Marketing & Sales

New Home Building's Collision Course With Demographics

Too little focus is given to the specific make-up of households — specifically, how different many of them are in composition today and what that may mean concerning household finances, household formation, family formation, and a related array of economic implications, including homeownership.

New-home planning, design, development, and construction – despite baby-step progress getting who's buying homes and why – are still likely to be on a collision course with demographics.

For a journalist, demographics is a beat that rarely breaks news but has a way of always staying relevant. Its timelines are glacial. The revelations this science of people patterns peel back occur with the excitement of watching paint dry; and so many of them should hardly come as a surprise.

Except when they do. For example, a Census statement yesterday:

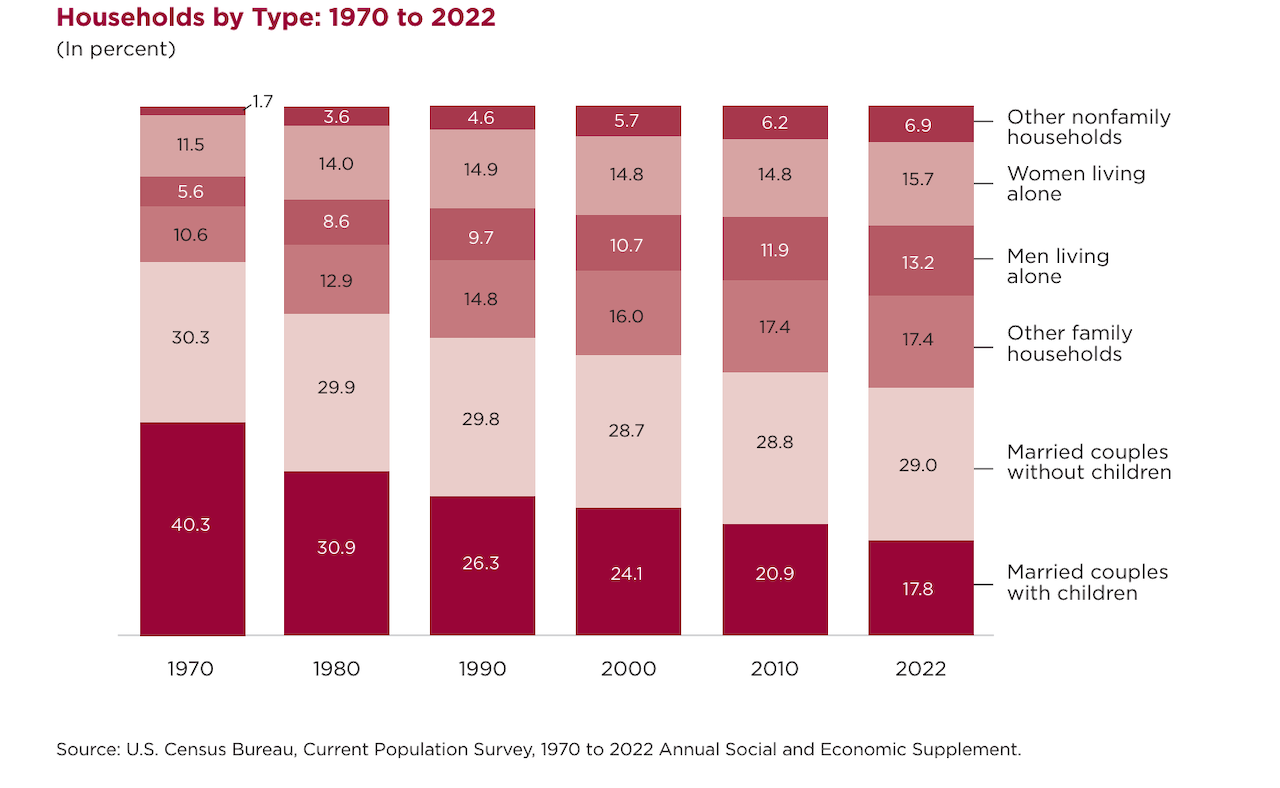

The U.S. Census Bureau today released estimates showing that married-couple households made up 47% of all households in 2022, down from 71% in 1970. Estimates from the America’s Families and Living Arrangements: 2022 report also show that about 80 million U.S. households in 2019 were family households. Of those family households, 58 million were married-couple households, about 6 million were a male householder with no spouse present, and 15 million were a female householder with no spouse present.

Additionally, nonfamily households were about 19% of all households in 1970, but by 2022, they made up about 36% of all households. Women living alone made up the largest percentage of nonfamily households in both 1970 and 2022. In 1970, about 12% of households were women living alone, compared to about 16% in 2022. The share of households with men living alone grew from about 6% in 1970 to about 13% in 2022, the largest percentage-point change of other nonfamily household groups."

Want a picture that almost literally captures the spirit of what we mean by watching paint dry? It's here:

When a profound and structural change – unimagined and unimaginable in 1970 – occurs within a lifetime, it can feel as if it all happened a blur. As a 15-year-old, all reference points in life and society, among family and extended family members and friends, and a ripple-effect of acquaintances, were to the seven-out-of-10 homes made up of married couples.

The fact that fewer than half of homes are made up that way now – despite it being 54 years since – feels like whiplash.

What's gotten so much focus among residential development, design, and construction strategists in a period of five to seven years straddling the Covid pandemic and its accelerated force factors has been economically-galvanized young adult households, seeking affordability and livability balances in the context of livelihoods less tethered to five-day-a-week workplace requirements.

That focus on domestic migration patterns and their ultimate sustainability continues, impacting Smile States' regional growth and sparking satellite submarket opportunities in the outer fringes of secondary and tertiary markets.

Too little focus is given to the specific make-up of those households — specifically, how different many of them are in composition today and what that may mean concerning household finances, household formation, family formation, and a related array of economic implications, including homeownership.

How deeply understood, for instance, are the impacts of the following household composition data points on paths to new-homeownership?

- In 2022, about 57% of men and 55% of women ages 18-24 lived in their parents’ home, compared to 52% of men and 35% of women in that age group in 1960.

- In 2022, 65% of all family groups with children under age 18 were maintained by married parents.

- About 74% of mothers and 91% of fathers lived with their child and the child’s other parent in 2022.

- In 2020, about 20% of children lived in a household that received food stamps, up from 17% in the previous year.

- The share of children with no coresident parent(s) in the labor force increased from about 7% in 2019 to 8% in 2021.

Now there are so many factors at work in this higher-for-longer interest rate and pricing era that act to shrink the pool of people who can qualify to purchase a new home, and have the monthly payment means to make a go of it.

Don't make the mistake of shrinking that pool further by failing to grasp the fact that just 17.8% of households today – vs. 40.3% in 1970 when I was 15 and the world as I'd forever imagine it was fixed in my mind – are ones headed up by a married couple with children under the age of 18.

MORE IN Marketing & Sales

Why Homebuilders Should Stop Ignoring the Move-In Moment

Buyers don’t just want a new home — they want a seamless handoff into it. Concierge services may be the zero-cost amenity that becomes a new industry standard.

When Homebuyers Pull Back, Builder Brands Must Step Up

In markets under stress, consistency, empathy, and value-driven messaging provide builders with a critical edge among today’s cautious buyers. Advisor Barbara Wray gets real about the path forward for homebuilders today.

What Separates Homebuilders Thriving Amidst 2025’s Chaos

Builders face rising stakes to unify tech, data, and operations or risk falling behind amid affordability, insurance, and labor challenges.