Land

Meritage Homes Expands Footprint With Elliott Homes Buy

Strategic Gulf Coast inroads strengthen Meritage's reach in affordable, high-demand markets amid 2024’s fast-paced homebuilding M&A surge.

Meritage Homes, one of the nation’s top five homebuilders by volume, has announced a significant acquisition as it expands its national footprint to the Mississippi Gulf Coast.

From a Meritage statement this morning:

This acquisition provides us with a respected team and valuable assets positioned in the highly desirable markets in the Gulf Coast," said Phillippe Lord, CEO of Meritage Homes. "This is our first acquisition since 2014 and aligns with our spec building strategy of affordable entry-level homes. We are excited to be partnering with founder and CEO Brandon Elliott and the entire Elliott team, as we welcome them into the Meritage family."

The acquisition of Gulfport-based Elliott Homes reflects a growing trend of strategic market share expansion through mergers and acquisitions (M&A), especially as 2024’s fourth quarter promises a surge of homebuilder deal-making activity. Meritage's strategic move not only leverages Elliott Homes’ established pipeline and local expertise but also underscores the M&A momentum expected to accelerate through year-end.

The combination is emblematic of the broader environment driving acquisitions in the U.S. homebuilding sector: well-capitalized public builders are seizing growth opportunities by securing local partners and pipelines, while private builders increasingly look to monetize their hard-earned market presence and land assets amid intensifying competition and operational demands. This analysis explores the Meritage-Elliott Homes acquisition, its alignment with industry trends, and the implications for stakeholders across the homebuilding and real estate development landscape.

A Strategic Market Entry

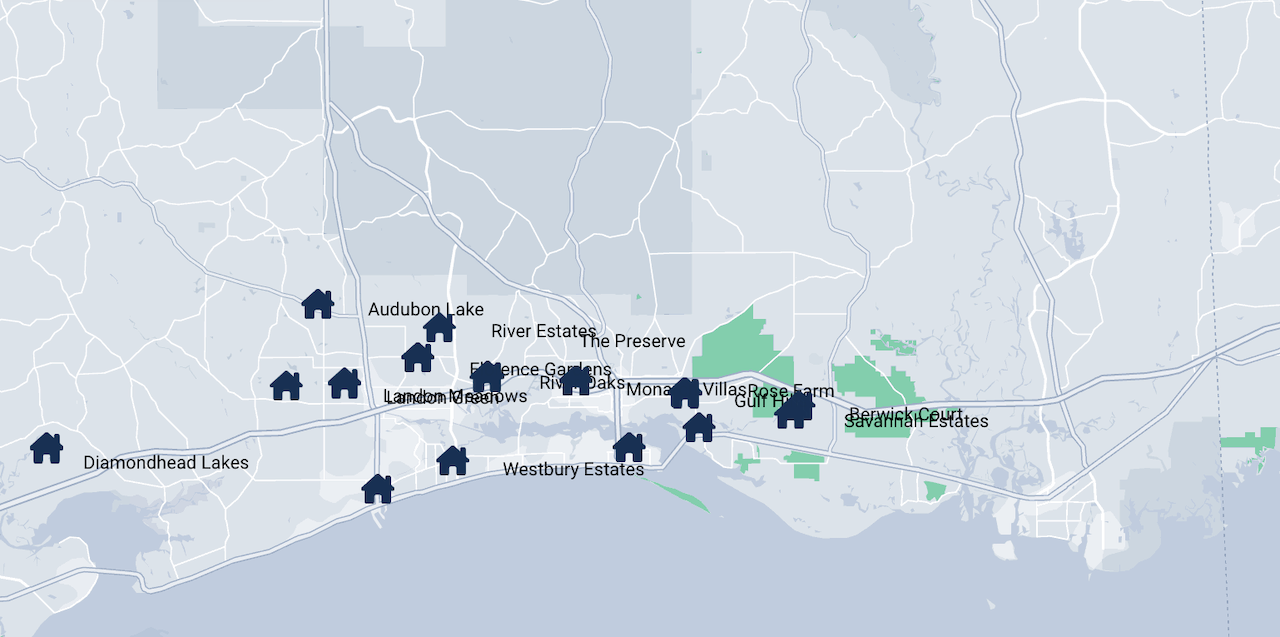

By acquiring Elliott Homes, Meritage Homes secures a strong foothold in the Mississippi Gulf Coast — a region that had gained attention as an emerging domestic migration destination even before COVID-19 and has since grown in appeal due to hybrid work trends and a favorable cost-of-living profile.

The Mississippi Gulf Coast area attracts a diverse set of homebuyers, including near-retirees, retirees, and young professionals who are drawn by affordability and quality of life. Elliott Homes, known for its award-winning designs and commitment to quality, has successfully captured this market segment, making it an ideal acquisition target for Meritage.

We were honored to work with Brandon Elliott and the Elliott Homes team, says Tony Avila, CEO of Builder Advisor Group, which served as advisor to Elliott in the transaction. "Brandon has built a formidable company with outstanding profitability and enjoys the best Gulf Coast land position from which Meritage will greatly benefit. "

As Meritage expands into this region, it brings a robust operational infrastructure designed to capitalize on its strategy of maintaining an ample available supply of move-in-ready homes. This approach has proven effective for Meritage in other markets and aligns well with the Gulf Coast’s demand dynamics, where available inventory remains limited despite high interest in the region. Just yesterday, with its Q3 2024 earnings release, Meritage's clear-headed strategic positioning – aiming to bend buyers' cost curves via strong spec-driven operational performance – came through in the narrative.

Our solid third quarter 2024 results reflected the pivot in our strategy to affordable, quick-turning move-in ready homes, which generated $1.6 billion of home closing revenue and our highest third quarter closing volume," said Steven J. Hilton, executive chairman of Meritage Homes. "Our rate buy-down offerings in July and August and the pull back in mortgage rates in September all contributed to order volume that slightly outpaced traditional seasonality, aiding us to achieve orders totaling 3,512 homes this quarter with average monthly absorptions of 4.1. Although the mortgage rate market remains volatile, we believe that the expectation of lower rates over the next several quarters and the ongoing combination of favorable demographics and an undersupply of homes will be constructive for homebuyer demand and will enable us to keep growing our market share."

The acquisition provides Meritage with a beachhead from which to grow its market share while benefiting from Elliott’s established local relationships and operational expertise.

Per this morning's statement:

I am proud of the Elliott team for their incredible growth as professionals,” said Brandon Elliott. “We look forward to joining Meritage and leveraging their scale as a top five national builder to bring more affordable quality homes to the Gulf Coast markets and most importantly, add value for the homebuyer.”

Three key quotes from Meritage Homes' Q2 2024 earnings call with CEO Phillippe Lord earlier this year foreshadow the company's thinking ahead of the Elliott Homes acquisition:

On Expanding Market Reach and Strategic Fit

Our focus is on aligning with regional players that have a strong local presence and reputation. We know the value of market familiarity, and acquiring well-positioned builders in high-growth areas is key to our strategy.”

This comment highlights Meritage's intent to align with builders who know their local markets well, which resonates with the strategic fit of Elliott Homes in the Mississippi Gulf Coast area.

On Ensuring Lot Supply to Meet Future Demand

As we continue to see demand shift into more affordable regions, we are committed to securing our pipeline. The ability to deliver homes on time and at scale in new markets is an advantage that acquisitions allow us to leverage.”

This quote hints at the importance Meritage places on having an established pipeline and timely lot supply, both of which are supported by acquiring local builders like Elliott Homes.

On Leveraging Scale for Operational Efficiency

Building efficiencies into our operations has been central to our success, and part of that includes evaluating where we can gain scale and improve our market reach through partnerships or acquisitions.”

This suggests Meritage's focus on scaling through acquisitions to support its operational model, which directly aligns with the acquisition of a regional player to strengthen its market presence.

This approach, in some ways, mirrors Lennar’s recent acquisition of WCH Homes in the South Atlanta market, where the focus was on leveraging local expertise and a reliable lot supply to strengthen competitive positioning. Both acquisitions highlight a critical advantage for public builders: the ability to combine national resources with local market knowledge to streamline operational integration and boost closings volume.

Capitalizing on M&A Tailwinds

As the U.S. homebuilding industry enters the final quarter of 2024, M&A activity is set to intensify, with analysts forecasting a flurry of late-year deals as public builders actively seek acquisitions to secure land positions, expand their geographic presence, and strengthen their competitive positioning. Builder Advisor Group's Avila, a leading M&A expert, has projected as many as 10 to 12 major deals by year-end. His firm’s involvement in several of these deals underscores the appetite among public builders to leverage their capital and market advantages to acquire valuable land and local expertise, particularly as the economic environment grows more favorable.

A key driver behind this accelerated M&A activity is the Federal Reserve’s recent policy rate cut. The Fed’s 50-basis-point reduction, announced in September, marks the beginning of an easing cycle that has already reduced borrowing costs for public builders. This cut is expected to lower mortgage rates further, creating a prime opportunity for acquisitions by reducing capital costs and enabling builders to secure strategic assets in high-demand regions.

In a recent analysis, Avila noted that the current economic environment creates ideal conditions for public builders to pursue acquisitions and secure growth pathways for 2025 and beyond.

With the Fed’s recent rate reduction, borrowing costs are expected to fall significantly, which will compress mortgage rates for buyers and increase profitability for builders,” Avila said. “This creates the perfect storm for M&A, as builders seize opportunities to expand land portfolios before the market becomes even more competitive.”

Avila’s firm is currently representing seven companies in active acquisition discussions, further indicating the high level of interest in the market.

Why Private Builders Are Selling

For many private builders, the current M&A climate offers an ideal exit opportunity. Rising land costs, limited access to capital, and intensifying competition from public builders have made the operating environment more challenging. These factors, combined with an attractive valuation environment, make now a compelling time to sell.

Elliott Homes, founded in 2009 by Brandon and Adrienne Elliott, has grown into one of the premier homebuilders on the Mississippi Gulf Coast. Known for its quality craftsmanship and award-winning designs, the company has built a loyal customer base and a strong local brand.

However, as with many private builders, Elliott faces the pressures of a high-cost, competitive landscape where operational efficiencies and access to capital often determine long-term viability. As Elliott shifts its focus, Meritage’s acquisition allows the company to monetize its hard-won market presence and refocus on land development — an area where Brandon Elliott believes his team can generate significant value in the years ahead.

Elliott will stay on with Meritage for at least a transition period, and see to the completion of its current Work-in-Process. After that, he may shift his focus to local land acquisition and development, and could continue to provide critical lot supply to Meritage while creating new growth opportunities for Elliott Homes’ leadership team.

This pivot reflects a broader trend among private builders, including WCH Homes’ recent transition to land development following its acquisition by Lennar. As many private builders face constraints on their capacity to expand while navigating rising land and construction costs, M&A provides an appealing exit that allows them to focus on land development or other complementary ventures where they can leverage local relationships and market expertise.

Public Builders’ Strategic Edge

The acquisition of Elliott Homes by Meritage demonstrates the advantage public builders have over their private counterparts, particularly in the current economic climate. Public builders’ access to fixed-rate debt, extensive capital reserves, and economies of scale position them to outcompete private builders, who increasingly struggle with rising borrowing costs and limited access to capital.

In Q2 2024, public builders gained 490 basis points of market share year-over-year, now accounting for 43% of New Home Sales nationwide, according to a Wolfe Research report. This growth is a testament to the public builders’ ability to leverage strategic M&A to consolidate market share and expand their geographic presence.

As public builders pursue acquisitions to secure critical lot supply and expand market share, private builders find it challenging to keep pace. This pressure has created a robust M&A environment, where private builders are increasingly opting to sell rather than face the daunting task of competing with larger, capital-rich competitors. Public builders like Meritage, Lennar, and D.R. Horton are capitalizing on this trend, acquiring local builders with valuable land positions and established local networks that can be immediately integrated into their operations.

The Meritage-Elliott Homes deal underscores a key shift in the homebuilding industry: consolidation. As public builders continue to gain market share, the industry is entering a period of intense competitive realignment where larger players are leveraging their financial advantages to acquire, integrate, and dominate regional markets. This consolidation is expected to continue as public builders pursue market dominance in high-growth areas such as the Southeast and Gulf Coast.

Looking Ahead: Implications for 2025 and Beyond

With this acquisition, Meritage is well-positioned to ramp up its production capacity in the Mississippi Gulf Coast market, aligning with its broader goal of supplying move-in-ready homes to meet consumer demand. The integration of Elliott Homes’ assets will enable Meritage to grow its community count and closings volume as it prepares for an expected demand resurgence in 2025, spurred by lower mortgage rates and continued domestic migration to affordable regions.

The outlook for M&A remains strong, with experts like Avila predicting that the current environment will drive additional transactions into early 2025. Factors such as millennial household formation, increased demand from the 55-plus market, and potential favorable housing policies from the upcoming election are expected to sustain demand for new homes, particularly in markets like the Southeast and Gulf Coast.

For CEOs, presidents, and strategic leaders across the homebuilding industry, the Meritage-Elliott Homes acquisition offers valuable insights into the imperatives of the current M&A landscape. As consolidation reshapes the industry, leaders will need to carefully weigh their options—whether to pursue acquisitions, be acquired, or adapt to new competitive dynamics. Those who act decisively will be best positioned to secure the resources and market share necessary for sustained growth.

What's Next?

The Meritage-Elliott Homes acquisition marks a significant moment in the 2024 homebuilding M&A cycle. It captures the essence of a competitive environment where strategic acquirers, well-capitalized and focused on growth, are reshaping the industry landscape through targeted acquisitions. For Meritage, this deal strengthens its operational presence in a high-demand region while securing local expertise and valuable land assets. For Elliott Homes, the acquisition provides a timely and strategic exit that allows it to refocus on land development and capitalize on the value it has created.

As the U.S. homebuilding industry moves toward 2025, the M&A landscape will continue to evolve, with public builders leveraging their scale and access to capital to consolidate market positions. In this environment, homebuilding leaders will need to navigate the balance between growth and competition, making strategic decisions that will define their position in an industry marked by transformation and opportunity.

MORE IN Land

Lone Star Diamond In The Rough: A Case For 'Why Weatherford'

Longtime Texas residential land strategist Scott Finfer opens up his land scouting manual to explain the stark difference between speculation and data-backed, applied vision.

Little Deal ... Big, Timely Product Pivot: Lokal’s Capital Play

A $12M facility fuels Lokal Homes’ swift shift into higher-margin homes and a smarter land strategy in a tough market.

Oversupply or Overreaction? DFW Market Needs To Hit Reset

Scott Finfer breaks down the DFW-area oversupply crisis: post-pandemic assumptions, slower job growth, and mispriced inventory. Across the U.S., high-volume markets face similar risks. Finfer outlines five strategic moves to cut through the noise — and seize ground as bigger players pull back.