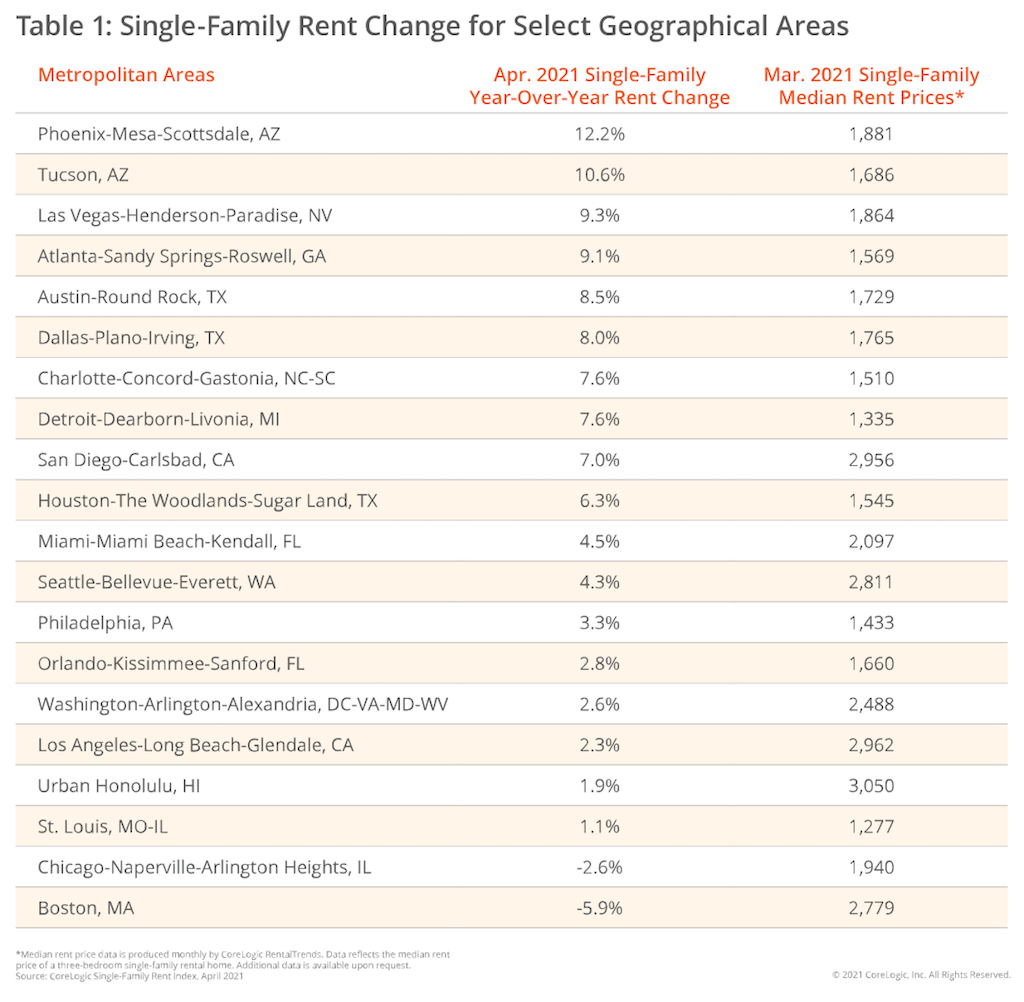

Looking at how varying metro areas performed in the analysis, CoreLogic zeroes in on 20 key markets, shown here:

The spectrum highlights economic dynamics that illustrate SFR's varying strength of appeal, meaning that assumptions on SFR performance don't hold equally for all markets – an important fact when capital investment continues pours into SFR projects everywhere. Boesel explains:

Boston and Chicago were also the only 2 of the 20 metros shown in Figure 3 to have lower rent growth than a year ago with Boston showing a deceleration of 7.5 percentage points and Chicago showing a deceleration of 4 percentage points from April 2020.

The slowdown in Boston rent growth might be attributed to college students choosing not to return to Boston, but instead opting to continue virtual learning elsewhere. For Chicago, there were large differences in rents of attached versus detached properties. While rent prices of detached rentals in Chicago increased by 5.6%, attached rentals experienced a decrease of 4.1%.

The question now is how many capital investors seeking to continue to hit paydirt in this hottest of hot residential real estate segments will do so? As Boesel and CoreLogic's data, showing the geography of single-family-rental winners and losers, illustrates, markets are not created equal.